Living Trust Mississippi With Pour-over Will

Category:

State:

Mississippi

Control #:

MS-E0178B

Format:

Word;

Rich Text

Instant download

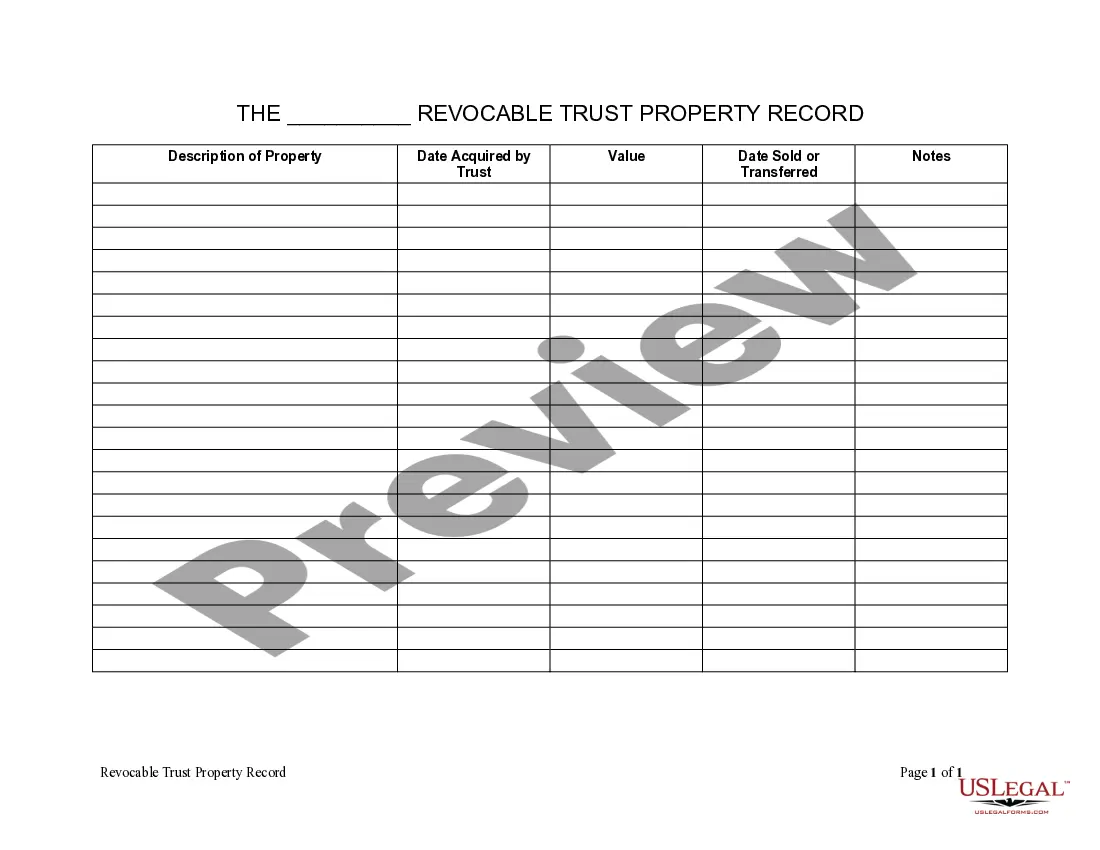

Description

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.