Revocable Living Trust Form Mississippi

Description

Form popularity

FAQ

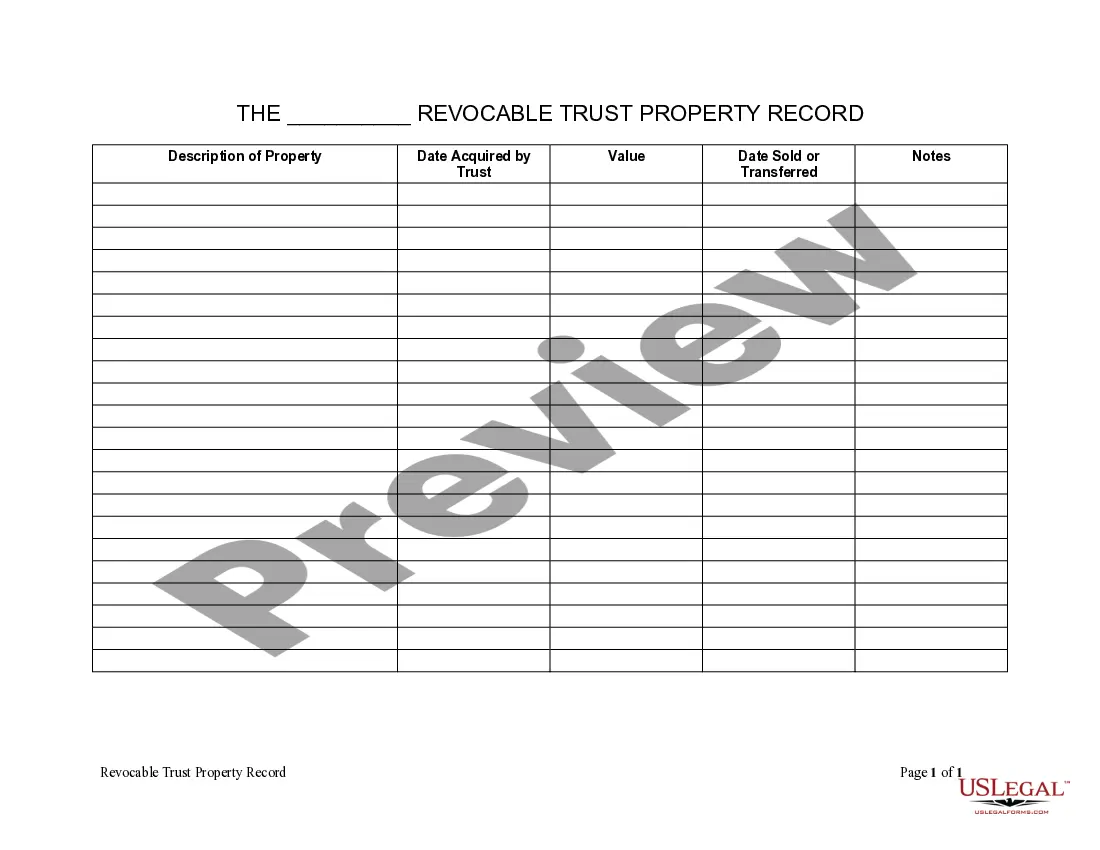

To set up a living trust in Mississippi, start by gathering necessary documents such as the revocable living trust form Mississippi. Next, you will need to draft the trust document that outlines how you want your assets managed and distributed. After that, you must transfer your assets into the trust, which officially establishes it. For assistance, consider using platforms like US Legal Forms to ensure your trust meets all legal requirements.

Certain assets should generally be kept out of a revocable living trust, such as retirement accounts like IRAs and 401(k)s due to tax implications. Additionally, any asset that requires a specific beneficiary designation, such as life insurance policies, should be left out. Using a revocable living trust form in Mississippi can help you identify which assets are suitable for inclusion and which should be handled differently.

Writing up a revocable trust typically involves specifying your preferences for asset distribution and choosing a trustee. It’s useful to start with a comprehensive revocable living trust form in Mississippi to provide a structured template for your trust. Additionally, clearly state your goals and any specific conditions for distributions to help avoid confusion for your beneficiaries.

To fill out a revocable living trust, start by gathering information about your assets and beneficiaries. Clearly identify each asset, its value, and who will receive it. You can simplify this process by using a reliable revocable living trust form in Mississippi, which guides you step-by-step to ensure accuracy and legality.

A common mistake parents make when setting up a trust fund is not clearly defining their wishes and the guidelines for distributing assets. Without clear instructions, beneficiaries might face confusion, leading to disputes or mismanagement of trust funds. It is crucial to use a detailed revocable living trust form in Mississippi for outlining your desires and ensuring that your children benefit as intended.

One downside of a revocable living trust is that it does not offer any protection from creditors. This means that if you face financial issues, your assets in the trust may still be vulnerable. Additionally, a revocable trust can be more complicated and time-consuming to set up compared to a will. When considering the revocable living trust form in Mississippi, it’s essential to weigh these factors.

While placing your house in a revocable living trust can provide benefits, there are some disadvantages to consider. One downside is the potential for additional paperwork and complexities in managing the trust. Moreover, transferring property into the trust doesn't protect it from creditors. If you want to explore this option further, consider using a revocable living trust form in Mississippi from US Legal Forms for clear guidance.

Suze Orman emphasizes the importance of having a revocable living trust to ensure your assets are managed according to your wishes during and after your life. She advises that this legal tool can help you avoid probate, making the transition smoother for your loved ones. By using a revocable living trust form in Mississippi, you can retain control over your assets while simplifying estate planning.