The United States Constitution provides every individual the freedom and right to own property in their own name. The Office of the Recorder protects that freedom by permanently recording all original documents pertaining to property ownership and real property transactions. Real property records can be examined to ensure good title, and recording of documents may entitle a person to a lien, security interest, or priority to stand in line ahead another creditor.

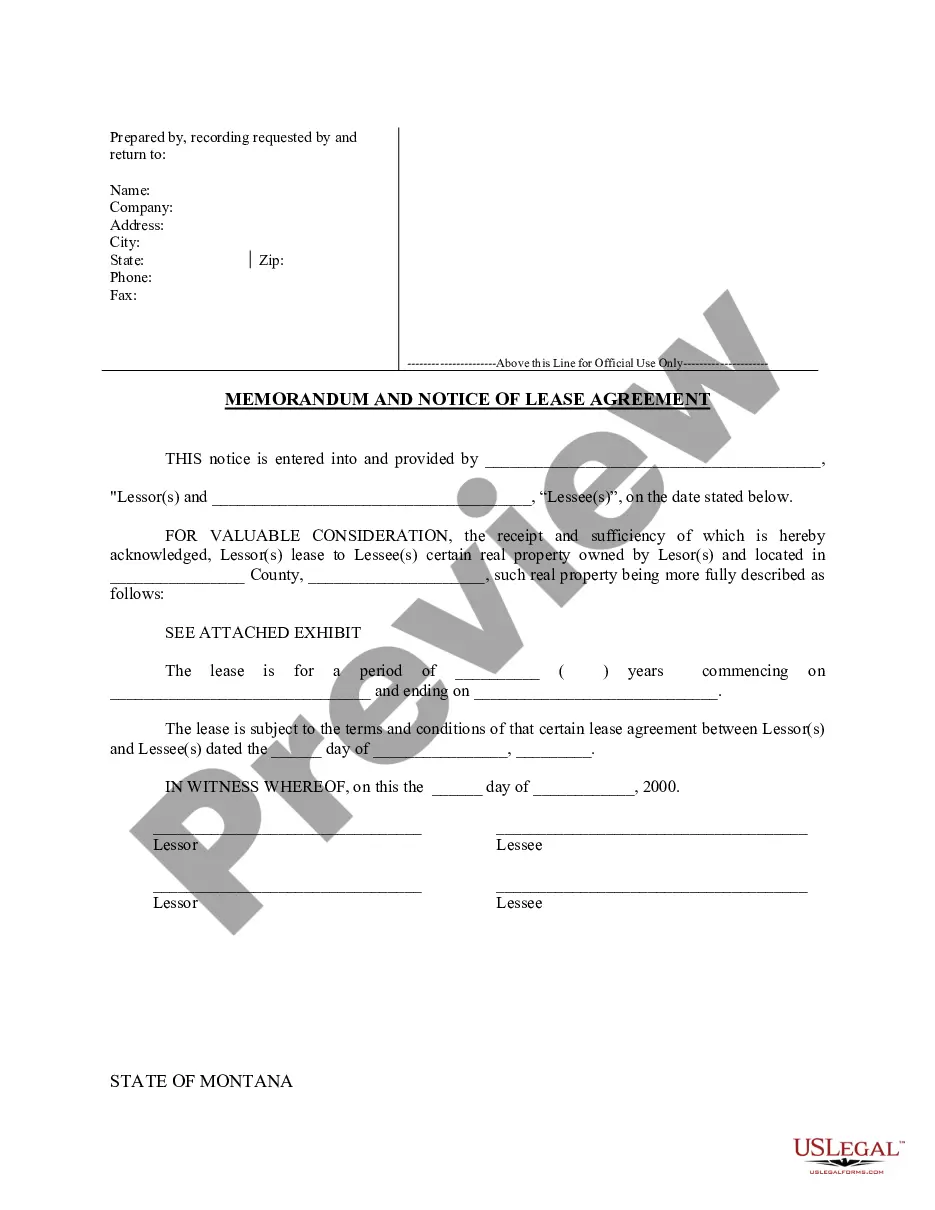

Memorandum Of Lease Montana Withholding

Description

How to fill out Memorandum Of Lease Montana Withholding?

There's no longer a necessity to squander hours searching for legal paperwork to comply with your local state mandates.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our platform provides over 85k templates for various business and personal legal matters categorized by state and usage area.

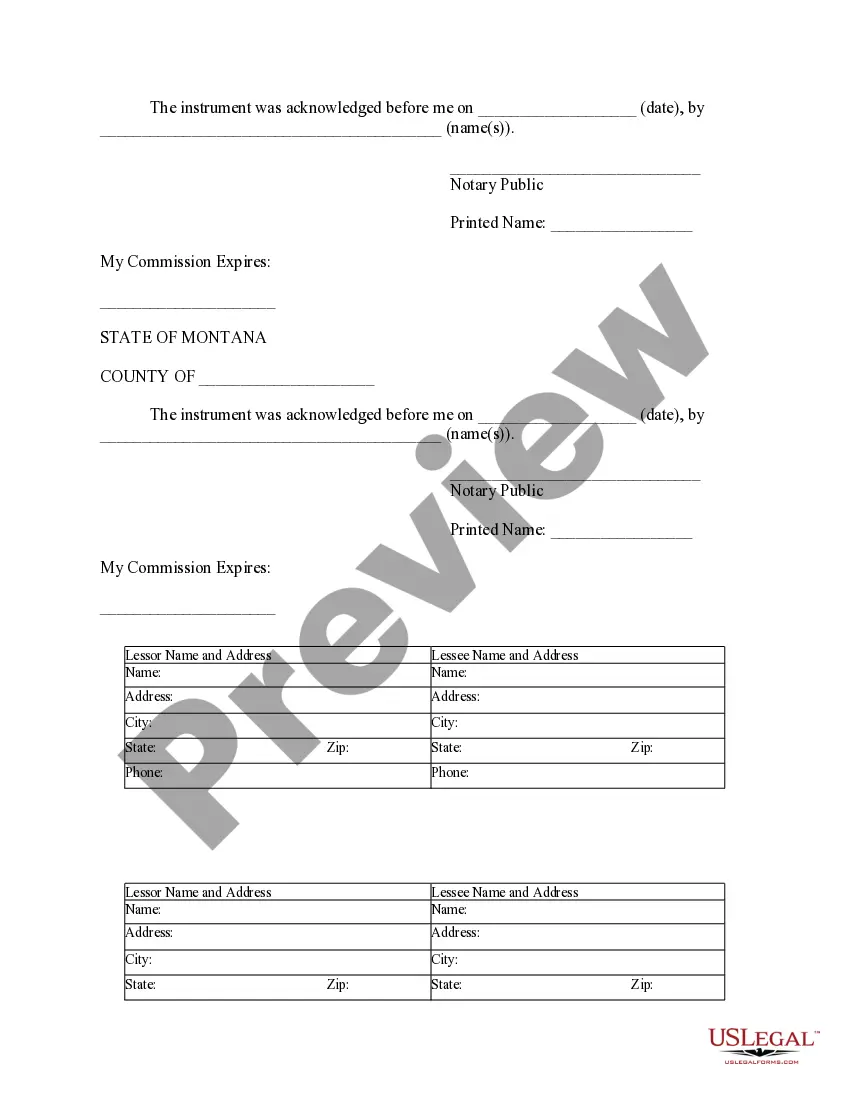

Once you locate the correct one, click Buy Now next to the template name, select a preferred pricing plan, and create an account or Log In. Complete your subscription payment with a credit card or via PayPal to continue. Choose the file format for your Memorandum Of Lease Montana Withholding and download it to your device. You may either print your form to fill it out manually or upload the sample if you prefer to do it within an online editor. Creating legal documents under federal and state regulations is quick and straightforward with our platform. Give US Legal Forms a try now to keep your documentation organized!

- All forms are appropriately constructed and verified for accuracy, so you can be confident in acquiring an up-to-date Memorandum Of Lease Montana Withholding.

- If you are acquainted with our service and already possess an account, ensure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by accessing the My documents tab in your profile.

- If you haven't utilized our service before, completing the process will take a few additional steps.

- Here's how new users can acquire the Memorandum Of Lease Montana Withholding from our collection.

- Review the page content thoroughly to verify it contains the sample you require.

- If the previous one does not suit you, utilize the Search field above to explore additional samples.

Form popularity

FAQ

Home / Taxes & Fees / Wage Withholding. Wage withholding is the money held back by an employer to pay an employee's income tax. This is the employee's money, held in trust by the employer until paid to the state. Employers can find more information in the Montana Withholding Tax Table and Guide.

U.S. States that Require State Tax Withholding FormsAlabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.More items...

In an operating lease, the lessee may deduct the amount of rental actually due under the lease agreement during the year. This is subject to 5% expanded withholding tax (EWT).

Montana wage withholding is required when wages are earned in Montana. Employers are liable for Montana withholding taxes and are only relieved of that liability once they have withheld the correct amount of taxes from the employees' wages for a given pay period.

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.