The United States Constitution provides every individual the freedom and right to own property in their own name. The Office of the Recorder protects that freedom by permanently recording all original documents pertaining to property ownership and real property transactions. Real property records can be examined to ensure good title, and recording of documents may entitle a person to a lien, security interest, or priority to stand in line ahead another creditor.

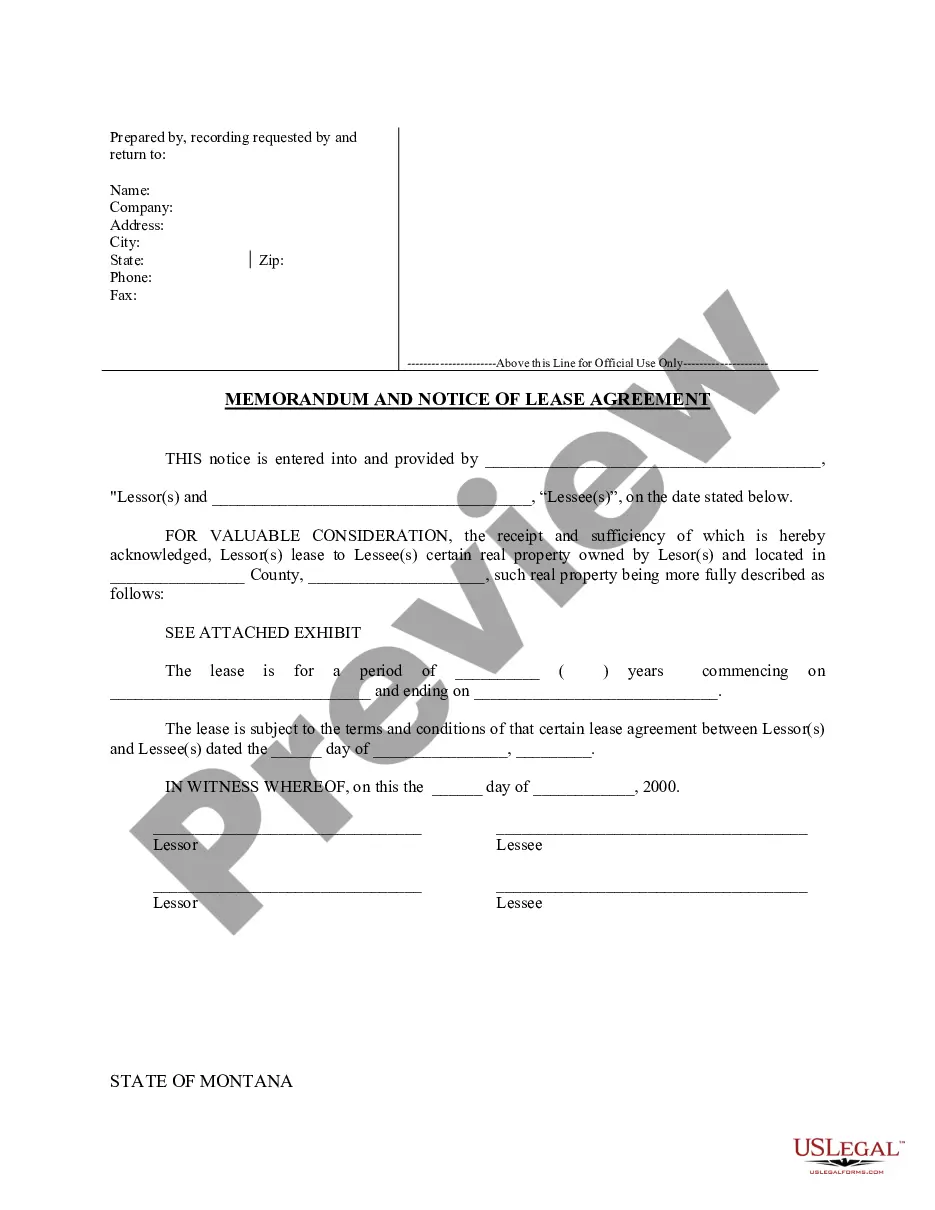

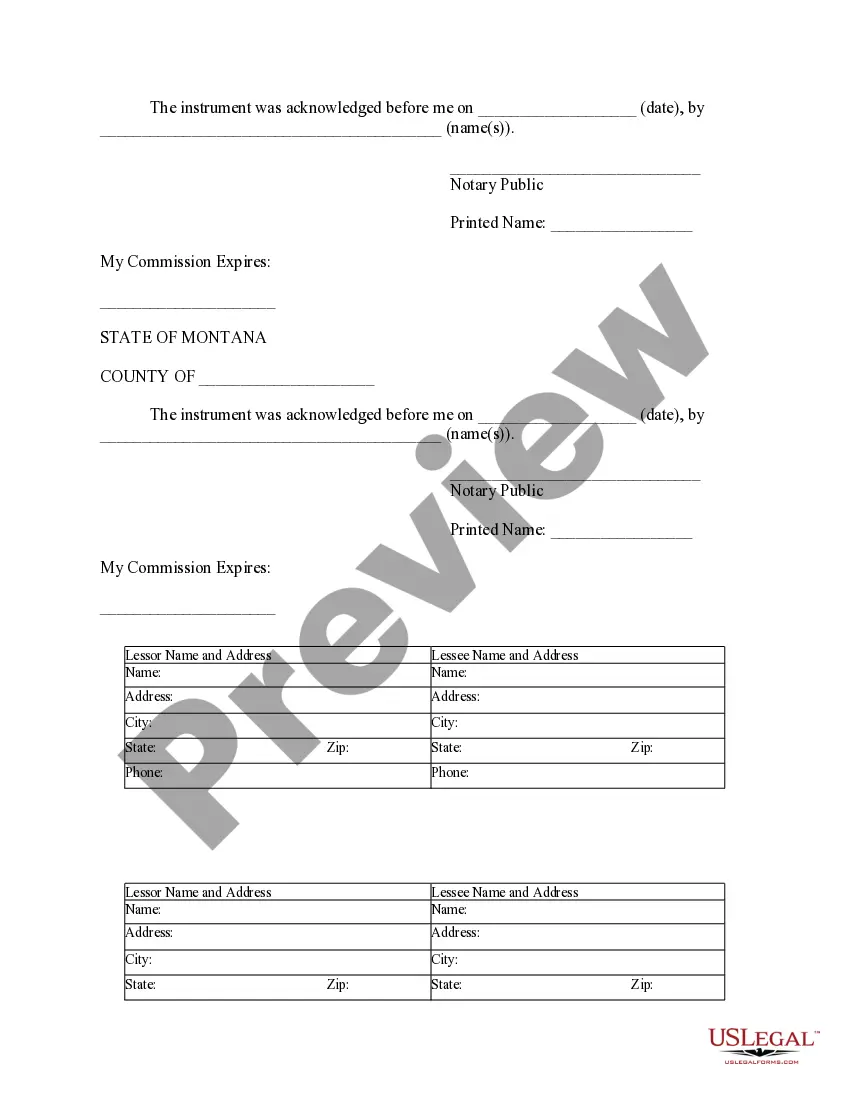

Memorandum Of Lease Montana Withholding Form

Description

How to fill out Memorandum Of Lease Montana Withholding Form?

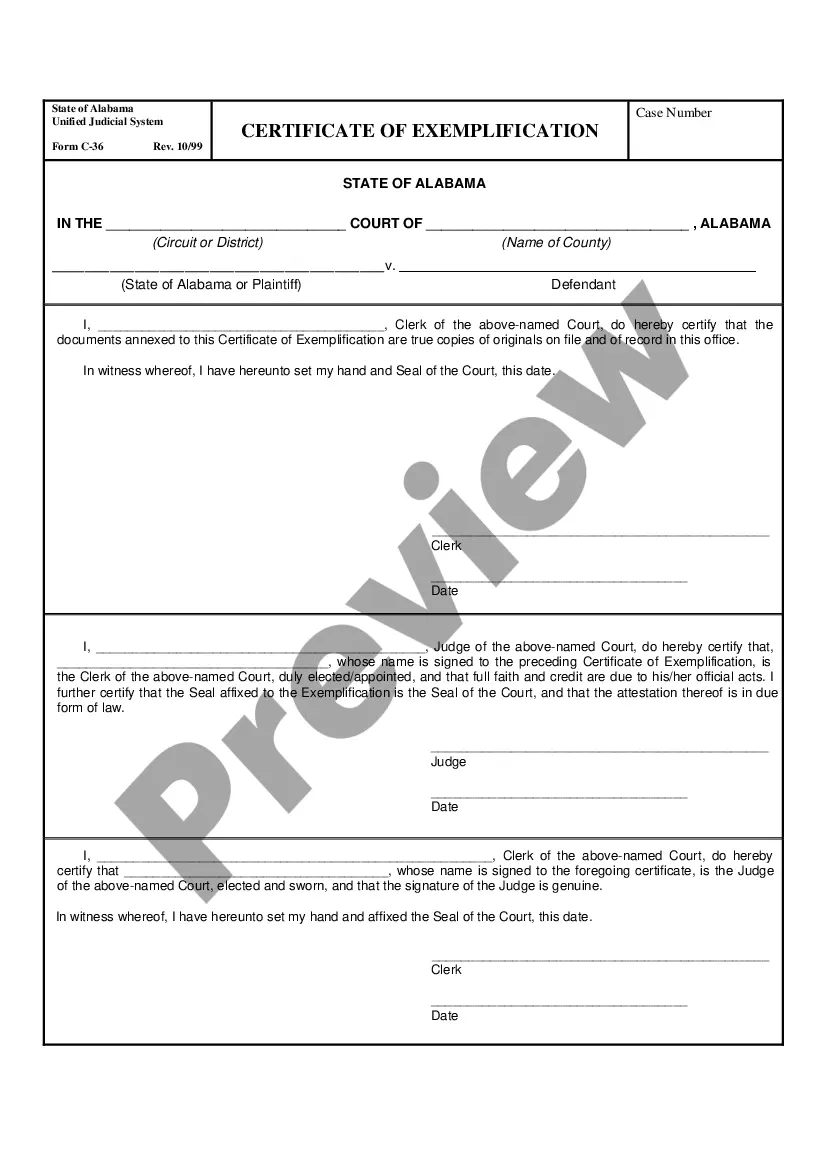

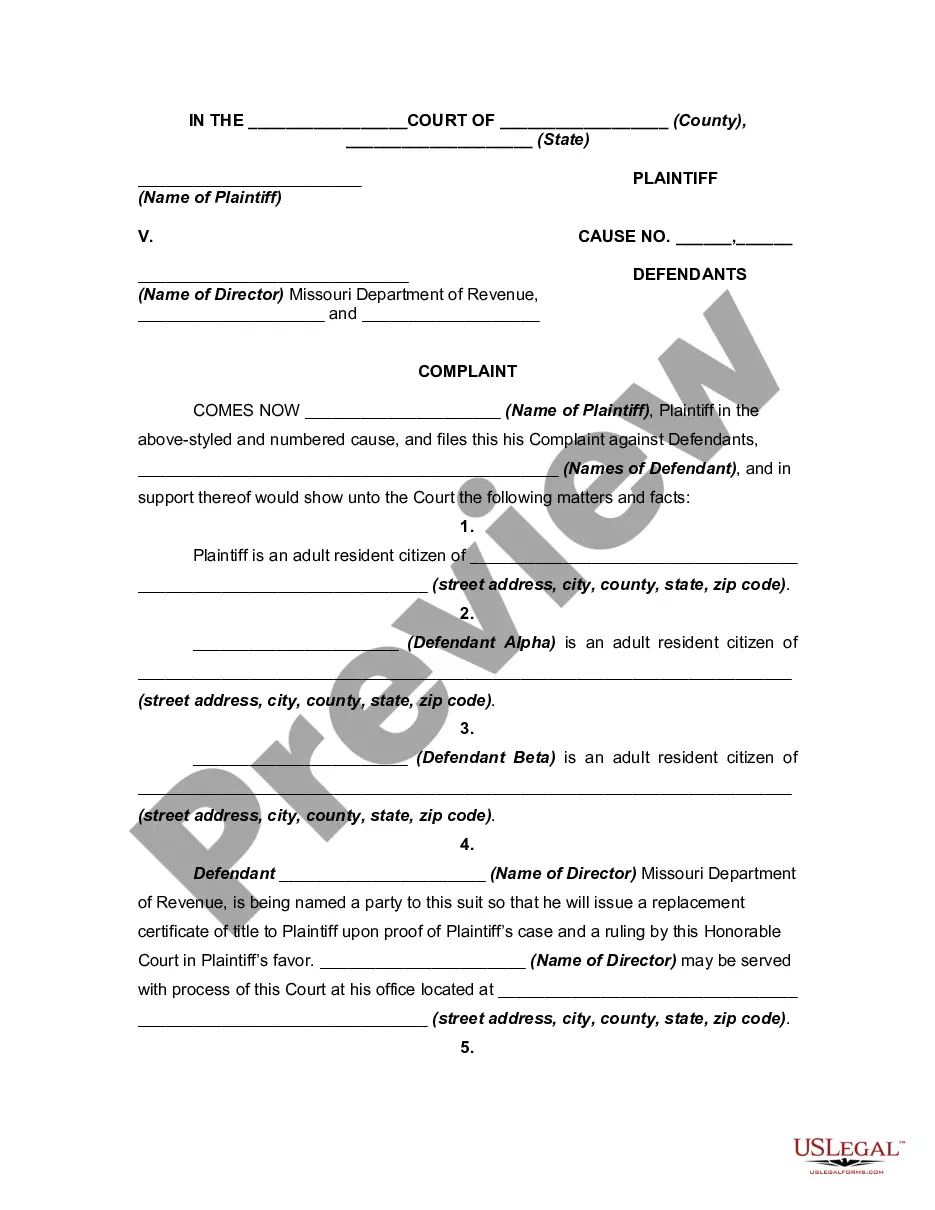

There is no longer a necessity to invest time searching for legal documents to satisfy your local state stipulations. US Legal Forms has compiled all of them in a singular location and enhanced their availability.

Our platform offers over 85,000 templates for any business and individual legal situations categorized by state and purpose. All forms are expertly drafted and validated, ensuring you receive a current Memorandum Of Lease Montana Withholding Form.

If you are acquainted with our service and already possess an account, ensure that your subscription is active before accessing any templates.

Creating formal documentation in accordance with federal and state laws and regulations is quick and straightforward with our library. Explore US Legal Forms today to maintain your documents in order!

- Log In to your account, select the document, and click Download.

- Access all previously acquired documentation at any time by opening the My documents tab in your profile.

- If you are a first-time user, the process will involve additional steps.

- Carefully review the page content to ensure it features the sample you need.

- Use the form description and preview options if available.

- Utilize the search field above to look for another template if the current one does not suit you.

- Click Buy Now next to the template title when you locate the appropriate one.

- Choose the most suitable subscription plan and either create an account or Log In.

- Complete your payment for the subscription using a card or PayPal to proceed.

- Select the file format for your Memorandum Of Lease Montana Withholding Form and download it to your device.

- Print your form to fill it out by hand or upload the document if you prefer to complete it in an online editor.

Form popularity

FAQ

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.

Montana has a progressive state income tax, with a top rate of 6.9%. Montana has only a few other types of taxes. There is no sales tax in the state and property taxes are below the national average.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Home / Taxes & Fees / Wage Withholding. Wage withholding is the money held back by an employer to pay an employee's income tax. This is the employee's money, held in trust by the employer until paid to the state. Employers can find more information in the Montana Withholding Tax Table and Guide.