- US Legal Forms

- Trusts

-

Montana Reconveyance - Satisfaction...

Trust And Indenture Act

Description Reconveyance Deed Trustee

Reconveyance Trust Trustee Related forms

View Alaska deed form for trust

View Alaska deed form for lieu of foreclosure

View Alaska deed form for death

View Alaska deed forms

View Alaska deed of trust

Montana Trust Indenture Form Rating

Trust Indenture Document Form popularity

Mt Reconveyance Trustee Other Form Names

Trust And Indenture Act Related Searches

-

trust indenture act of 1939 pdf

-

trust indenture act of 1939 exemptions

-

trust indenture act of 1939 protects

-

trust indenture act section 310

-

indenture act of 1850

-

trust indenture act 314

-

trust indenture example

-

trust indenture act of 1939 sec

-

trust indenture act of 1939 pdf

-

trust indenture act of 1939 text

Montana Deed Trustee Interesting Questions

The Trust and Indenture Act in Montana is a set of laws and regulations that govern the creation and operation of trusts and indentures, which are legal agreements that outline the rights and obligations of parties involved in financial transactions or debt securities.

The Trust and Indenture Act is important because it ensures the fair treatment of parties involved in financial transactions and debt securities. It provides a legal framework to protect the rights and interests of all parties, including investors and issuers.

The Trust and Indenture Act in Montana applies to anyone involved in the creation, management, and enforcement of trusts and indentures within the state. This includes trustees, issuers, investors, and other parties involved in financial transactions or debt securities.

The Trust and Indenture Act in Montana includes provisions related to the appointment and duties of trustees, protection of rights and interests of investors, disclosure requirements, enforcement mechanisms, and remedies in case of default or non-compliance.

The Trust and Indenture Act in Montana protects investors by setting standards for disclosure of relevant information, ensuring the proper management of funds held in trust, and providing remedies in case of default or non-compliance. It helps ensure transparency, accountability, and fair treatment for investors.

A trustee, as defined by the Trust and Indenture Act in Montana, is a person or entity responsible for administering and enforcing the terms of a trust or indenture. Their role involves safeguarding the interests of the parties involved, managing funds, ensuring compliance with legal requirements, and acting as a fiduciary.

In case of default under the Trust and Indenture Act, the trustee may have the authority to take various actions depending on the terms of the trust or indenture. These actions may include accelerating the repayment of debt, initiating legal proceedings, enforcing collateral, or taking possession of assets to satisfy the obligations.

To ensure compliance with the Trust and Indenture Act in Montana, parties involved should carefully review and understand the provisions of the Act, seek professional legal advice if needed, accurately fulfill disclosure requirements, maintain proper records, and act in good faith to fulfill their obligations under the trust or indenture.

Yes, there can be penalties for non-compliance with the Trust and Indenture Act in Montana. These penalties may include fines, suspension or revocation of licenses or registrations, damages to aggrieved parties, or other remedies as determined by the court.

Mt Satisfaction Indenture Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Montana

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

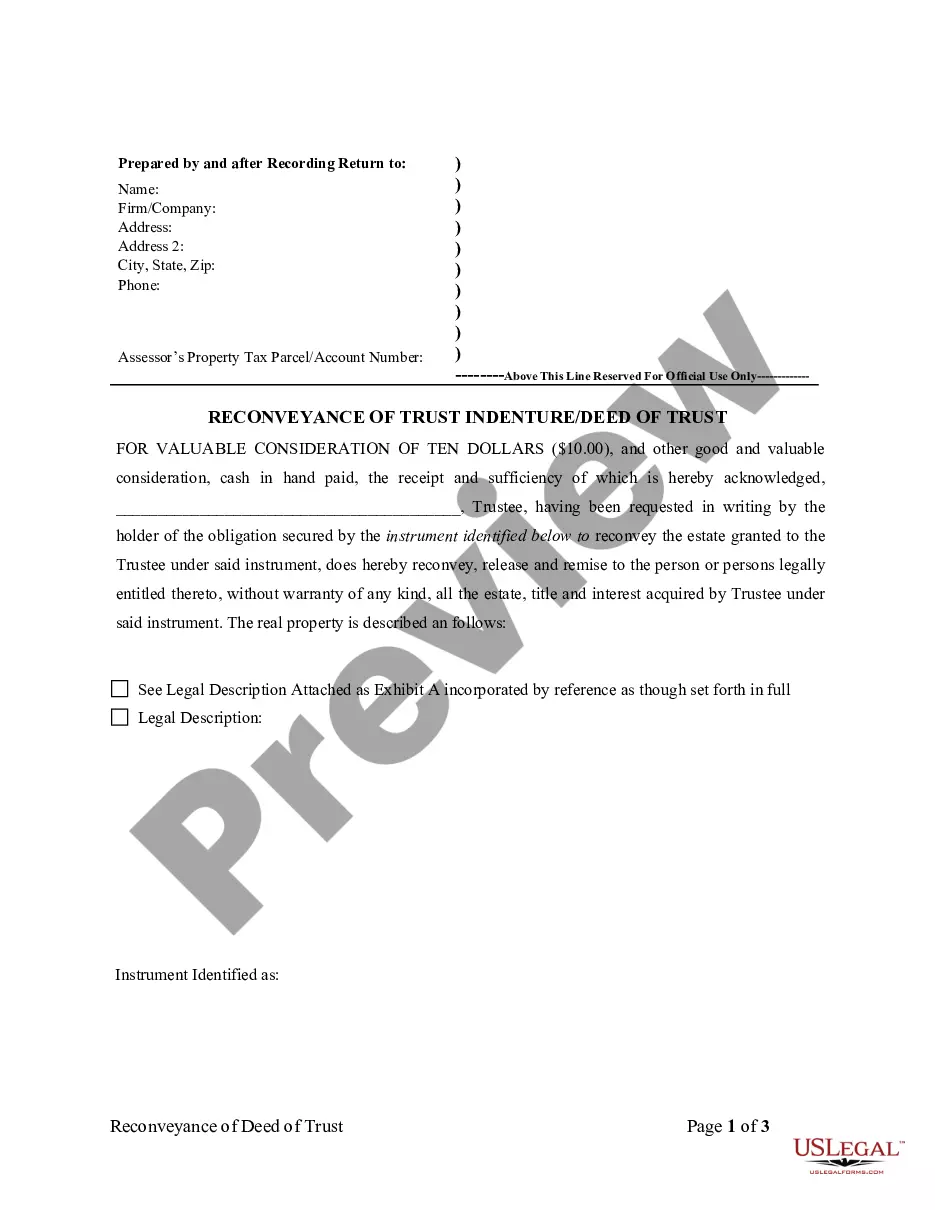

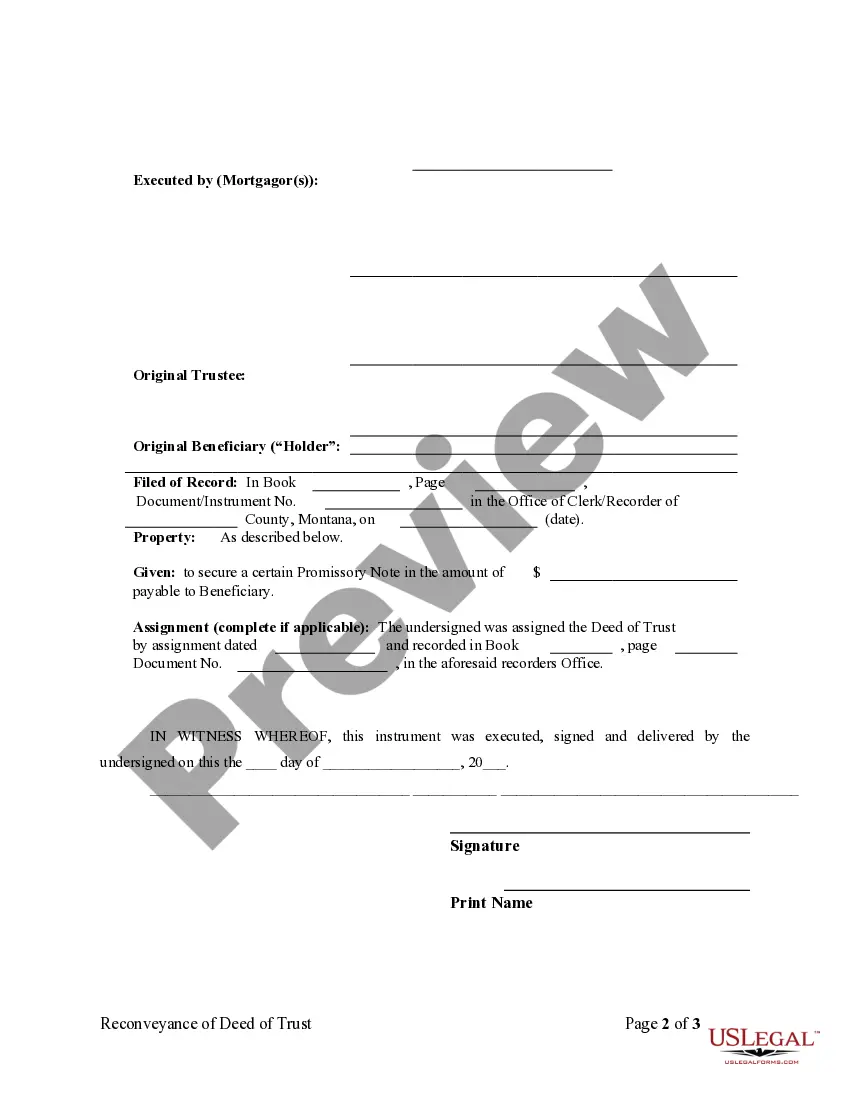

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Montana Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment of a real estate mortgage may be recorded in like manner as a real estate mortgage and the record thereof shall operate as due and legal notice to the mortgagor and all persons subsequently deriving title to the mortgage from the assignor as well as to all other persons, including subsequent purchasers, encumbrancers, mortgagees, or other lienholders.

Demand to Satisfy: Upon full payoff, borrower may request that lender record satisfation of the deed of trust, whereupon the lender must do so within 30 days or face liability.

Recording Satisfaction: A mortgage shall be discharged upon the record thereof by the county clerk in whose custody it shall be whenever there shall be presented to him a certificate executed by the mortgagee, and certified as in this code prescribed to entitle a conveyance to be recorded, specifying that such mortgage has been paid or otherwise satisfied or discharged.

Penalty: If mortgagee fails to record satisfaction within 30 days of request to do so from mortgagor, mortgagee is liable for damages of $100, plus all actual damages.

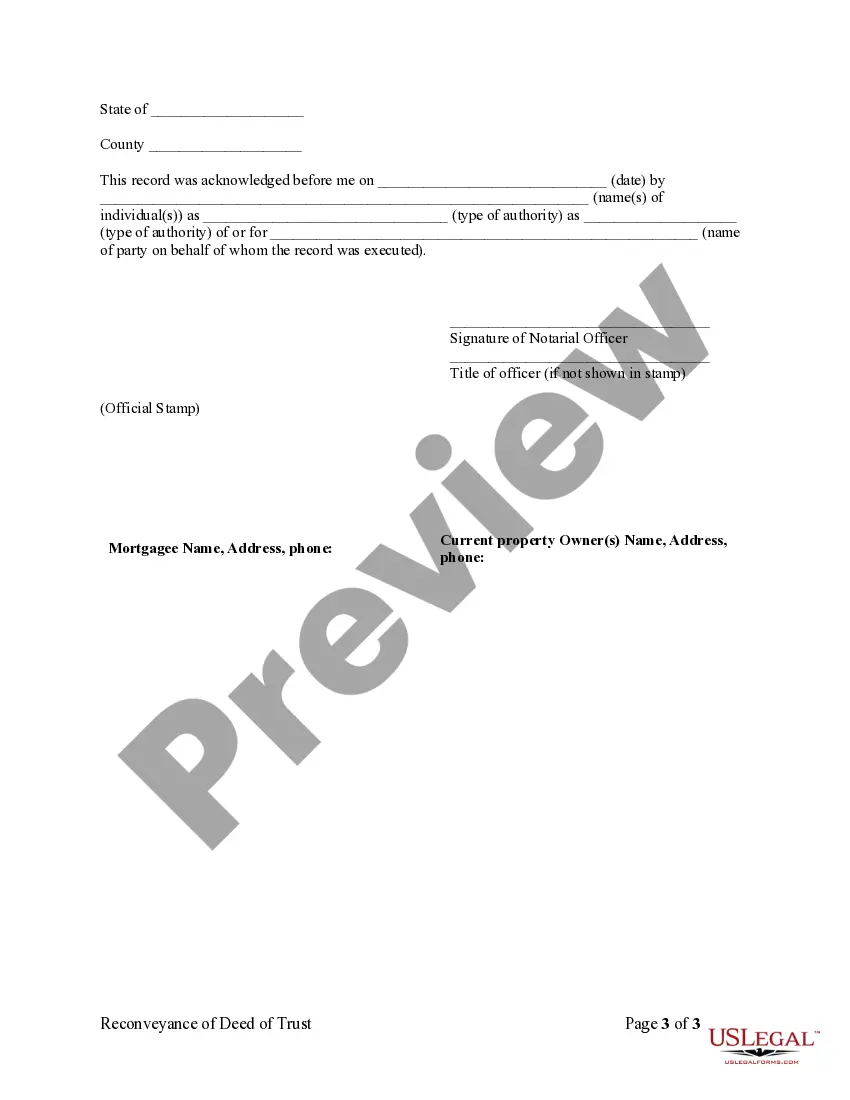

Acknowledgment: An assignment or satisfaction must contain a proper Montana acknowledgment, or other acknowledgment approved by Statute.

Montana Statutes

71-1-207. Recording of mortgages and assignments.(1) Mortgages of real property may be acknowledged or proved, certified, and recorded in the same manner and with the same effect as grants of real property.

(2) An assignment of a real estate mortgage may be recorded in the same manner as a real estate mortgage, and the record operates as legal notice to the mortgagor and all persons subsequently deriving title to the mortgage from the assignor as well as to all other persons, including subsequent purchasers, encumbrancers, mortgagees, or other lienholders. An assignment must contain the assignee's post-office address at the assignee's place of residence and may not be recorded or filed unless it contains the post-office address.

71-1-211. Satisfaction of mortgage -- record thereof.

(1) A mortgage must be discharged upon the record by the county clerk in whose custody it is recorded whenever there is presented to the clerk a certificate executed by the mortgagee or the mortgagee's personal representative or assignee, acknowledged or proved and certified as prescribed in this chapter that entitles a conveyance to be recorded, specifying that the mortgage has been paid or otherwise satisfied or discharged.(2) Every certificate and the proof and acknowledgment must be recorded at full length, and a reference must be made to the book and page containing the record in the mortgagor and mortgagee indexes as to the discharge of the mortgage.

71-1-212. Penalties for failure to give certificate of discharge or release after full performance.

After the full performance of the conditions of a mortgage and whether before or after a breach of the mortgage, a mortgagee or the personal representative or assignee of the mortgagee who refuses or neglects to execute, acknowledge, and deliver to the mortgagor a certificate of discharge or release of the mortgage within 90 days after a request for one is liable to the mortgagor or the mortgagor's heirs or assigns in the sum of $500 and all actual damages resulting from the neglect or refusal.

71-1-213. Discharge or release by other than mortgagee.

(1) If a discharge or release is made by the personal representative of the mortgagee, it must be accompanied by a certified copy of the personal representative's authority unless the authority is already recorded in the office of the county clerk and recorder where the mortgage is recorded.(2) If the discharge or release is made by an assignee, it must be accompanied by the assignment of the mortgage unless the assignment is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(3) If the discharge or release is executed by an attorney-in-fact, the discharge or release must have attached to it the power of attorney under which it is made unless the power of attorney is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(4) If the discharge or release is executed by the heir or heirs of the mortgagee, the discharge or release must be accompanied by a certified copy of an order or decree of a court of competent jurisdiction showing the authority unless the order or decree is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(5) Foreign administrators and executors may discharge or release mortgages of record in Montana if the discharge or release of mortgages is accompanied by an authenticated copy of their letters of administration or letters testamentary, with the certificate of the clerk of the court in which the appointment was made that the letters have not been revoked and are in full force. The certificate and certified copy of letters must be recorded with the discharge or release of the mortgage. When presented and recorded, the discharge or release has the same effect as if the mortgage was discharged or released by the mortgagee.

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Montana Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment of a real estate mortgage may be recorded in like manner as a real estate mortgage and the record thereof shall operate as due and legal notice to the mortgagor and all persons subsequently deriving title to the mortgage from the assignor as well as to all other persons, including subsequent purchasers, encumbrancers, mortgagees, or other lienholders.

Demand to Satisfy: Upon full payoff, borrower may request that lender record satisfation of the deed of trust, whereupon the lender must do so within 30 days or face liability.

Recording Satisfaction: A mortgage shall be discharged upon the record thereof by the county clerk in whose custody it shall be whenever there shall be presented to him a certificate executed by the mortgagee, and certified as in this code prescribed to entitle a conveyance to be recorded, specifying that such mortgage has been paid or otherwise satisfied or discharged.

Penalty: If mortgagee fails to record satisfaction within 30 days of request to do so from mortgagor, mortgagee is liable for damages of $100, plus all actual damages.

Acknowledgment: An assignment or satisfaction must contain a proper Montana acknowledgment, or other acknowledgment approved by Statute.

Montana Statutes

71-1-207. Recording of mortgages and assignments.(1) Mortgages of real property may be acknowledged or proved, certified, and recorded in the same manner and with the same effect as grants of real property.

(2) An assignment of a real estate mortgage may be recorded in the same manner as a real estate mortgage, and the record operates as legal notice to the mortgagor and all persons subsequently deriving title to the mortgage from the assignor as well as to all other persons, including subsequent purchasers, encumbrancers, mortgagees, or other lienholders. An assignment must contain the assignee's post-office address at the assignee's place of residence and may not be recorded or filed unless it contains the post-office address.

71-1-211. Satisfaction of mortgage -- record thereof.

(1) A mortgage must be discharged upon the record by the county clerk in whose custody it is recorded whenever there is presented to the clerk a certificate executed by the mortgagee or the mortgagee's personal representative or assignee, acknowledged or proved and certified as prescribed in this chapter that entitles a conveyance to be recorded, specifying that the mortgage has been paid or otherwise satisfied or discharged.(2) Every certificate and the proof and acknowledgment must be recorded at full length, and a reference must be made to the book and page containing the record in the mortgagor and mortgagee indexes as to the discharge of the mortgage.

71-1-212. Penalties for failure to give certificate of discharge or release after full performance.

After the full performance of the conditions of a mortgage and whether before or after a breach of the mortgage, a mortgagee or the personal representative or assignee of the mortgagee who refuses or neglects to execute, acknowledge, and deliver to the mortgagor a certificate of discharge or release of the mortgage within 90 days after a request for one is liable to the mortgagor or the mortgagor's heirs or assigns in the sum of $500 and all actual damages resulting from the neglect or refusal.

71-1-213. Discharge or release by other than mortgagee.

(1) If a discharge or release is made by the personal representative of the mortgagee, it must be accompanied by a certified copy of the personal representative's authority unless the authority is already recorded in the office of the county clerk and recorder where the mortgage is recorded.(2) If the discharge or release is made by an assignee, it must be accompanied by the assignment of the mortgage unless the assignment is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(3) If the discharge or release is executed by an attorney-in-fact, the discharge or release must have attached to it the power of attorney under which it is made unless the power of attorney is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(4) If the discharge or release is executed by the heir or heirs of the mortgagee, the discharge or release must be accompanied by a certified copy of an order or decree of a court of competent jurisdiction showing the authority unless the order or decree is already recorded in the office of the county clerk and recorder where the mortgage is recorded.

(5) Foreign administrators and executors may discharge or release mortgages of record in Montana if the discharge or release of mortgages is accompanied by an authenticated copy of their letters of administration or letters testamentary, with the certificate of the clerk of the court in which the appointment was made that the letters have not been revoked and are in full force. The certificate and certified copy of letters must be recorded with the discharge or release of the mortgage. When presented and recorded, the discharge or release has the same effect as if the mortgage was discharged or released by the mortgagee.