North Carolina Fundraising Disclosure Form

State:

North Carolina

Control #:

NC-00470-22

Format:

Word;

Rich Text

Instant download

Description Nc Seller Disclosure Statement

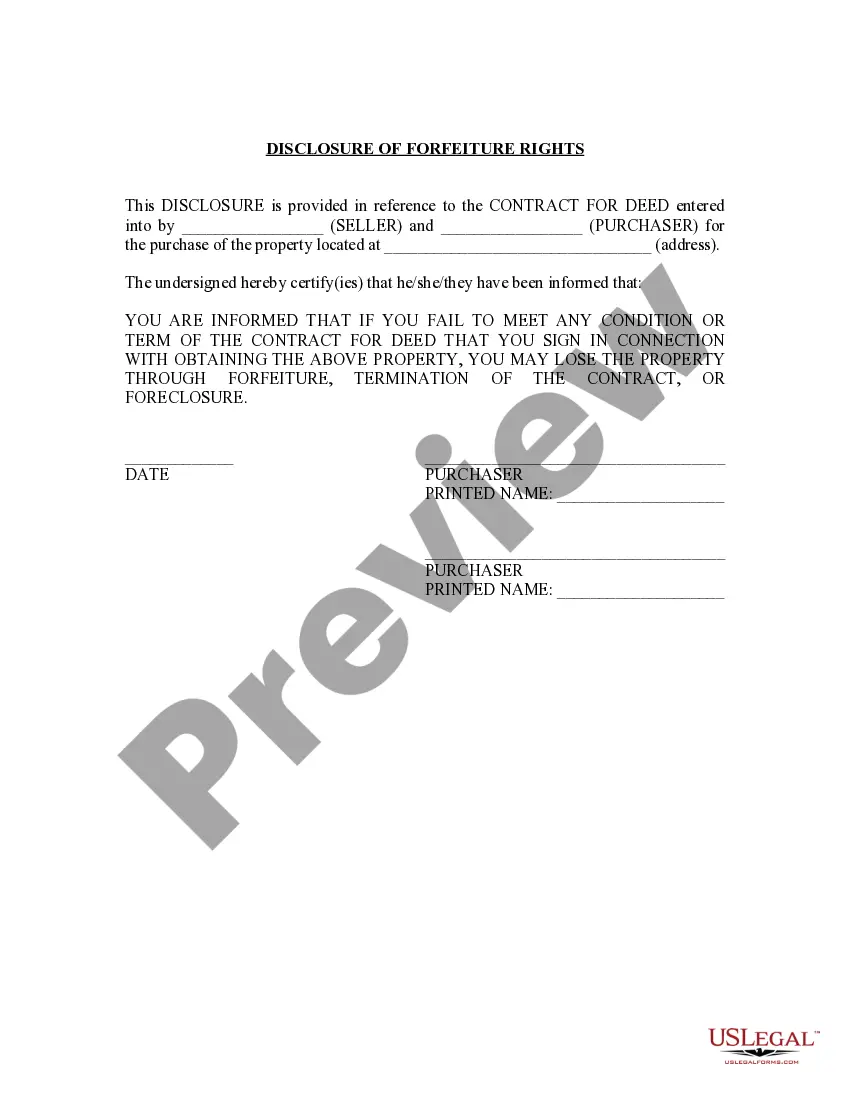

This Disclosure Notice of Forfeiture Rights form is provided by the Seller to the Purchaser at the time of the contract signing. Mandatory use of this form is rarely required; however, this form provides the Purchaser with a good understanding of forfeiture and how he or she can be affected by it in the event of a default. Should the courts become involved, the use of this form will help the Seller show that the Purchaser understood his side of the bargain and may help the Purchaser pursue the remedy of forfeiture if challenged by the Purchaser.