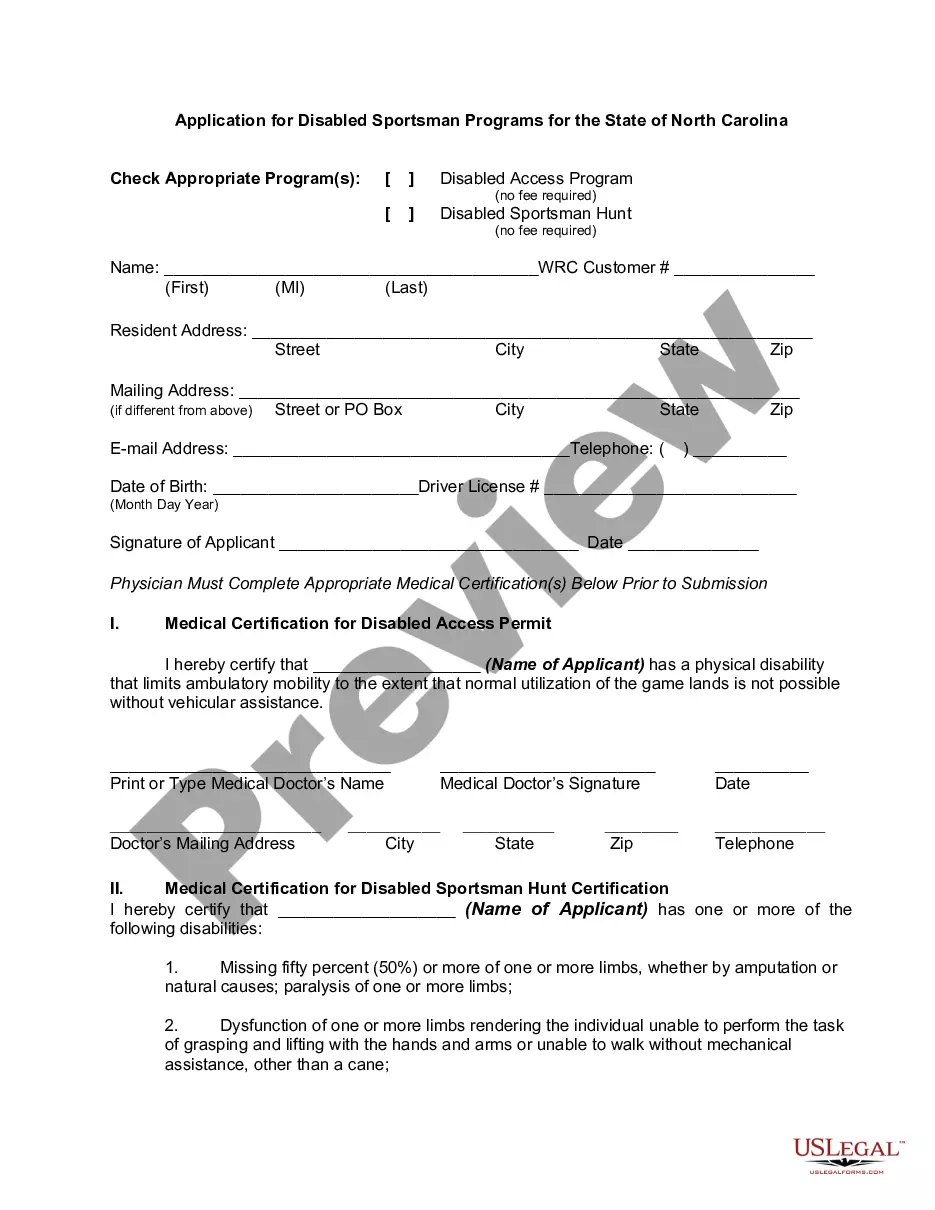

The North Carolina Wildlife Resources Commission has developed several programs, outlined below, designed to benefit persons with disabilities. The required medical certification for each is attached.

The Disabled Access Program is designed to generally improve access for persons with disabilities on game lands where landowners agree. It allows persons with limited physical mobility to operate vehicles, including ATVs, on any Commission-maintained road open for vehicular travel, those trails posted for vehicular travel and on open-gated or un-gated roads otherwise closed to vehicular traffic on certain game lands and to have access to special waterfowl hunting blinds designed for hunters with disabilities. A list of Game Lands affected by this is available in the N.C. Inland Fishing, Hunting & Trapping Regulations Digest available at wildlife service agent locations or online at www.ncwildlife.org. There is no fee associated with this permit. Participants will be issued permanent identification cards, companion cards, and vehicular access permits valid for as long as the disability remains. Qualifications: Competent medical evidence must be submitted indicating that a disability exists that limits physical mobility to the extent that normal utilization of the game lands is not possible without vehicular assistance.

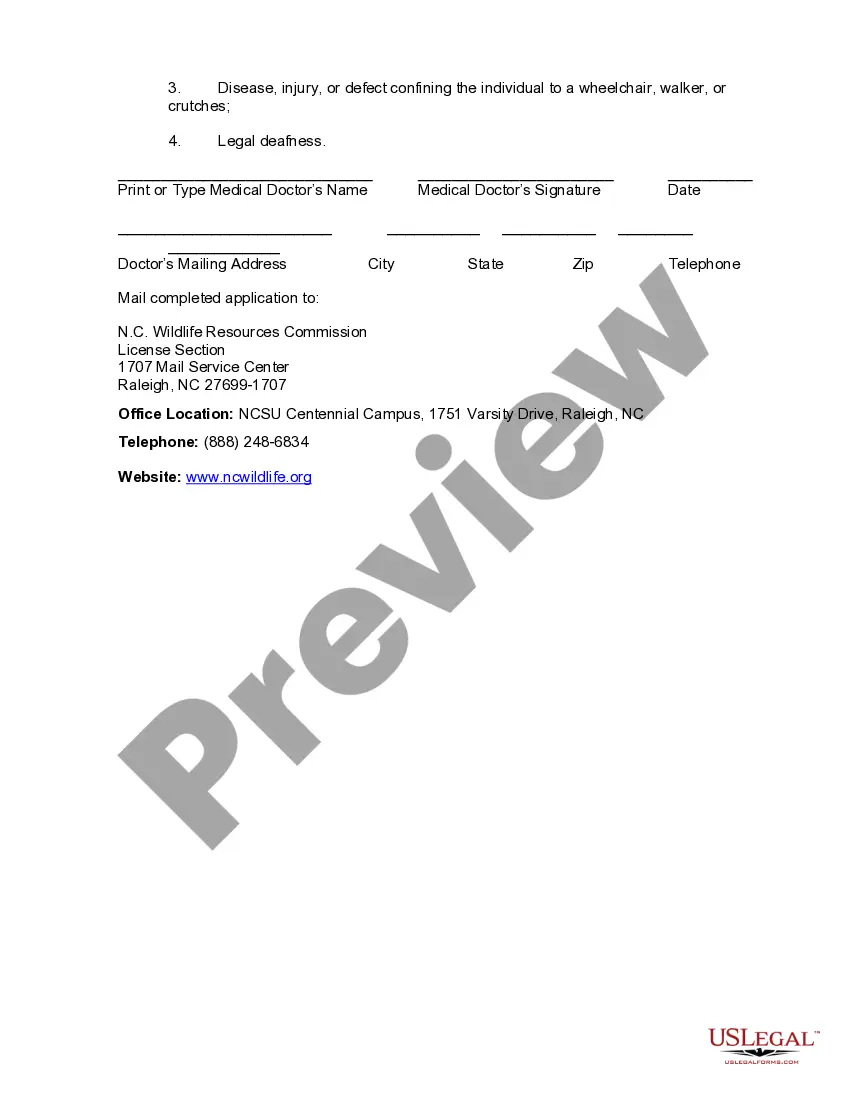

II. The Disabled Sportsman Hunt Certification is a medical certification used to establish eligibility for participation in disabled hunt opportunities. This certification is only necessary when the applicant does not possess a disabled veteran or totally disabled license. This certification is not a license; therefore, a valid hunting license, in addition to the hunt permit, is required when participating in a disabled hunt opportunity. There is no fee for this certification and it shall remain valid as long as the qualifying disability persists. A list of disabled hunt opportunities and permit hunt application procedures is available in the Permit Hunting Opportunities Guide online at www.ncwildlife.org. Qualifications: Medical certification in one of the following disabilities:

1. Missing fifty percent (50%) or more of one or more limbs, whether by amputation or natural causes; paralysis of one or more limbs;

2. Dysfunction of one or more limbs rendering the individual unable to perform the task of grasping and lifting with the hands and arms or unable to walk without mechanical assistance, other than a cane;

3. Disease, injury, or defect confining the individual to a wheelchair, walker, or crutches;

legal deafness.

Enrollment in any of these programs may continue as long as the qualifying disability remains. Participants should remember that all normal rules and regulations concerning license requirements, bag limits, manner of take, etc. apply to these program opportunities.

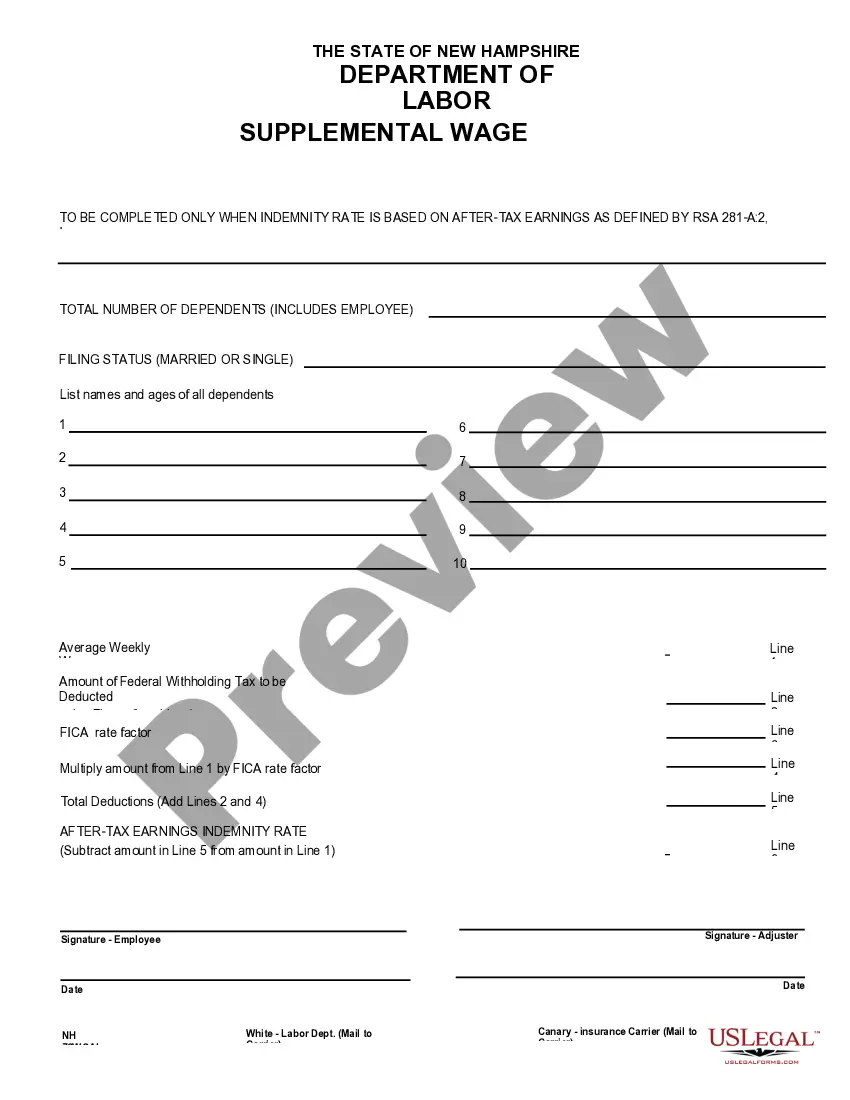

North Carolina Application Disabled Withholding Tax: A Comprehensive Overview Introduction: The North Carolina application disabled withholding tax is an important aspect of the state's tax system. Designed to support disabled individuals, this tax allows eligible applicants with disabilities to receive certain exemptions and deductions, providing much-needed financial relief. In this article, we will delve into the details and types of North Carolina application disabled withholding tax, shedding light on its purpose, eligibility criteria, and benefits. I. Understanding North Carolina Application Disabled Withholding Tax: The North Carolina application disabled withholding tax is a program administered by the state's Department of Revenue. Its main objective is to ease the tax burden on disabled individuals and their families by providing tax exemptions and deductions. II. Eligibility Criteria: To qualify for the North Carolina application disabled withholding tax, applicants must meet several requirements. These may include but are not limited to: 1. Disability Status: The applicant must have a qualifying disability as defined by the Social Security Administration (SSA), accompanied by appropriate medical documentation. 2. Age Requirement: Applicants should be at least 18 years old to be considered for this tax relief program. 3. Residency: Candidates must be residents of North Carolina, providing proof of their state residency. 4. Income Limits: The applicant's income must fall within the defined parameters set by the state. III. Types of North Carolina Application Disabled Withholding Tax: The North Carolina application disabled withholding tax includes various types of deductions and exemptions tailored to the specific needs of disabled individuals. These may encompass: 1. Standard Deduction: Eligible applicants are entitled to a standard deduction designed to reduce their overall taxable income. 2. Medical Expenses Deduction: Those with significant medical expenses can deduct these costs from their taxable income, providing additional financial relief. 3. Disabled Dependent Deduction: If the applicant has a disabled dependent, they may qualify for an additional deduction, further reducing their tax liability. 4. Disabled Access Credit: Businesses or landlords who make their premises accessible for disabled individuals may be eligible for tax credits. 5. Equipment and Home Modification Deduction: This deduction allows taxpayers to claim expenses related to adaptive equipment and necessary home modifications made to accommodate the disability. 6. Local Property Tax Exemptions: In some cases, disabled individuals may be eligible for exemptions from local property taxes on their primary residence. IV. Application Process: To apply for the North Carolina application disabled withholding tax, individuals must complete the appropriate forms provided by the Department of Revenue. These forms typically require detailed information about the applicant's disability, income, medical expenses, and other relevant documentation. It is crucial to ensure accurate and complete information is provided to avoid delays in processing. Conclusion: The North Carolina application disabled withholding tax is a vital program that offers much-needed financial relief to disabled individuals and their families. Through a range of deductions and exemptions, this tax initiative aims to alleviate the tax burden and improve the quality of life for those living with disabilities. By understanding the eligibility criteria and types of deductions available, eligible applicants can take full advantage of this program, gaining the tax benefits they deserve.