North Carolina Rent To Own Homes

State:

North Carolina

Control #:

NC-1500LT

Format:

Word;

Rich Text

Instant download

Description Notice Property Landlord

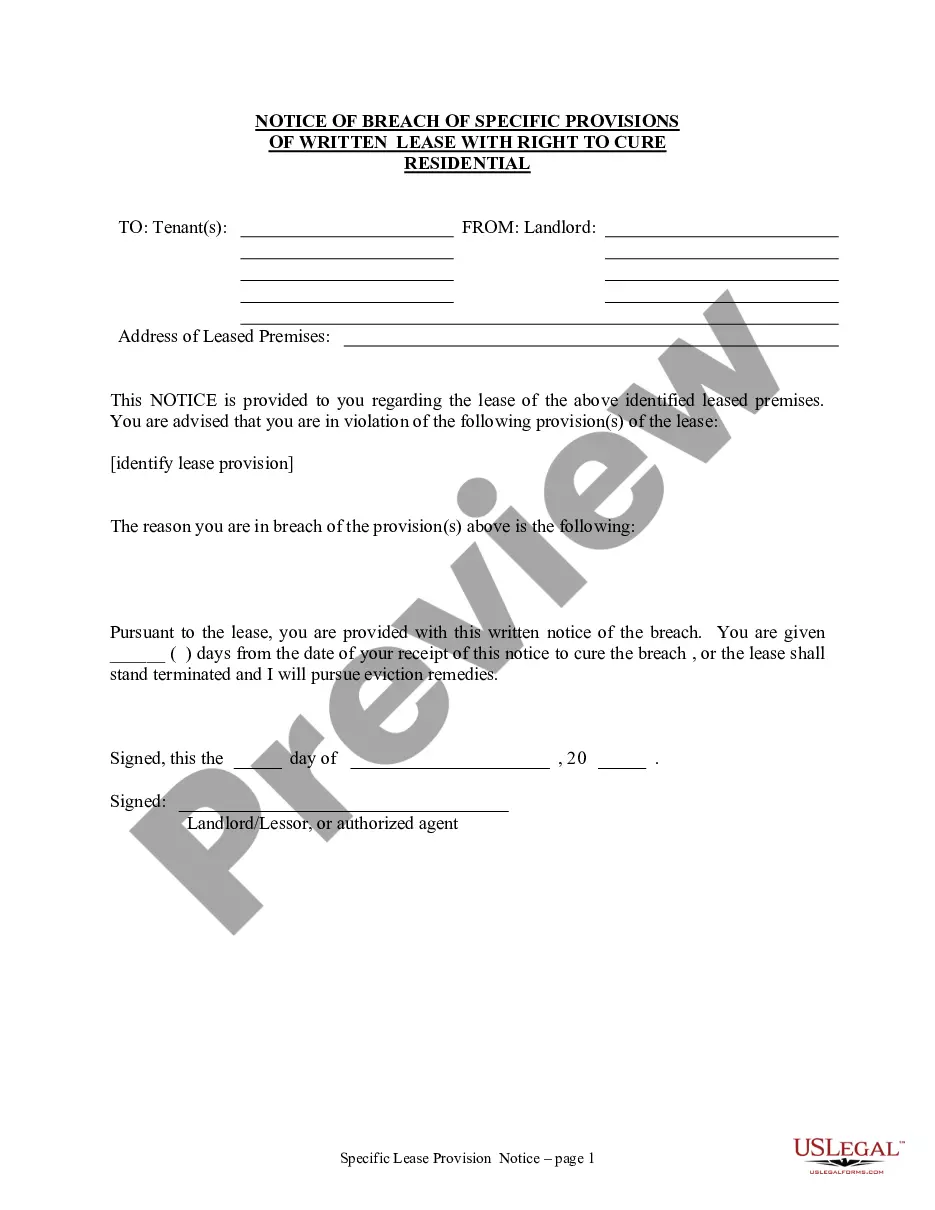

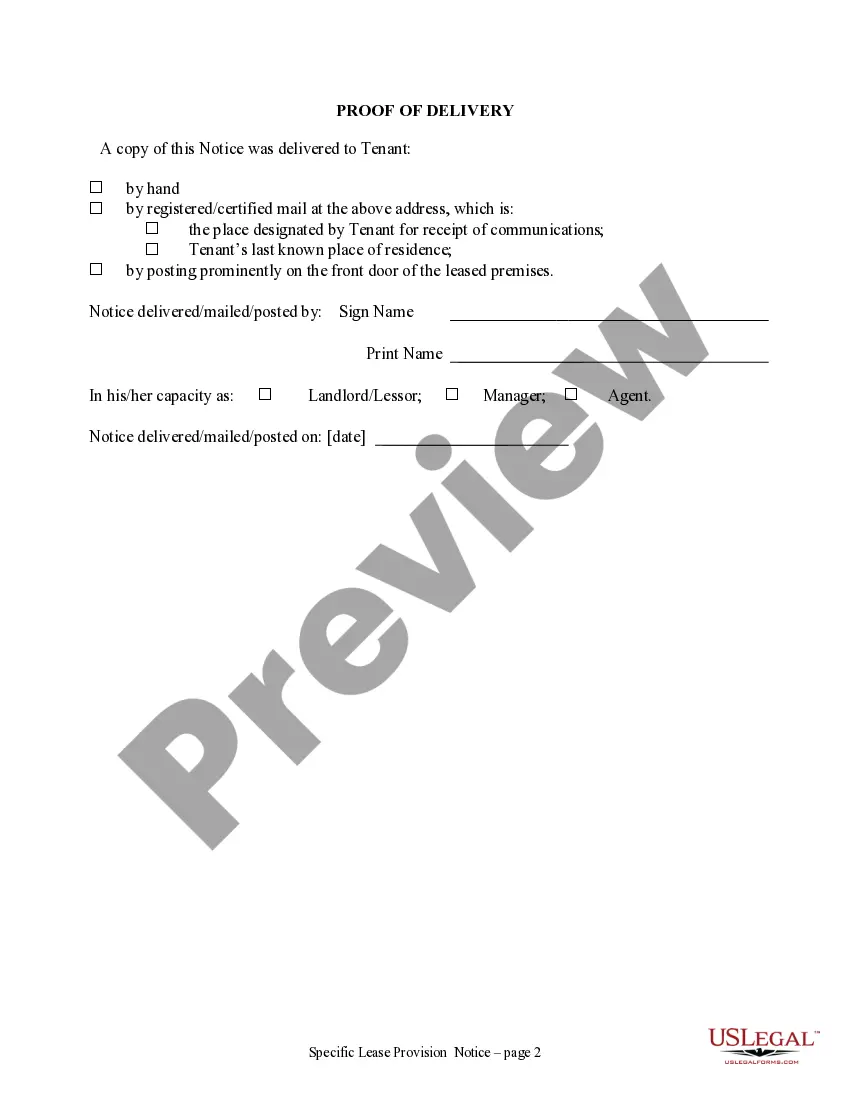

This Notice of Breach of Written Lease for Violating Specific Provisions of Lease with Right to Cure for Residential Property from Landlord to Tenant form is for a Landlord to provide notice of breach of a Written Lease for violating a specific provision of the lease with the right to cure. It is for a Residential lease. You insert the specific breach in the form. The lease should contain the specific provision which has been violated and provide the deadline to cure the breach. This form is for use when a form for your specific situation is not available.

Free preview Written Violating Tenant