Workers Comp North Carolina Agreement For Independent Contractors

Description

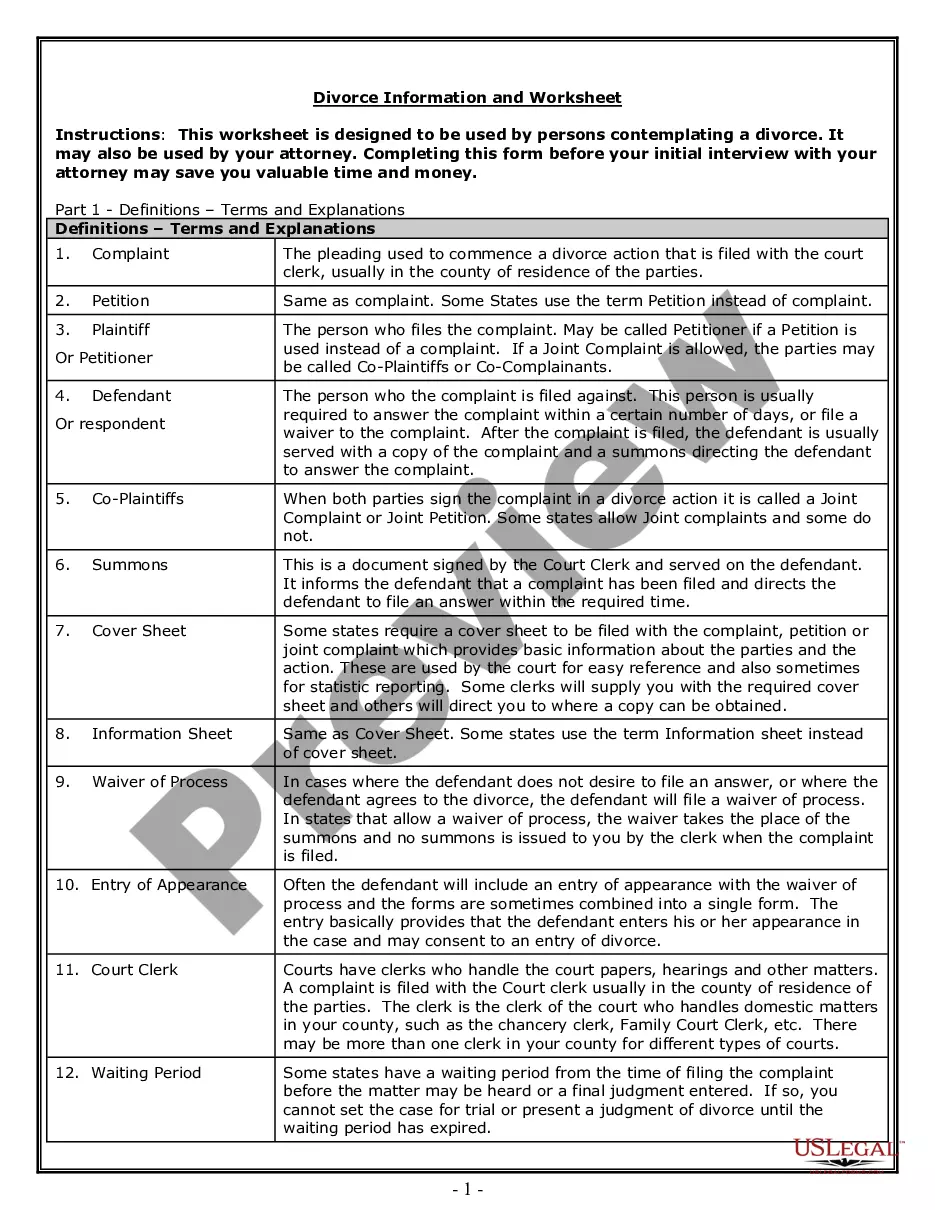

How to fill out Workers Comp North Carolina Agreement For Independent Contractors?

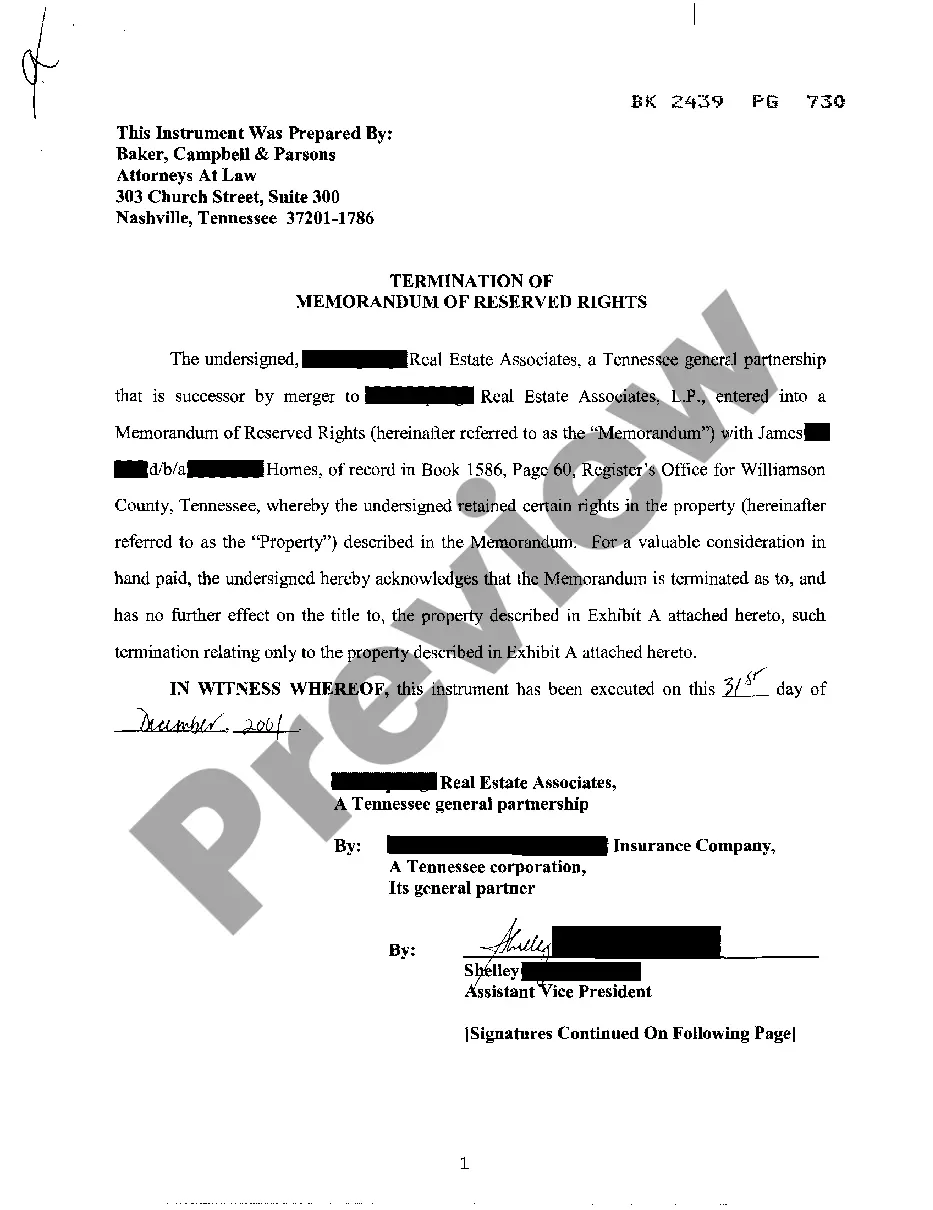

What is the most reliable service to obtain the Workers Comp North Carolina Agreement For Independent Contractors and other up-to-date versions of legal documents? US Legal Forms is the solution! It boasts the largest collection of legal documents for any requirement. Each sample is professionally drafted and verified for adherence to federal and state laws and regulations. They are organized by region and state of application, making it easy to find what you need.

Experienced users of the platform simply need to Log In/">Log In to the system, verify if their subscription is active, and click the Download button next to the Workers Comp North Carolina Agreement For Independent Contractors to retrieve it. Once downloaded, the document remains accessible for future use within the My documents section of your profile. If you do not yet have an account with us, here are the steps you should follow to create one.

US Legal Forms is an excellent choice for anyone needing to handle legal documents. Premium users can enjoy even more features as they can fill out and sign previously saved files electronically at any time using the integrated PDF editing tool. Explore it today!

- Examination of form compliance. Before acquiring any template, you need to ensure it meets your usage requirements and complies with your state or county's rules. Review the form description and utilize the Preview option if available.

- Search for alternative forms. If there are any discrepancies, use the search bar in the header to find a different sample. Click Buy Now to choose the appropriate one.

- Account registration and subscription purchase. Select the best pricing plan, Log In/">Log In or create an account, and complete the payment for your subscription using PayPal or a credit card.

- Document downloading. Choose the format you prefer to save the Workers Comp North Carolina Agreement For Independent Contractors (PDF or DOCX) and click Download to get it.

Form popularity

FAQ

Generally speaking, employers and companies in North Carolina are not required to purchase workers' compensation coverage for independent contractors, freelancers and subcontractors.

Those businesses that employ three or more employees are required to carry workers compensation insurance except agricultural employment with fewer than 10 employees, certain sawmill and logging operations and all domestic employees are exempt.

Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors. However, some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers' comp premiums for them.

North Carolina law specifies that any business that employs three or more people is required to carry workers' compensation coverage. This policy provides medical benefits in the event of a work-related accident.