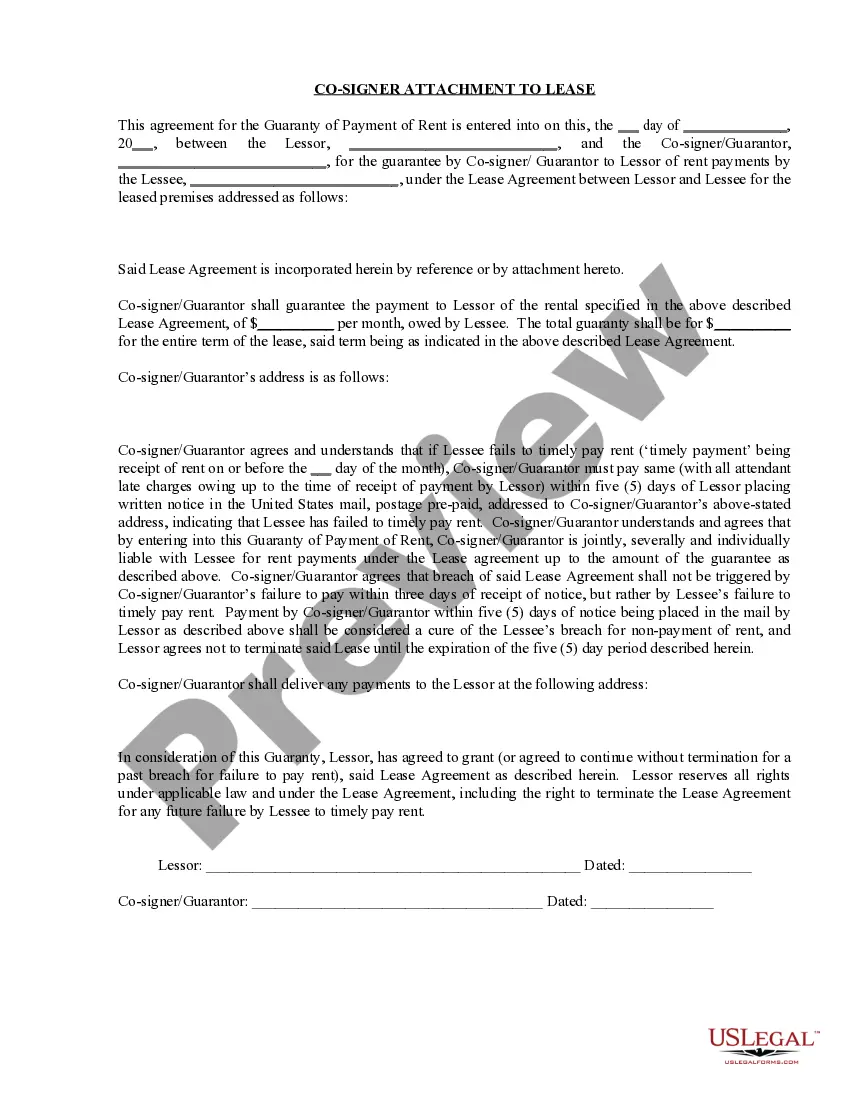

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

North Carolina Guarantor For Retirement

Description

Form popularity

FAQ

To calculate your retirement benefits as a North Carolina state employee, begin by determining your average final compensation, which is generally the highest average salary you earned during any four consecutive years of service. Next, consider your total years of service, as this will affect the percentage of your salary that you will receive in retirement. You can use the North Carolina Retirement System's formulas, which typically involve multiplying your average final compensation by the percentage based on your years of service. For individualized assistance, consider visiting US Legal Forms, where you can find resources related to the North Carolina guarantor for retirement.

North Carolina does not tax 401K contributions at the time of deposit, which provides a tax advantage for retirees. However, taxes may apply when you withdraw funds during retirement. Understanding these tax implications is crucial if you are considering becoming a North Carolina guarantor for retirement.

Option 4 for retirement in North Carolina refers to an enhanced retirement plan that some employees may choose. This option typically offers greater benefits tailored to your retirement needs. Exploring such options can be valuable if you see yourself as a North Carolina guarantor for retirement.

Yes, the state of North Carolina does match 401K contributions, providing an excellent opportunity to grow your retirement savings. This matching policy can significantly enhance your overall retirement planning. If you are considering being a North Carolina guarantor for retirement, understanding this match will benefit your financial strategy.

Retiring in North Carolina offers various advantages, such as a mild climate and access to beautiful outdoor activities. However, some retirees may face challenges, such as taxes on retirement income. We encourage you to weigh these pros and cons carefully if you are contemplating your role as a North Carolina guarantor for retirement.

Being a state employee in North Carolina comes with numerous benefits, such as job stability, health insurance, and retirement plans. These perks provide a supportive environment for your career and financial well-being. As a potential North Carolina guarantor for retirement, evaluating these benefits can help you make informed decisions about your future.

North Carolina state contributes a certain percentage of your salary to your retirement plan, which is a valuable benefit for state employees. This contribution is part of the overall retirement package provided to ensure financial security. Understanding these contributions is vital for anyone considering their role as a North Carolina guarantor for retirement.

Yes, employees of the state of North Carolina typically benefit from a 401K match. This matching contribution can significantly enhance your retirement savings. When considering your options as a North Carolina guarantor for retirement, this match plays a crucial role in building a robust financial foundation.

To be vested in the North Carolina retirement system, you must complete at least five years of service. Once vested, you retain your pension right regardless of your job status. This reinforces the importance of long-term planning to fully benefit from your retirement options. Use US Legal Forms to gain insights on how vesting works and to prepare for a secure retirement.

To retire with benefits in North Carolina, you typically need at least five years of creditable service. This time may vary based on the retirement plan you are under, so be sure to verify the exact requirements. Achieving the necessary service period allows you access to various benefits that can support your retirement lifestyle. For personalized information, US Legal Forms can guide you through benefits eligibility.