North Carolina Name Change With Irs

Category:

State:

North Carolina

Control #:

NC-9088

Format:

Word;

Rich Text

Instant download

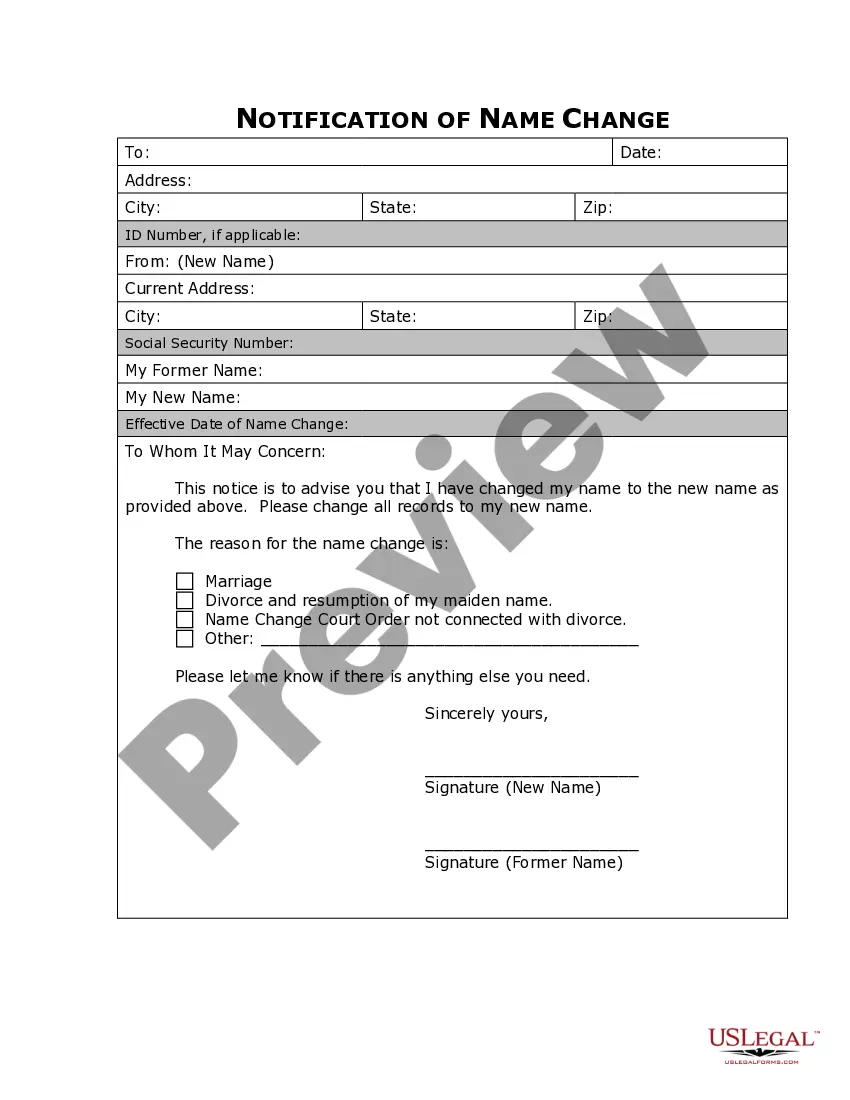

Description Nc Name Change

This form is for use after you have changed your name through a legal process. It is used to notify companies, organizations, government agencies and others of the name change.