Dissolve Limited Liability Company For Real Estate

State:

North Carolina

Control #:

NC-DP-LLC-0001

Format:

Word;

Rich Text

Instant download

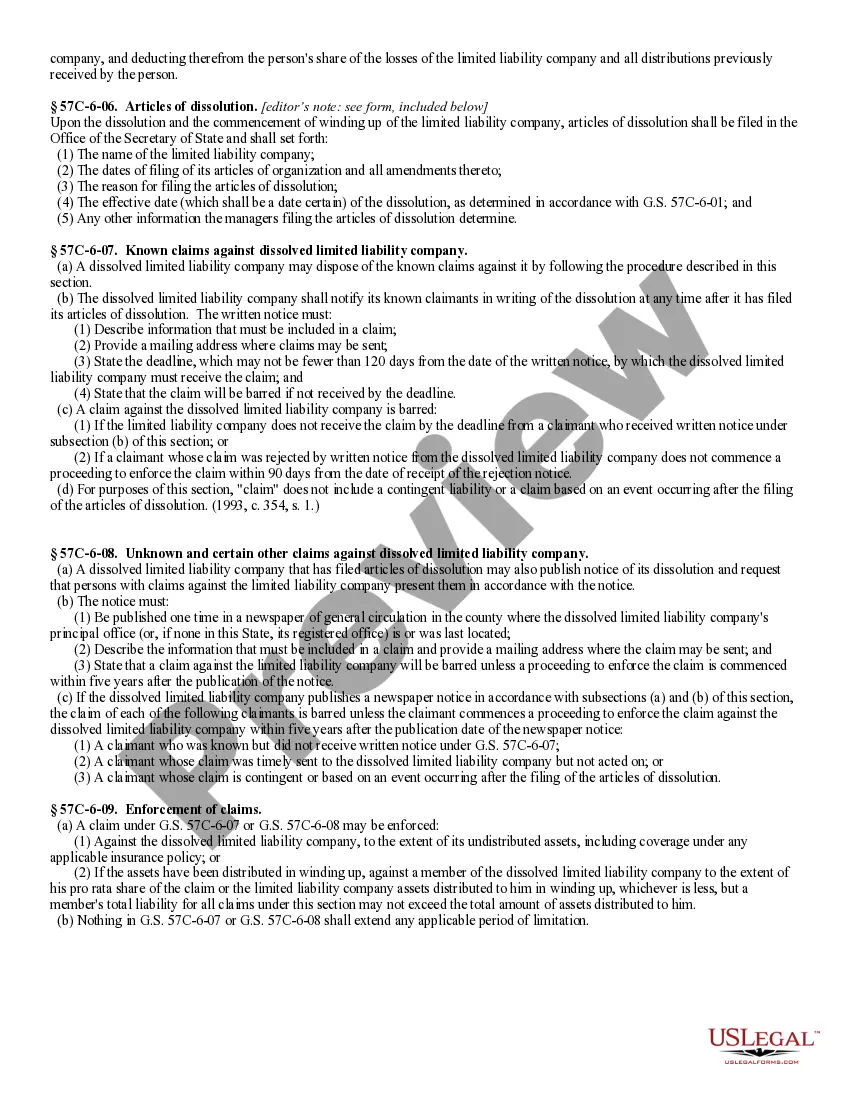

Description North Carolina Dissolution

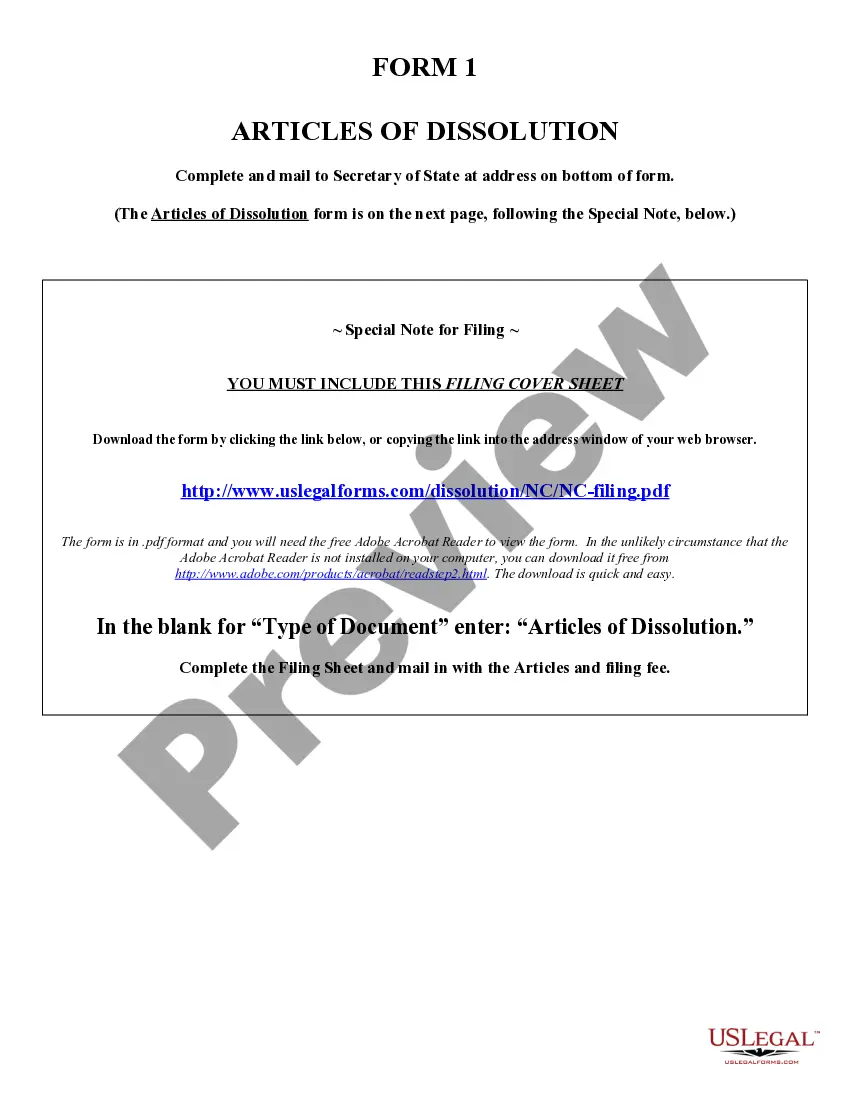

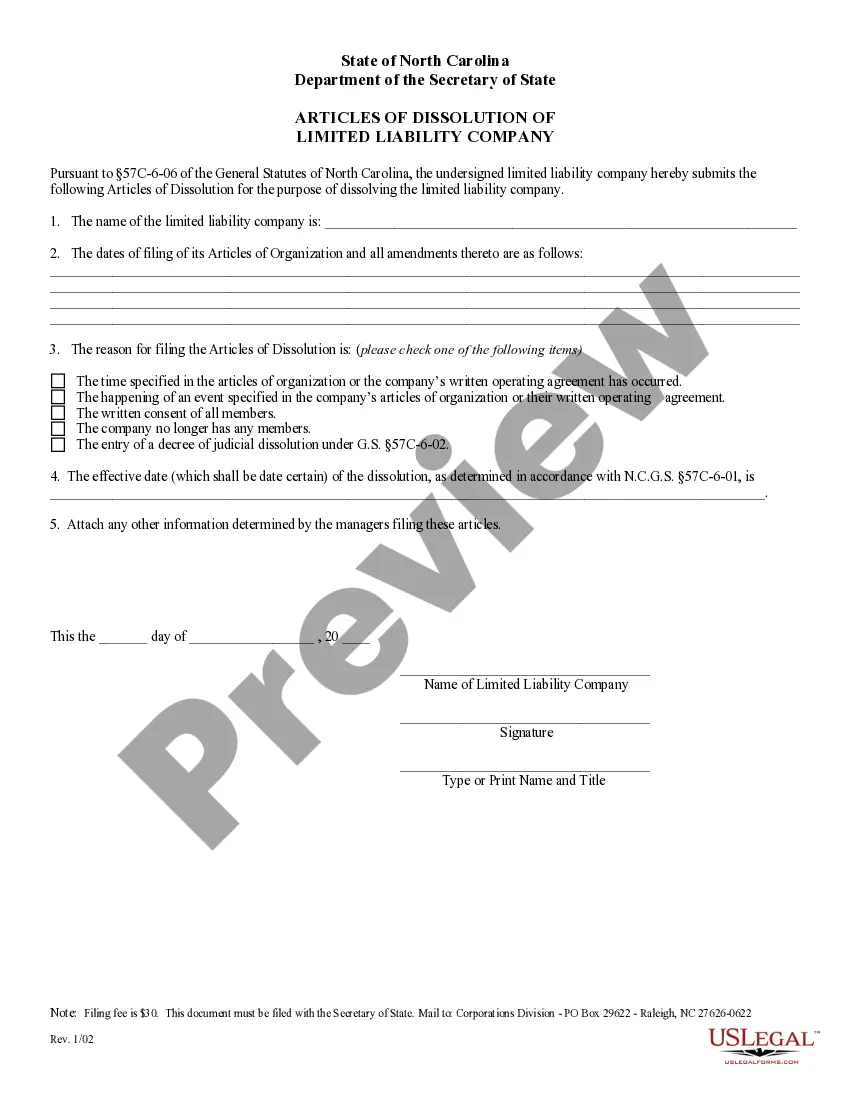

The dissolution package contains all forms to dissolve a LLC or PLLC in North Carolina, step by step instructions, addresses, transmittal letters, and other information.

Free preview Limited Liability Company