North Carolina Release Withholding Registration

Description

How to fill out North Carolina Release Withholding Registration?

Well-prepared formal documentation is one of the essential safeguards for preventing issues and disputes, but obtaining it without the assistance of a lawyer may require time.

Whether you need to swiftly locate an updated North Carolina Release Withholding Registration or other forms for work, family, or business matters, US Legal Forms is always available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Furthermore, you can access the North Carolina Release Withholding Registration at any time later, as all documents ever obtained on the platform are accessible within the My documents section of your profile. Save time and resources on preparing formal documents. Experience US Legal Forms today!

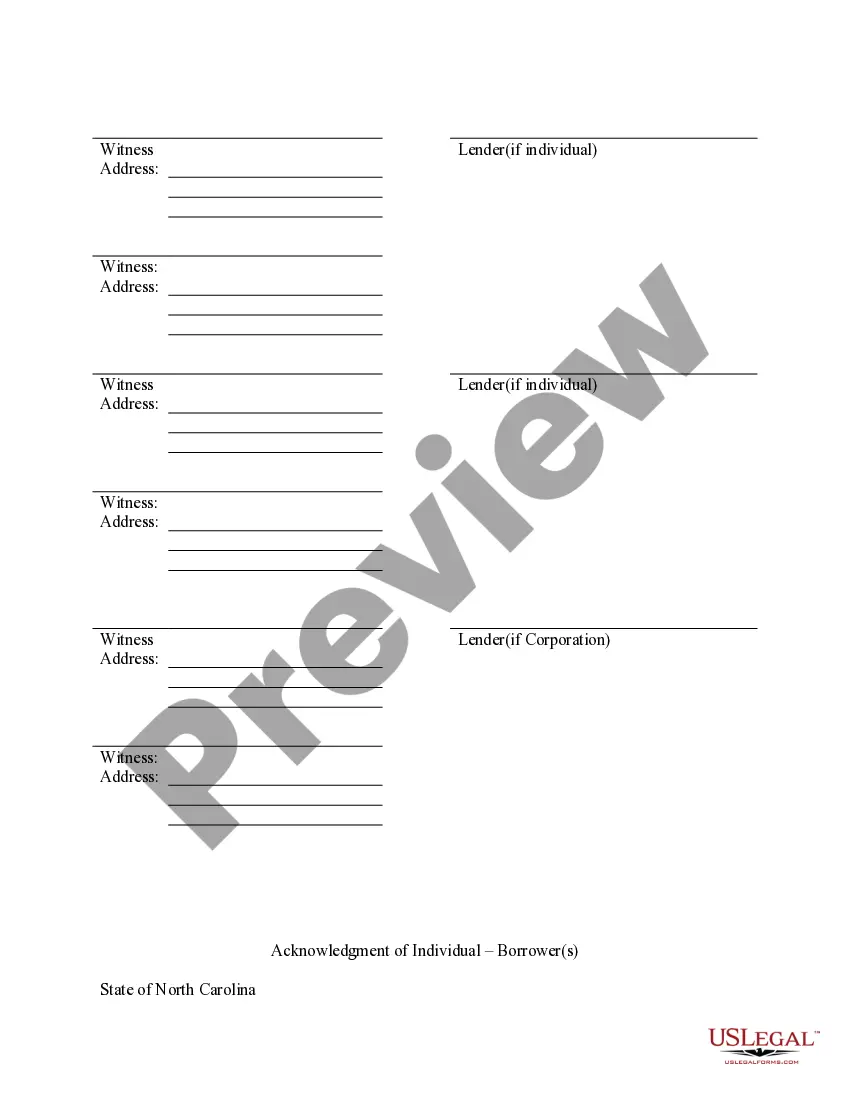

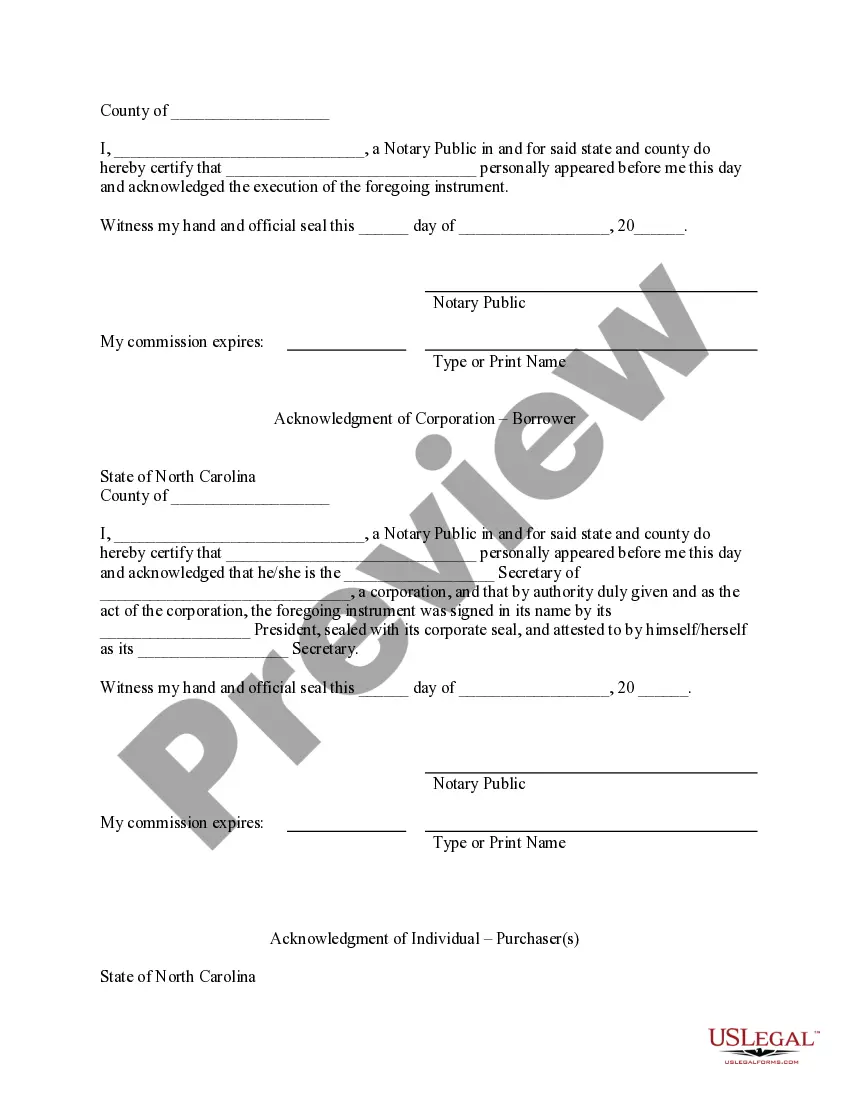

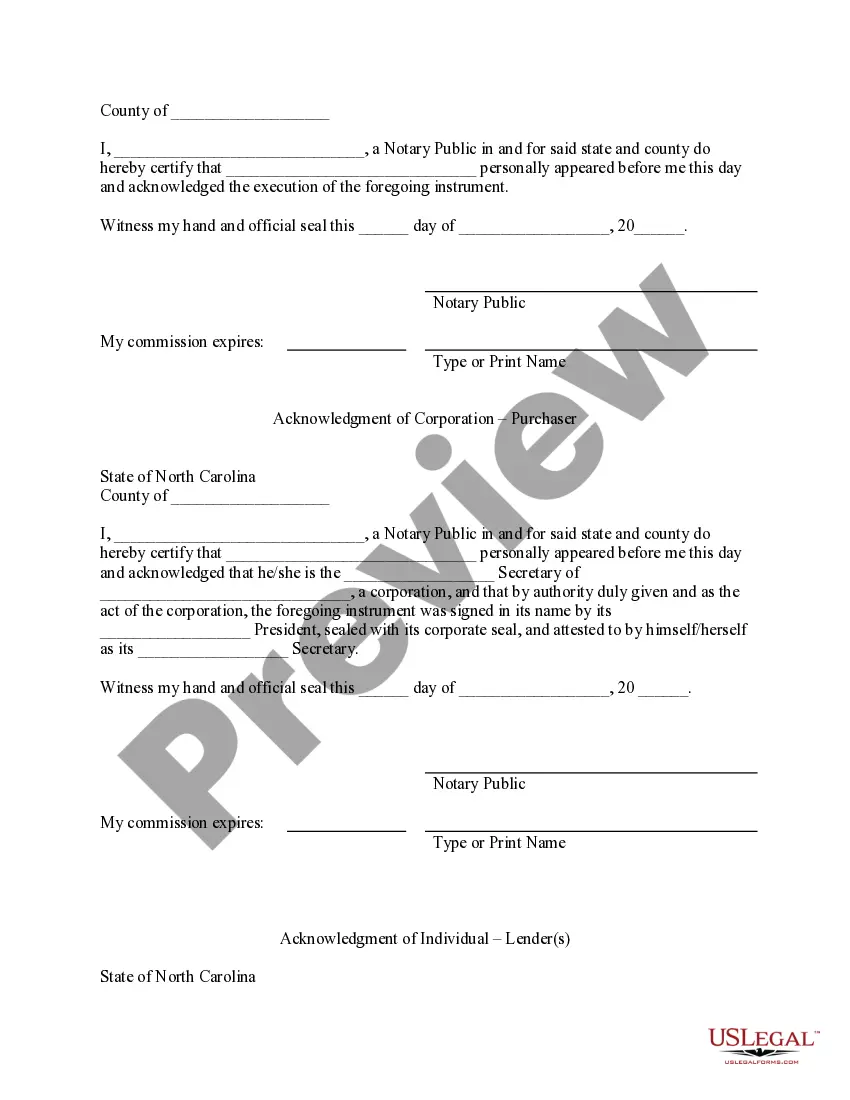

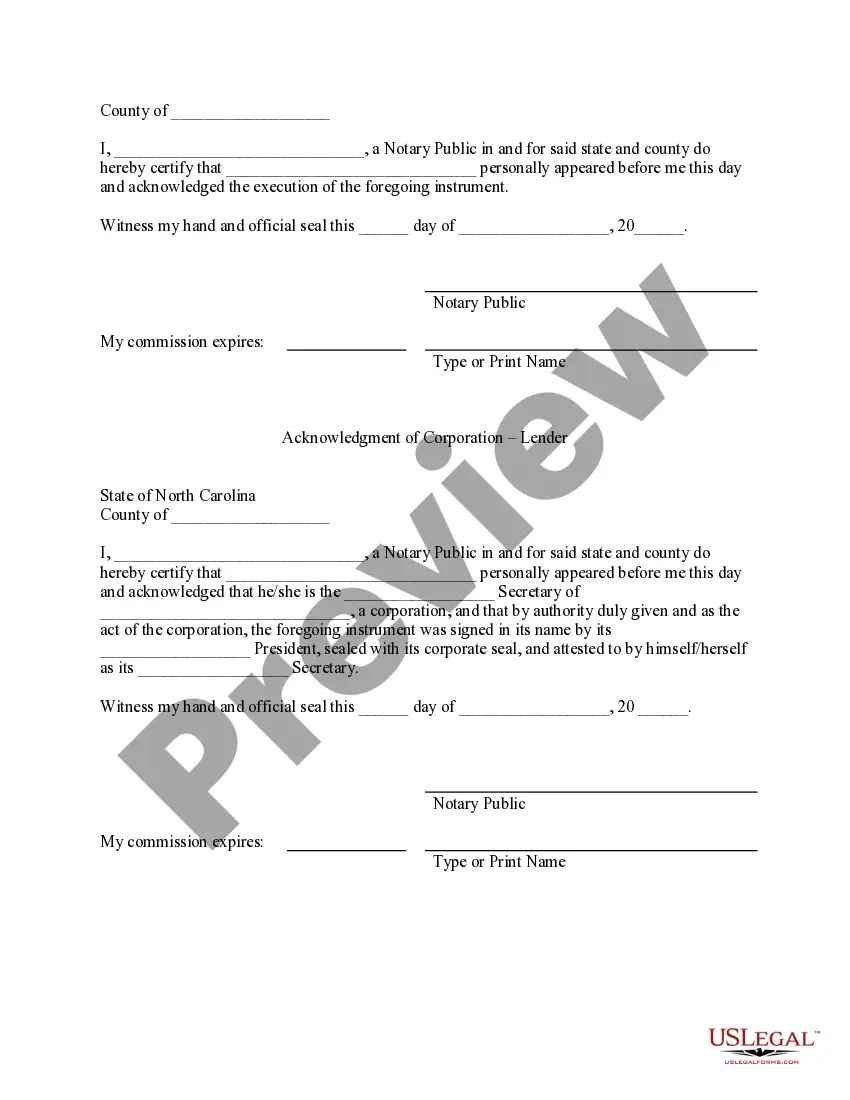

- Ensure that the form is appropriate for your circumstances and area by reviewing the description and preview.

- Search for an alternative example (if necessary) using the Search bar at the top of the page.

- Click on Buy Now once you have identified the correct template.

- Choose the pricing plan, Log Into your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Choose either PDF or DOCX file format for your North Carolina Release Withholding Registration.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Final Payroll: If you have stopped doing business or no longer have employees, you can close your North Carolina withholding tax account by completing and returning a Change of Address/Out of Business Notification form.

Form NC-4EZ Web Employee's Withholding Allowance Certificate.

The NC-4EZ is a new, simplified form which should suffice for most taxpayers. The NC-4 is the complete form which may result in a more accurate withholding amount, but requires historical tax information and will involve estimates.

Yes. You must complete a new NC-4EZ or NC-4 for each employer.

The income earned for services performed in North Carolina by the spouse of a servicemember who is legally domiciled in a state other than North Carolina is exempt from North Carolina income tax if (1) the servicemember is present in North Carolina solely in compliance with military orders; (2) the spouse is in North