North Carolina Release Withholding Tax Rate

Description

How to fill out North Carolina Release Withholding Tax Rate?

Individuals frequently link legal documentation with something complex that only an expert can handle.

In a certain sense, this is accurate, as creating the North Carolina Release Withholding Tax Rate necessitates considerable expertise in subject matter, particularly state and county laws.

However, with US Legal Forms, the process has become more straightforward: pre-prepared legal documents for any personal or business occasion tailored to state legislation are assembled in one online directory and are now accessible to everyone.

All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them whenever needed through the My documents section. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, making the search for the North Carolina Release Withholding Tax Rate or any other specific form a quick endeavor.

- Existing users with an active subscription need to Log In to their account and select Download to retrieve the document.

- New users must create an account and subscribe before they can store any paperwork documentation.

- Here’s a step-by-step guide on how to acquire the North Carolina Release Withholding Tax Rate.

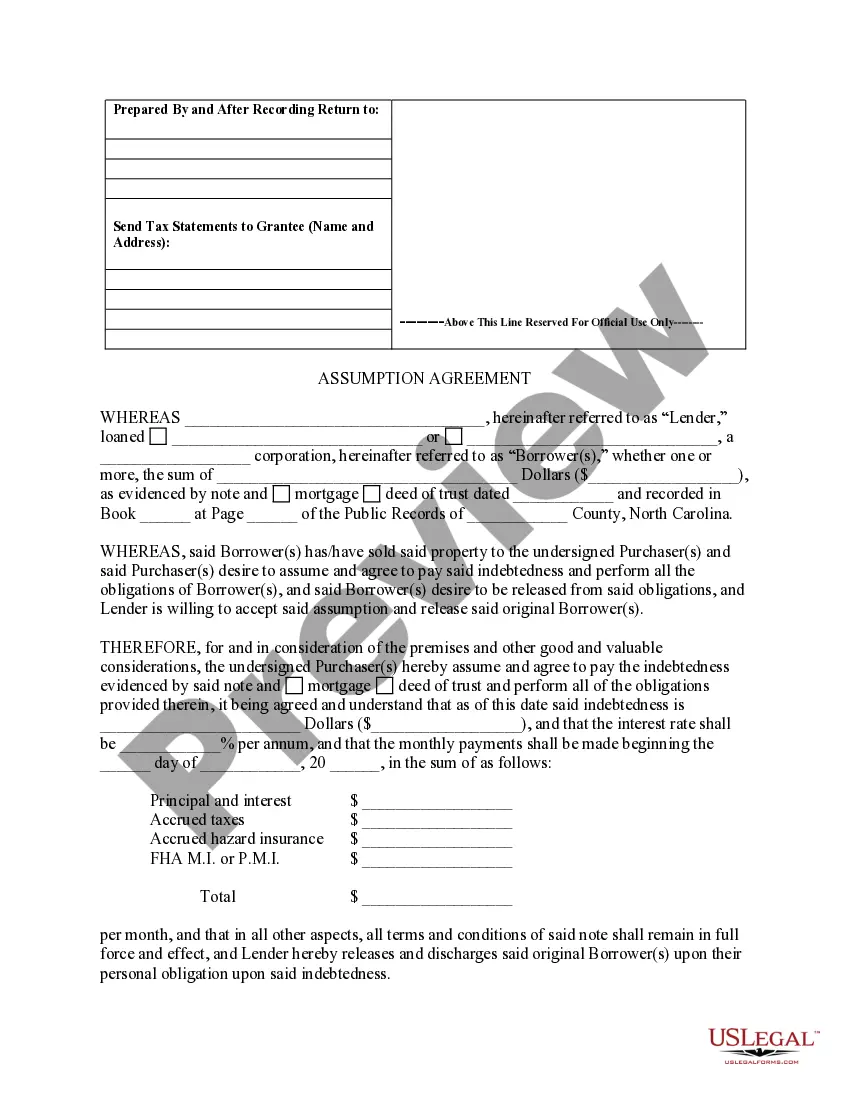

- Carefully review the content of the page to ensure it meets your requirements.

- Examine the form description or confirm it through the Preview feature.

- If the previous option does not fit your needs, look for another template using the Search bar at the top.

- Click Buy Now when you locate the appropriate North Carolina Release Withholding Tax Rate.

- Select a subscription plan that suits your preferences and budget.

- Create an account or Log In to continue to the payment section.

- Complete your payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

The NC-4EZ is a new, simplified form which should suffice for most taxpayers. The NC-4 is the complete form which may result in a more accurate withholding amount, but requires historical tax information and will involve estimates.

Yes. You must complete a new NC-4EZ or NC-4 for each employer.

North Carolina Median Household Income Every taxpayer in North Carolina will pay 5.25% of their taxable income for state taxes. North Carolina has not always had a flat income tax rate, though.

For Tax Years 2019, 2020, and 2021 the North Carolina individual income tax rate is 5.25% (0.0525).

6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 (up from $142,800 in 2021).