A Professional Corporation With $10 Par Common Stock

State:

North Carolina

Control #:

NC-PC-OM

Format:

Word

Instant download

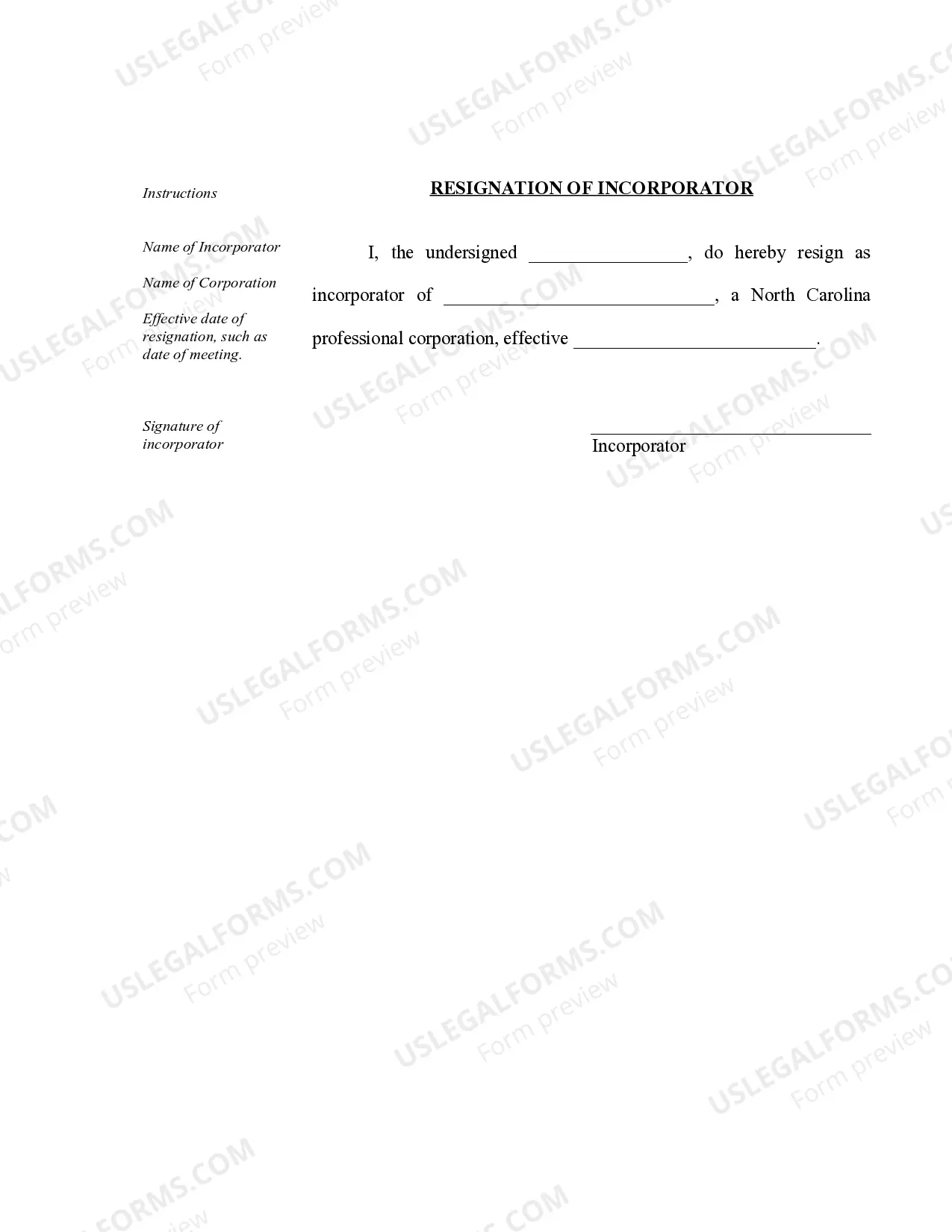

Description Nc Corporation Complete

Organizational Minutes document the activities associated with the creation of the professional corporation.

Free preview North Carolina A Corporation