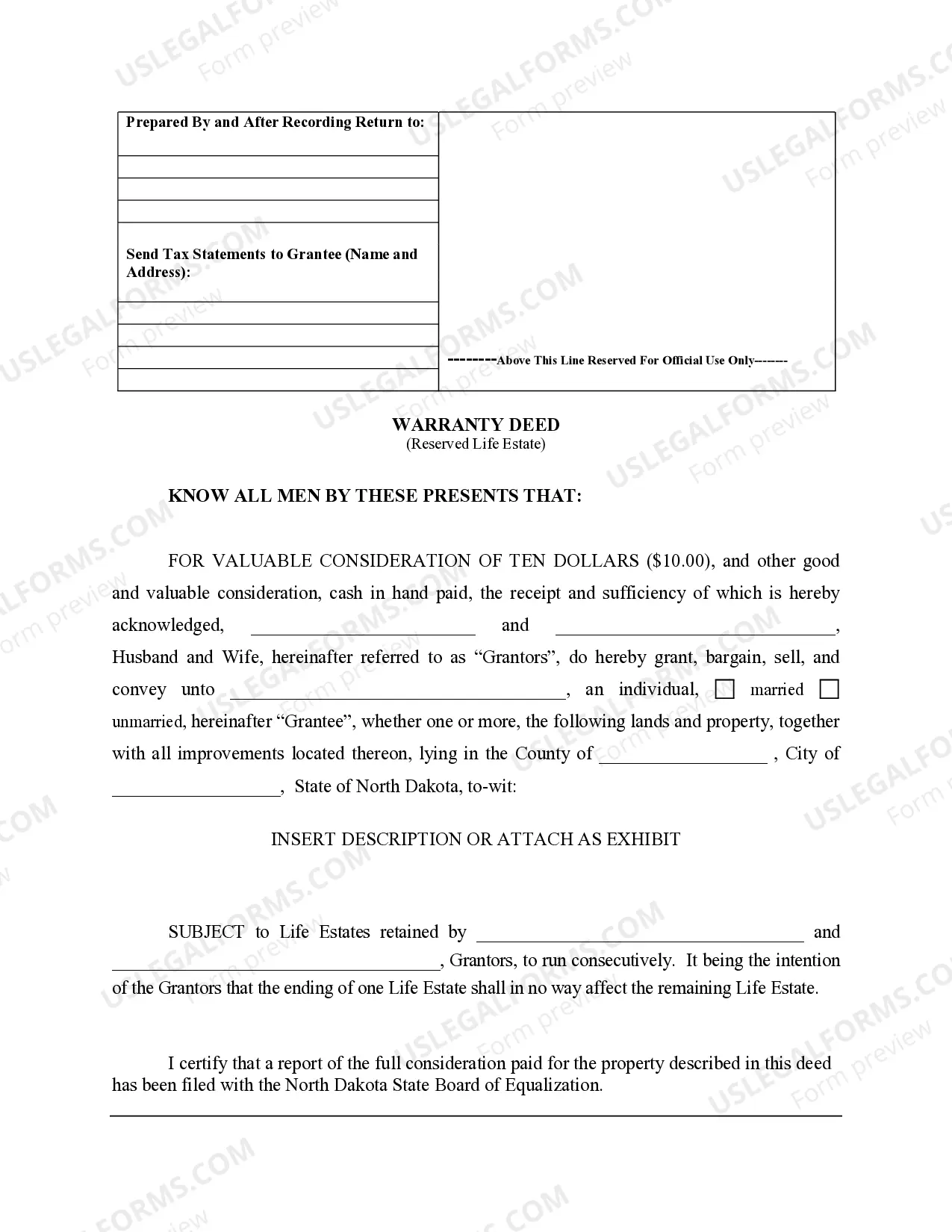

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

North Dakota Life Estate Deed Form with Beneficiaries: A Comprehensive Overview In North Dakota, a life estate deed is a legal document that allows a property owner, referred to as the "granter," to transfer their real estate to one or more individuals, known as "grantees," while retaining the right to reside on or use the property during their lifetime. The life estate deed ensures that the property will pass to the designated beneficiaries, called "remainder men," upon the granter's passing. Here, we will delve into the North Dakota life estate deed form with beneficiaries, its purpose, benefits, and different types. 1. Purpose of a Life Estate Deed with Beneficiaries: The primary aim of a life estate deed with beneficiaries is to establish a clear legal framework for the transfer of real estate while allowing the granter to enjoy the property rights until their demise. By designating beneficiaries, the granter ensures a seamless transfer of the property, avoiding probate and potential disputes. 2. Benefits of a Life Estate Deed with Beneficiaries: 2.1 Avoidance of Probate: The utilization of a life estate deed form with beneficiaries helps to circumvent the probate process, saving time and expenses associated with probate court proceedings. 2.2 Retaining Control: Granters maintain control and ownership of the property during their lifetime, thereby enjoying all the benefits such as residing on the premises, generating rental income, or even selling the property if required. 2.3 Quick Property Transfer: Upon the granter's passing, the property seamlessly transfers to the remainder men, avoiding potential delays and challenges typically associated with traditional property transfers. 2.4 Tax Benefits: A life estate deed may offer certain tax advantages, potentially reducing estate tax liability or qualifying for certain exemptions. It is advisable to consult a legal professional or tax expert for specific advice. 3. Different Types of North Dakota Life Estate Deed Form with Beneficiaries: 3.1 Enhanced Life Estate Deed: Also known as a "Ladybird Deed," this type of life estate deed allows the granter to retain full control and ownership of the property during their lifetime, including the right to sell or mortgage the property, without requiring the consent of the remainder men. 3.2 Traditional Life Estate Deed: This type of life estate deed grants the granter the right to use and enjoy the property during their lifetime, but they cannot sell or mortgage it without the consent of the remainder men. The remainder men hold a future interest in the property and inherit it upon the granter's passing. In conclusion, the North Dakota life estate deed form with beneficiaries serves as a powerful legal tool for property owners looking to transfer their real estate assets smoothly while ensuring their continued use during their lifetime. Whether choosing an enhanced or traditional life estate deed, individuals can enjoy the benefits of avoiding probate, maintaining control, facilitating quick property transfer, and potentially maximizing tax advantages. It is vital to consult with a qualified attorney to determine the most suitable life estate deed form based on specific requirements and circumstances.