North Dakota Incorporation Forest

State:

North Dakota

Control #:

ND-PC-TL

Format:

Word;

Rich Text

Instant download

Description

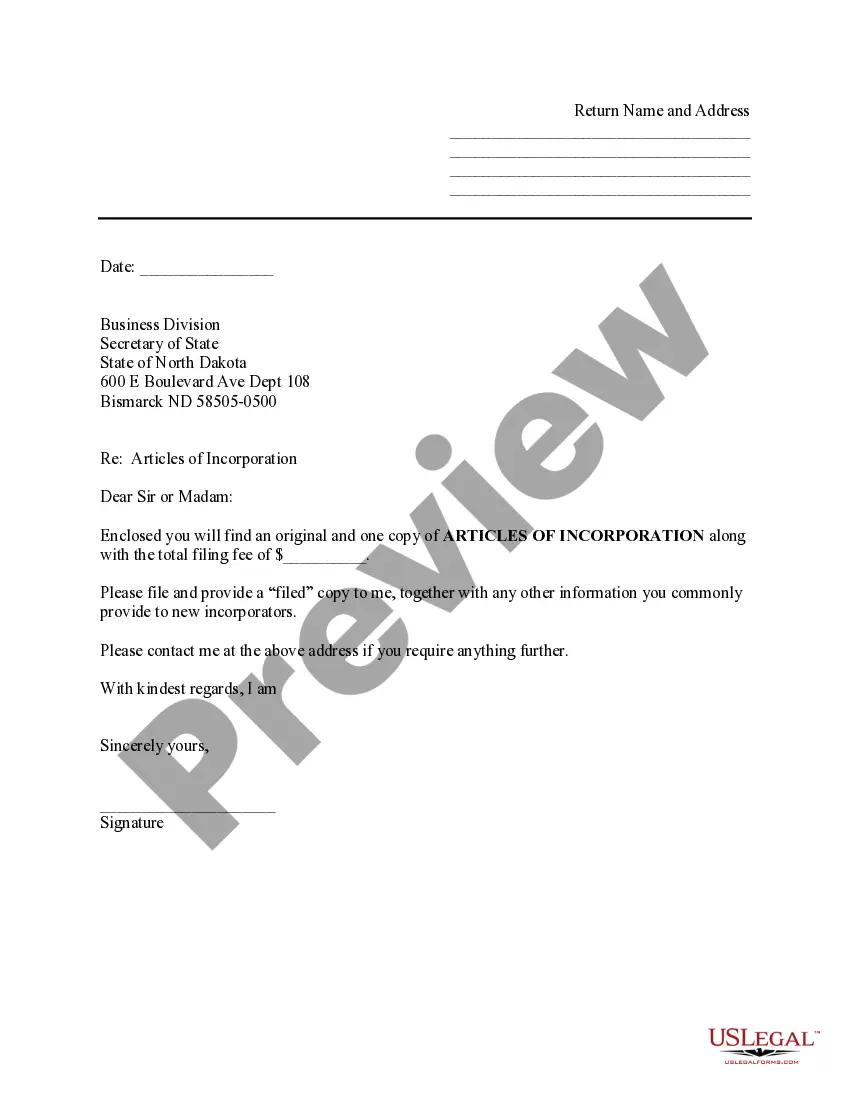

This sample transmittal letter can accompany the Articles of Incorporation when filed with the Secretary of State.