Natwest Mortgage Redemption For Solicitors

Description natwest redemption statement solicitors

Form popularity

FAQ

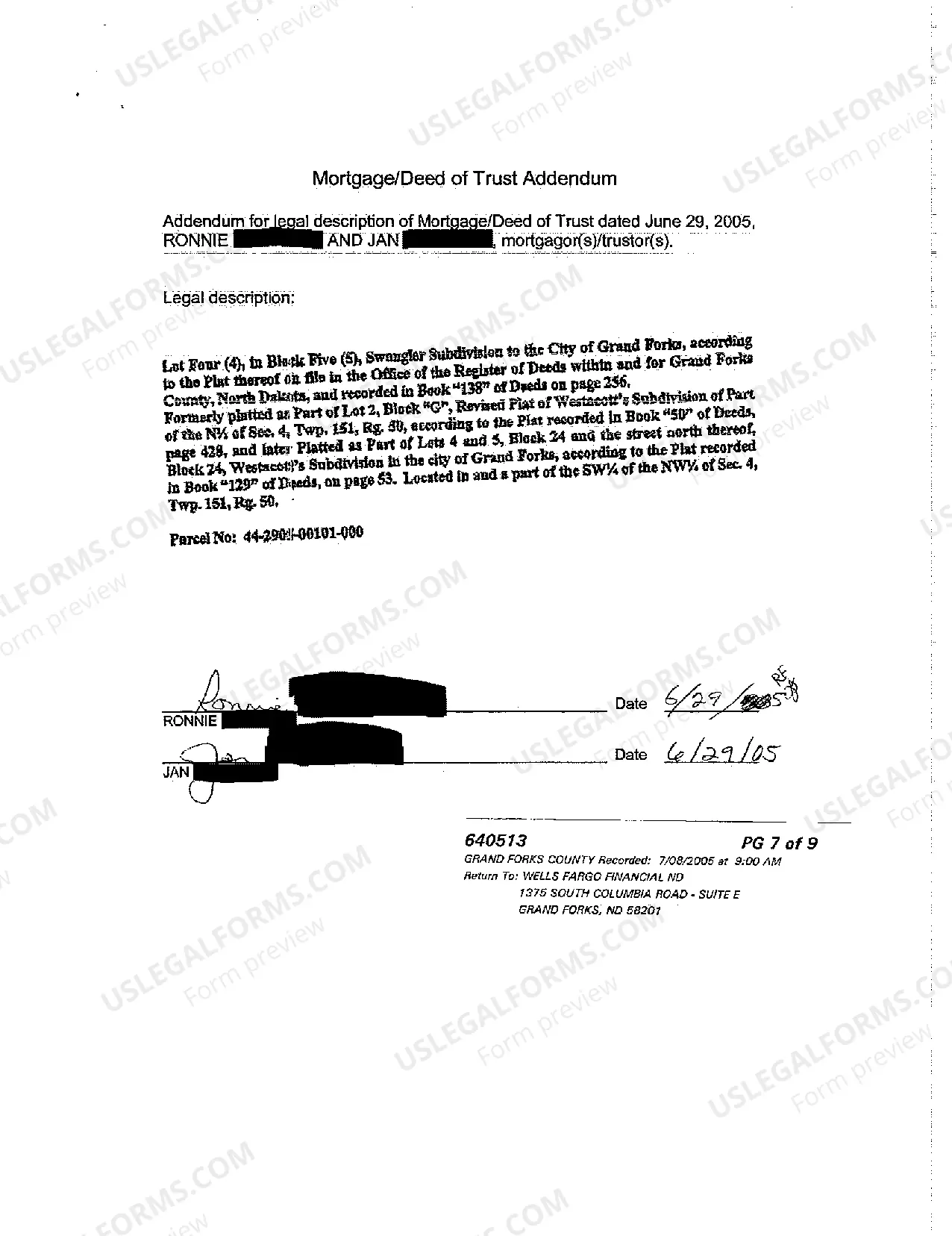

The final redemption statement is an official document provided by your mortgage lender that states the total sum necessary to clear your mortgage debt. This document provides transparency regarding the amount owed, which is particularly important during the mortgage redemption process. For solicitors involved in Natwest mortgage redemption, it’s crucial to ensure clients obtain this statement to finalize their mortgages.

A final mortgage statement summarises the outstanding balance on your mortgage, along with any remaining payments due. This document serves as a clarity tool for both borrowers and solicitors during the mortgage redemption process. When dealing with Natwest mortgage redemption for solicitors, this final statement is a critical component.

To work out your mortgage redemption figure, you need to first request a final redemption statement from your mortgage lender, like NatWest. This figure typically consists of the remaining balance of your mortgage, plus accrued interest and fees. As a solicitor, providing guidance on this calculation can help your clients achieve a smooth Natwest mortgage redemption.

A redemption statement for the final amount includes a detailed breakdown of what you owe at the time of mortgage redemption. This statement is essential for calculating the payment amount to settle your mortgage. If you are a solicitor assisting clients with Natwest mortgage redemption, ensure they understand all elements listed in this important document.

To redeem a NatWest mortgage, you need to obtain a redemption statement from NatWest, which specifies the total amount required to close your mortgage. Ensure you have all necessary documentation ready, such as your identification and property details. Once you have the redemption statement, you can proceed to arrange the payment, commonly facilitated by solicitors who specialize in Natwest mortgage redemption.

To obtain a mortgage redemption statement at NatWest, you can log into your online banking account or contact customer service for assistance. The statement provides crucial details about your remaining mortgage balance and associated fees. Solicitors often require this document to facilitate smooth property transactions, making it essential to secure it timely. For efficient handling of such requests, utilizing the US Legal Forms platform can be beneficial for solicitors working with mortgage clients.

The time it takes for a solicitor to obtain a redemption statement from NatWest can vary, but it generally takes between a few days to a week. Prompt communication with NatWest helps facilitate a quicker process. When managing NatWest mortgage redemption for solicitors, engaging with your solicitor early can ensure a smooth transaction.

Yes, a mortgage in principle from NatWest typically lasts for six months. This agreement indicates that NatWest is willing to lend you a specified amount, provided your financial situation remains stable during that time. It’s a helpful tool for solicitors and clients alike to establish potential financing when navigating NatWest mortgage redemption for solicitors.

Conditions for a NatWest mortgage may include providing proof of income, maintaining a good credit score, and demonstrating affordability based on your financial situation. Additionally, specific terms might vary depending on whether you seek a residential or buy-to-let mortgage. Ensure you review these conditions carefully to facilitate your NatWest mortgage redemption for solicitors process.

The 6 month rule for NatWest mortgages typically refers to the period in which you are required to hold a mortgage before redeeming it without penalties. This rule often signifies that if you redeem your mortgage early, within six months, you may incur additional charges. Understanding this rule is essential for anyone looking into NatWest mortgage redemption for solicitors, as it can impact financial decisions.