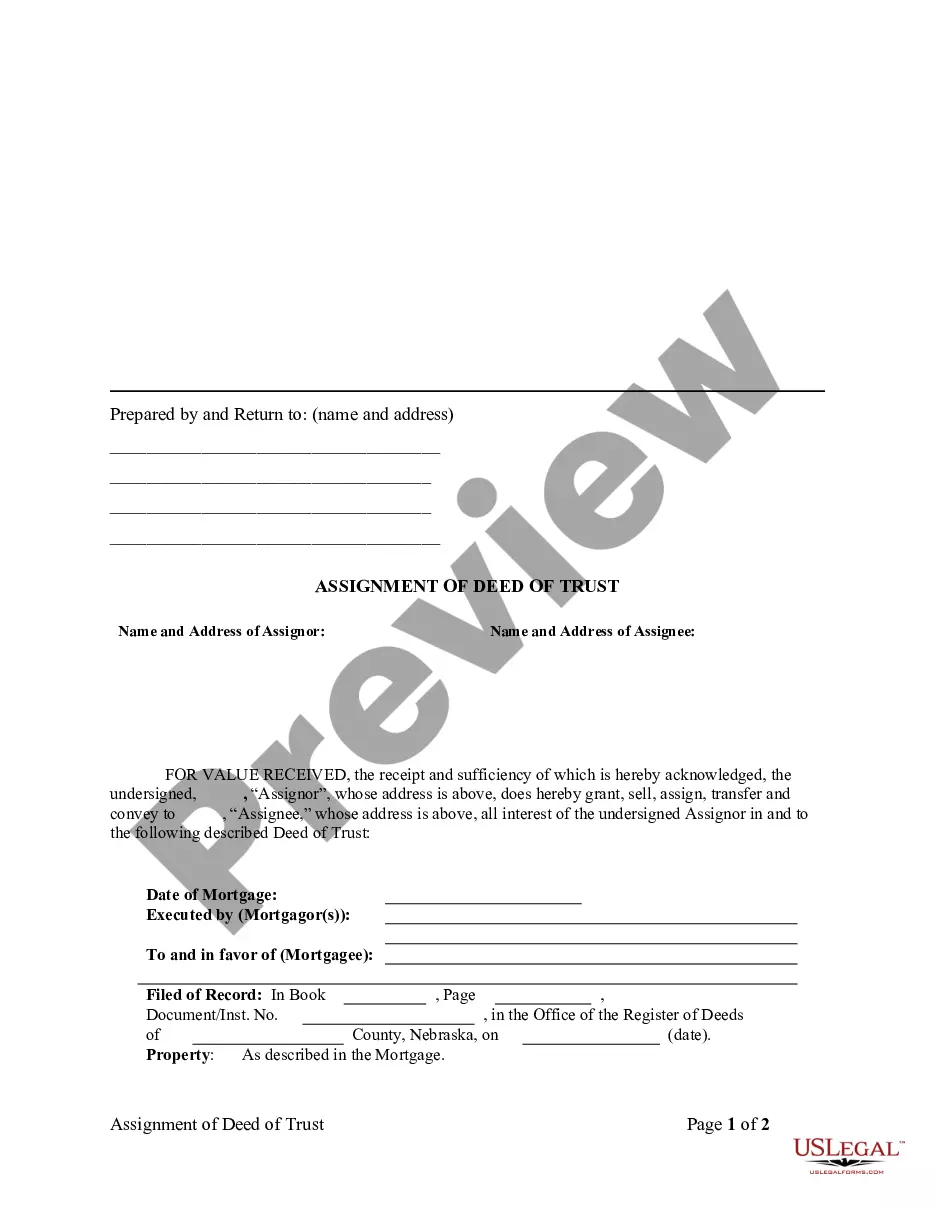

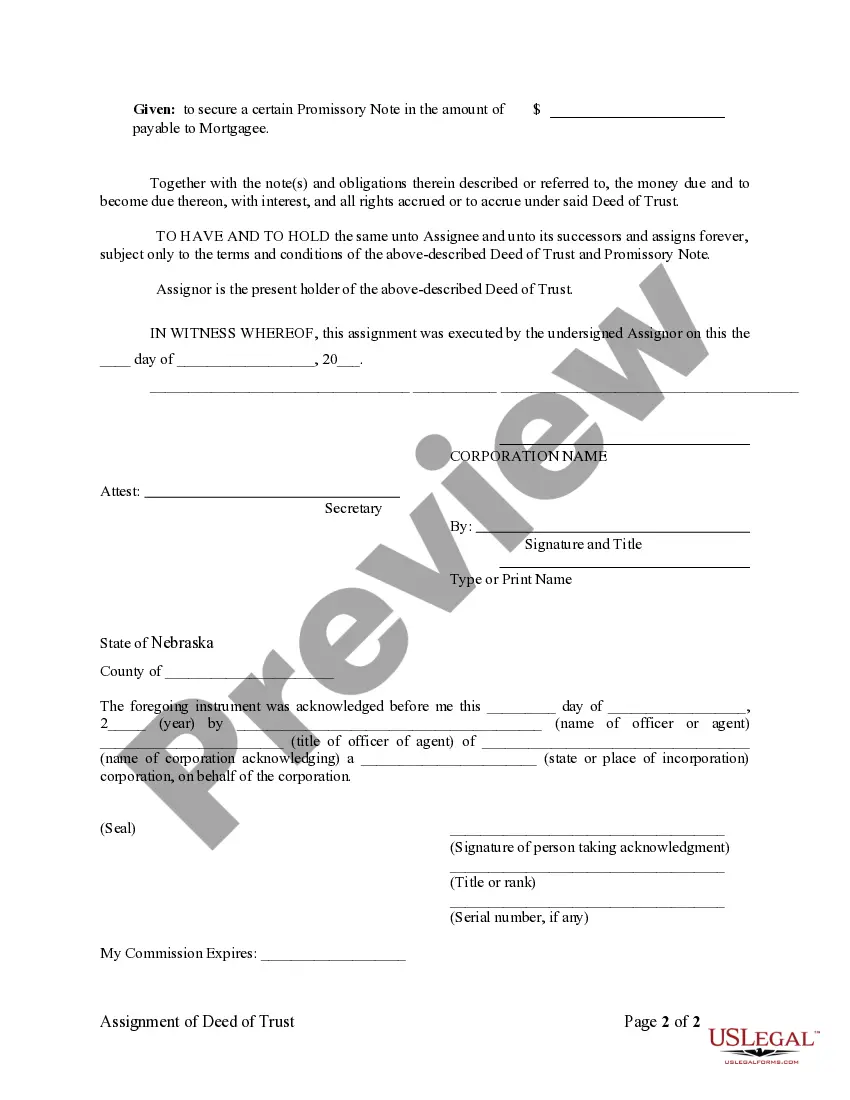

Assignment of Deed of Trust by Corporate Mortgage Holder

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rule is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Nebraska Law

Execution of Assignment or Satisfaction:

Must be signed by the mortgagee.

Assignment:

It is recommended that an assignment be in writing and recorded.

Demand to Satisfy:

When the obligation secured by any mortgage has been satisfied, the mortgagee shall, upon receipt

of a written request by the mortgagor, execute and deliver a release of

mortgage in recordable form to the mortgagor. Any mortgagee who fails to

deliver such a release within sixty days after receipt of such written

request shall be liable to the mortgagor for one thousand dollars or actual

damages resulting from the failure, whichever is greater, plus costs and

attorney fees.

Recording Satisfaction:

Any mortgage shall be discharged upon the record thereof by the register of deeds in whose

custody it shall be, whenever there shall be presented to him a certificate

executed by the mortgagee, acknowledged or proved or certified, specifying

that such mortgage has been paid, or otherwise satisfied and discharged.

Penalty:

See above, Demand to Satisfy.

Acknowledgment:

An assignment or satisfaction must contain a proper Nebraska acknowledgment, or other acknowledgment

approved by Statute.

Nebraska Statutes

76-252 - Release of mortgage; required; when; failure to

deliver; effect; damages.

When the obligation secured by any mortgage has been

satisfied, the mortgagee shall, upon receipt of a written request

by the mortgagor or the mortgagor's successor in interest or designated

representative or by holder of a junior trust deed or junior mortgage,

execute and deliver a release of mortgage in recordable form to the mortgagor

or mortgagor's successor in interest or designated representative. Any

mortgagee who fails to deliver such a release within sixty

days after receipt of such written request shall be liable to the mortgagor

or the mortgagor's successor in interest, as the case may be, for one

thousand dollars or actual damages resulting from the failure, whichever

is greater. In any action against the mortgagee pursuant to this

section, the court shall award, in addition to

the foregoing amounts, the cost of suit, including reasonable

attorney's fees, and may further order the mortgagee to

execute a release. Successor in interest of the mortgagor shall

include the current owner of the property.

76-253 - Mortgage; record; certificate of discharge or satisfaction.

Any mortgage shall be discharged upon the record thereof by the register of deeds in whose custody it shall be, whenever there shall

be presented to him a certificate executed

by the mortgagee, his legal personal representative or assignee,

acknowledged or proved or certified as prescribed in

sections 76-216 to 76-236, specifying that such mortgage has been paid,

or otherwise satisfied and discharged.

76-254 Mortgage; record; certificate of discharge

or satisfaction; how indexed.

Every such certificate and the proof or the acknowledgment

thereof shall be indexed in the order of mortgages and recorded

at full length. In the record of discharge the

register of deeds shall make a reference to the book and page or

computer system reference where the mortgage is recorded.