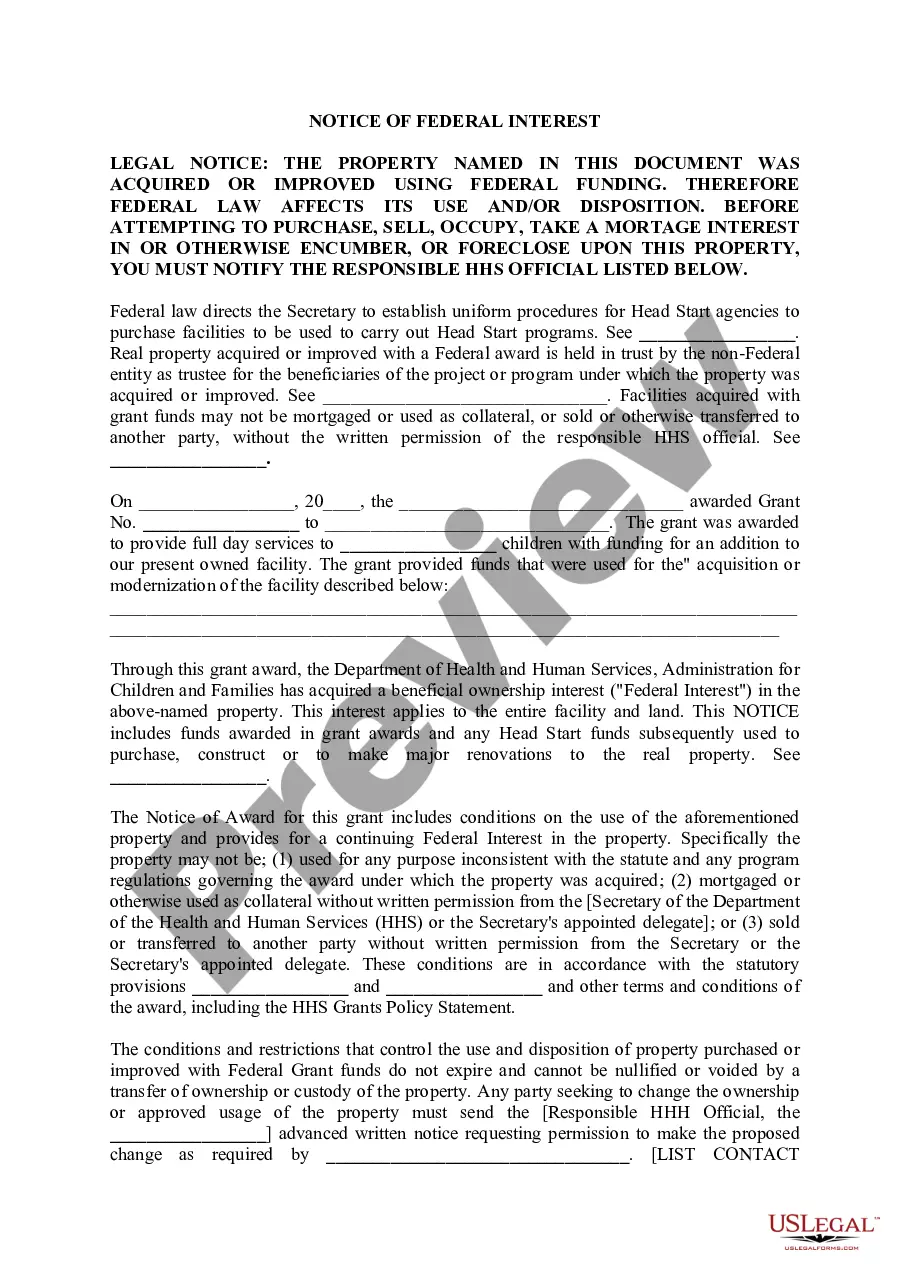

A Notice of Federal Interest Withheld Chase is an important legal document issued by the federal government in relation to a financial entity. It serves as a notification to the entity that federal agencies have identified specific funds or assets within the entity's possession that are subject to being withheld due to federal interest or concern. The Notice of Federal Interest Withheld Chase is typically issued when the federal government has reason to believe that the financial entity is involved in activities or transactions that are illegal or violate federal regulations. This document is often the initial step in a legal process aimed at recovering funds or assets that are considered to be of interest to the federal government. There are several types of Notice of Federal Interest Withheld Chase that may be issued depending on the nature of the alleged wrongdoing or violation. Some common types include: 1. Notice of Tax Withheld Chase: This type of notice is typically issued by the Internal Revenue Service (IRS) when a financial institution is suspected of withholding or misreporting taxes. The government may pursue the recovery of unpaid taxes through various legal means, including the withholding of funds from the financial entity. 2. Notice of Money Laundering Withheld Chase: This notice is often issued by law enforcement agencies, such as the Federal Bureau of Investigation (FBI) or the Financial Crimes Enforcement Network (Fin CEN). It alerts the financial institution that it is under investigation for suspected involvement in money laundering activities. The government may seek to withhold funds that are believed to be connected to illegal activities. 3. Notice of Asset Forfeiture Withheld Chase: This type of notice is issued when the federal government has reason to believe that the financial institution or its clients possess assets that are subject to seizure due to their involvement in criminal activities. The government has the authority to initiate forfeiture proceedings to strip the entity or individuals of their unlawfully obtained assets. When a financial entity receives a Notice of Federal Interest Withheld Chase, it is crucial to take it seriously and promptly seek legal counsel. Ignoring the notice or failing to cooperate with the government can lead to severe consequences, including legal penalties and the loss of funds or assets. In conclusion, a Notice of Federal Interest Withheld Chase is a legal document that serves as a warning to financial institutions that federal agencies have identified funds or assets that are subject to being withheld. It is crucial for financial entities to address these notices responsibly and seek legal guidance to ensure compliance with federal regulations and protect their interests.

Notice Of Federal Interest Withheld Chase

Description federal interest withheld bank account

How to fill out Notice Of Federal Interest Withheld Chase?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, beginning from choosing the correct form template. For example, if you pick a wrong edition of a Notice Of Federal Interest Withheld Chase, it will be rejected when you submit it. It is therefore essential to get a dependable source of legal papers like US Legal Forms.

If you have to get a Notice Of Federal Interest Withheld Chase template, stick to these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s description to ensure it matches your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to locate the Notice Of Federal Interest Withheld Chase sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Notice Of Federal Interest Withheld Chase.

- Once it is downloaded, you are able to fill out the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate sample across the web. Take advantage of the library’s simple navigation to get the right form for any occasion.

Form popularity

FAQ

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

The B Notice creates potential backup withholding exposure, incorrect filing penalties, and potentially an IRS Form 1099 audit. B Notices are sent to IRS Form 1099 filers who've submitted a name and taxpayer identification number (TIN) combination that doesn't match the IRS database.

How to prevent or stop backup withholding. To stop backup withholding, you'll need to correct the reason you became subject to backup withholding. This can include providing the correct TIN to the payer, resolving the underreported income and paying the amount owed, or filing the missing return(s), as appropriate.

Also known as an IRS B Notice, the IRS notifies the 1099 filer that a name and taxpayer identification number (TIN) don't match the IRS database and need correction. Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits.

A A ?B? Notice is a backup withholding notice. There are two ?B? Notices -- the First ?B? Notice and the Second ?B? Notice. You must send the First ?B? Notice and a Form W-9 to a payee after you receive the first CP2100 or CP2100A Notice with respect to this account for soliciting a correct Name/TIN combination.