Domestic Professional Llc With Foreign Member

State:

New Hampshire

Control #:

NH-00INCP

Format:

PDF

Instant download

Public form

Description New Hampshire Incorporation

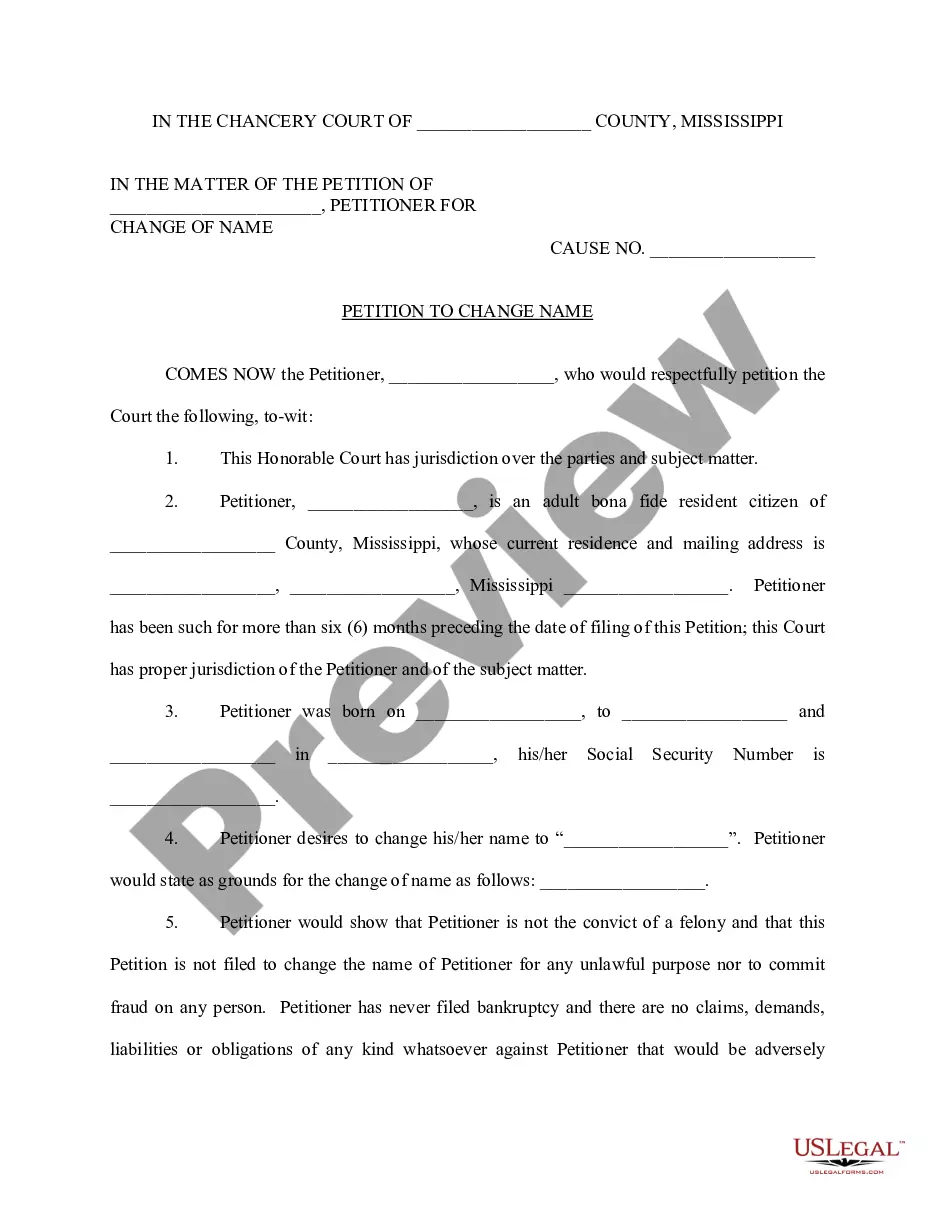

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new professional corporation. The form contains basic information concerning the professional corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.