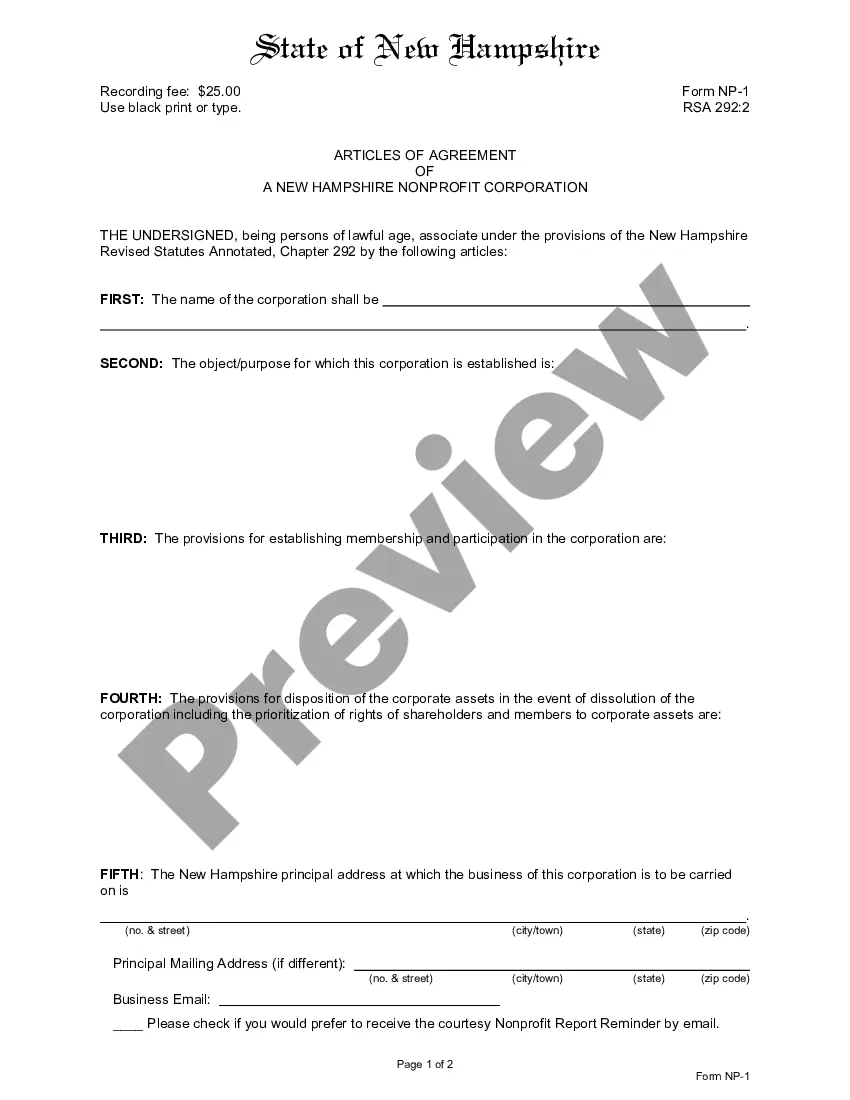

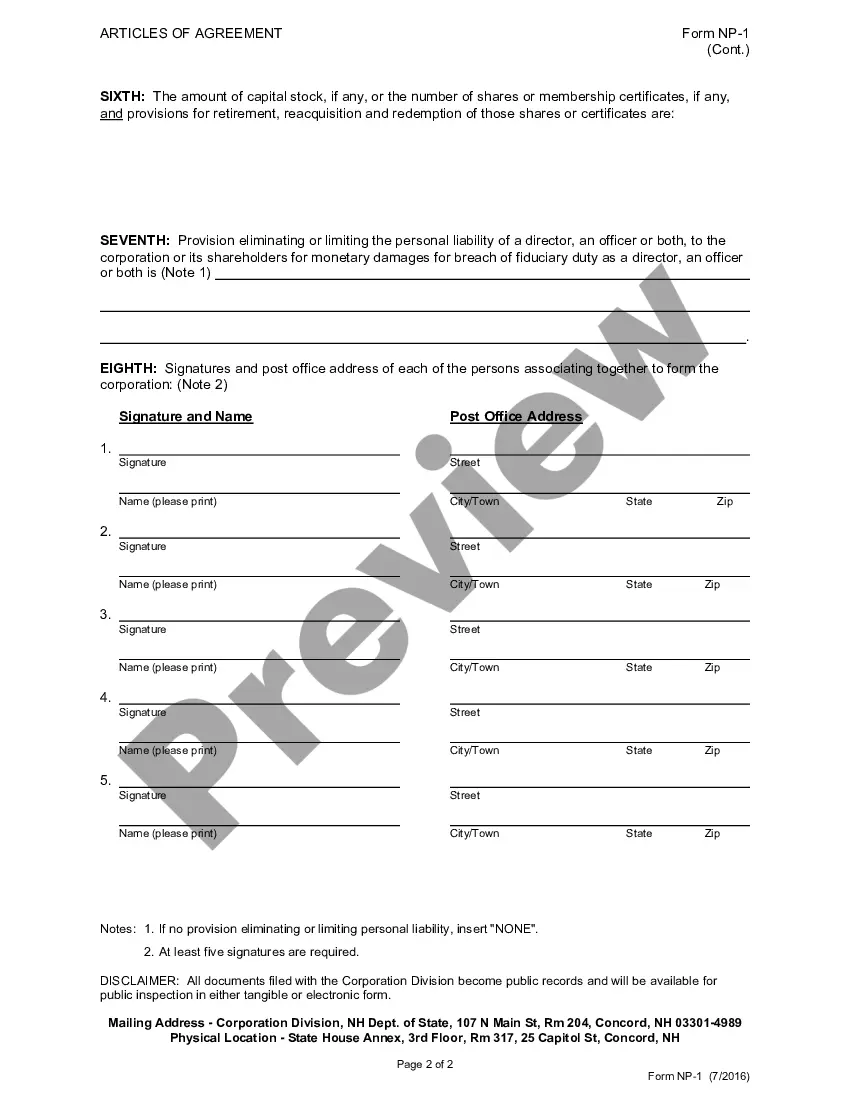

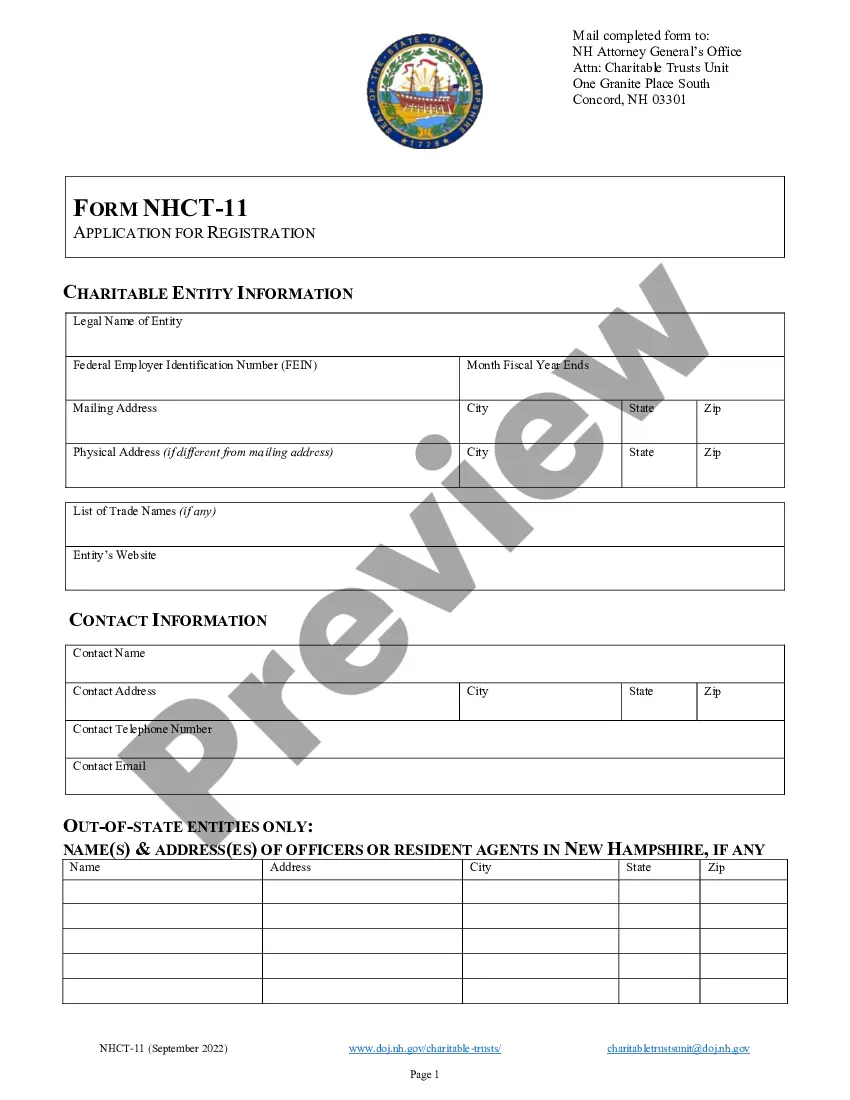

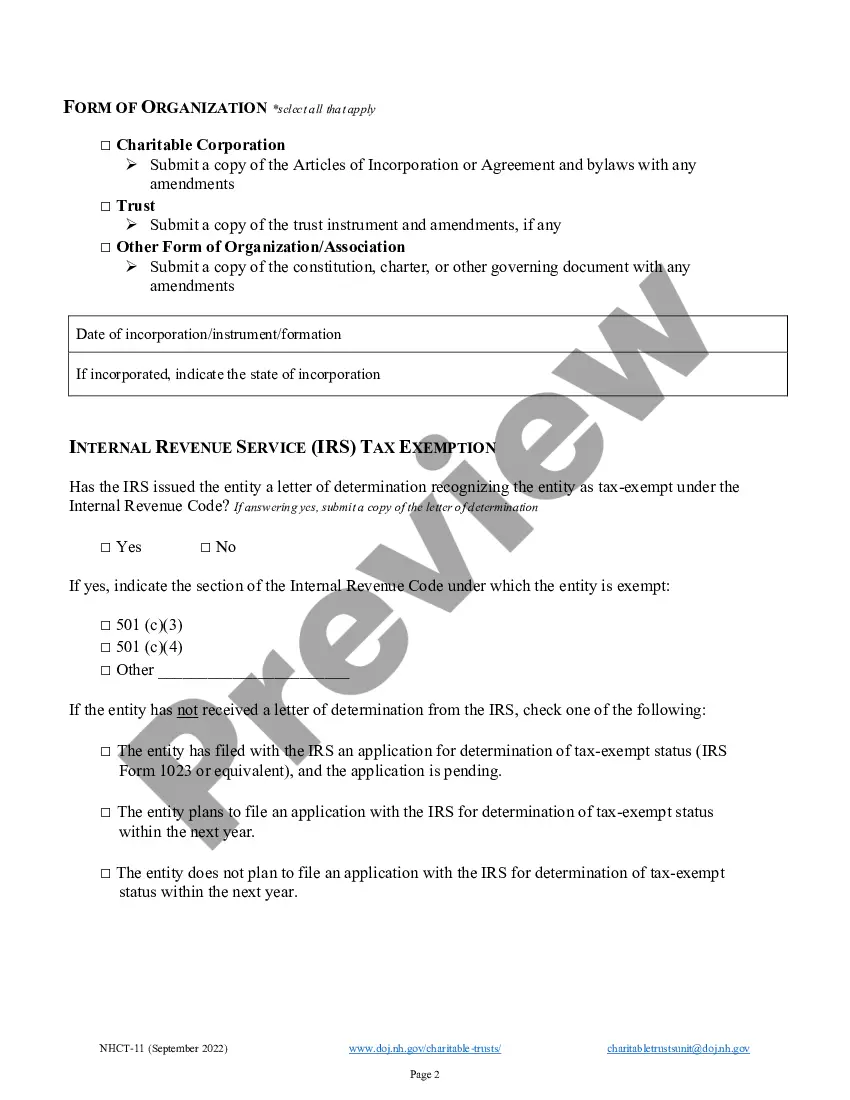

Sample Operating Agreement For Nonprofit

Description operating agreement for corporation

How to fill out Sample Operating Agreement For Nonprofit?

Individuals typically link legal documentation with something complex that only an expert can manage.

In a sense, this is accurate, as creating a Sample Operating Agreement For Nonprofit requires comprehensive understanding of the relevant criteria, including local and state laws.

However, with US Legal Forms, situations have become more convenient: pre-made legal templates for any business or personal requirements tailored to state legislation are gathered in a single online repository and are now accessible to all.

All templates in our collection are reusable: once acquired, they stay saved in your profile. You can access them anytime needed through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and usage area, making it easy to find a Sample Operating Agreement For Nonprofit or any specific template in mere minutes.

- Previously registered users with an active subscription must sign in to their account and select Download to obtain the form.

- New users will need to register for an account and subscribe before downloading any documents.

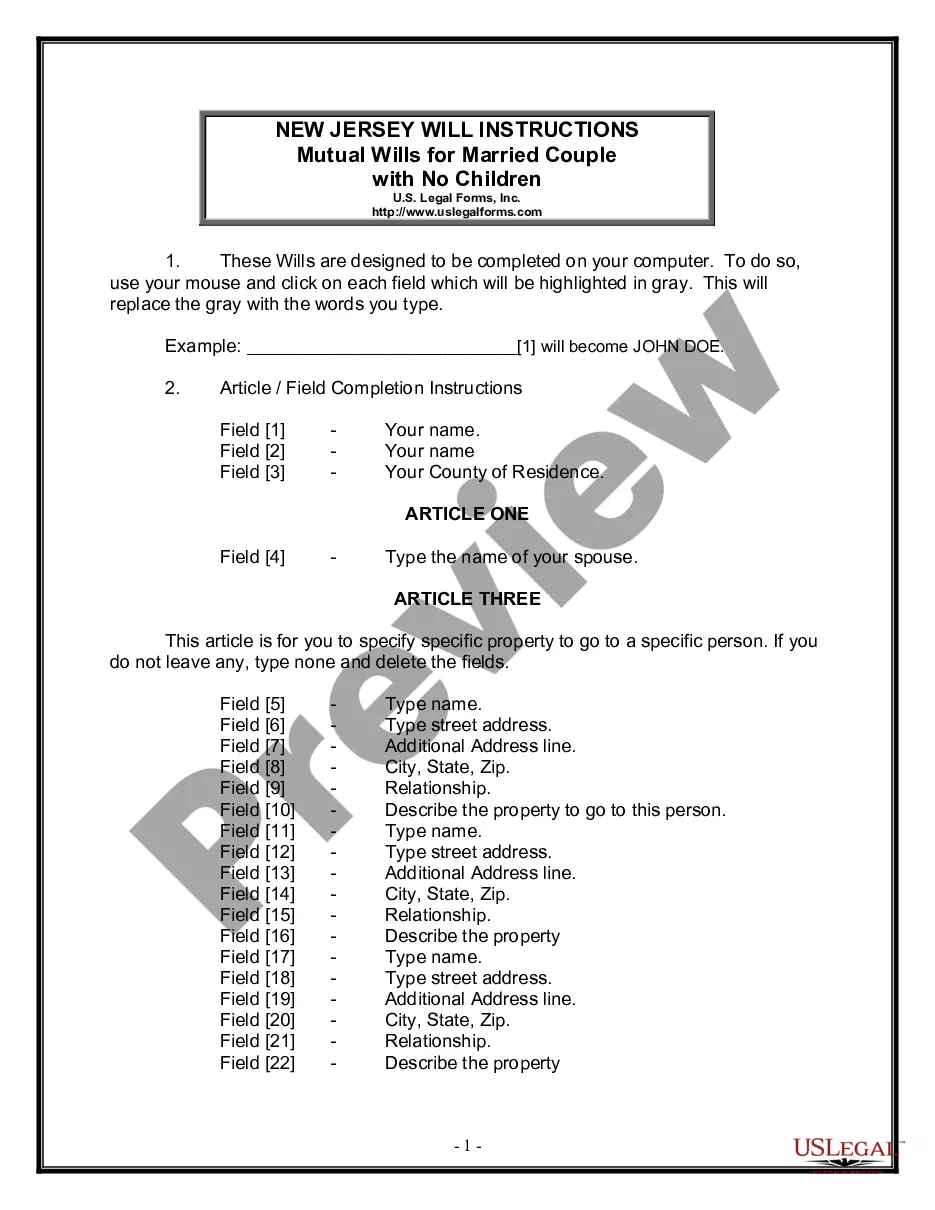

- Here is the step-by-step guide on how to obtain the Sample Operating Agreement For Nonprofit.

- Review the page content meticulously to confirm it fits your requirements.

- Check the form description or view it through the Preview feature.

- Find another sample using the Search bar above if the first one does not meet your needs.

- Select Buy Now when you identify the suitable Sample Operating Agreement For Nonprofit.

- Choose the subscription plan that matches your requirements and budget.

- Create an account or Log In/">Log In to advance to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your sample and click Download.

- Print your document or import it to an online editor for quicker completion.

non profit operating agreement Form popularity

FAQ

An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

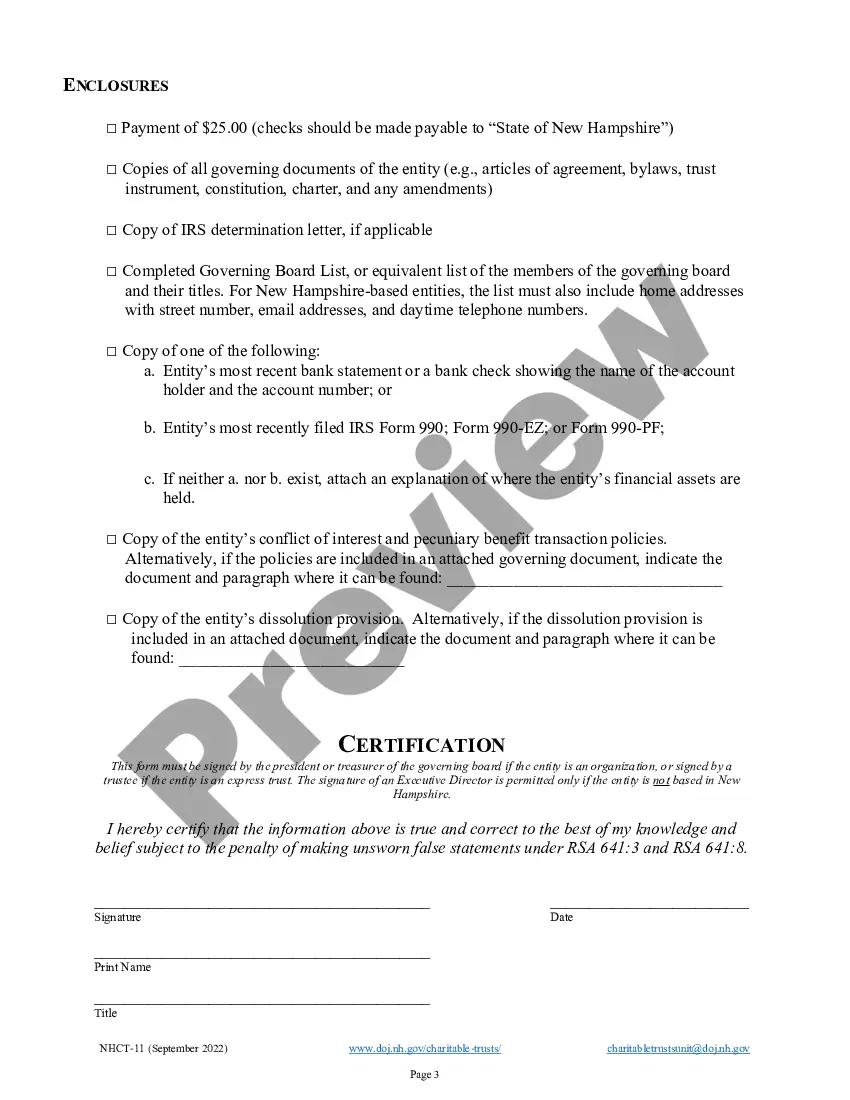

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.