New Hampshire Rental Ze For Sale

State:

New Hampshire

Control #:

NH-1054LT

Format:

Word;

Rich Text

Instant download

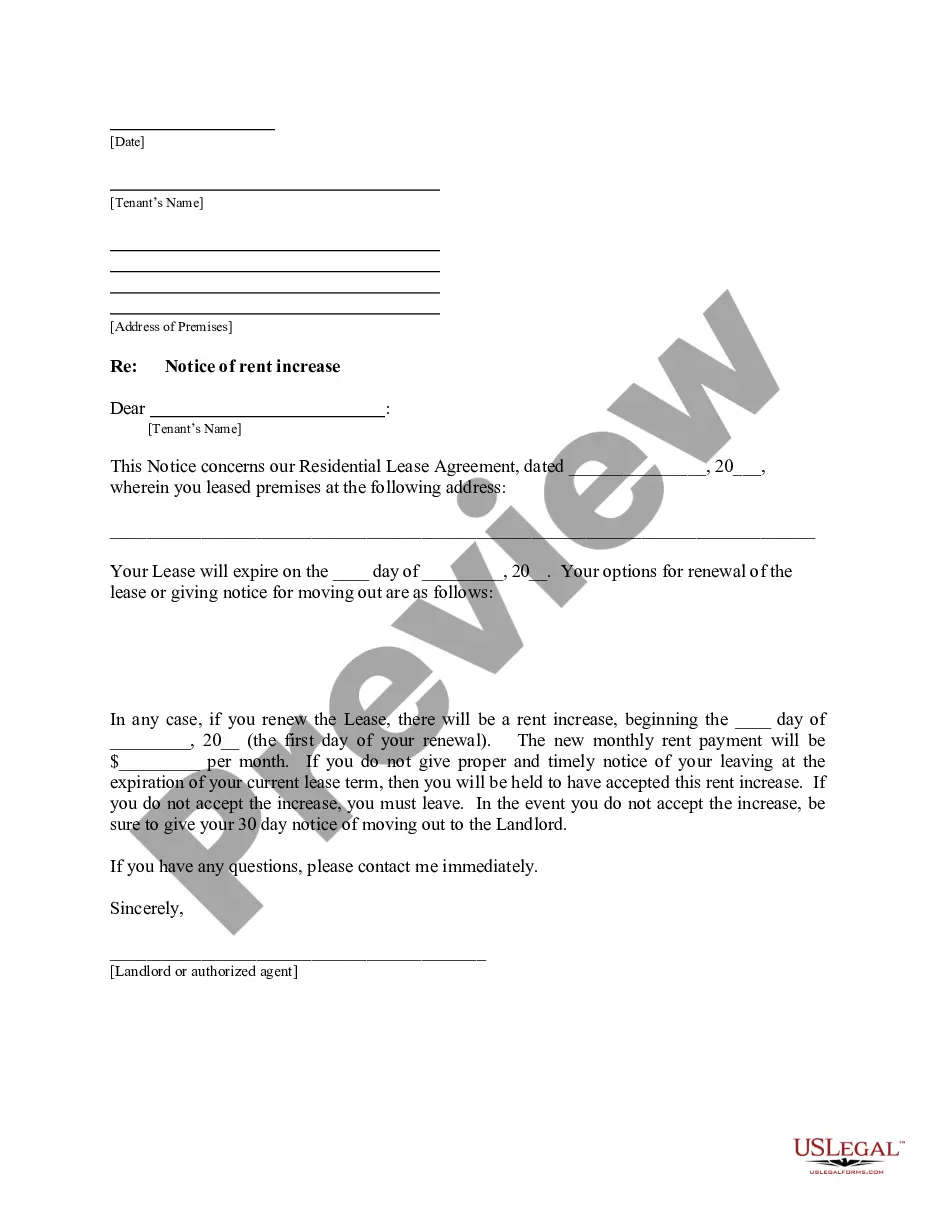

Description Increase Rent Letter

This is a notice provided by the Landlord to Tenant explaining that once the lease term has expired. Tenant has the option of vacating the premises or remaining on the premises provided that they abide by the posted rent increase.

Free preview Landlord Rent Increase Letter