New Hampshire Landlord Forensic Audit

State:

New Hampshire

Control #:

NH-1082LT

Format:

Word;

Rich Text

Instant download

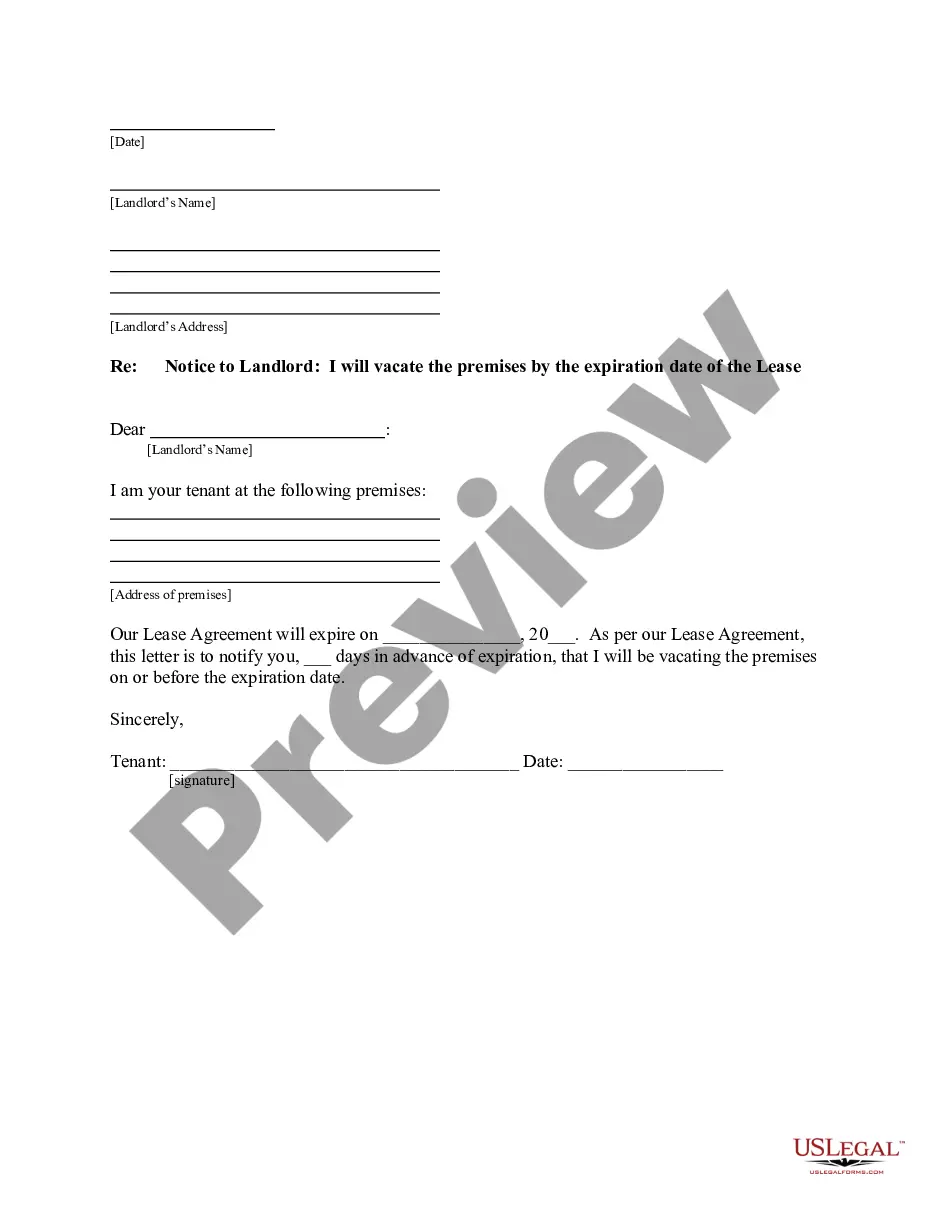

Description Letter To Landlord

This letter from the Tenant places the Landlord on notice that Tenant expects to move out of the residential property at the expiration of the lease, within 30 days. Tenant is complying with the terms of the lease and with state statutory law.

Free preview Tenant 30 Day Notice Vacate