New Hampshire Real Estate Foreclosures

Category:

State:

New Hampshire

Control #:

NH-37014

Format:

Word;

Rich Text

Instant download

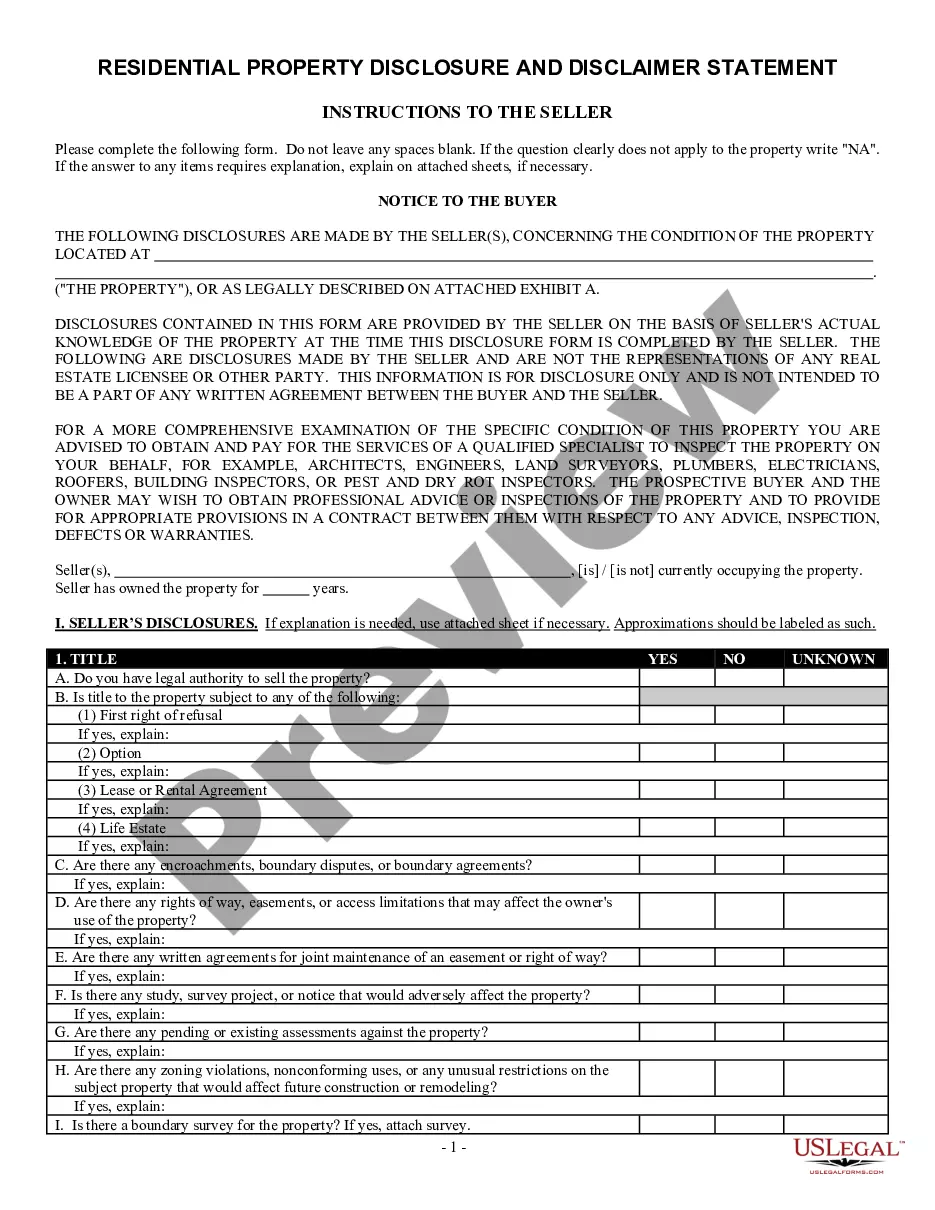

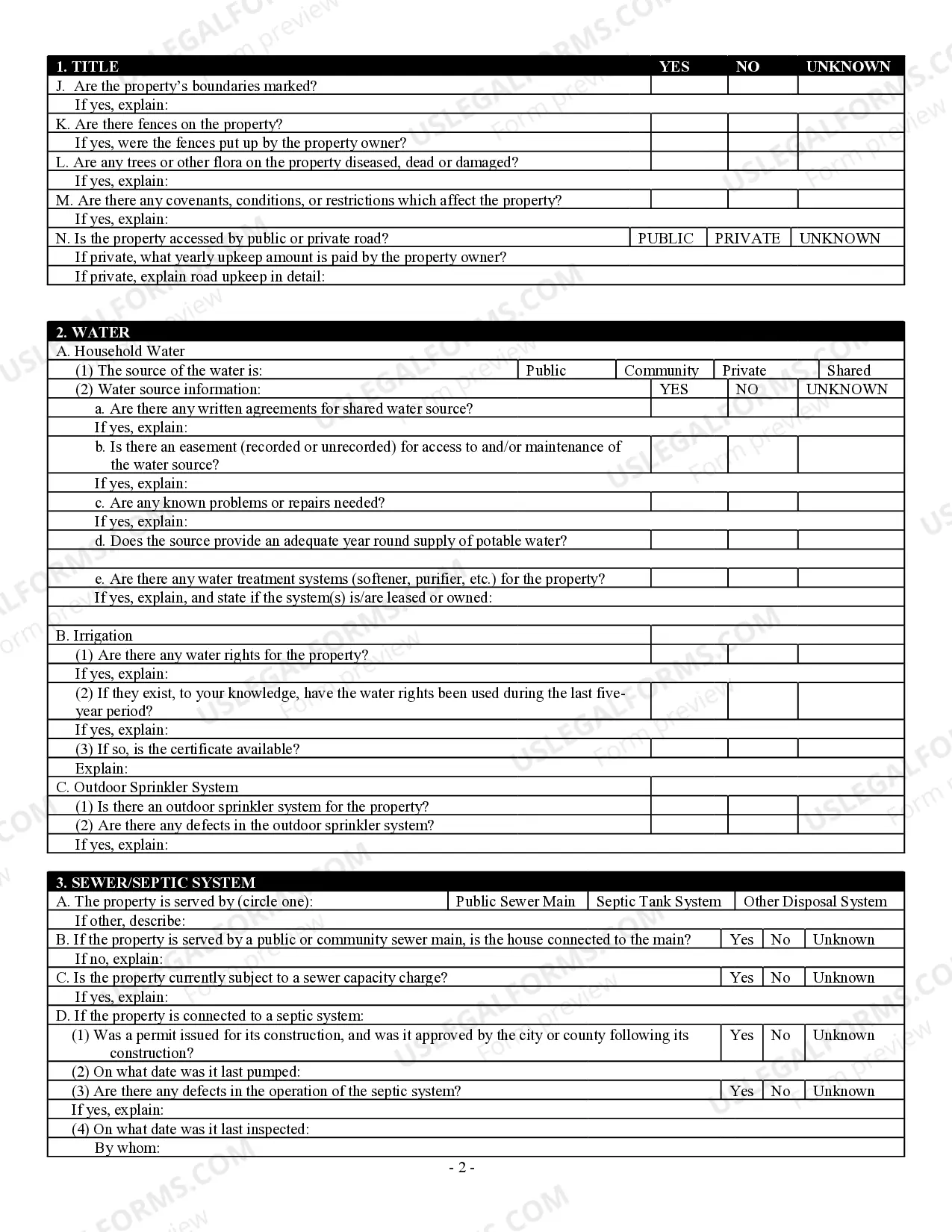

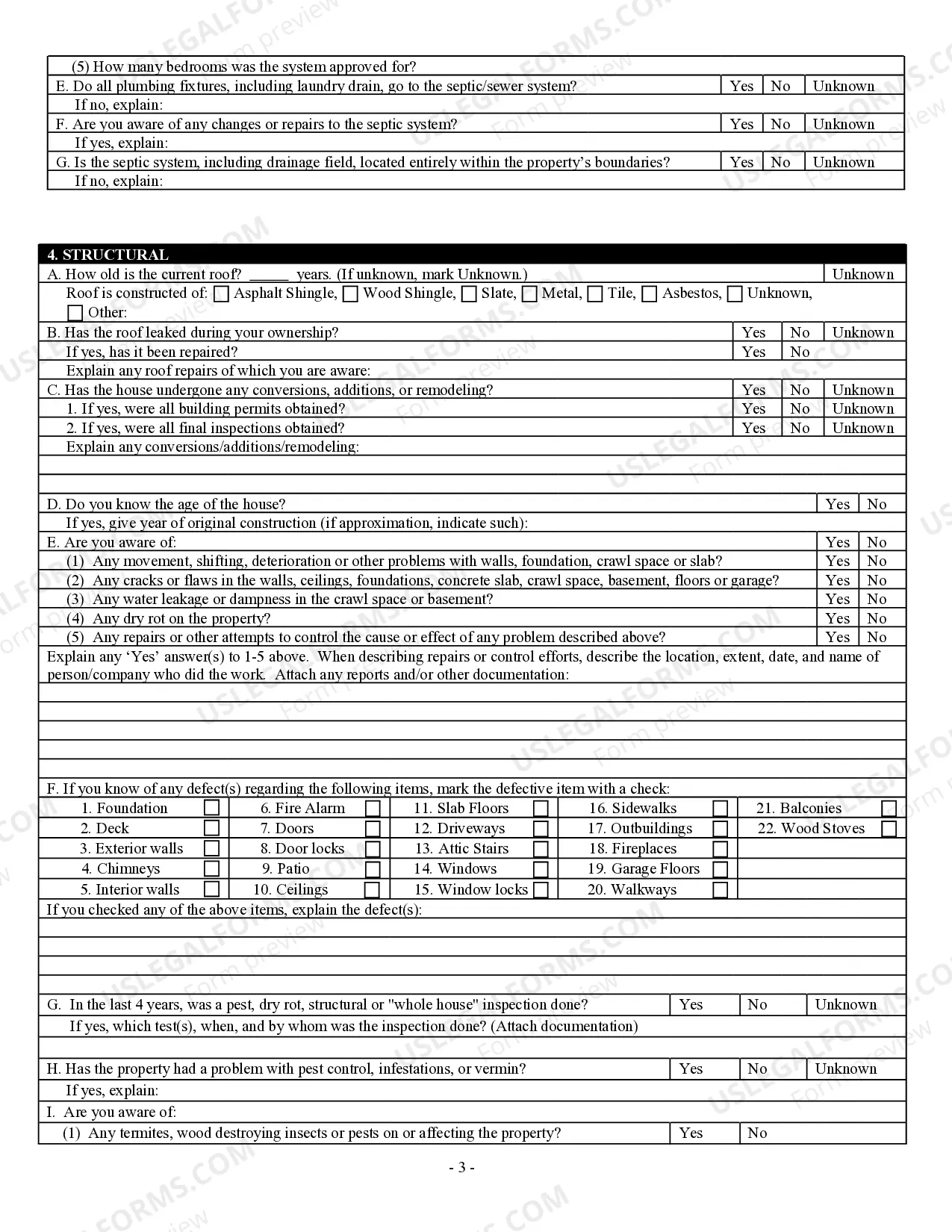

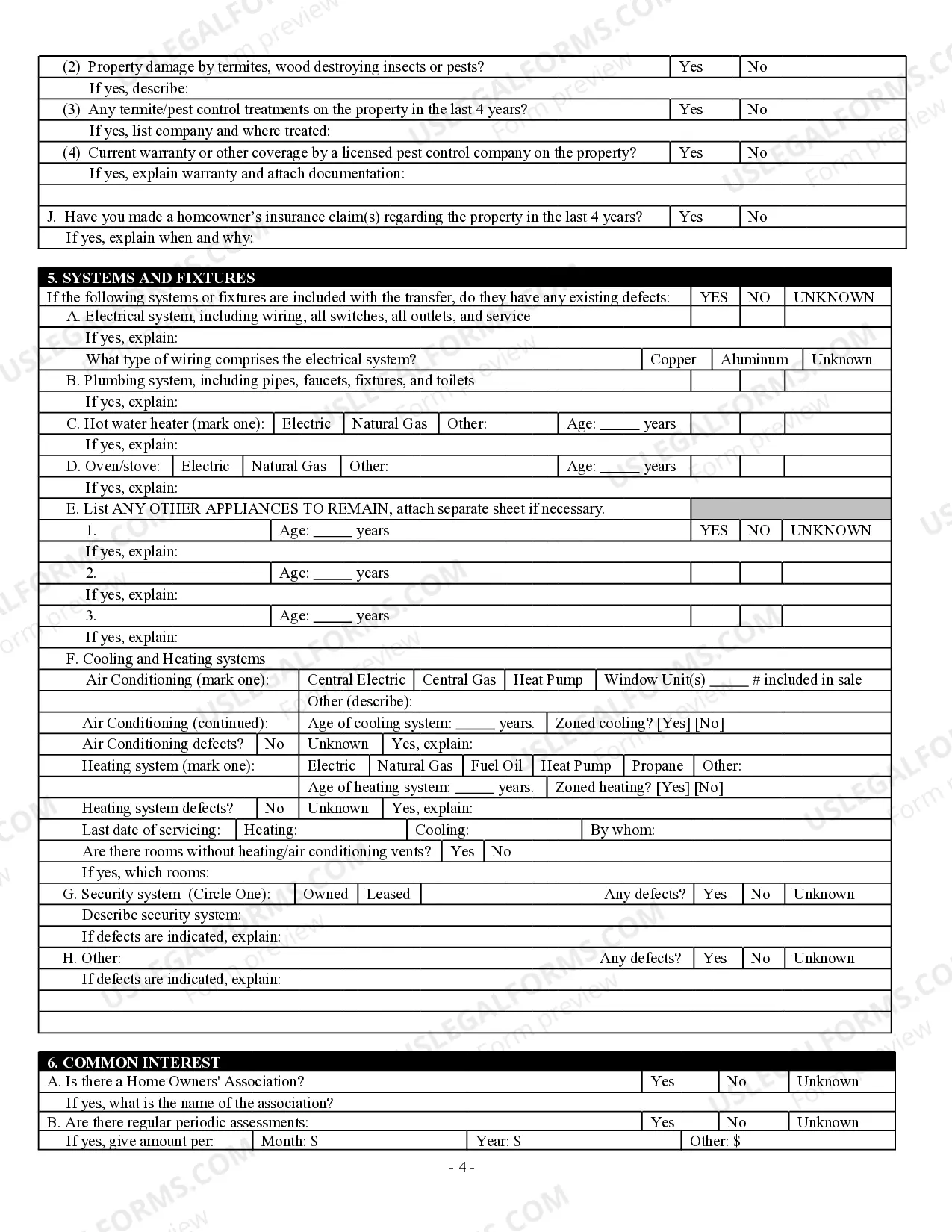

Description Real Estate Contracts

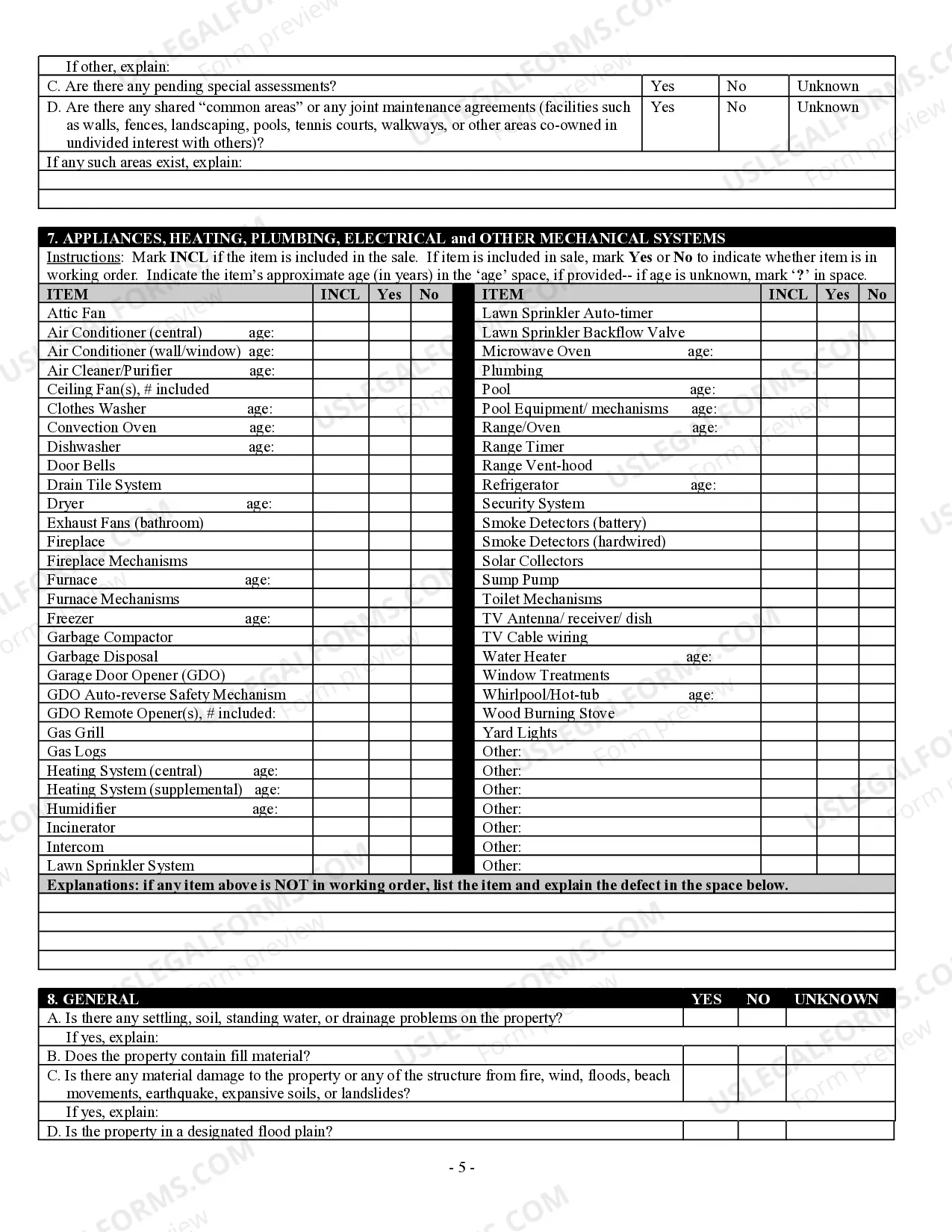

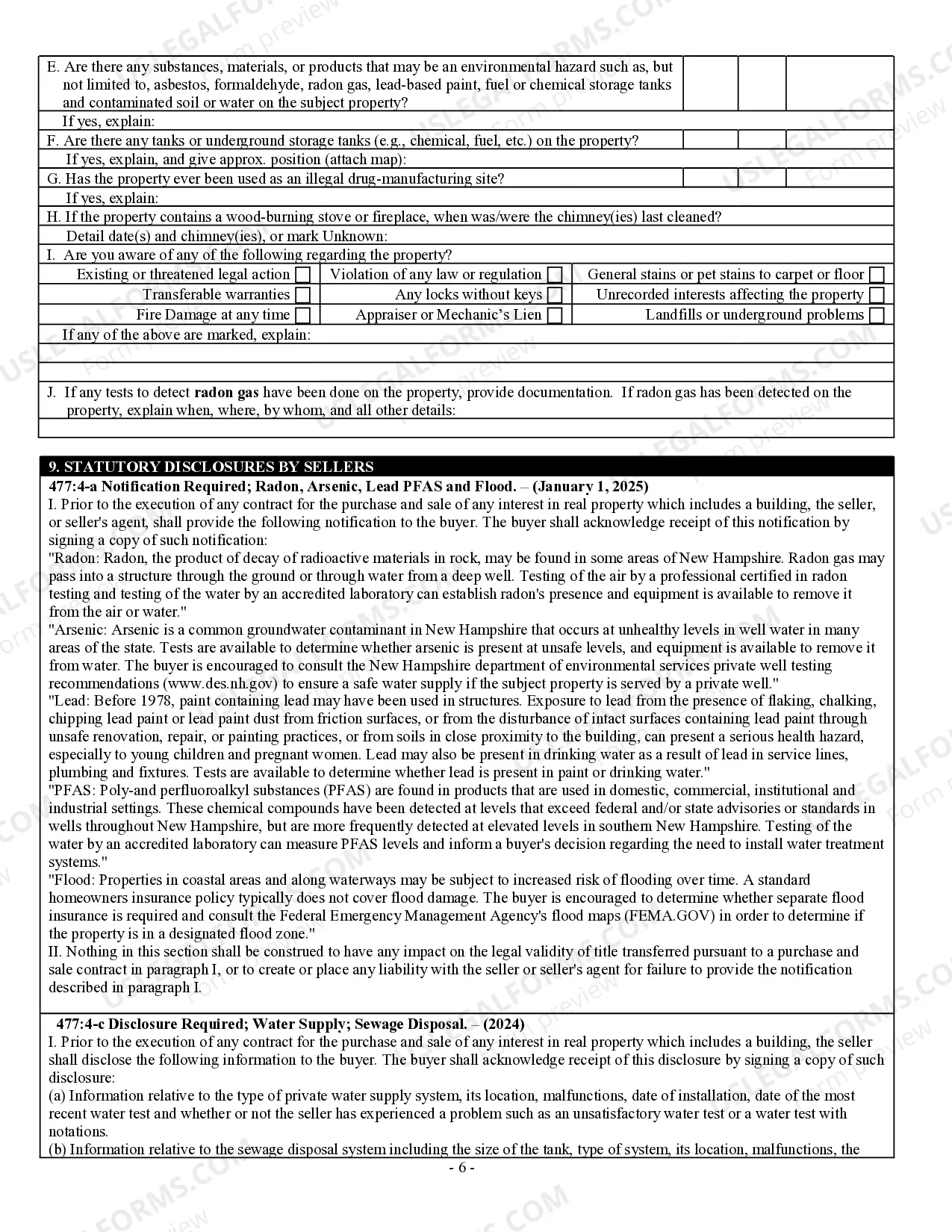

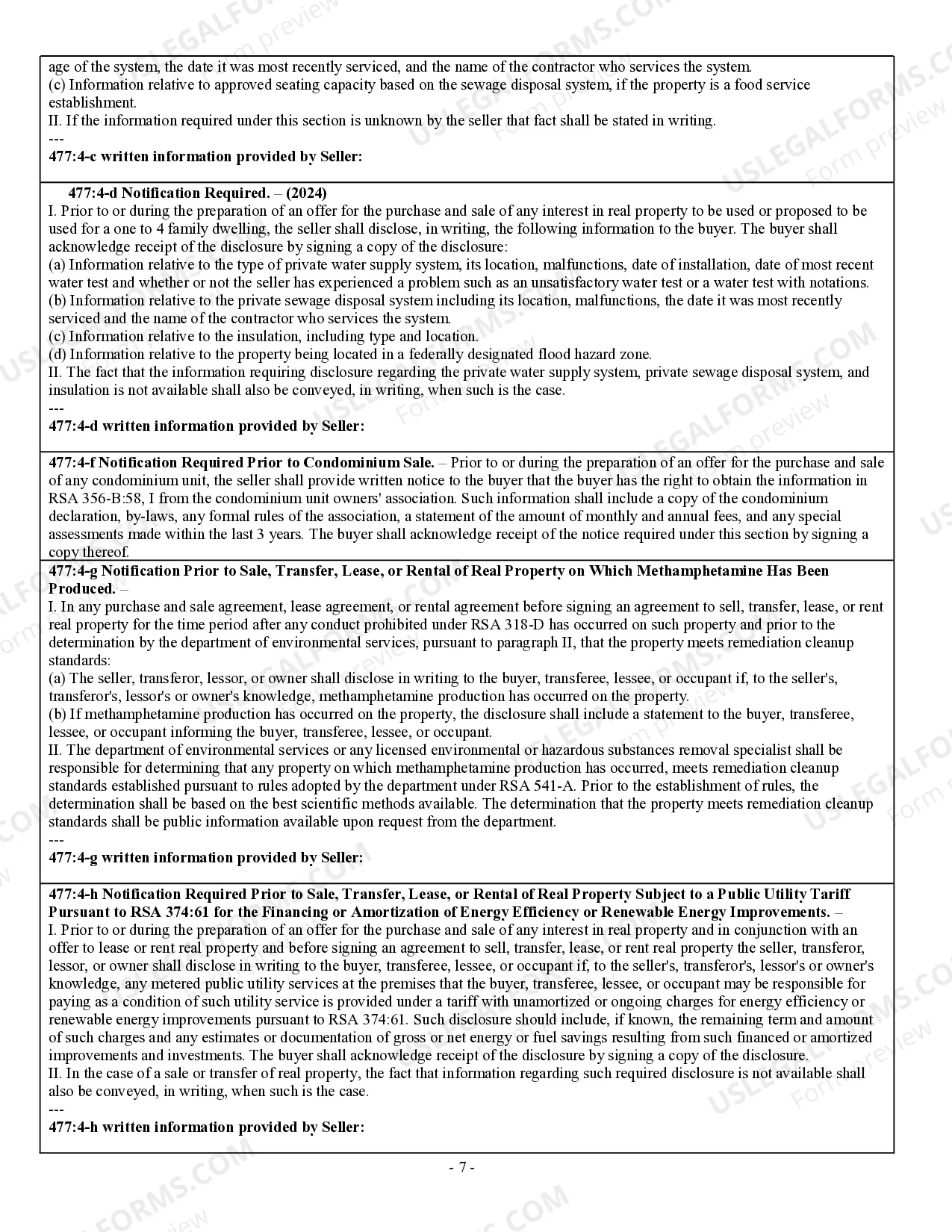

This form is a Seller's Disclosure Statement for use in a residential sales transaction in New Hampshire. This disclosure statement concerns the condition of property and is completed by the Seller.

Free preview Real Estate Disclosure Agreement