Living Trust New Hampshire For Sale

Description

Form popularity

FAQ

In New Hampshire, it's generally required for a trust to be notarized to be legally recognized. A notary public will verify your identity and witness your signature, adding an extra layer of protection to your living trust. By notarizing your trust, you help ensure that your estate plan is secure. When exploring living trust options in New Hampshire for sale, consider using resources like USLegalForms to guide you in the notarization process.

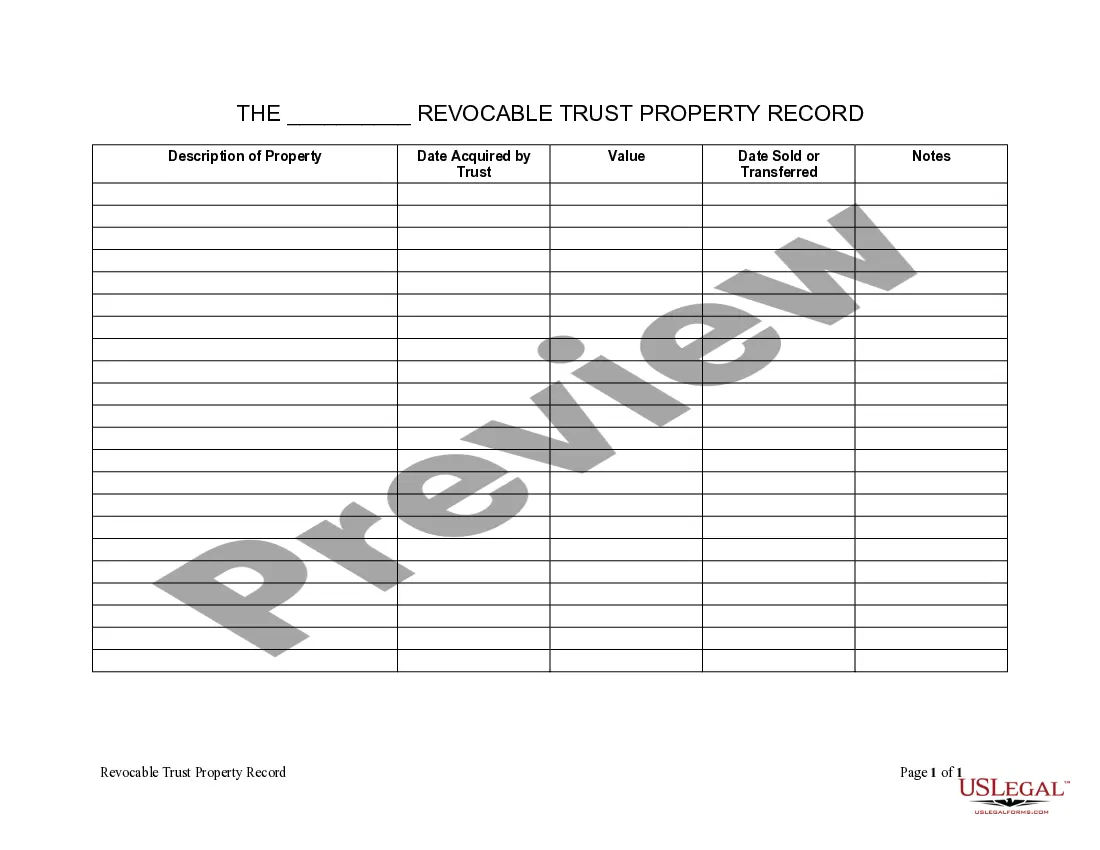

The best trust for holding your house typically depends on your specific situation, but a revocable living trust is a popular choice. This type of trust allows you to maintain control over your property while providing benefits such as avoiding probate. For many individuals in New Hampshire looking for a trust for sale, a revocable living trust offers flexibility and ease of management. Consult with a legal professional to determine the best option for your needs.

To fill a living trust, begin by gathering all essential documents, such as property deeds and financial accounts. Clearly outline your assets, beneficiaries, and the responsibilities of your trustee. Once you have all the information ready, you can use online platforms like USLegalForms to assist you in creating a properly structured living trust in New Hampshire for sale. Following this process ensures that your trust meets legal requirements and protects your estate.

One key disadvantage of placing your home in a trust is that it can be complex and may involve upfront costs. You may need legal assistance to set up the trust correctly, which adds to the initial expense. Additionally, transferring your house into a living trust may result in tax implications, depending on your circumstances. It's important to weigh these factors before considering a living trust in New Hampshire for sale.

No, a trust itself does not need to be recorded in New Hampshire. However, if you hold real estate within a trust, you must record a deed to transfer ownership legally. When exploring a living trust in New Hampshire for sale, remember to consider the documentation needed for any property held in trust to ensure everything is in order.

In New Hampshire, trusts are not required to be recorded in a public registry. However, certain assets held in a trust, like real estate, may require recording a deed to indicate ownership transfer. If you are interested in a living trust in New Hampshire for sale, be sure to understand how documentation and recording requirements can affect your estate planning.

In New Hampshire, the taxation of trusts can vary based on the type of income and the residence of the beneficiaries. Generally, a living trust is pass-through for tax purposes, meaning the individual beneficiaries report the income on their tax returns. If you're considering a living trust in New Hampshire for sale, it's wise to consult a tax professional to ensure you're managing your tax responsibilities correctly.

You can determine the location of a trust by checking the documentation associated with it, typically held by the trustee. Additionally, state laws in New Hampshire may require trusts to disclose their location in certain situations. For those looking for a living trust in New Hampshire for sale, tracking down this information can be essential for your planning.

To place your house in a trust in New Hampshire, you need to draft a trust document that clearly outlines your intentions. Once your living trust is established, you will transfer the title of your house into the trust's name. This process requires signing a deed that reflects this change, which can be facilitated through resources like US Legal Forms, where you can find a living trust in New Hampshire for sale.

Some disadvantages of a living trust include the initial setup costs and the need for regular maintenance. Unlike a will, a living trust requires you to actively fund it and update it over time. This responsibility may seem daunting but is crucial for ensuring it meets your family's needs. A living trust new hampshire for sale can streamline this process if you seek professional assistance.