New Jersey Real Estate Deeds Warranty For Rent

Description

Form popularity

FAQ

If you’ve misplaced your deed, you can obtain a copy from your county clerk's office. They archive all deeds, including lost ones, and can provide you with a replacement. Using services like USLegalForms can also help you navigate this situation and gain quick access to New Jersey real estate deeds warranty for rent.

To get a copy of a deed in New Jersey, start by checking with your county clerk's office, as they maintain all property records. You can request a copy in person or check if there's an option for online requests. Platforms like USLegalForms can simplify this process and ensure you find the New Jersey real estate deeds warranty for rent that you need.

To obtain a copy of your deed online in New Jersey, visit your county clerk's official website. Many counties offer digital access to property records, making it easy for you to find your warranty deed. You can also utilize USLegalForms as a reliable platform to assist in accessing these documents efficiently.

Yes, deeds are considered public records in New Jersey. This means anyone can access them for inspection at the county clerk's office. This transparency promotes accountability and ensures that New Jersey real estate deeds warranty for rent can be easily verified by potential buyers or renters.

The timeframe to get a deed in New Jersey can vary. Typically, it may take a few days to a couple of weeks, depending on the county and the workload of the office handling the request. If you require efficiency, consider using online services like USLegalForms for quicker access to New Jersey real estate deeds warranty for rent.

To get a copy of your warranty deed, visit the county clerk's office where your property is located. They maintain records of all real estate transactions, including warranty deeds. Alternatively, you can also use USLegalForms to access and request copies online, streamlining the process.

You can obtain a warranty deed form from various places, including legal websites, local real estate offices, and USLegalForms. It's crucial to ensure that the form meets New Jersey regulations, especially when it pertains to New Jersey real estate deeds warranty for rent. Always verify the source to ensure accuracy.

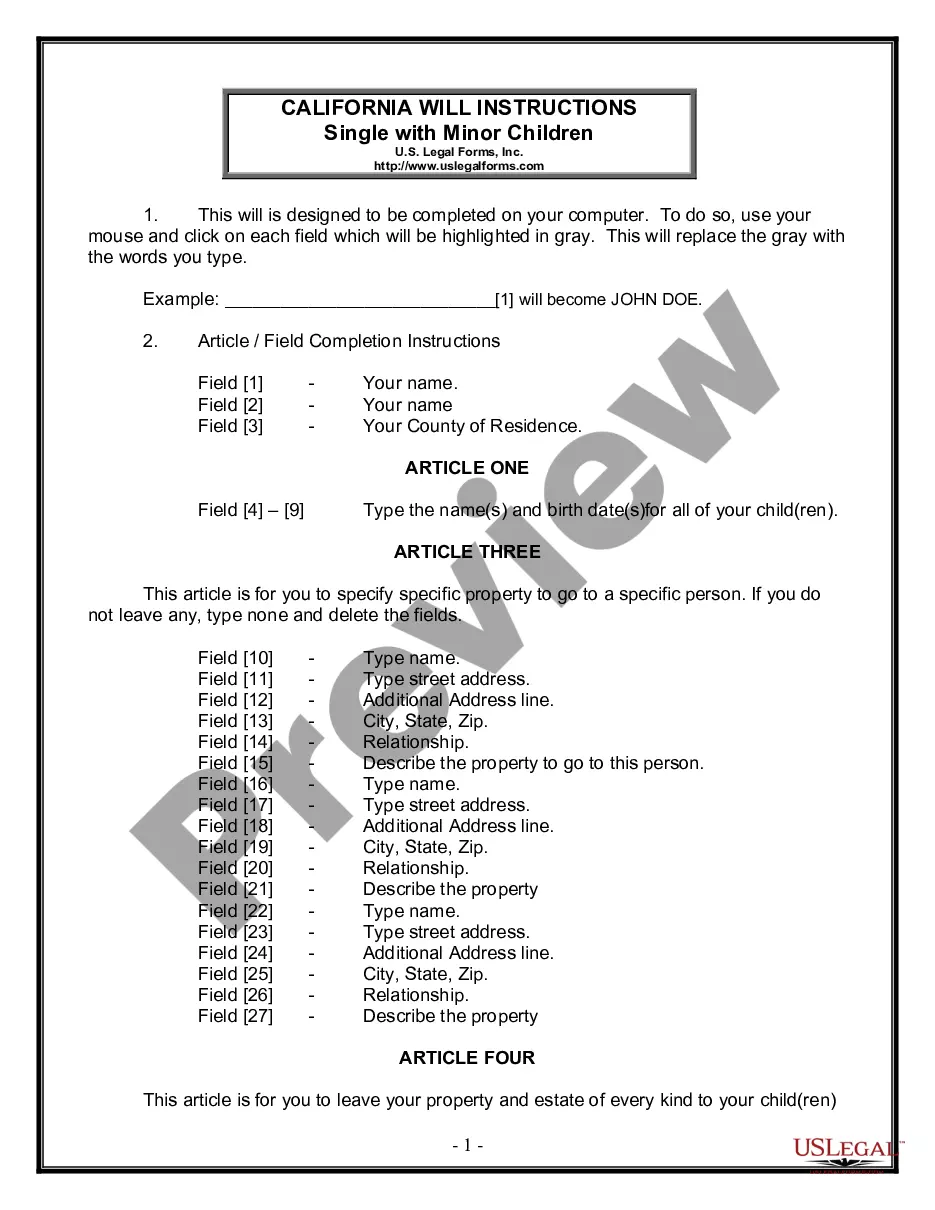

Yes, you can prepare your own deed in New Jersey, but it is essential to follow specific legal requirements to ensure validity. You need to provide the correct property description, include all required parties, and adhere to state laws. Utilizing tools from resources like USLegalForms can streamline the process, especially for New Jersey real estate deeds warranty for rent. This way, you can avoid potential pitfalls and create a legally sound document.

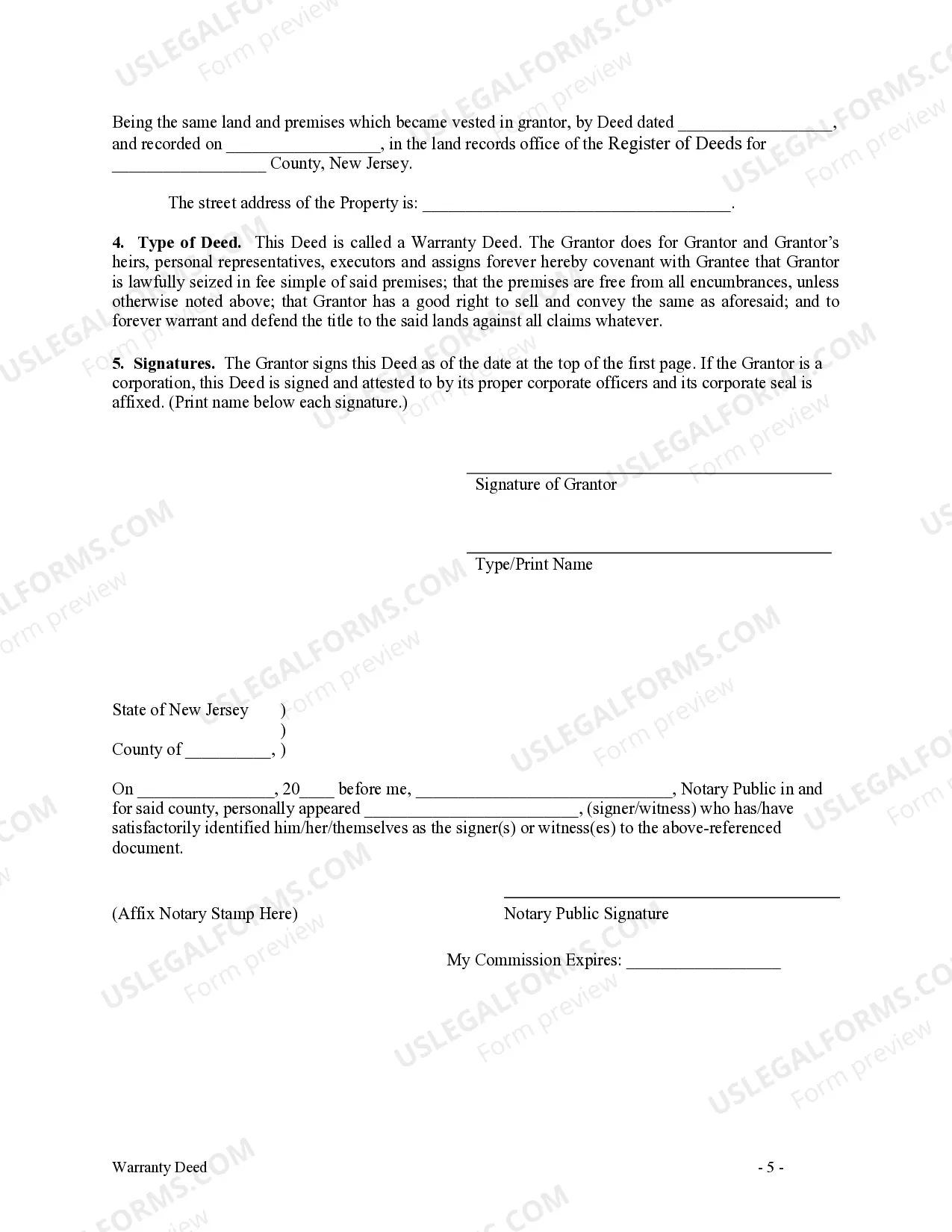

Filling out a warranty deed form requires careful attention to detail. Start by entering the current owner's full name, the buyer's name, and the legal description of the property. When dealing with New Jersey real estate deeds warranty for rent, include any rent-related terms or conditions that apply. If you encounter any confusion, consider seeking guidance from platforms like USLegalForms that offer resources and templates to simplify the process.

A warranty deed should clearly outline the property involved and the parties to the transaction. It needs to state that the seller guarantees clear title to the property and will defend the title against any claims. In the context of New Jersey real estate deeds warranty for rent, ensure the deed specifies the terms of any rental agreements or conditions. This clarity helps protect both the buyer and the seller and ensures smooth transactions.