New Jersey Foreign Llc Annual Report

State:

New Jersey

Control #:

NJ-2222LLC

Format:

Word;

Rich Text

Instant download

Description New Jersey Limited Liability Company

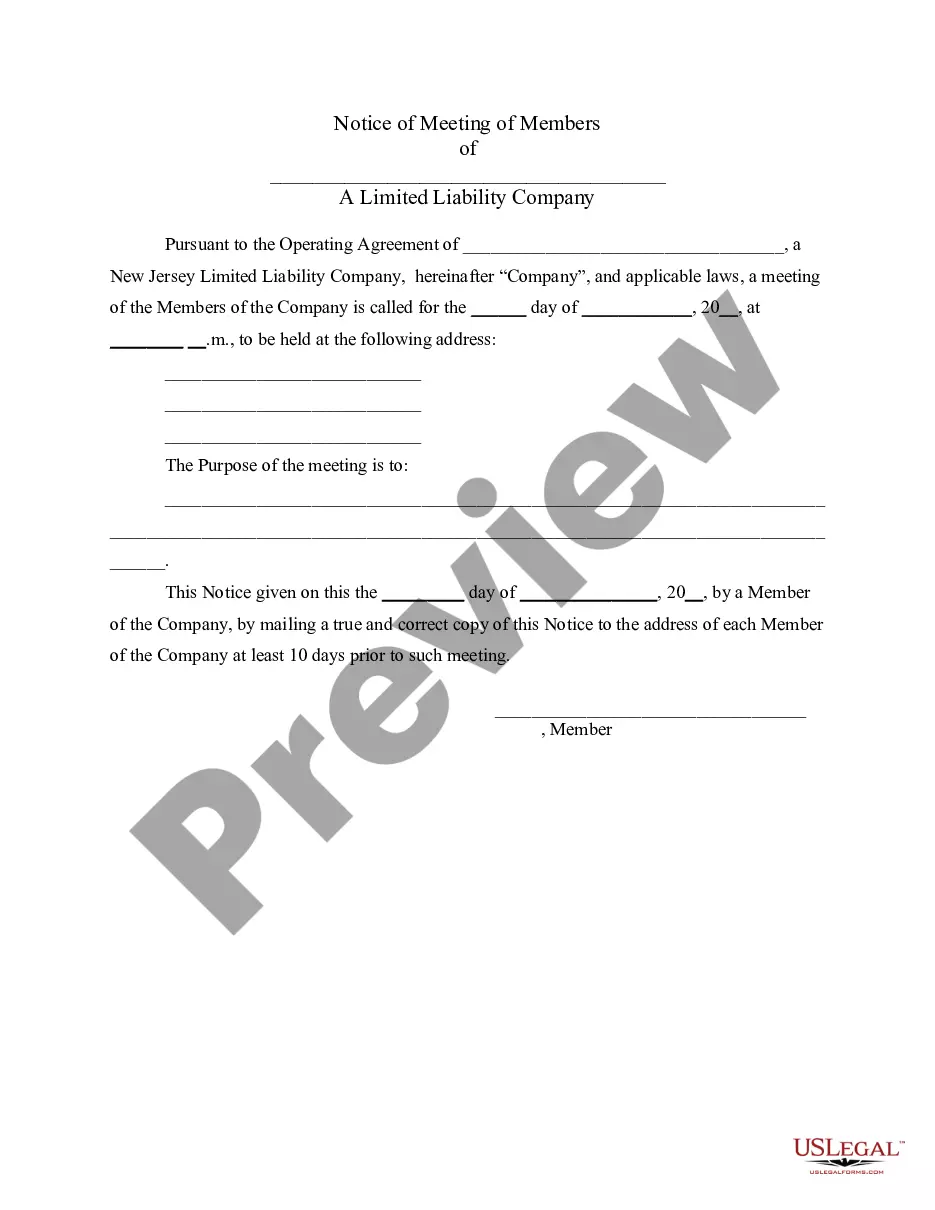

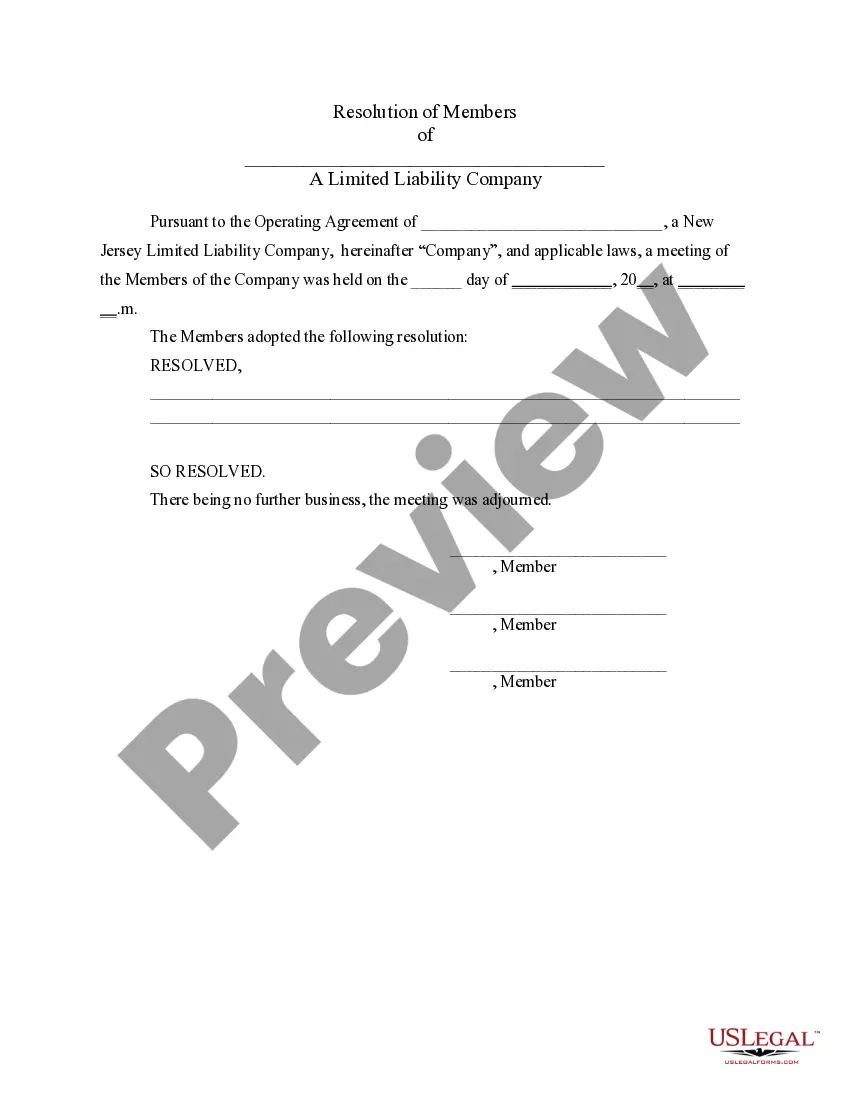

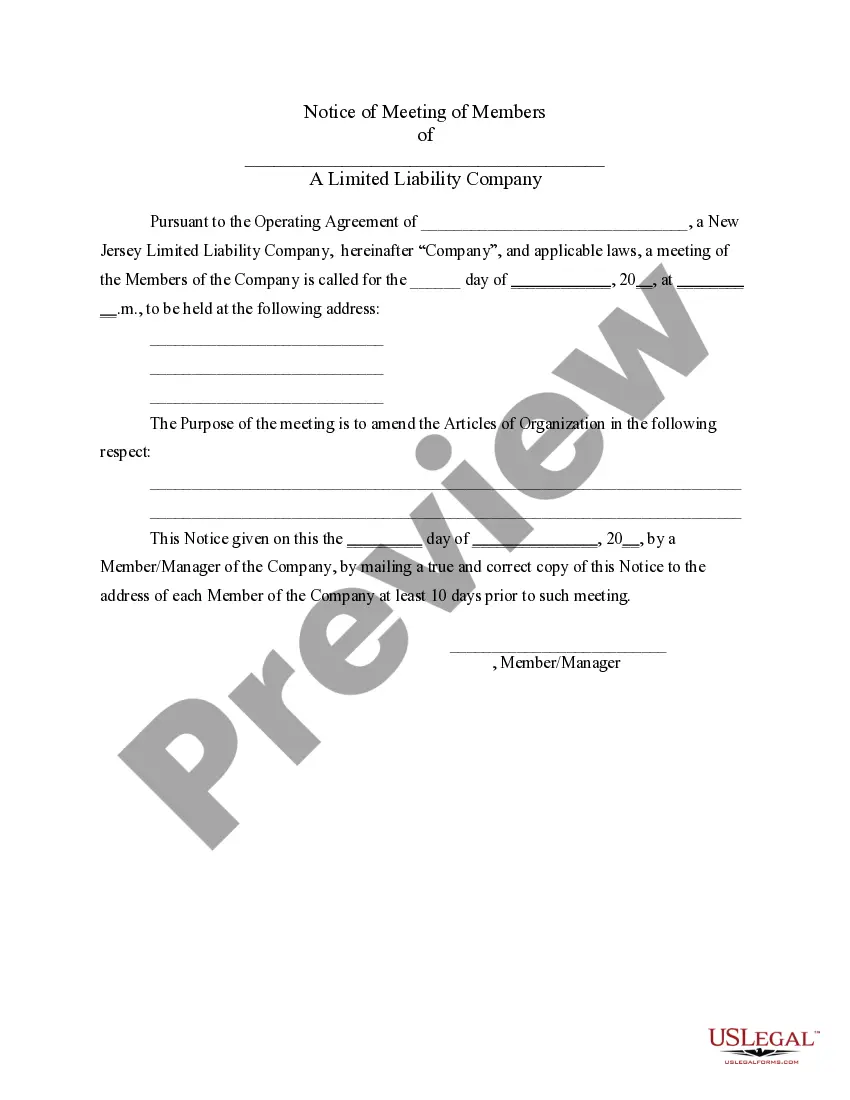

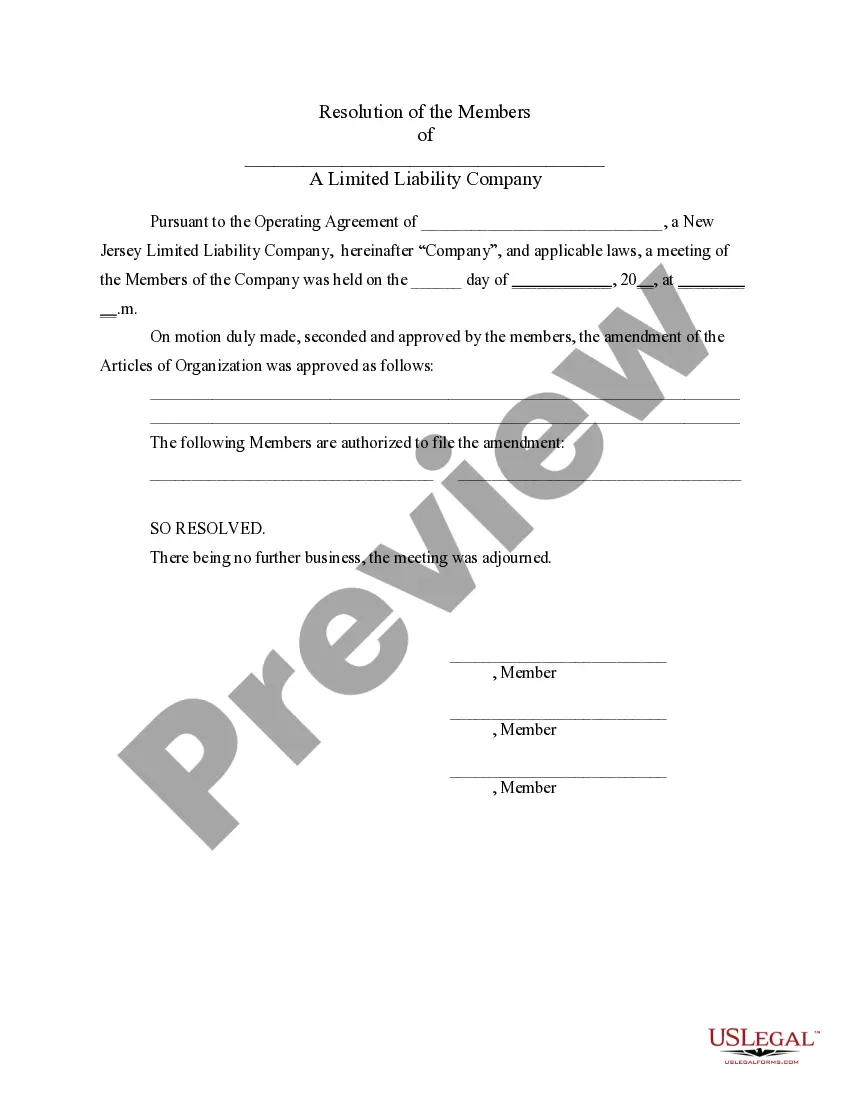

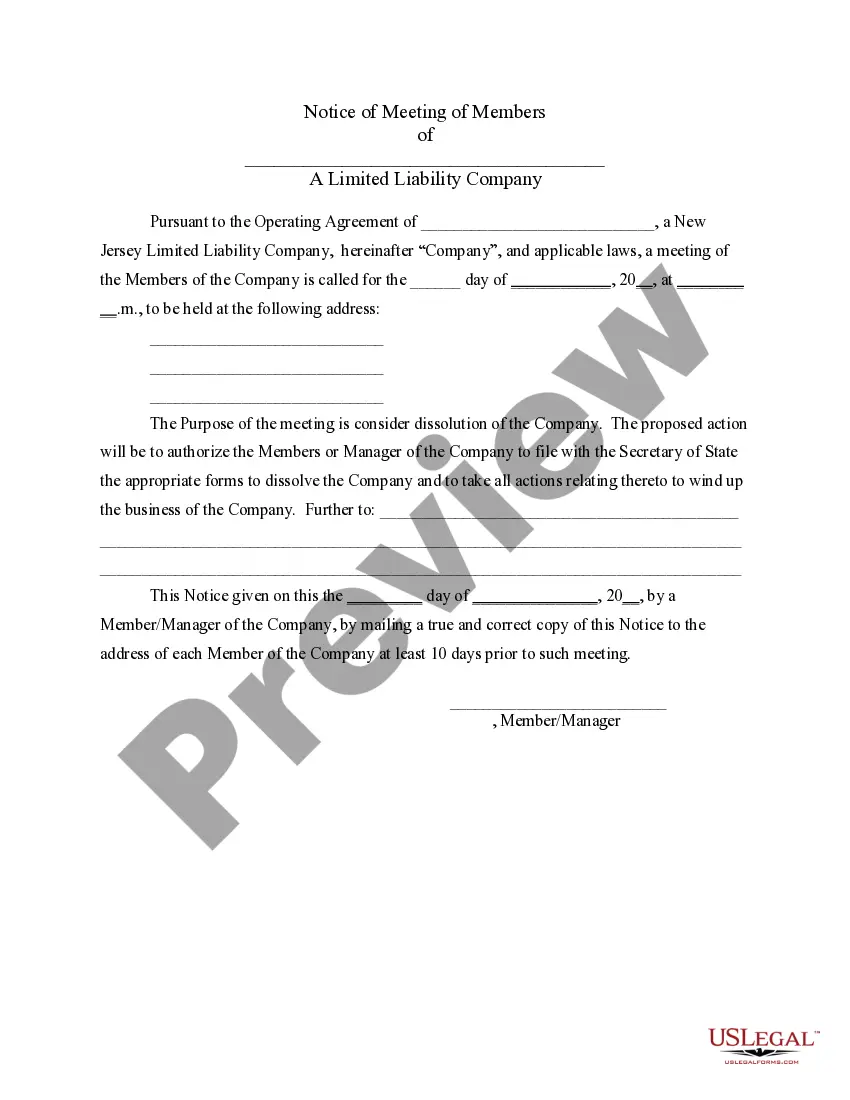

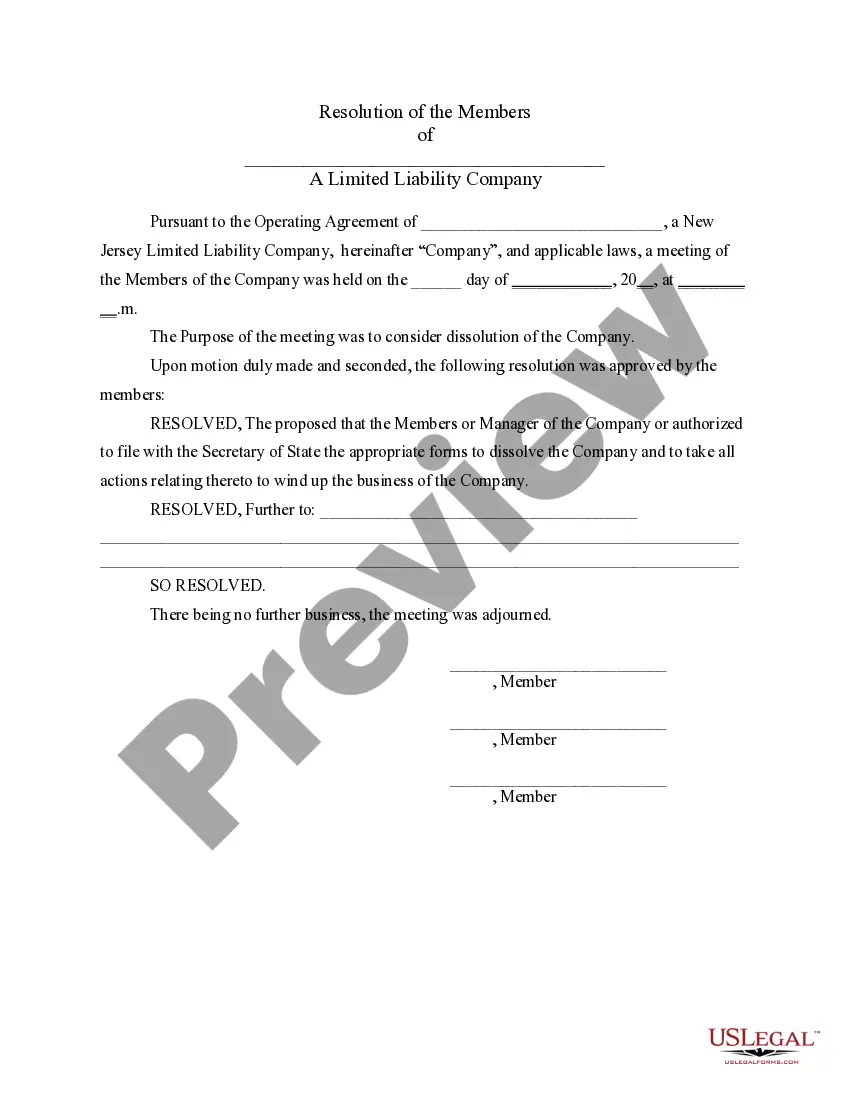

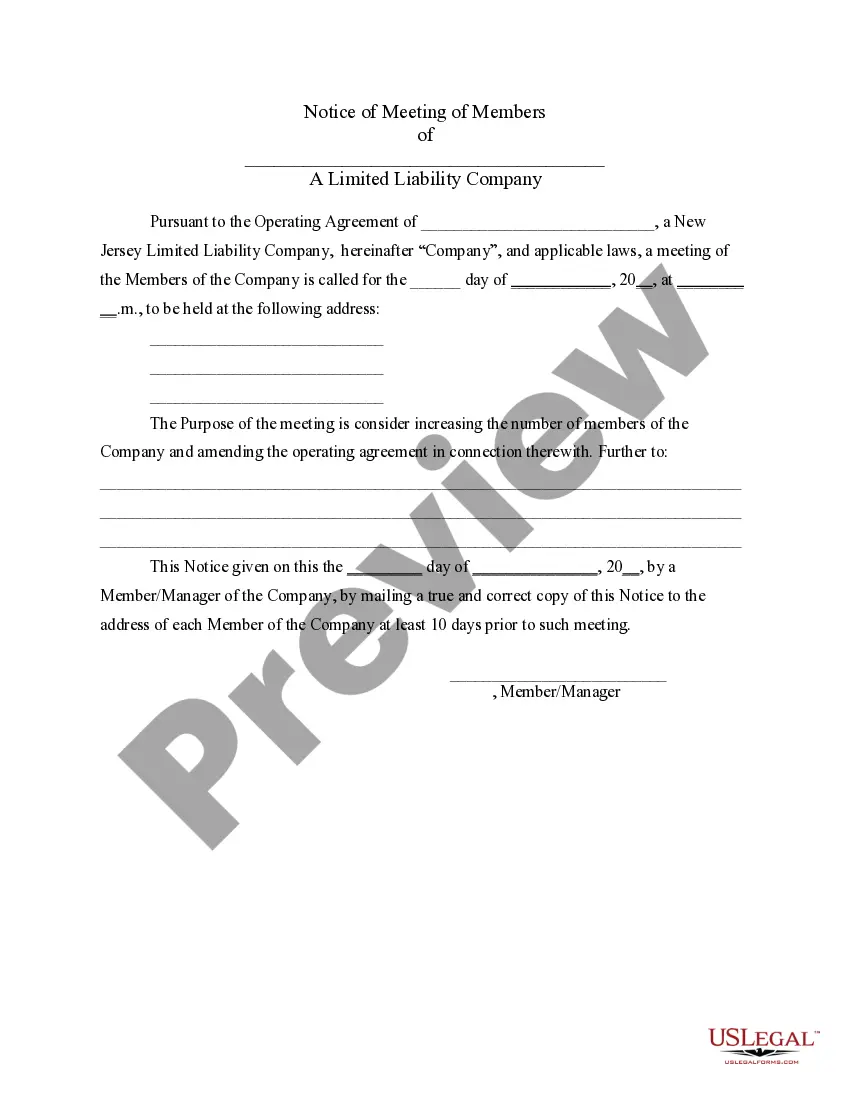

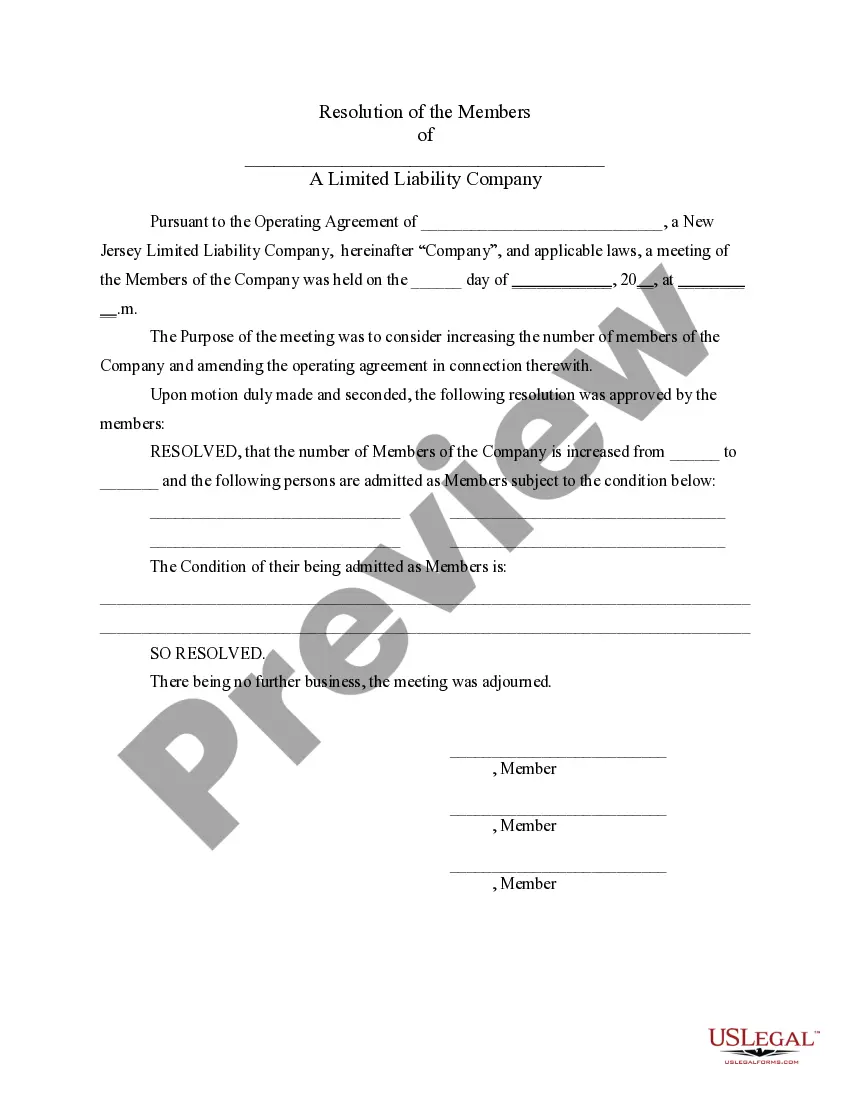

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Free preview Limited Liability Company Resolutions