Real Estate Subordination Form 14134

Description

Form popularity

FAQ

A federal tax lien typically lasts for ten years from the date it is assessments. However, this timeframe may extend if a payment plan has been established or the tax debt is not resolved. Utilizing a Real estate subordination form 14134 can assist in negotiating terms and safeguarding your property during this duration.

A federal tax lien can significantly impact your financial situation. It affects your credit score, making it harder to qualify for loans and mortgages. Addressing the issue promptly, such as using a Real estate subordination form 14134, can help you manage your obligations and protect your assets.

The IRS may place a lien on your property when you owe at least $10,000 in unpaid federal taxes. This lien gives the IRS a legal claim to your assets, including your real estate. If you find yourself in this situation, understanding how a Real estate subordination form 14134 works can help protect your property rights.

Securing a home equity line of credit with an existing tax lien can be challenging but not impossible. Lenders typically require that the tax lien be subordinated to the new debt for approval. By completing the Real estate subordination form 14134, you may successfully negotiate this with the IRS or tax authority. This step can open up borrowing opportunities, allowing you to access funds as needed.

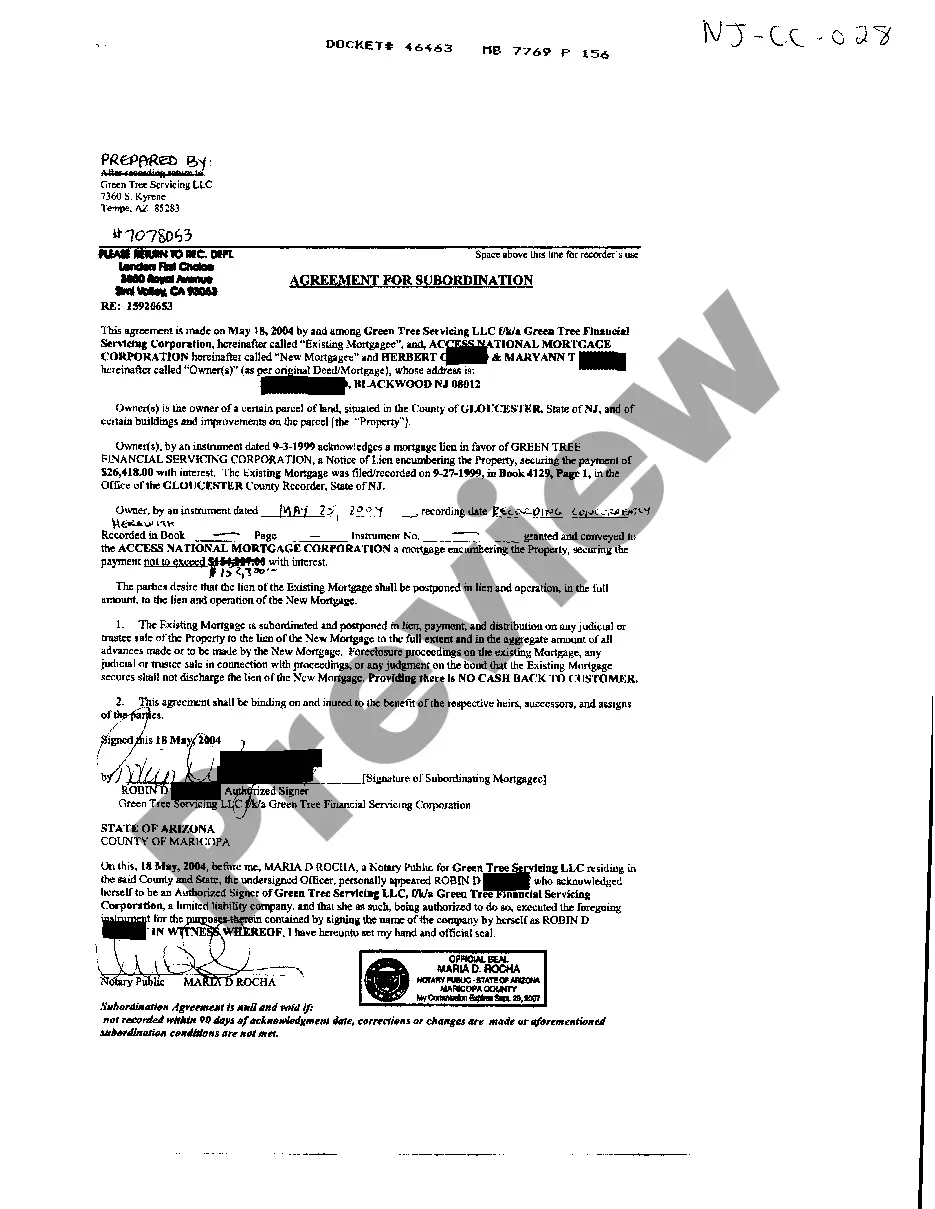

Form 14134 is a specific document used to request lien subordination for real estate. It serves as a formal application for adjusting the priority of liens against a property. Utilizing this standardized form can expedite the subordination process, making it easier for all involved. For detailed instructions and support, you can rely on the USLegalForms platform to assist with the Real estate subordination form 14134.

A landlord lien subordination agreement is a legal document that allows a tenant's lender to have priority over the landlord's claims on the property. This is often utilized in commercial leases to facilitate financing for tenants. If you are a landlord or tenant, using the Real estate subordination form 14134 can formalize this agreement effectively. It ensures all parties understand their rights and obligations.

IRS lien subordination involves the IRS allowing a subsequent lien to take priority over its claim against a property. This can be beneficial if you aim to refinance or secure new loans despite existing tax liens. Homeowners often utilize the Real estate subordination form 14134 to request this change. This form simplifies the communication and approval process with the IRS.

Debt subordination refers to prioritizing one debt over another, affecting repayment order in bankruptcy. On the other hand, lien subordination specifically pertains to the order of liens against a property. For homeowners, recognizing these differences is vital when considering new financing options. The Real estate subordination form 14134 offers a clear path to lien subordination.

A subordination of a federal tax lien occurs when the IRS allows other lenders to have priority over its tax lien on a property. This is often necessary for a property owner seeking additional financing and needs their mortgage to rank higher than the tax lien. The Real estate subordination form 14134 can be useful in this situation, as it provides a formal mechanism for documenting the new priority of loans, enabling smoother financial transactions.

Subordination works by changing the order of claims against a property. In real estate transactions, when a property has multiple liens, subordination allows one lien to take priority over another. This process is often facilitated by the Real estate subordination form 14134, which serves as an official agreement outlining the new priorities and ensuring all parties understand their positions.