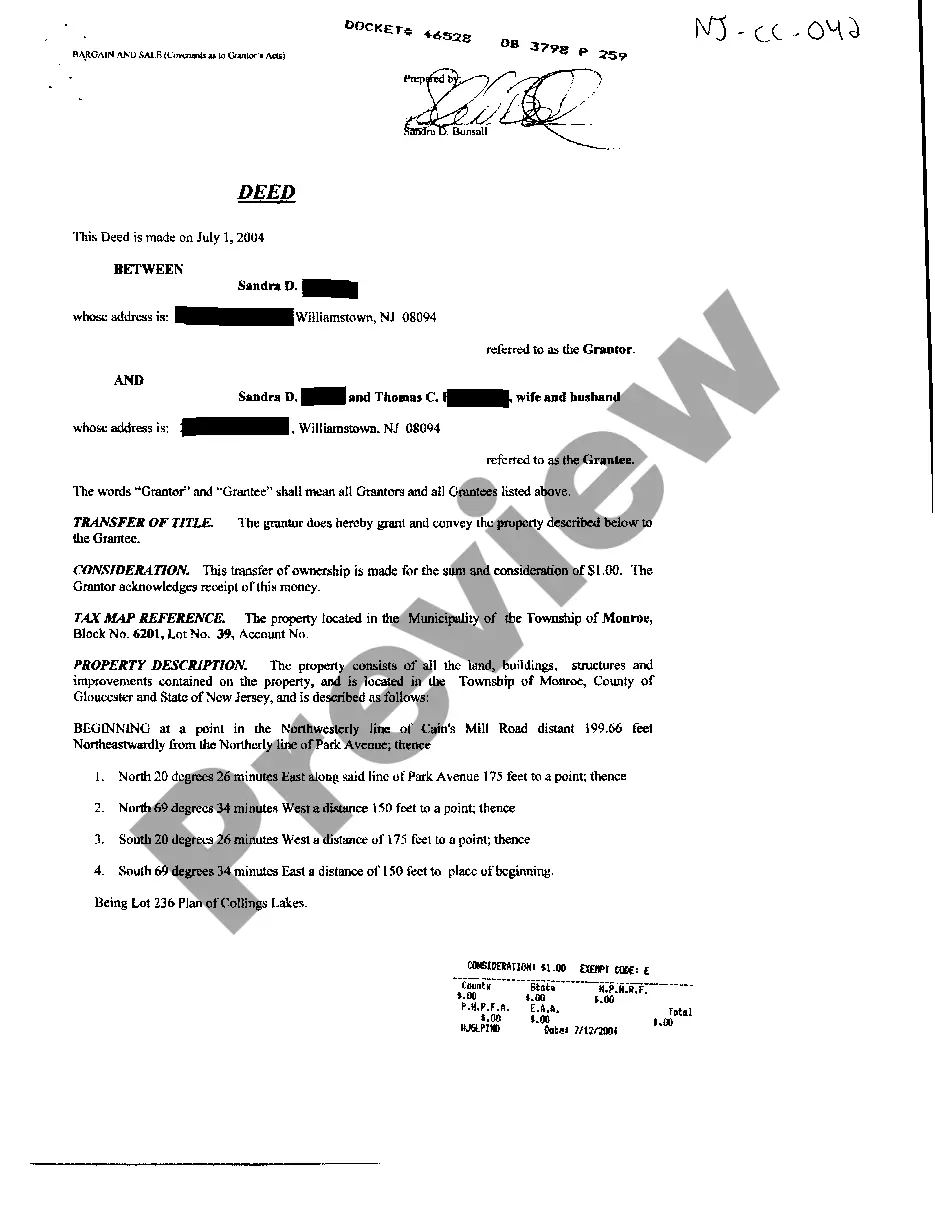

Affidavit Of Consideration For Use By Buyer

Description affidavit of consideration

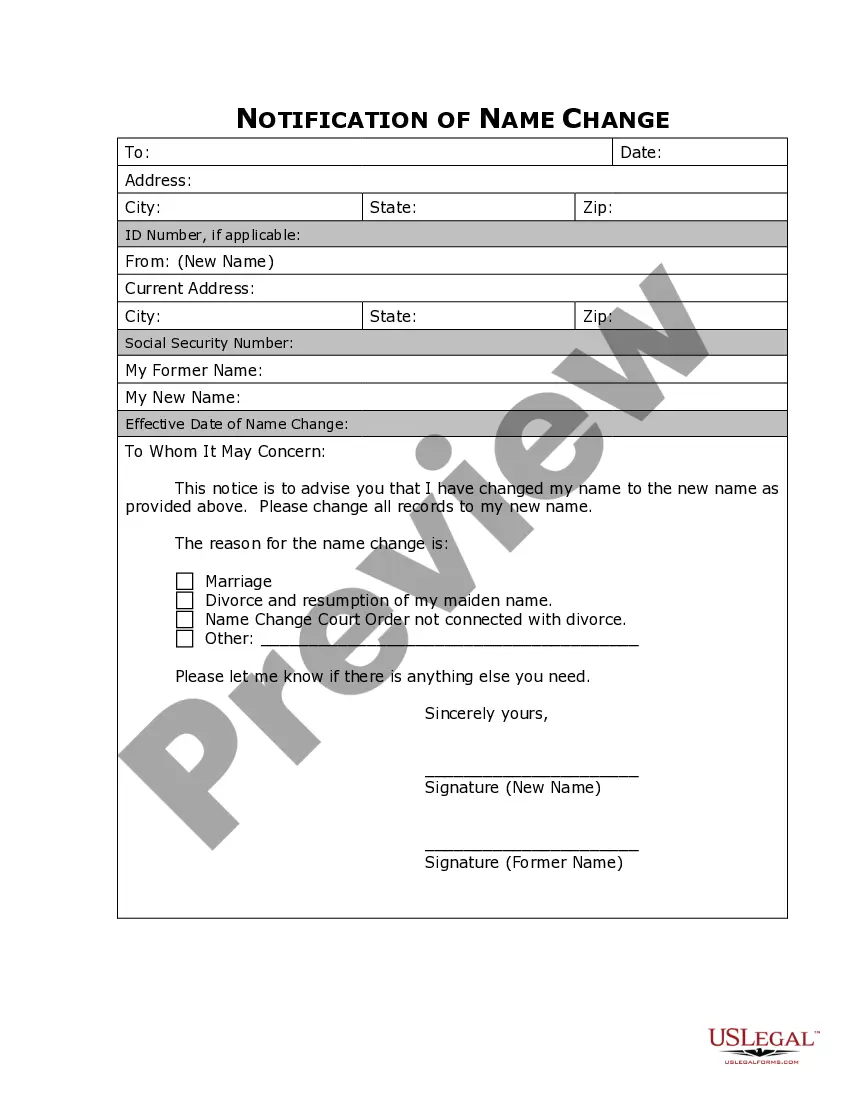

How to fill out Affidavit Of Consideration For Use By Buyer?

How to locate professional legal documents that comply with your state laws and create the Affidavit Of Consideration For Use By Buyer without hiring a lawyer.

Numerous online services offer templates to address various legal situations and requirements. However, it can take time to determine which available examples meet both your usage needs and legal standards.

US Legal Forms is a trusted platform that assists you in finding official documents crafted in accordance with the latest state law revisions and helps you save on legal fees.

If you don't possess an account with US Legal Forms, please follow the steps below.

- US Legal Forms is not just a typical online resource.

- It is a repository of over 85k verified templates for diverse business and life scenarios.

- All documents are organized by region and state to streamline your searching experience.

- It also features comprehensive tools for PDF editing and electronic signatures, allowing users with a Premium membership to swiftly finalize their documents online.

- It requires minimal time and effort to acquire the essential paperwork.

- If you already possess an account, Log In/">Log In and verify that your subscription is active.

- Download the Affidavit Of Consideration For Use By Buyer using the related button next to the document name.

affidavit use Form popularity

new jersey affidavit of consideration Other Form Names

FAQ

The mansion tax was introduced in 2004 when home values were considerably less than they are now and $1 million home prices were much less commonplace. Unless otherwise agreed upon by the buyer and seller, the mansion tax is typically paid by the seller at closing.

As a supplemental fee to the RTF, N.J.S.A. -7.2 imposes a fee on the recording of the deed for the sale of real property when the consideration paid is more than $1,000,000. While the seller pays the RTF, the buyer pays this supplemental fee of one percent of the consideration recited in the deed.

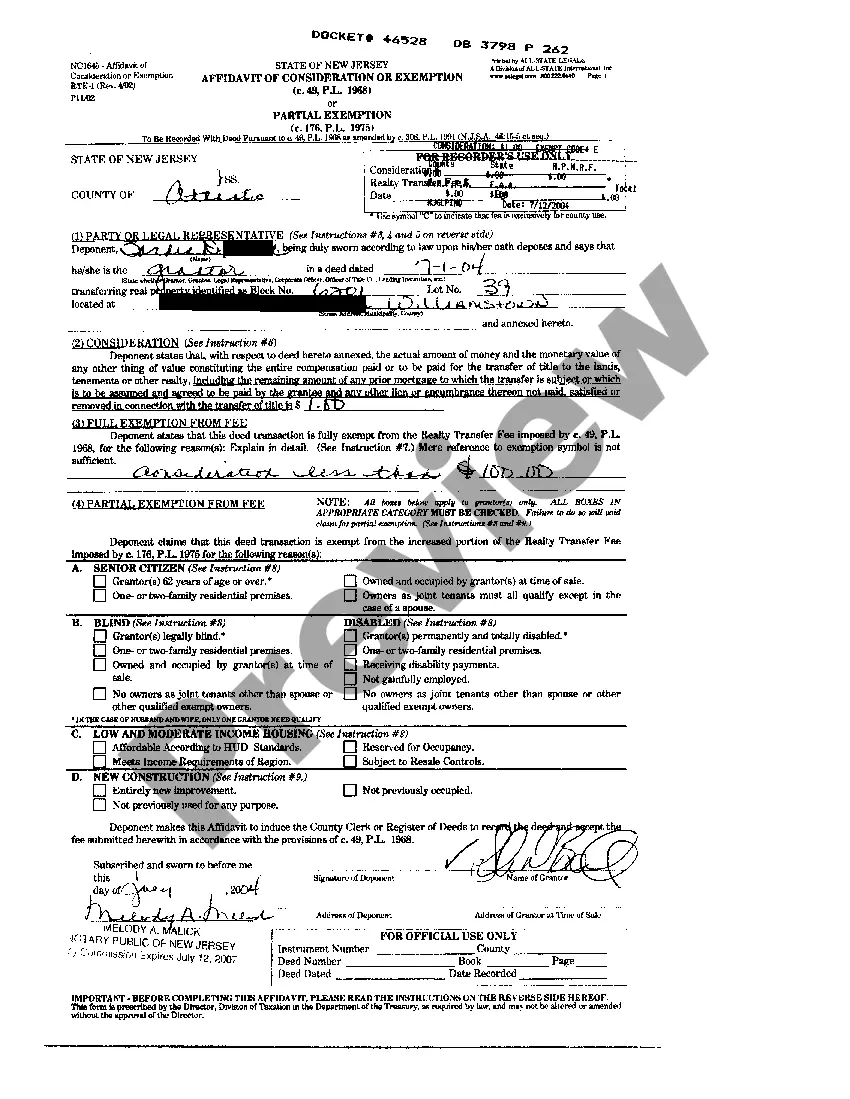

The State of New Jersey imposes a Realty Transfer Fee (RTF) on the seller whenever there is a transfer of title by deed. The fee is based on the sales price of the property, and the seller is required to pay the fee at the time of closing.

NJ Taxation An Affidavit of Consideration (RTF-1 ) must be filed with any deed in which a full or partial exemption is claimed from the Realty Transfer Fee.

Generally, in New Jersey, the Seller pays the Transfer Tax. If you qualify for an exemption, you are entitled to pay a reduced amount. Consult your attorney to see if any of these exemptions apply to you. Note:If purchase price is over 1 million dollars, a 1% mansion tax may be due.