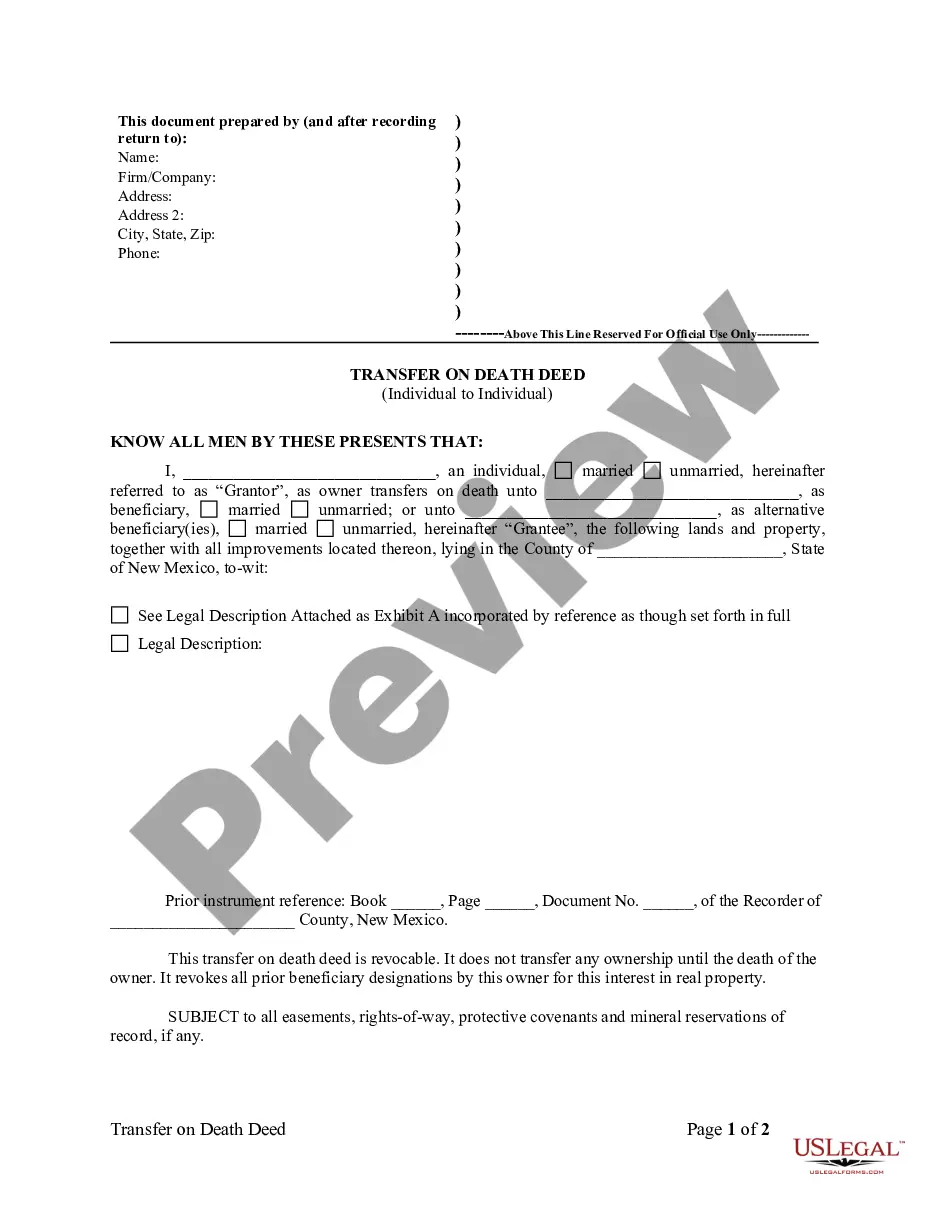

Transfer on death (TOD) property deed form in California is a legal tool that allows individuals to designate beneficiaries who will inherit their real estate properties upon their death, without the need for probate proceedings. This form ensures a smooth transfer of ownership and simplifies the process for the beneficiaries. One of the types of Transfer on death property deed forms in California is the revocable transfer on death deed (ROD). This form allows the property owner, also known as the transferor, to retain full control and ownership rights over the property during their lifetime. They can modify or even revoke the TOD designation at any time without the consent of the beneficiary. Another type is the irrevocable transfer on death deed (iPod). This form, once executed, cannot be changed or revoked without the consent of the beneficiary. The transferor relinquishes control and ownership rights over the property, effective upon their death. The beneficiary has no rights or interest in the property until the transferor passes away. The Transfer on death property deed form in California offers several advantages. Firstly, it bypasses the need for probate, which can be a time-consuming and costly process. Secondly, it provides an efficient method of transferring property to the intended beneficiaries. Lastly, it allows for the clear designation of successor beneficiaries in case the primary beneficiary predeceases the transferor. To execute a Transfer on death property deed in California, the transferor must ensure that the form meets the legal requirements outlined by the California Probate Code Section 5642. This includes the transferor being of legal age, sound mind, and the form being properly notarized and recorded with the county recorder's office where the property is located. In summary, the Transfer on death property deed form in California is an effective estate planning tool that offers a convenient way to transfer real estate properties upon the transferor's death without the need for probate. Both the revocable and irrevocable forms provide flexibility and peace of mind to the property owners, allowing them to control the destiny of their assets even after their demise.

Transfer On Death Property Deed Form California

Description transfer on death deed california

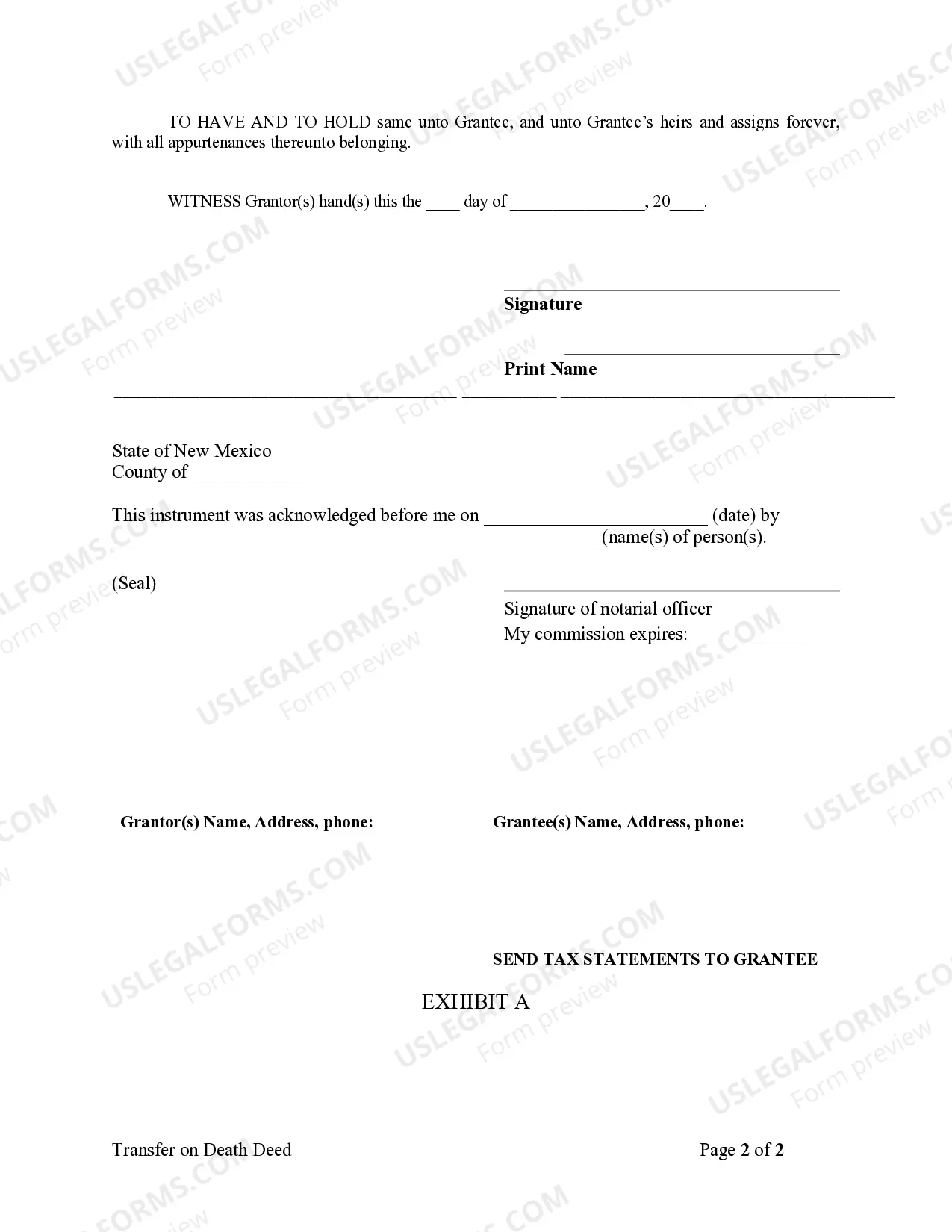

How to fill out Transfer On Death Property Deed Form California?

Finding a go-to place to take the most current and relevant legal templates is half the struggle of handling bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is why it is vital to take samples of Transfer On Death Property Deed Form California only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details concerning the document’s use and relevance for the circumstances and in your state or county.

Consider the following steps to finish your Transfer On Death Property Deed Form California:

- Utilize the library navigation or search field to locate your sample.

- View the form’s information to check if it suits the requirements of your state and area.

- View the form preview, if available, to make sure the template is definitely the one you are searching for.

- Get back to the search and find the appropriate template if the Transfer On Death Property Deed Form California does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Choose the document format for downloading Transfer On Death Property Deed Form California.

- Once you have the form on your device, you may alter it with the editor or print it and complete it manually.

Eliminate the headache that comes with your legal documentation. Discover the comprehensive US Legal Forms catalog where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

How to Change a Deed When Inheriting a House Step 1: Get a Copy of the Probated Will. ... Step 2: Confirm the Nature of Property Ownership. ... Step 3: Get a Certified Copy of the Death Certificate. ... Step 4: Draft a New Deed that Names You as the Property Owner. ... Step 5: Sign the Deed. ... Step 6: Have the New Deed Notarized.

California's TOD deed requirements include: Residential property only. ... Owner with legal capacity. ... Beneficiaries identified by name. ... Valid legal description. ... Signed, dated, notarized, and witnessed. ... Statutory form. California law does not allow just any deed form to qualify as a TOD deed. ... Record within 60 days.

Property You Can Transfer With a TOD Deed You may transfer any of the following types of California real estate with a TOD deed: property that contains one to four residential units. a condominium unit, or. a parcel of agricultural land of 40 or fewer acres that includes a single-family residence.

Step 1: Locate the Current Deed for the Property. ... Step 2: Read the ?Common Questions? Listed on Page 2 of the TOD Deed. ... Step 3: Fill Out the TOD Deed (Do Not Sign) ... Step 4: Sign in Front of a Notary; Have Two Witnesses Sign. ... Step 5: Record the Deed at the Recorder's Office within 60 Days of Signing It.

In 2016, the laws in California were updated to allow people with a home, condo, farm of 40 acres or less, or a multi-unit building with no more than four units to be designated on a property deed known as a Transfer-on-Death deed which the beneficiary of the property would be at the owner's death.