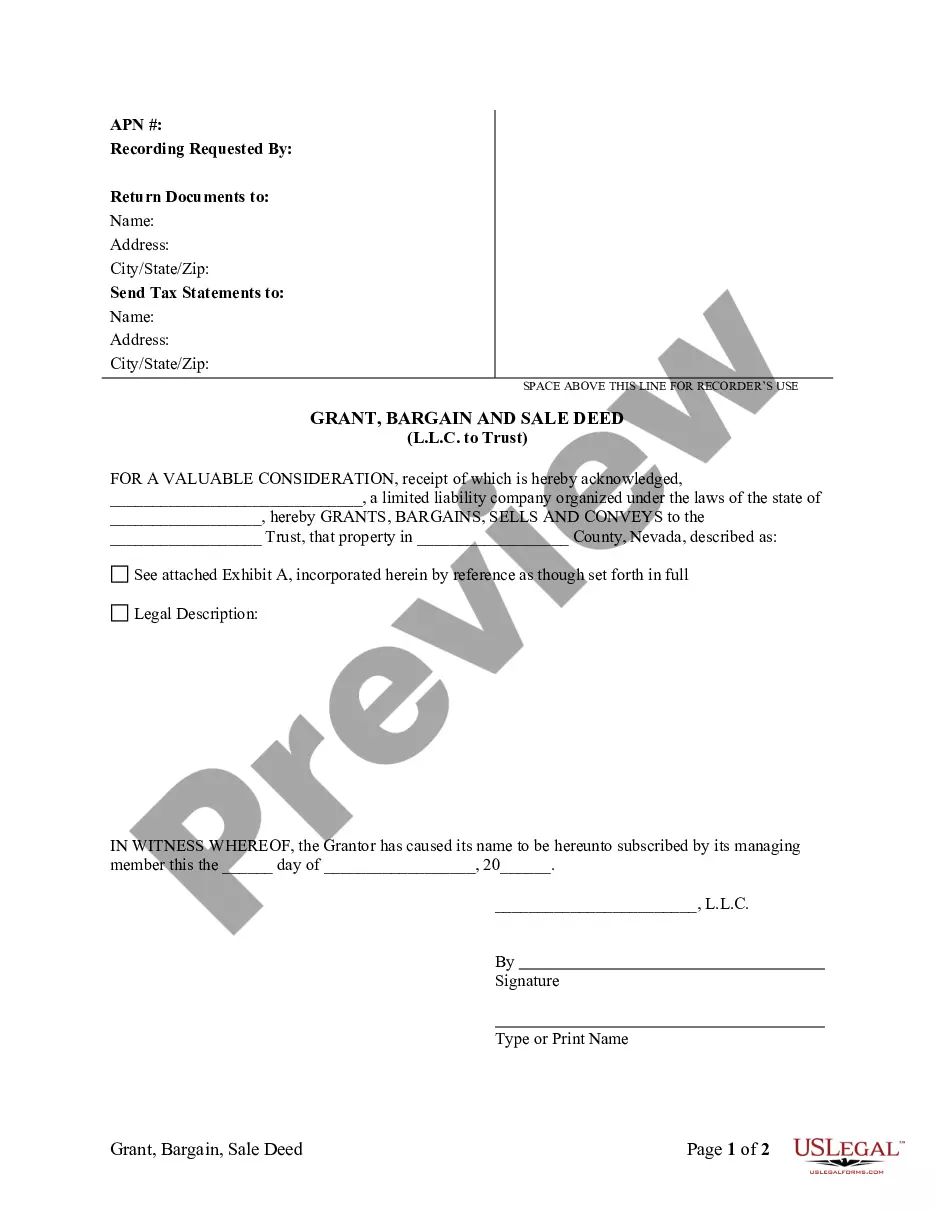

This form is a Grant, Bargain and Sale Deed where the Grantor is a Limited Liability Company and the Grantee is a Trustl. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Nevada Grant Deed With Mortgage

Description

How to fill out Nevada Grant Deed With Mortgage?

What is the most reliable service to secure the Nevada Grant Deed With Mortgage and other current versions of legal documents? US Legal Forms is your solution! It boasts the largest array of legal forms for any situation. Each template is expertly crafted and verified for adherence to federal and local legislation. They are categorized by area and state of application, making it effortless to locate the one you require.

Experienced users of the platform only need to Log In to the system, verify that their subscription is active, and click the Download button next to the Nevada Grant Deed With Mortgage to obtain it. Upon saving, the template remains accessible for future use within the My documents section of your profile. If you do not yet have an account with us, here are the steps you need to follow to create one.

US Legal Forms is an ideal solution for anyone needing to handle legal documentation. Premium users have even more benefits as they can complete and sign previously saved documents electronically at any time using the built-in PDF editing tool. Give it a try today!

- Document compliance check. Before you obtain any template, ensure it meets your intended use and complies with your state or county laws. Review the form description and utilize the Preview if available.

- Alternative document search. If there are any discrepancies, use the search bar at the top of the page to look for another template. Click Buy Now to select the correct one.

- Account registration and subscription purchase. Choose the most suitable pricing plan, Log In or create your account, and pay for your subscription using PayPal or credit card.

- Paperwork download. Select the format in which you would like to save the Nevada Grant Deed With Mortgage (PDF or DOCX) and click Download to retrieve it.

Form popularity

FAQ

Yes, Nevada operates as a trust deed state, which impacts how properties are financed and foreclosed. In this system, lenders can use a deed of trust instead of a mortgage. This means that when you complete a Nevada grant deed with mortgage, you're also engaging with the trust deed process, streamlining property transfers and enhancing security for lenders.

The grant deed ranks as the most popular type of deed in Nevada. It serves both sellers and buyers well, as it conveys property and provides essential warranties. When paired with a mortgage, a Nevada grant deed facilitates the financing process, assuring lenders of a legitimate claim to the property throughout the life of the mortgage.

The most commonly used deed in Nevada is the grant deed. This type of deed is often preferred because it guarantees the property seller has not transferred the title to someone else. Additionally, the grant deed with mortgage offers the buyer a level of security, ensuring a clear title to the property upon completion of the transaction.

Yes, Nevada is considered a deed state, primarily using various types of deeds for property ownership transfers. These deeds include grant deeds, quitclaim deeds, and warranty deeds. When you consider a Nevada grant deed with mortgage, you can rest assured that you are following a legal pathway that provides clear documentation of your property rights.

Nevada operates primarily as a deed of trust state for property financing. This means that in most cases, a deed of trust is used instead of a traditional mortgage. However, when dealing with ownership transfers, a Nevada grant deed with mortgage terms can help clarify the rights of the borrower and lender in property transactions.

A quitclaim deed is often used to transfer interest in a property without making any warranties about the title. It is commonly used in situations involving family transfers, divorce settlements, or to clear up title issues. Although a quitclaim deed does not guarantee a clear title, a Nevada grant deed with mortgage provides stronger assurances, especially when financing is involved.

To transfer ownership of a house in Nevada, you must prepare a deed, which is a legal document that conveys ownership from one party to another. Once you have created the deed, you need to sign it in presence of a notary public and then record it with the county recorder's office. For those using a Nevada grant deed with mortgage, make sure to include any mortgage details, as this impacts the financing and ownership structure.

The four main types of deeds used in real estate transactions include warranty deeds, grant deeds, quitclaim deeds, and special purpose deeds. Each of these deeds serves a unique function in transferring property rights. Keep in mind that a Nevada grant deed with mortgage ensures the buyer receives clear title to the property, offering additional protections.

To fill out a quit claim deed in Nevada, start by obtaining the correct form, which you can find on US Legal Forms. Clearly provide the names of both the grantor and grantee, along with their addresses. Ensure you include a legal description of the property being transferred, and remember to sign the deed in front of a notary. After completing the form, you should record it with the county recorder's office to finalize the transfer; this is vital for maintaining a clear title, especially when working with a Nevada grant deed with mortgage.

To obtain a copy of your Nevada grant deed with mortgage, you can start by visiting the website of your county recorder's office. Most counties allow you to request documents online, by mail, or in person. If you provide your property details and identification, the office will assist you in retrieving the deed. For a more efficient process, consider using legal platforms like US Legal Forms, which simplify acquiring important documents like your Nevada grant deed with mortgage.