Nevada Deed In Lieu Of Foreclosure

Description

How to fill out Nevada Deed In Lieu Of Foreclosure?

Whether you frequently handle documents or only need to send a legal document occasionally, it is crucial to have a reliable source of information where all samples are pertinent and current.

The first action you must take with a Nevada Deed In Lieu Of Foreclosure is to confirm it is the most recent version, as this determines its eligibility for submission.

If you aim to streamline your search for the most recent document samples, look for them on US Legal Forms.

Utilize the search menu to locate the form you require.

- US Legal Forms is a repository of legal forms that includes nearly every document sample you might be searching for.

- Locate the templates you require, evaluate their relevance immediately, and learn more about their applications.

- With US Legal Forms, you have access to over 85,000 document templates across diverse fields.

- Obtain the Nevada Deed In Lieu Of Foreclosure samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account facilitates access to all the necessary samples with greater ease and minimal hassle.

- Simply click Log In/">Log In in the site header and navigate to the My documents section to access all the forms you need, eliminating the need to spend time searching for the suitable template or verifying its validity.

- To acquire a form without an account, follow these guidelines.

Form popularity

FAQ

A deed in lieu of foreclosure is an agreement where a homeowner voluntarily transfers their property to the lender, often to avoid foreclosure. You should consider this option if you face financial challenges and want to mitigate the long-term negative effects of foreclosure on your credit. In many cases, a Nevada deed in lieu of foreclosure can offer a smoother exit strategy. It is wise to explore this route with a knowledgeable advisor to evaluate if it’s the right fit for your situation.

The best type of deed to have is one that clearly establishes your rights to the property and minimizes your liability. A warranty deed offers the greatest protection, as it guarantees the title is clear from any claims. When considering a Nevada deed in lieu of foreclosure, understanding your deed's implications can help protect you in the future. Always consult with legal professionals to ensure you make informed decisions.

One disadvantage for lenders accepting a Nevada deed in lieu of foreclosure is the potential for financial loss. The lender may not recover the full outstanding balance of the mortgage since the property might be worth less than what is owed. Additionally, the lender takes on the responsibility for selling the property, which can prolong their time and resources. It’s crucial for both parties to carefully assess their financial situations before proceeding.

A deed in lieu of foreclosure is often considered the best alternative to foreclosure. This process allows homeowners to voluntarily transfer their property back to the lender, which can provide a fresh start and prevent the negative impacts of foreclosure on credit scores. By choosing a Nevada deed in lieu of foreclosure, you may save time and expenses related to the lengthy foreclosure process. It is essential to consult with legal experts to understand your options fully.

Yes, Nevada is considered a non-recourse mortgage state. This means that if the borrower defaults on their mortgage, the lender cannot pursue additional claims beyond the property itself. In the context of a Nevada deed in lieu of foreclosure, this clause protects borrowers from personal liability after the property is no longer theirs. Understanding this can provide homeowners with peace of mind during financially challenging times.

For a lender, the biggest disadvantage of a deed in lieu of foreclosure is the potential loss of the property’s value. When accepting such a deed, lenders might face challenges if the property's market value diminishes significantly. Additionally, lenders may have to deal with outstanding liens or debts associated with the property, complicating asset recovery efforts. Proper assessments can help mitigate these risks.

In Nevada, the redemption period for a homeowner facing foreclosure is generally nine months after the auction sale. This timeframe allows owners a chance to reclaim their property, particularly relevant in discussions about a Nevada deed in lieu of foreclosure. Also, homeowners might have opportunities to work with lenders during this period to find satisfactory resolutions. Seeking professional guidance can offer clarity and additional options.

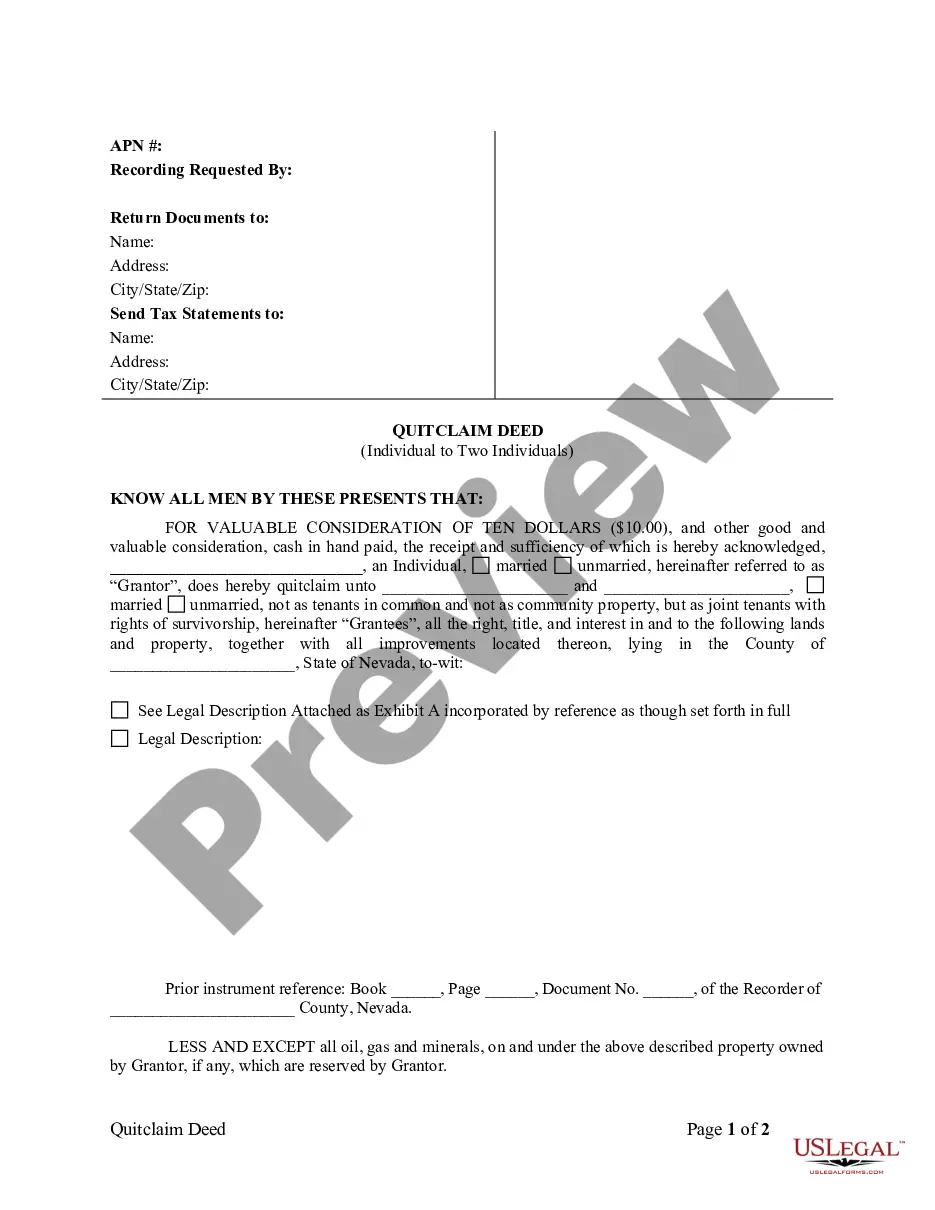

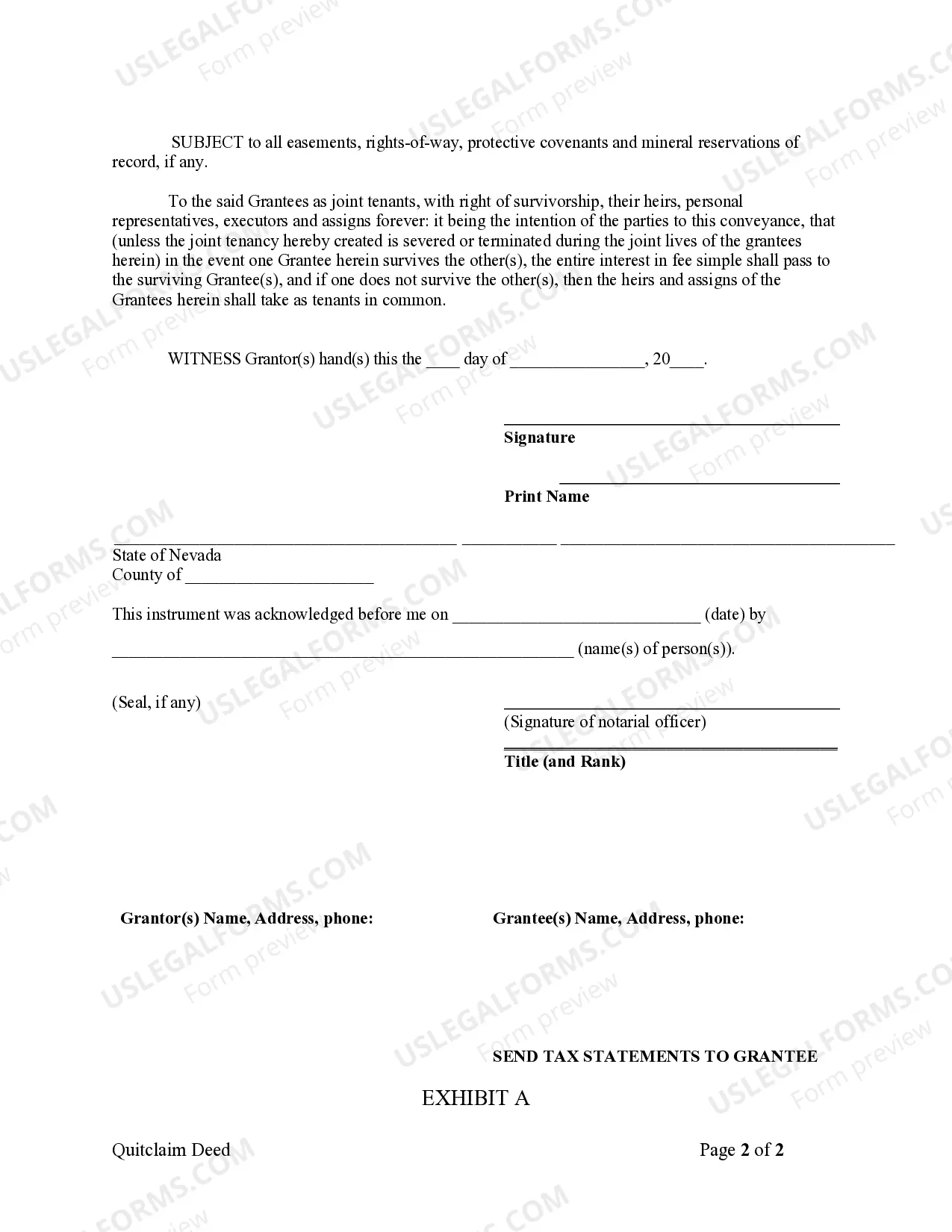

The weakest type of deed is often regarded as a quitclaim deed. When using a Nevada deed in lieu of foreclosure, a quitclaim deed offers no assurances or guarantees regarding the property title. This lack of protection means the grantee could inherit titles or claims against the property without any recourse from the grantor. Therefore, it’s vital to understand the implications of using this type of deed.

Deeds can have several disadvantages, especially regarding liability and potential risks in a Nevada deed in lieu of foreclosure. For instance, conveying property through a deed can leave the grantor exposed to future claims if warranties are not explicitly stated. Furthermore, depending on the type of deed, the absence of warranties can lead to issues of unclear title or potential legal disputes. Consulting legal resources can help navigate these complexities.

A deed of variation can create complexity in property management, particularly related to a Nevada deed in lieu of foreclosure. One significant disadvantage is that it may not always be legally binding without consent from all parties involved. Additionally, these deeds might lead to disputes if not properly outlined, ultimately creating a challenging situation for property owners. Thus, clarity and communication are essential components when considering this option.