Certificate Of Trust Form Nevada Form

Description

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Form popularity

FAQ

A certification of trust is typically prepared by the trustee or their legal representative. This document, along with the Certificate of trust form Nevada form, verifies the existence of the trust and outlines its key terms. Preparing this certification correctly is crucial for proper management and legal recognition. It's often beneficial to use a trusted platform like USLegalForms to ensure accuracy and completeness.

Yes, you can write your own trust in Nevada. However, it's important to ensure that your trust meets all legal requirements to be valid. Using the Certificate of trust form Nevada form can provide you with a clear structure and guidance. Consider consulting with an attorney for advice to avoid potential issues.

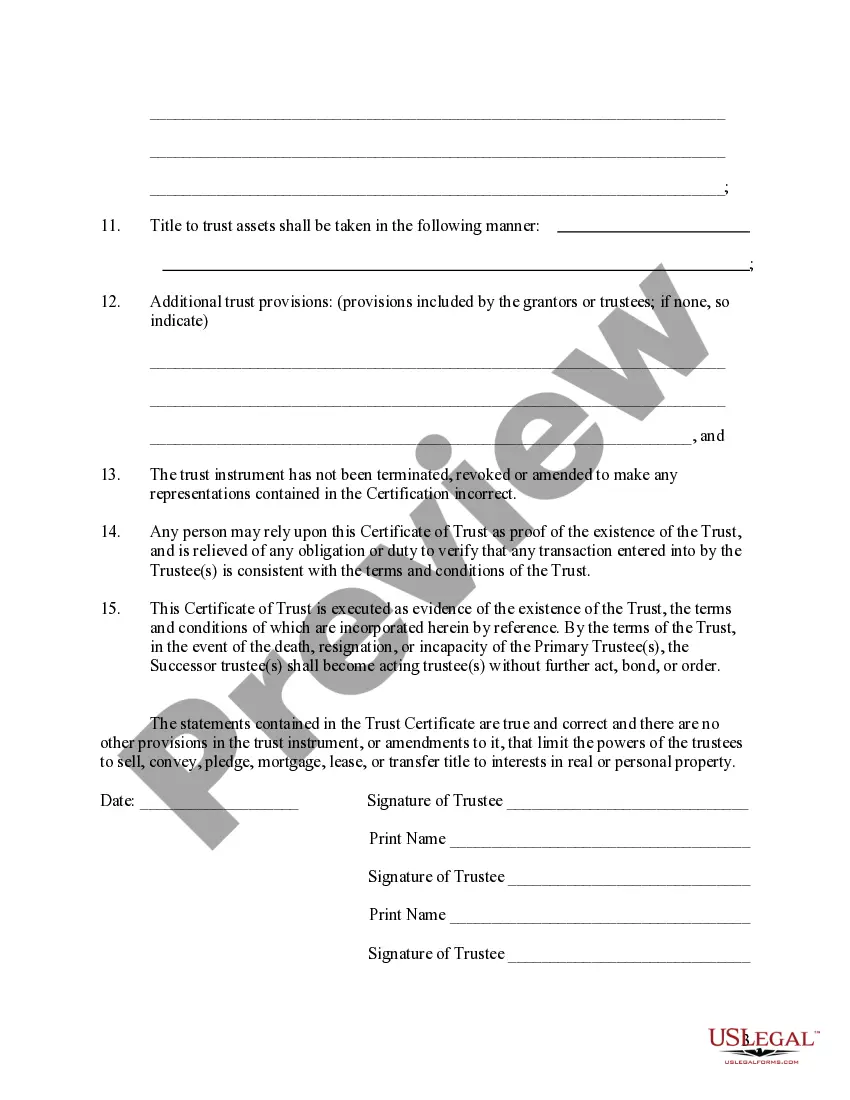

To record a certificate of trust, first, ensure you have completed the Certificate of Trust Form Nevada Form accurately. Then, you may need to file it with the relevant county office or record it in the jurisdiction where the trust's primary assets are located. This step provides public notice of the trust and helps facilitate transactions involving trust property.

A certificate of trust document serves as a verified record that outlines essential details of a trust without disclosing confidential terms. The Certificate of Trust Form Nevada Form is a streamlined way to convey the powers of the trustee and the trust's validity to financial institutions. This document enables easier management and access to trust assets while maintaining privacy.

Documenting a trust involves creating a trust agreement that details how the trust operates and the responsibilities of the trustee. It is important to include a Certificate of Trust Form Nevada Form to provide verification without revealing sensitive details from the full trust document. This form can simplify dealings with banks and other institutions that need proof of the trust's existence.

To file a trust in Nevada, start by preparing your trust document to outline your wishes for asset management. After creating the trust, you must also complete a Certificate of Trust Form Nevada Form, which acts as a summary of the trust's key provisions. You do not need to file the entire trust document with the court, but you should keep it safe with your important documents.

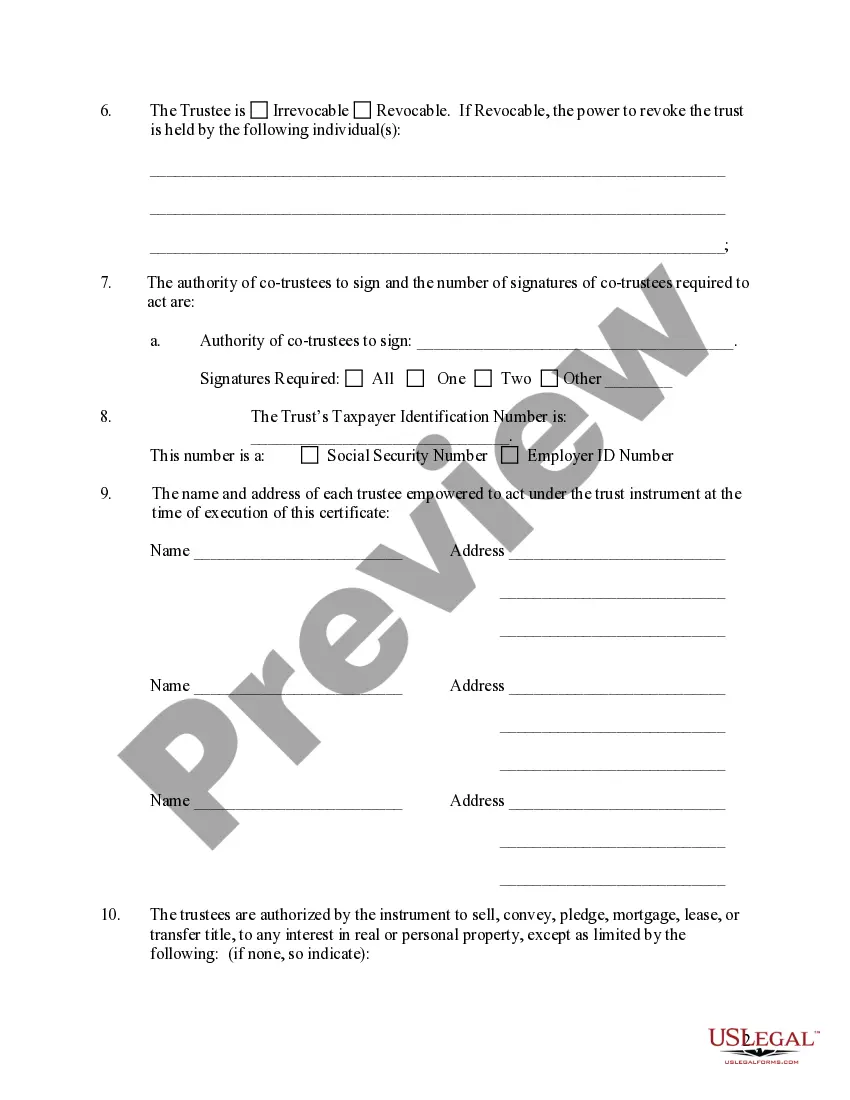

Filling out a certificate of trust form requires you to provide specific details such as the trust's name, the trustee's name, and the powers granted to the trustee. It's essential to be thorough and accurate to avoid complications later on. By following the guidelines in the Certificate of trust form Nevada form, you ensure that you include all necessary information for proper documentation.

A trust is a legal arrangement that holds and manages assets on behalf of beneficiaries, while a certificate of trust is a document that provides information about the trust's existence and trustee's powers without disclosing sensitive details. The certificate helps facilitate transactions and interactions with financial institutions. Using a Certificate of trust form Nevada form can help you effectively outline these differences.

A certificate of trust in Nevada serves as a simplified document that outlines the essential details of the trust without revealing its entire contents. It typically includes information about the trustee's authority and the trust's existence. This document is crucial for third parties who need confirmation regarding the trust. Utilizing a Certificate of trust form Nevada form can help you accurately create this important document.

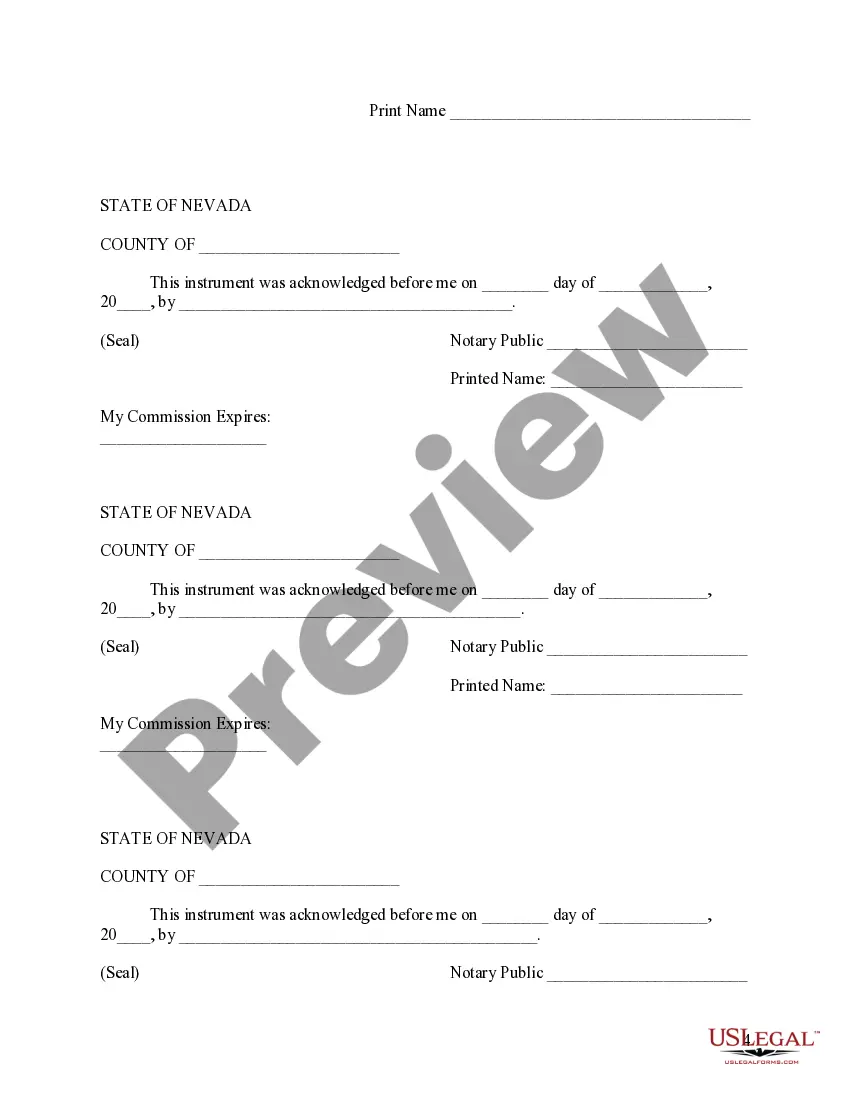

In Nevada, a declaration of trust does not generally need to be notarized, but notarization can add an extra layer of authenticity. The requirement may depend on the specific circumstances of the trust. When using a Certificate of trust form Nevada form, it is wise to consult local regulations to ensure you fulfill all legal obligations.