Certificate Of Trust Form Nevada Withholding

Description

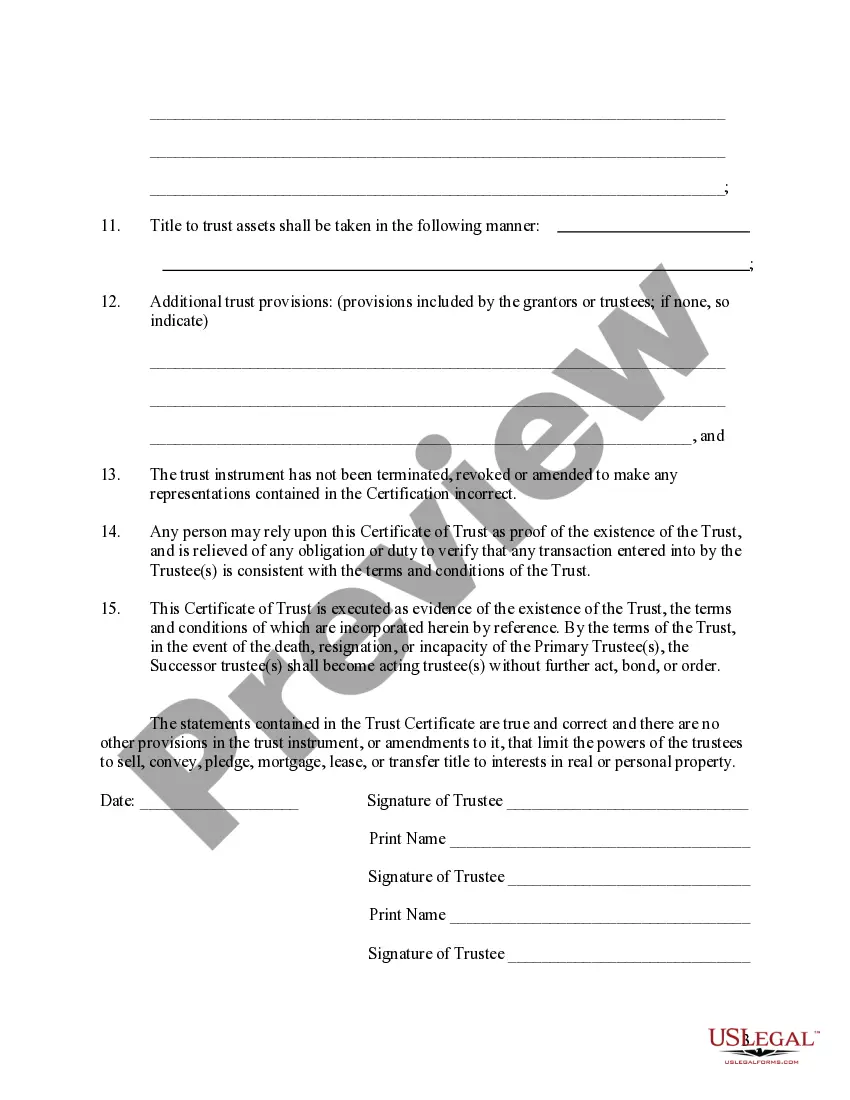

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Form popularity

FAQ

Yes, trusts can be linked to bank accounts, allowing the trustee to manage the funds on behalf of the beneficiaries. This provides an efficient way to handle financial assets within the trust. When establishing such accounts, it’s advisable to provide the bank with a certificate of trust form Nevada withholding to ensure compliance and transparency.

Trust documents should generally be kept as long as the trust remains in effect. Some experts recommend retaining them for at least seven years after the trust is dissolved. Keeping proper records helps in managing the trust and resolving any potential disputes in the future.

To obtain a certificate of trust, you can request one through your attorney who drafted your trust. If you're creating a new trust or need a new certificate, various online platforms, like uslegalforms, offer templates that meet Nevada's legal standards. Be sure to use the appropriate certificate of trust form Nevada withholding for your specific needs.

Banks typically do not keep copies of your full trust documents to protect your privacy. Instead, they may retain a copy of the certificate of trust form Nevada withholding, which provides the necessary information without revealing sensitive details. It's essential for you to understand your bank’s policy regarding trust documentation to ensure adequate compliance.

Filling out a certification of trust form template involves providing specific details about the trust and its beneficiaries. You should include the name of the trust, the name of the trustee, and any pertinent dates. If you need assistance, consider using services like uslegalforms, which offer comprehensive templates tailored to Nevada's requirements.

Banks often request a copy of your trust to verify your ownership of the trust assets. They need this information to comply with regulations and protect both your interests and theirs. Providing a certificate of trust form Nevada withholding can help simplify this process, offering the bank the details it requires without exposing the entire trust document.

You can obtain a certificate of trust from various sources. Typically, your attorney who helped create the trust can provide you with this document. Additionally, you may find templates available online, especially for specific states like Nevada. Ensure to review the certificate of trust form Nevada withholding to meet local requirements.

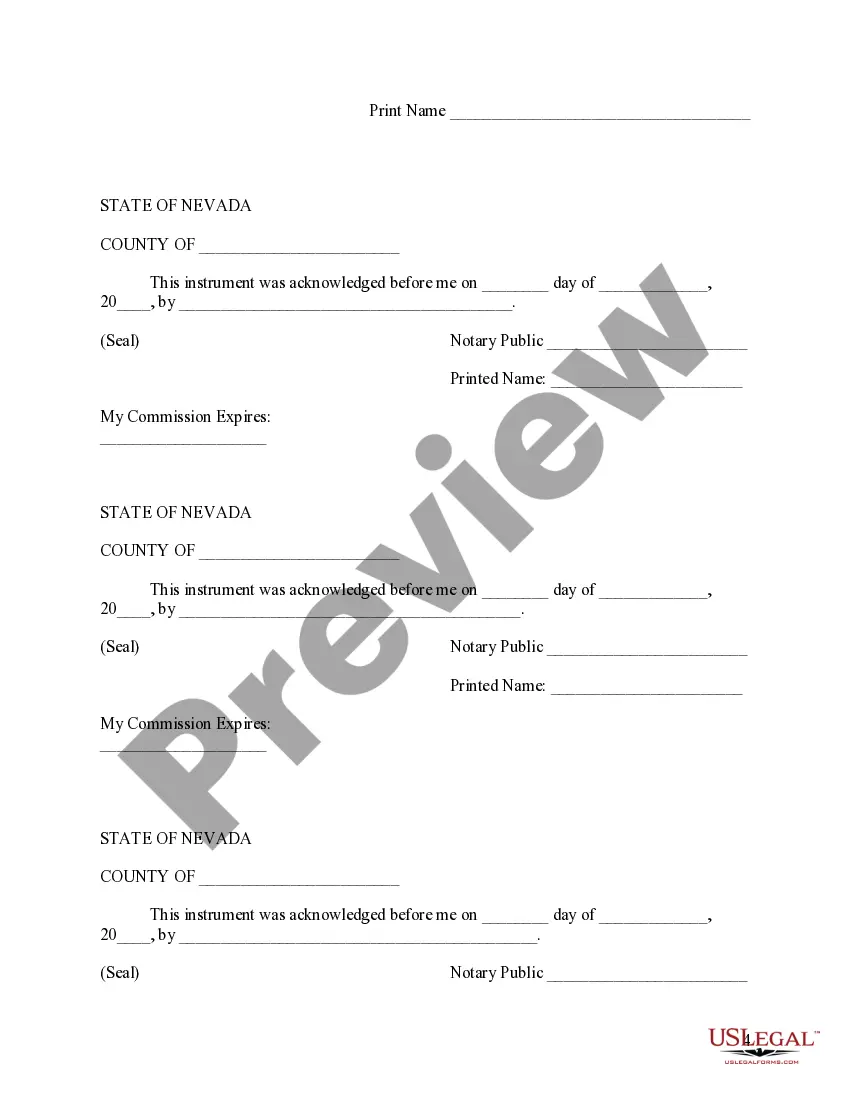

A certificate of trust in Nevada is a concise document that provides verification of a trust's existence without revealing specific financial details. It helps streamline interactions with financial institutions and other parties. When utilizing the certificate of trust form Nevada withholding, it allows trustees to manage trust assets and transactions efficiently while maintaining privacy.

A trust certificate is essentially another term for a certificate of trust, representing proof of a trust's establishment. This document assures third parties that the trust is valid and that the trustees have the power to act on behalf of the trust. It is a crucial tool for facilitating transactions while using the certificate of trust form Nevada withholding.

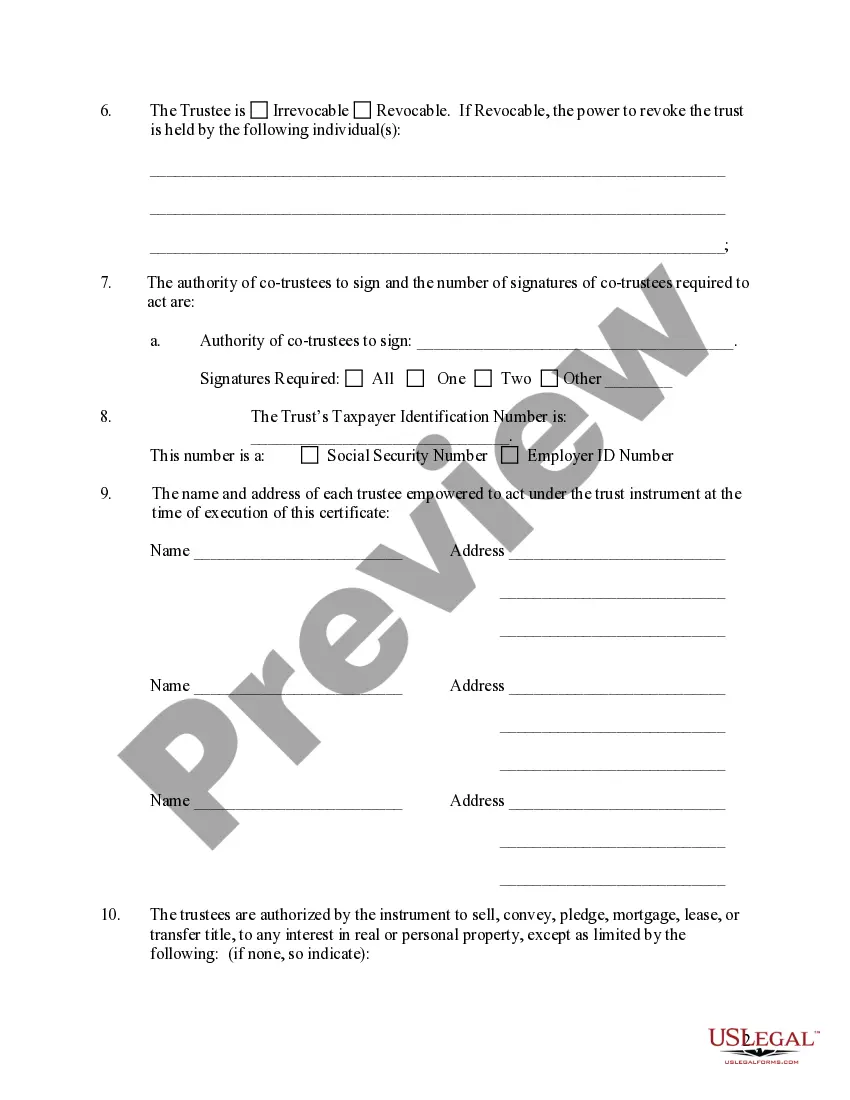

In Nevada, a certificate of trust is a formal document that outlines the key elements of a trust. It includes vital information such as the name of the trust, the names of the trustees, and the powers granted to them. This document is essential when dealing with certain financial and legal matters, as it verifies the authority of trustees while using the certificate of trust form Nevada withholding.