Certificate Of Trust Form Nevada Withholding Tax

Description

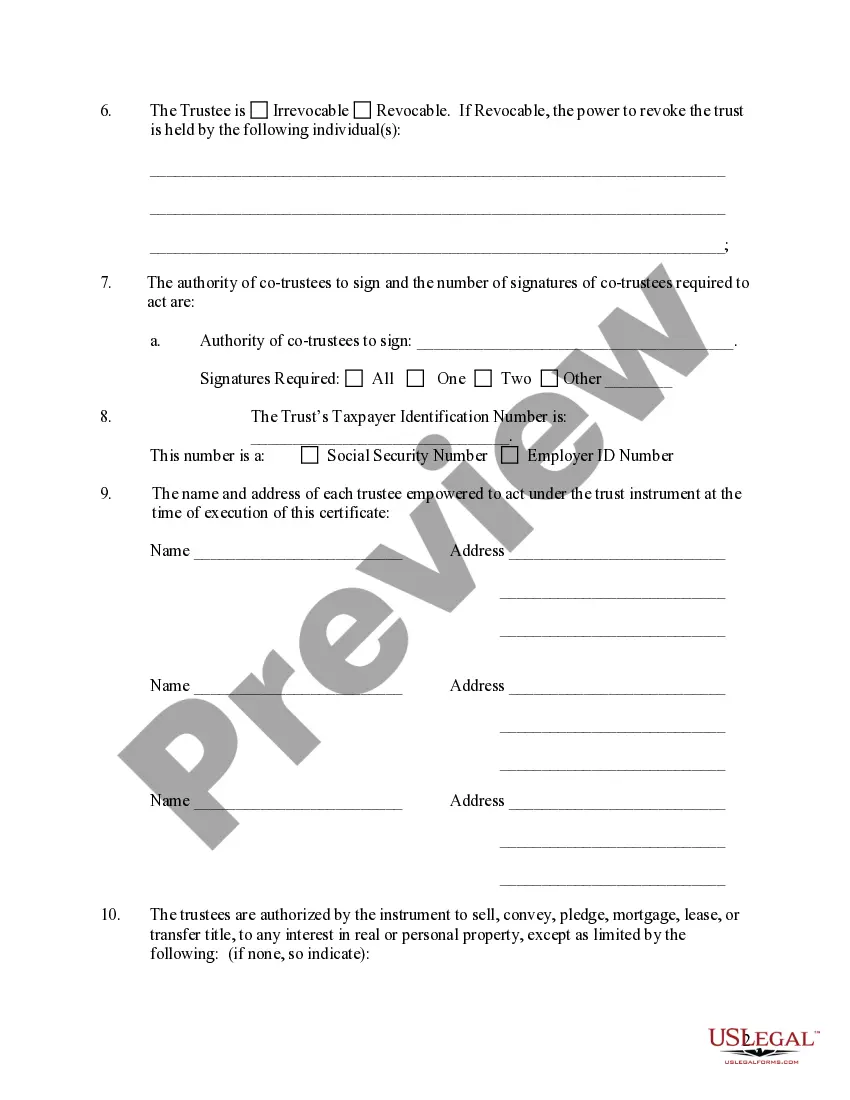

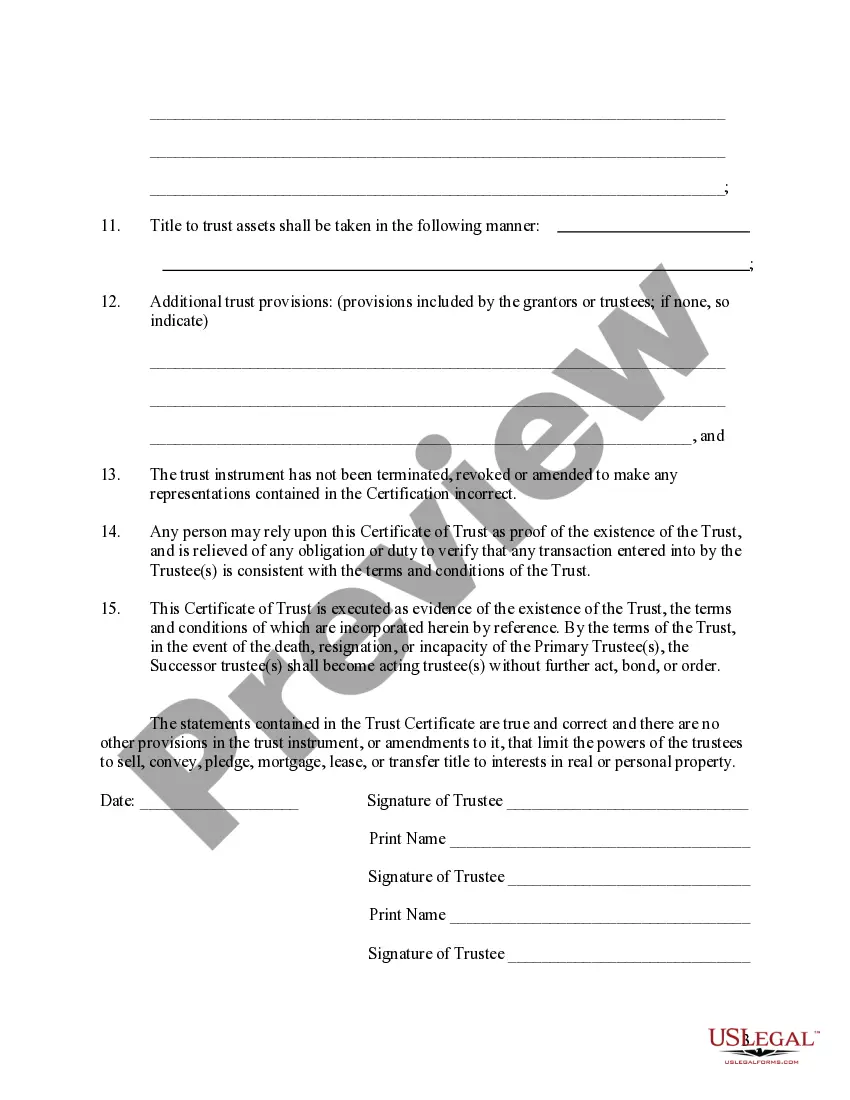

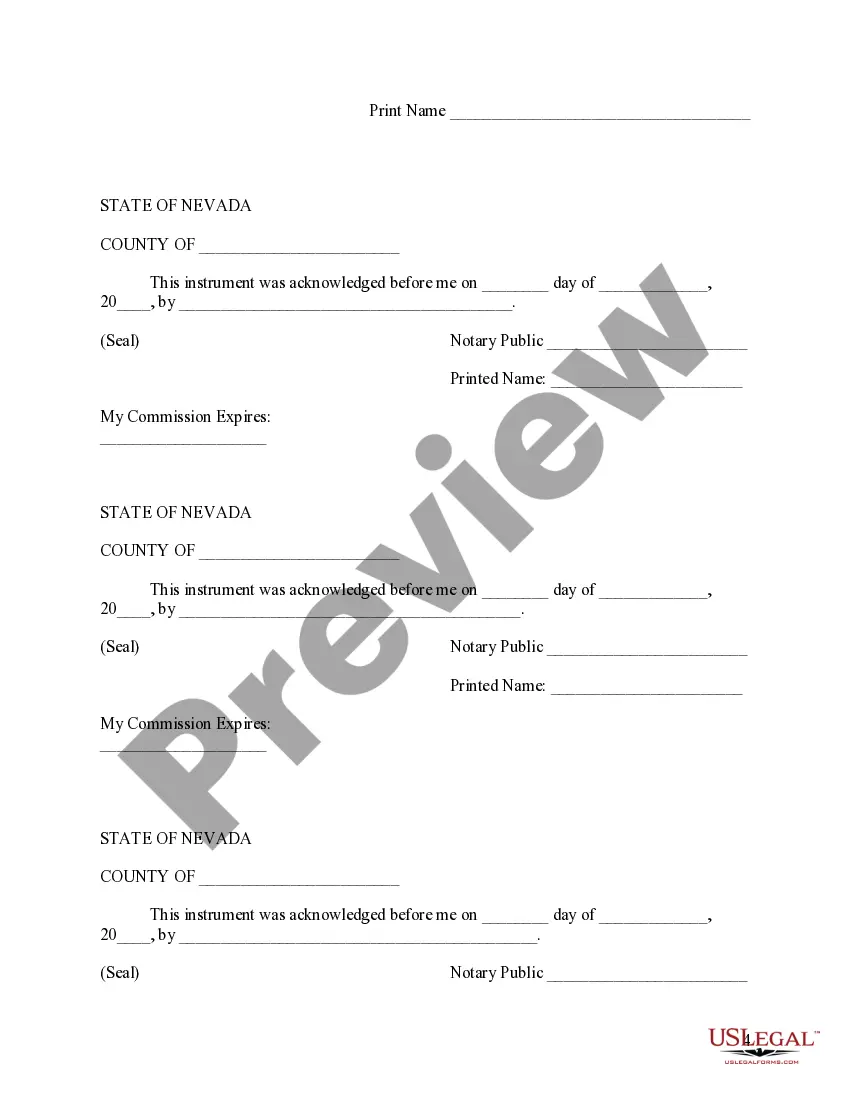

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Form popularity

FAQ

Nevada does not have a dedicated trust tax return for individuals, but multiple tax obligations may still apply to trusts depending on their specific setup. Generally, income generated by a trust must be reported to federal authorities. If you're managing trusts, using the Certificate of Trust Form Nevada withholding tax can help in understanding your filing responsibilities.

Yes, while Nevada does not have a state income tax, employers still must withhold federal taxes from employee paychecks. This includes Social Security and Medicare taxes, which contribute to your future benefits. Understanding the role of the Certificate of Trust Form Nevada withholding tax can guide you through this process effectively.

You can find your Nevada Modified Business Tax (MBT) number on your tax registration certificate or by accessing your account through the Nevada Department of Taxation's online portal. If you're new to business in Nevada, make sure to register properly to receive your MBT number. Using the Certificate of Trust Form Nevada withholding tax can help you streamline your tax responsibilities.

Nevada does not impose a state withholding tax on personal income, which sets it apart from many other states. This absence of state income tax means employees in Nevada retain more of their earnings. For tax management and other documentation, the Certificate of Trust Form Nevada withholding tax is essential in navigating federal requirements.

To obtain a Nevada resale certificate, you must complete the appropriate application form provided by the Nevada Department of Taxation. Make sure to include necessary details about your business activities and the reason for requesting the certificate. By using the Certificate of Trust Form Nevada withholding tax, you can demonstrate you are operating within legal guidelines, ensuring a smoother transaction process.

The Nevada state withholding tax is a tax that employers deduct from employees' wages to meet tax obligations. Although Nevada does not have a state income tax, businesses must still comply with certain tax withholdings related to salaries. Understanding how this interacts with the Certificate of trust form nevada withholding tax is beneficial for businesses to remain compliant and avoid penalties.

Yes, a seller's permit is required in Nevada for businesses selling tangible goods or services subject to sales tax. This permit allows your business to collect sales tax from customers legally. It’s an important aspect of compliance, particularly regarding the Certificate of trust form nevada withholding tax. You can obtain this permit directly through the Nevada Department of Taxation.

To get a Nevada resale certificate, you must apply through the Nevada Department of Taxation's website. Information such as your business details and tax identification number is required to complete the application process. This document is crucial to operate efficiently without upfront tax expenses, which aligns with the Certificate of trust form nevada withholding tax guidelines.

The Modified Business Tax (MBT) in Nevada is calculated based on your business's gross payroll over a specific period. However, certain deductions and exemptions may apply that can affect your overall tax liability. It's essential to understand these parameters for effective financial planning, especially regarding the Certificate of trust form nevada withholding tax obligations. Utilizing platforms like USLegalForms can simplify the documentation process.

A Nevada resale certificate remains valid as long as your business remains active and in good standing. However, it's wise to review your certificate annually to ensure it aligns with any changes in your business operations. Maintaining accurate records helps you comply with the Certificate of trust form nevada withholding tax rules and provides clarity if audited by the state.