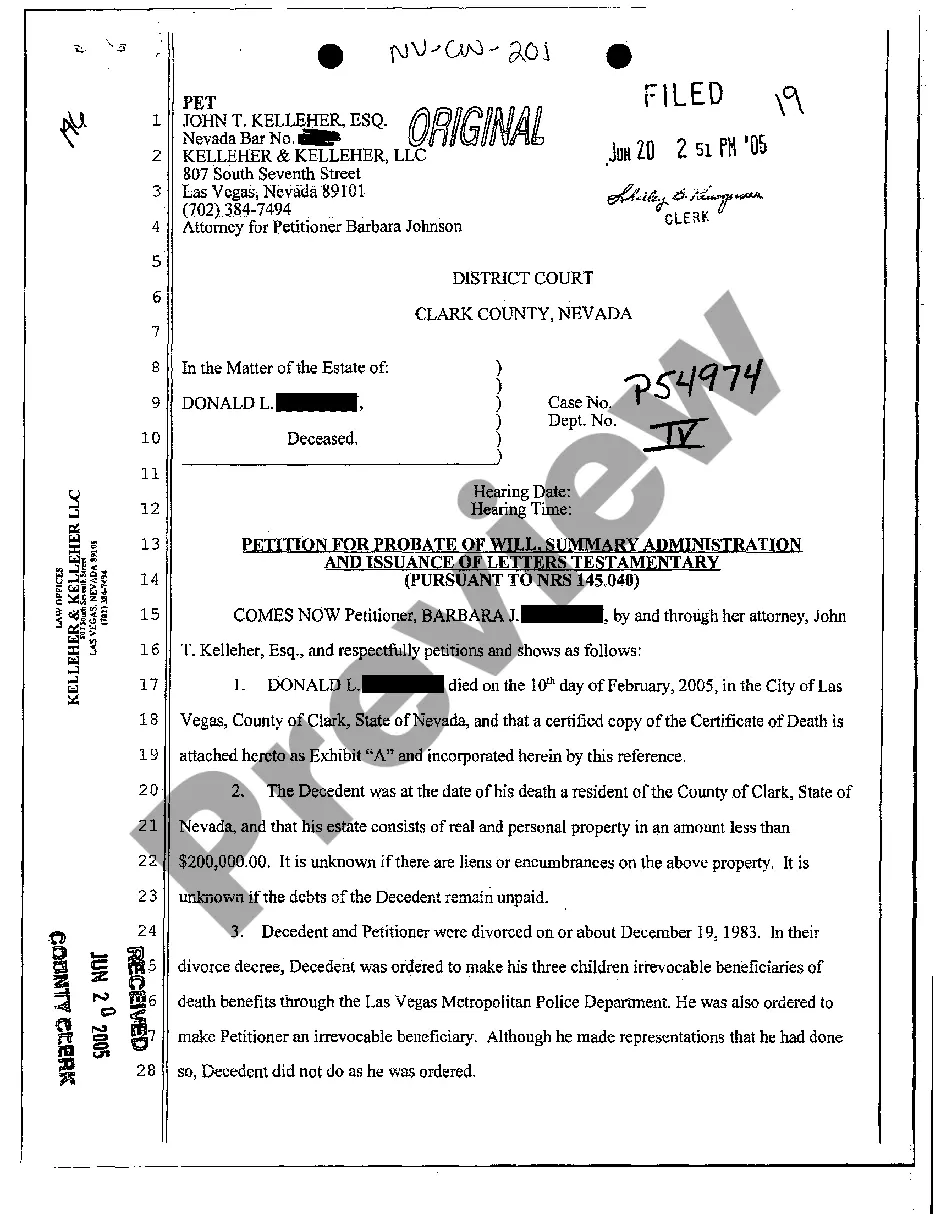

Nevada Letters Testamentary Without Will

Description

How to fill out Nevada Letters Testamentary Without Will?

No matter if you handle documentation frequently or occasionally need to submit a legal paper, it is crucial to find a valuable tool where all the samples are applicable and current.

The initial step you must take using a Nevada Letters Testamentary Without Will is to verify that it is indeed the latest version, as this determines its eligibility for submission.

If you wish to streamline your hunt for the most recent document examples, look for them on US Legal Forms.

To obtain a form without an account, adhere to the following instructions: Use the search function to locate the form you seek. Examine the preview and description of the Nevada Letters Testamentary Without Will to confirm it is the exact one you need. Once you verify the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log In/">Log Into your existing one. Use your credit card information or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Eliminate the hassle of dealing with legal documentation. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every document sample you might need.

- Search for the forms required, immediately check their relevance, and understand more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across a broad range of areas.

- Acquire the Nevada Letters Testamentary Without Will samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will grant you ease of access to all the forms you require, making the process simpler and less stressful.

- Simply click Log In/">Log In in the site header and navigate to the My documents section to have all the forms at your fingertips.

- You won't need to waste time searching for the right template or verifying its suitability.

Form popularity

FAQ

If you die without a valid will and testament in Nevada, your estate is subject to the state's inheritance laws or intestate succession laws, though there are some exceptions mainly, assets for which you've already named a beneficiary will be exempt from intestate laws.

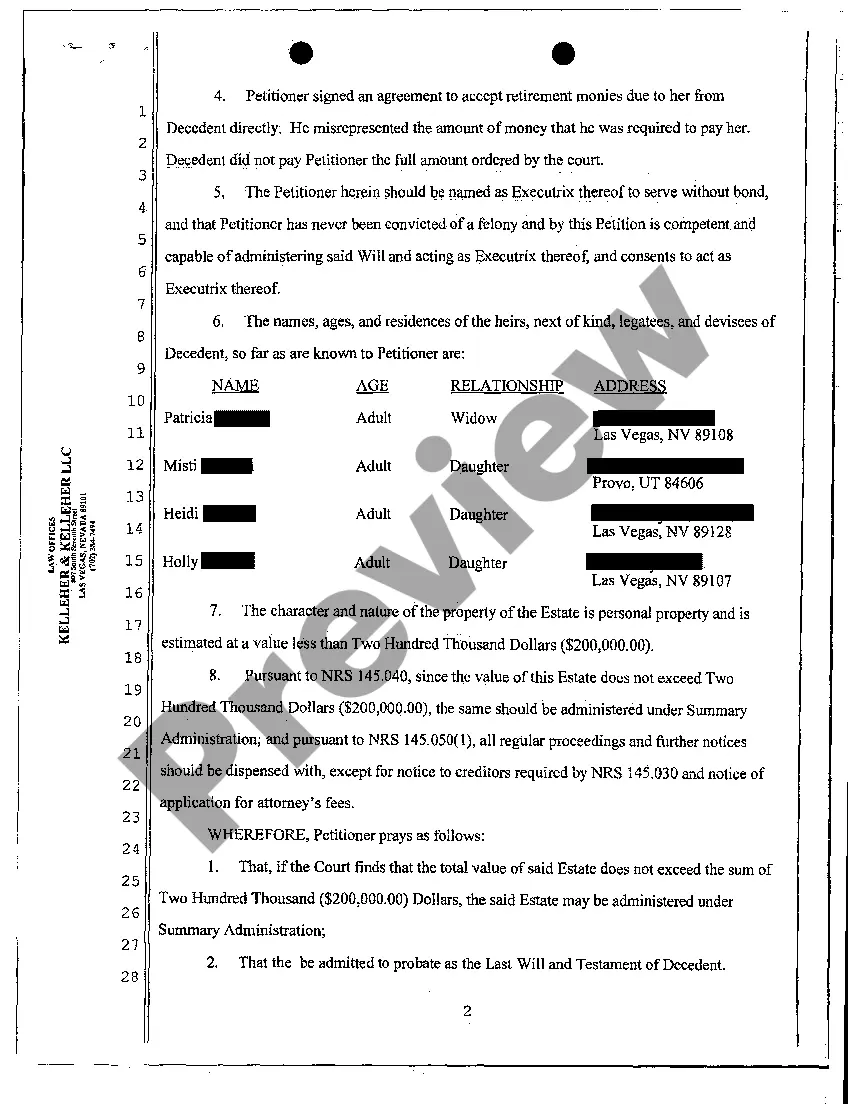

In Nevada, where a person passes away, the Executor of the Estate in the Will is expected to immediately file for a Letters Testamentary. The premise behind doing this is to officialize their legal standing as Executor of the Estate and all that comes along with it.

Letters Testamentary are issued when the decedent had a will, and Letters of Administration are issued when there was no will. Some financial institutions might request to see a certified copy of the Letters. You can get certified copies from the court clerk's office at the Regional Justice Center.

In Nevada, your spouse would get everything if you have no children. If you have children, but you don't have a spouse, your children would get everything. If you have both a spouse and children, your spouse would inherit all of the community property, and your spouse and children would share your separate property.

The Executors that are named in their Will can ensure that everything goes to the beneficiaries specified. However, if there is no Will, or if something is wrong with it, the process will not be as simple. In this case, you will need to apply for Letters of Administration in order to deal with the estate.