Nevada Living Trust Without Spouse

Description

Form popularity

FAQ

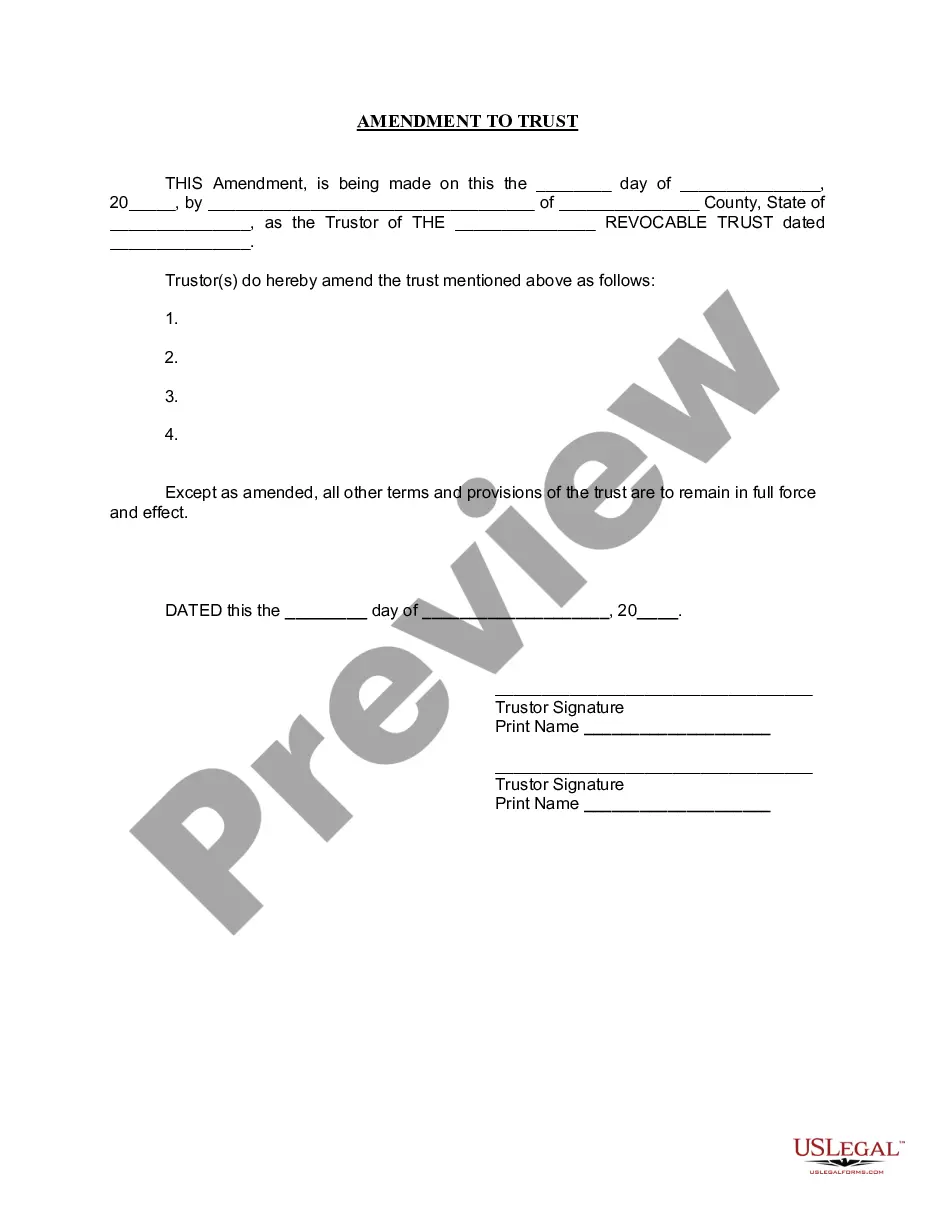

For a trust to be valid in Nevada, it must have a clear purpose, identifiable beneficiaries, and an appointed trustee. Additionally, the trust should be in writing and signed by the grantor. By following these guidelines, you can create a Nevada living trust without spouse that holds up. Familiarize yourself with Nevada's trust laws to ensure your estate plans are secure.

You can write your own living trust in Nevada, but it requires careful attention to detail. Utilizing resources from US Legal Forms can help guide you through the process. Their user-friendly templates allow you to draft a Nevada living trust without spouse efficiently. Make sure to follow state-specific regulations to keep your trust legally valid.

One of the biggest mistakes parents make is not clearly defining the terms of the trust fund. This can lead to confusion and disputes among heirs later on. When setting up a Nevada living trust without spouse, it's vital to specify how and when the assets should be distributed. An experienced advisor can help to avoid this pitfall and ensure your wishes are honored.

Yes, you can create a living trust in Nevada without your spouse. This is particularly useful if you prefer to manage your assets independently. With the right tools and resources, like US Legal Forms, establishing a Nevada living trust without spouse becomes straightforward. Be sure to review each provision carefully to reflect your wishes.

You can create your own living trust in Nevada, but it is important to understand the requirements for a valid trust. Using a self-service platform like US Legal Forms can simplify the process and ensure compliance with state laws. By using their templates, you can set up your Nevada living trust without spouse at your own pace and with ease. Always double-check that your documents meet all the legal criteria.

Yes, you can exclude your spouse from your Nevada living trust without spouse. This decision allows you to determine how your assets will be distributed without involving your spouse. It is essential to carefully consider the implications of excluding your spouse, as it may affect their rights to your estate. Consulting with a legal expert can provide guidance on how to proceed.

Excluding someone from a trust is a standard practice if you wish to control asset distribution. A Nevada living trust without spouse allows you to make these decisions clearly. When excluding beneficiaries, keep in mind to document your intentions within the trust to avoid future disputes.

Yes, you can leave your wife out of a trust if that aligns with your wishes. A Nevada living trust without spouse clearly specifies how you want your assets distributed, and leaving someone out is within your rights. Make sure to consult with a legal professional to navigate any potential repercussions.

Excluding your spouse from a trust is an option when you create a Nevada living trust without spouse. This decision can be based on various personal reasons, but it's important to understand potential financial responsibilities and state laws that may affect your trust's validity.

Setting up a living trust without your spouse is entirely possible in Nevada. This option enables you to appoint a trustee and outline the specific distribution of your assets. It’s crucial to handle the trust documentation correctly to ensure your wishes are honored.