Nevada Corporation Records Withdrawal

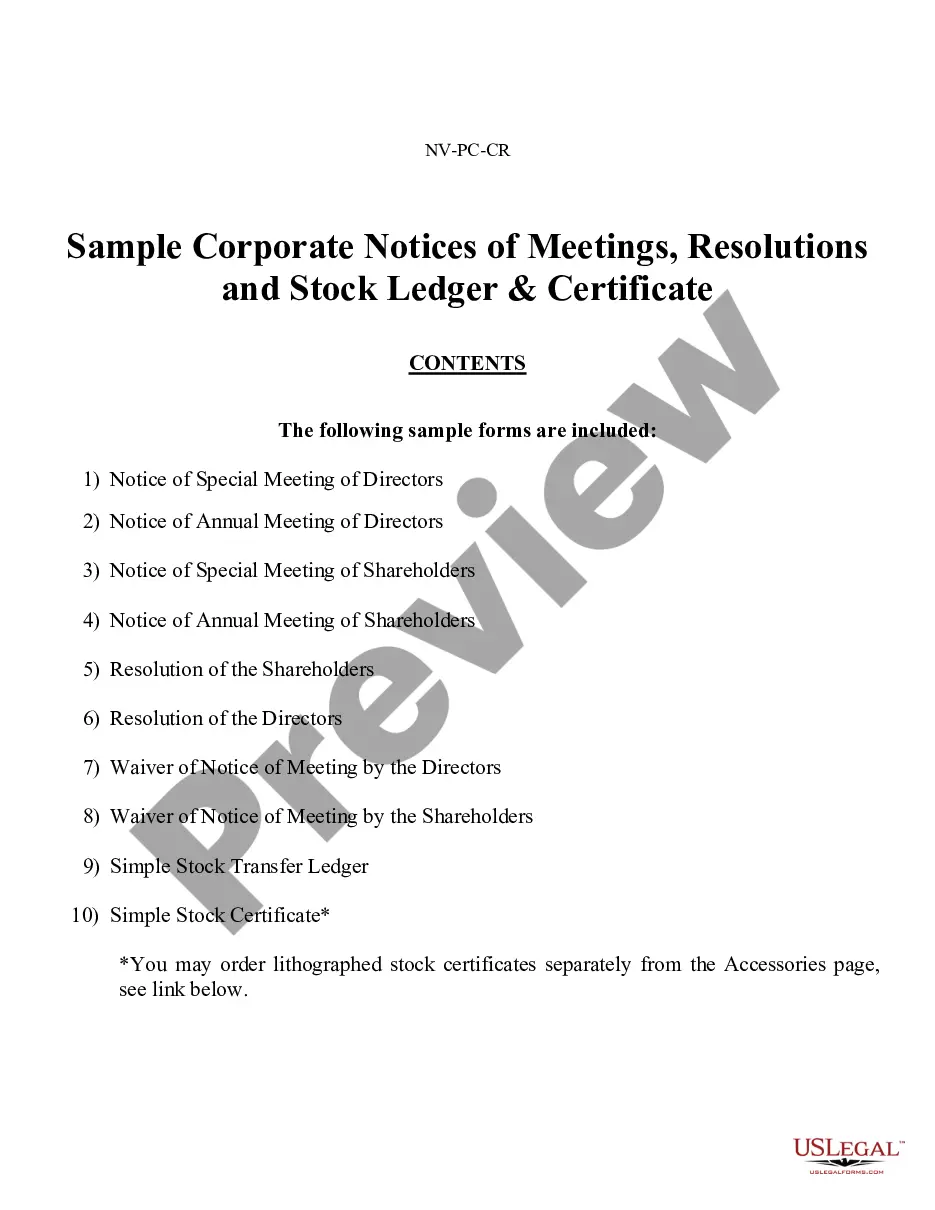

Description

How to fill out Nevada Corporation Records Withdrawal?

Properly prepared legal documents are crucial for preventing issues and disputes, but obtaining them without assistance from a lawyer may require time.

If you need to quickly procure the latest Nevada Corporation Records Withdrawal or any other forms related to work, family, or business matters, US Legal Forms is always ready to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and hit the Download button next to the chosen file. Furthermore, you can access the Nevada Corporation Records Withdrawal anytime later, as all documents ever obtained on the platform will remain accessible within the My documents section of your profile. Conserve time and funds while preparing official documents. Experience US Legal Forms today!

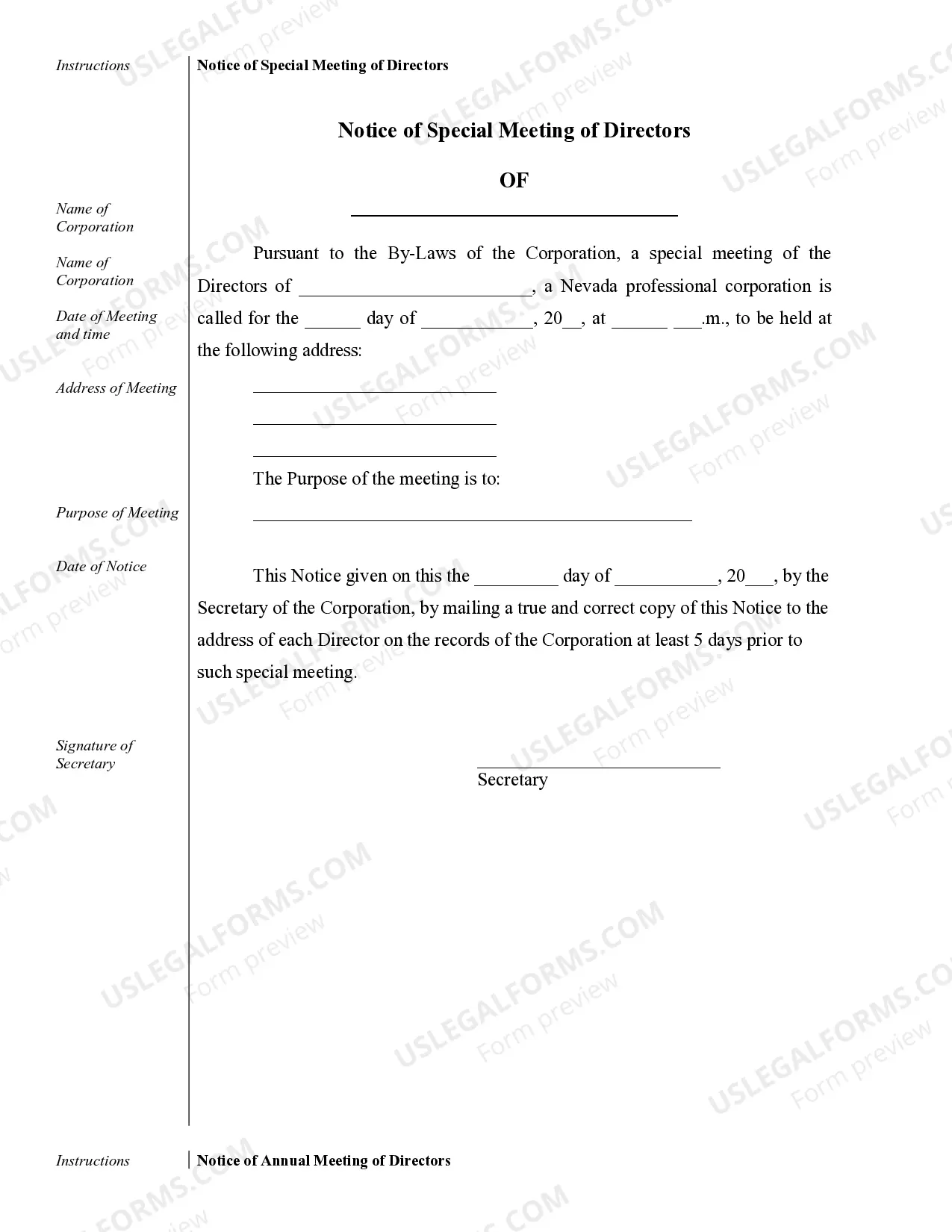

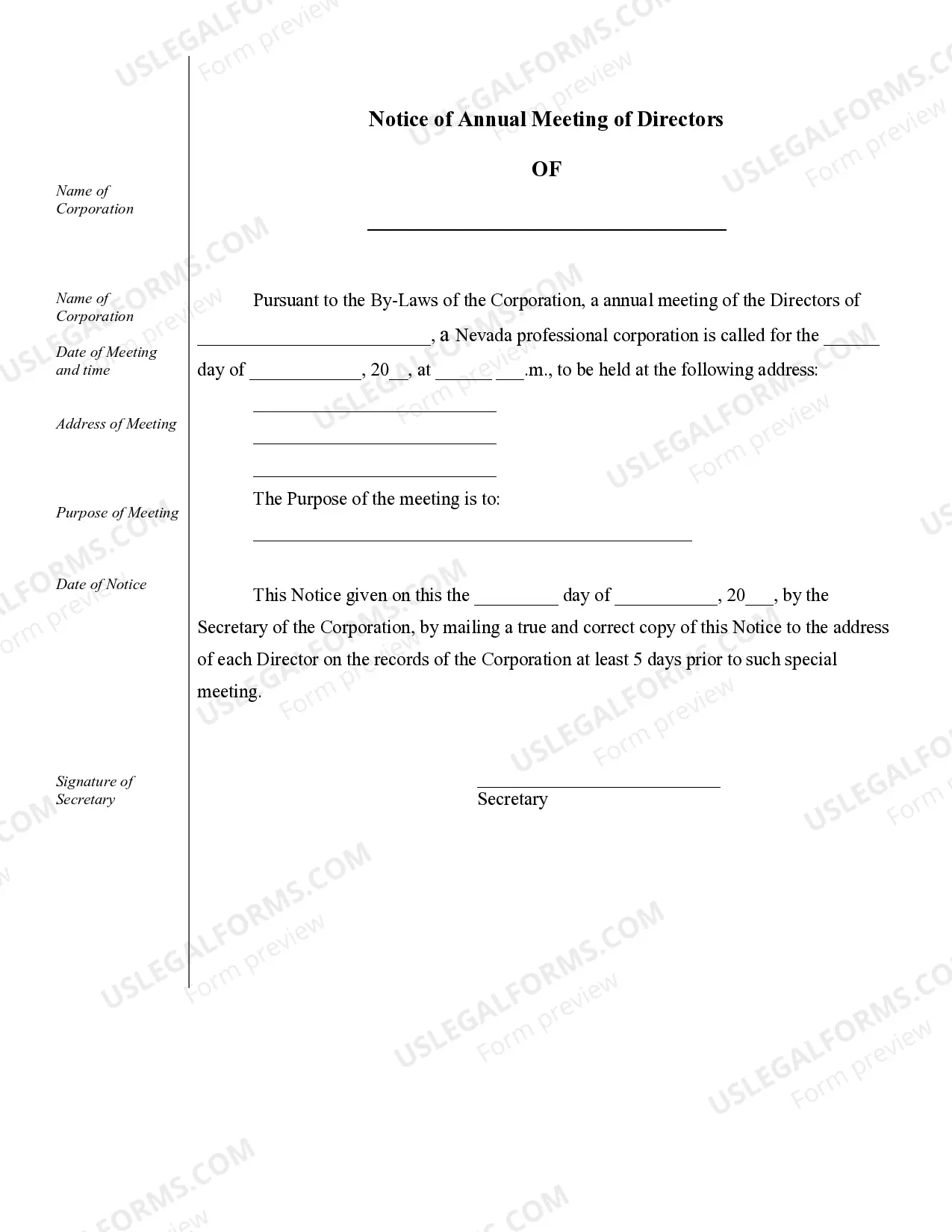

- Ensure that the document is appropriate for your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Click Buy Now when you locate the correct template.

- Choose the pricing option, sign into your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Nevada Corporation Records Withdrawal.

- Click Download, then print the document to complete it or incorporate it into an online editor.

Form popularity

FAQ

To close a corporation in Nevada, you must follow specific steps to ensure all legal obligations are met. First, you need to hold a formal vote among shareholders to approve the closure of the business. Afterward, you must file the necessary documents with the Secretary of State, including a Certificate of Dissolution, which officially takes your corporation off the records. Making sure to manage the Nevada corporation records withdrawal carefully will help you navigate this process smoothly.

A close corporation in Nevada is a type of business structure designed for small groups of people, often family-owned or closely-held businesses. In this setup, owners are typically involved in the management, allowing for more flexibility in operations and governance. Additionally, close corporations limit the transfer of shares to keep control within a select group. For anyone looking to manage their Nevada corporation records withdrawal effectively, understanding this structure can be quite beneficial.

To remove someone from your LLC in Nevada, you'll need to follow specific procedures outlined in your operating agreement. This may involve a vote by the remaining members or filing the appropriate forms with the state. Proper documentation is essential, especially when it relates to your Nevada corporation records withdrawal. If you're unsure, platforms like uslegalforms can provide guidance and resources to navigate this process confidently.

If you do not renew your LLC in Nevada, the state may dissolve your business, resulting in loss of good standing. This could impede your ability to access important Nevada corporation records withdrawal. You might also incur fines and penalties, making the reinstatement process complicated. Staying proactive in renewing your LLC helps you avoid unnecessary issues and keeps your business running smoothly.

Operating without a business license in Nevada can result in significant penalties, including fines and possible legal action. The state takes compliance seriously, and businesses found to be operating unlicensed may face financial consequences. Additionally, such a situation can complicate your Nevada corporation records withdrawal, making it harder to dissolve or manage your business effectively. Therefore, it's crucial to maintain proper licensing.

A business withdrawal refers to the process of a member or owner exiting a business entity, such as an LLC or corporation. This action can affect the management and ownership structure of the business. If withdrawal impacts your Nevada corporation records withdrawal, you may need to file specific documents to appropriately update your entity's status. Understanding this process ensures a seamless transition.

Yes, in Nevada, you are required to renew your business license every year. This ensures that your business remains in good standing and compliant with state laws. Failing to renew may lead to penalties or complications when accessing your Nevada corporation records withdrawal in the future. It's a straightforward process that helps maintain your business's legitimacy.

Accessing Nevada public records is quite simple and can be done online through the Nevada Secretary of State's website. Here, you can search for various records, including business filings, election results, and other public documents. If you require specific records or need assistance, US Legal Forms offers tools to help streamline your search process. This makes handling Nevada corporation records withdrawal more efficient.

You can request a copy of the articles of incorporation in Nevada through the Secretary of State's website. Simply enter your business information to access and download your documents. If you need a certified copy, there is an option for that as well, which should meet any official requirements during Nevada corporation records withdrawal.

Dissolving an LLC in Nevada typically takes around two weeks, assuming all paperwork is properly submitted. To begin the process, you must file the Articles of Dissolution with the Nevada Secretary of State. After filing, it's essential to settle any outstanding debts and notify the relevant parties. Completing these steps diligently helps facilitate a smooth Nevada corporation records withdrawal.