Life Estate Deed In New York State

Description

How to fill out New York Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether you handle documents frequently or occasionally need to submit a legal paper, it is essential to have a valuable resource that houses all related and current samples.

The first step regarding a Life Estate Deed in New York State is to verify that you possess the most recent version, as this determines its eligibility for submission.

If you desire to streamline your quest for the most current document examples, seek them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search function to locate the form you require, examine the preview and description of the Life Estate Deed in New York State to confirm it is the specific one you seek, double-check the form, then simply click Buy Now, select a subscription plan that suits you, register an account or Log Into your existing one, complete the transaction using your credit card information or PayPal account, select the file format for download, and confirm your selection. Eliminate the confusion associated with legal paperwork; all your templates will be organized and validated through an account with US Legal Forms.

- US Legal Forms is a repository of legal documents encompassing nearly every example you might need.

- Search for the necessary templates, review their relevance immediately, and learn more about their application.

- With US Legal Forms, you can access over 85,000 form templates across a variety of domains.

- Locate the Life Estate Deed in New York State samples in just a few clicks and save them at any time in your account.

- Creating a US Legal Forms account provides you with effortless access to all the templates you need without hassle.

- Simply click Log In in the site header and navigate to the My documents section with all your required forms at your fingertips.

- You won’t have to waste time searching for the right template or verifying its authenticity.

Form popularity

FAQ

To transfer your house deed after death in New York, start by verifying if there is a will or if the property passed through a life estate deed in New York state, which can make the process simpler. If the deed is not automatically transferred, you may need to go through probate court to establish the rightful owner. Using services like US Legal Forms can simplify this process, as they offer the necessary forms and instructions to ensure a smooth transfer.

Transferring a deed after death in New York often requires probate if the deceased left a will. If the property was held in a life estate deed in New York state or joint ownership, it may transfer automatically to the remaining owner. It's wise to consult with legal documents platforms like US Legal Forms to facilitate this process. They provide templates and guidance tailored to New York state's laws.

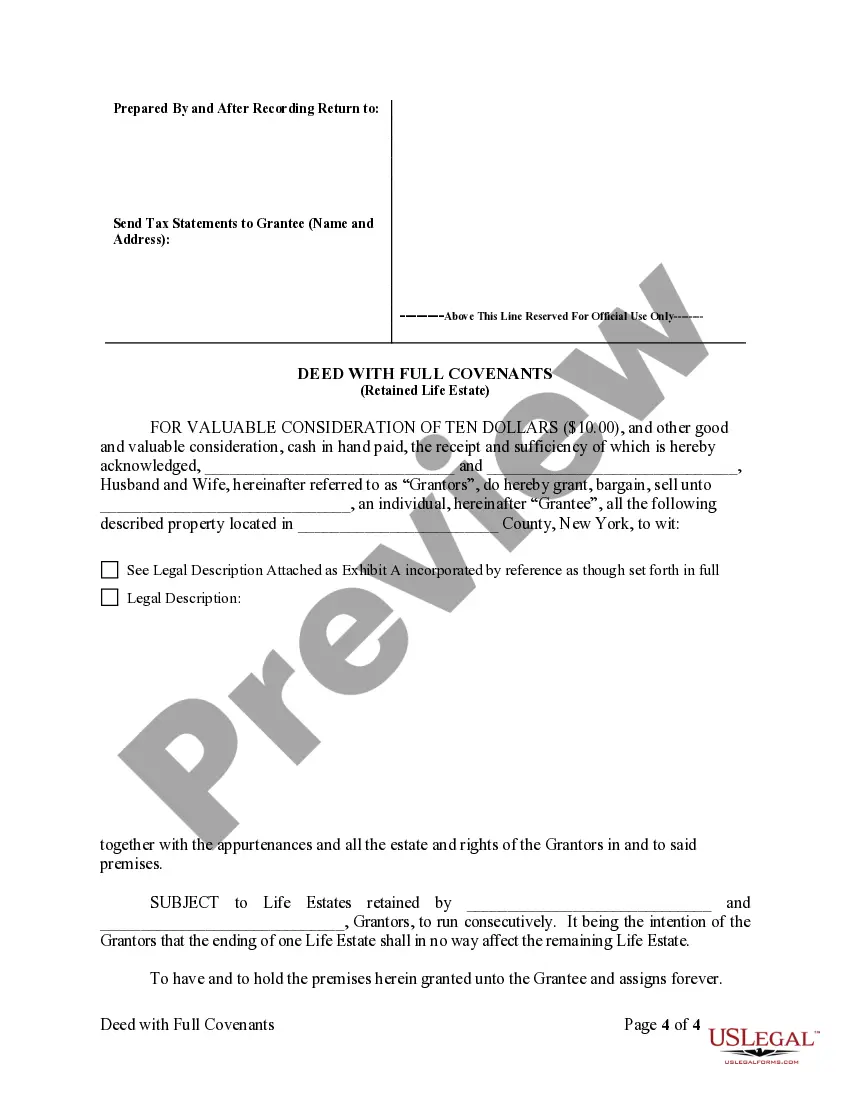

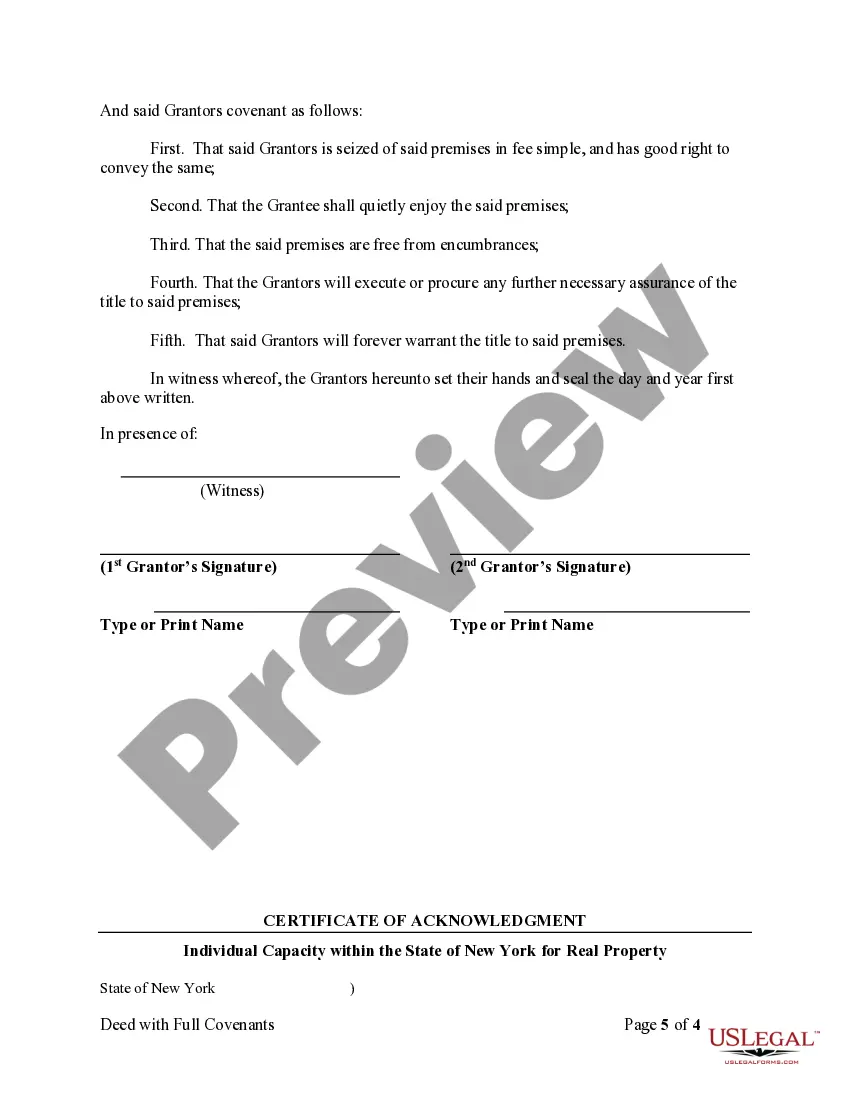

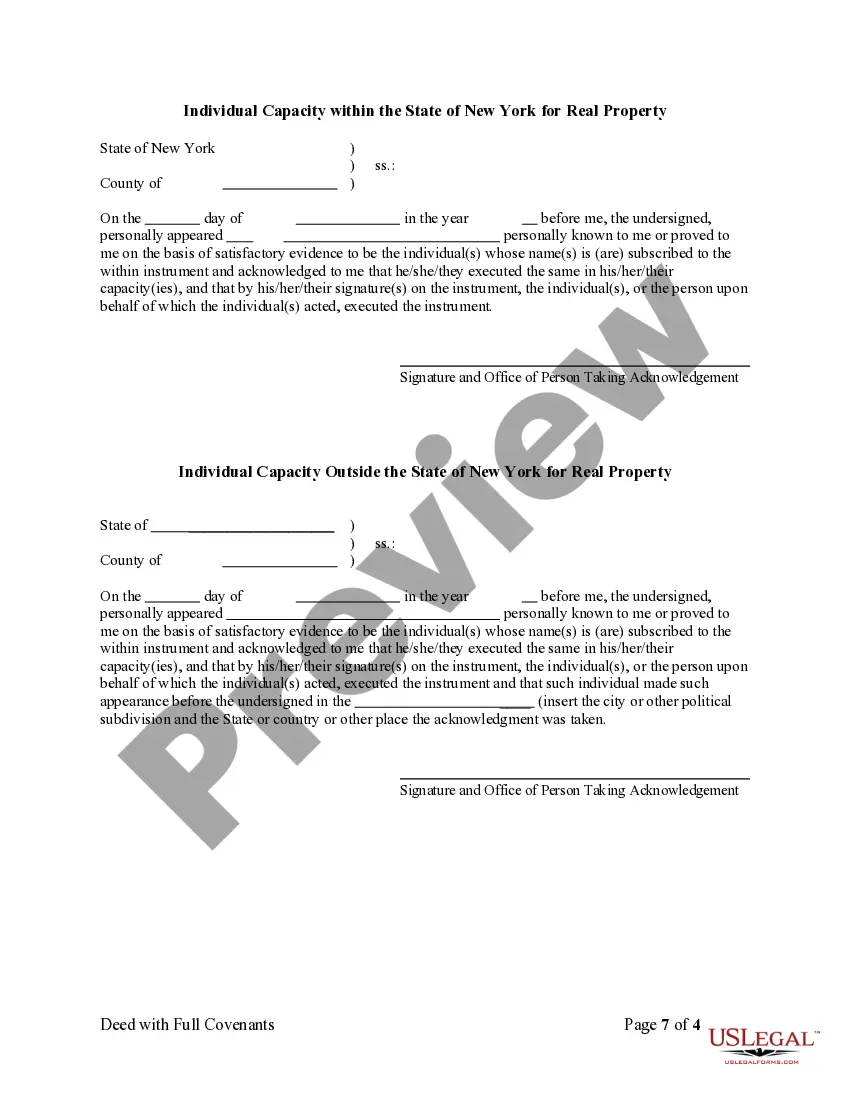

Executing a deed in New York requires you to prepare the deed document which includes the names of the grantor and grantee, a description of the property, and the type of deed being used. Once the deed is completed, it must be signed in front of a notary public. After proper signing, you should file the deed with the county clerk to make it legally binding. Using a life estate deed in New York state can provide special benefits, so make sure you choose the right deed type.

To remove a deceased person from a deed in New York, you typically need to file a death certificate along with a new deed that reflects the change. This process involves determining whether the deceased owned the property outright or through a life estate deed in New York state. If the property was held in joint tenancy, a simple affidavit may suffice. Consider using platforms like US Legal Forms to guide you through the necessary legal documents.

Transfer on death accounts, commonly known as TODs, are not available in New York for real property. Instead, many New Yorkers opt for a life estate deed in New York State, which effectively allows property owners to maintain control during their lifetime while ensuring a designated transfer upon their death. This approach can offer peace of mind and assurance for both property owners and their beneficiaries. Consider exploring more about this option for a straightforward transfer process.

Currently, New York State does not permit transfer on death deeds under the law. However, residents can utilize alternatives like a life estate deed in New York State. This deed structure allows property owners to pass their real estate directly to designated individuals after their passing. It's a wise choice if you're looking to ensure your property transfers seamlessly to heirs.

Transferring ownership of a TOD account in New York involves designating a beneficiary on the account itself, which can often be set up through your bank or financial institution. However, it's advisable to consider a life estate deed in New York State for real estate assets. This deed provides a more direct way to transfer property without probate complications. Always consult with your financial institution for specific procedures.

In New York, property transfer after death generally occurs through the probate process. This procedure can take several months to complete, depending on the estate's complexity. Utilizing a life estate deed in New York State can simplify this process, as it allows for direct transfer of property to beneficiaries without the need for probate. Timely action is important to ensure all necessary documents are properly filed.

New York State does not currently recognize transfer on death deeds. Instead, property owners may consider using a life estate deed in New York State. This option allows individuals to retain rights during their lifetime, while designating beneficiaries to receive property after death. It is essential to consult legal resources to understand your options.

A deed in New York typically includes the title at the top, followed by the date, and the names of the parties involved. It also contains a legal description of the property, the granting clause, and the signature of the grantor. For those using a life estate deed in New York State, the document will highlight the reserved life estate feature and ensure proper transfer requirements are satisfied.