New York Llc Request For Information

State:

New York

Control #:

NY-04-77

Format:

Word;

Rich Text

Instant download

Description What Does An Llc Do

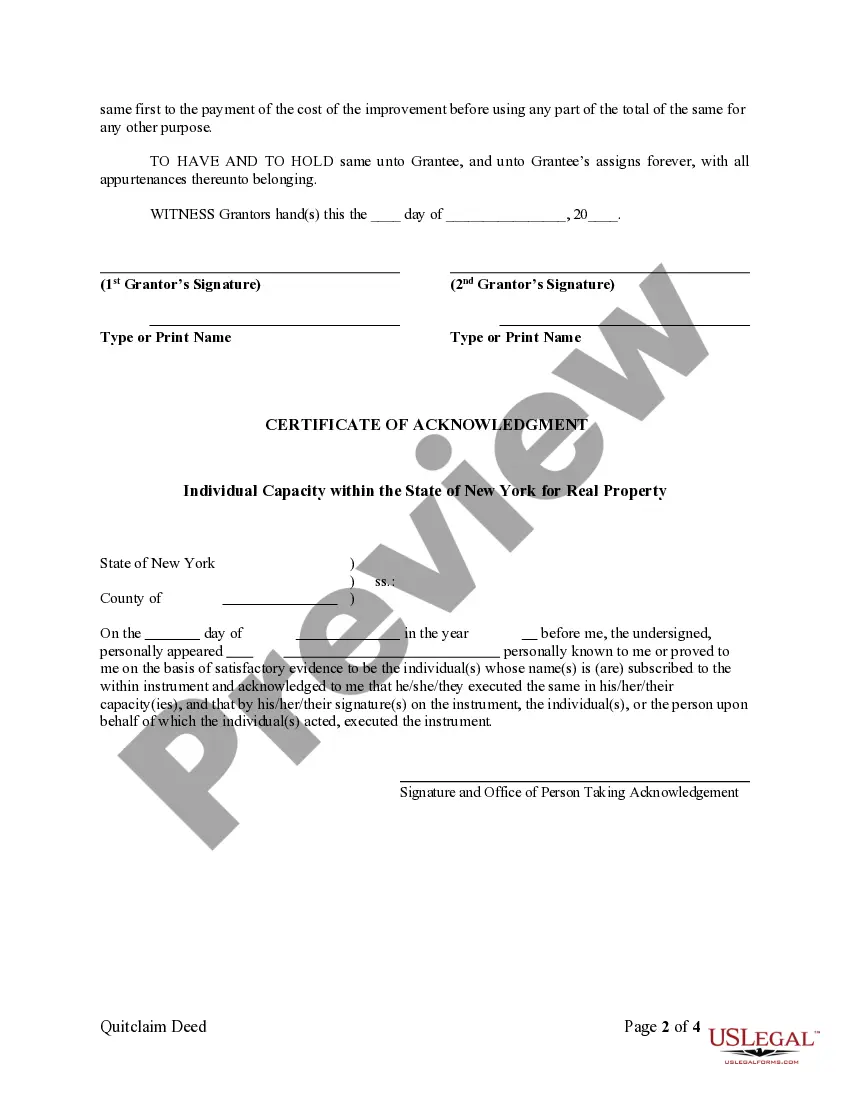

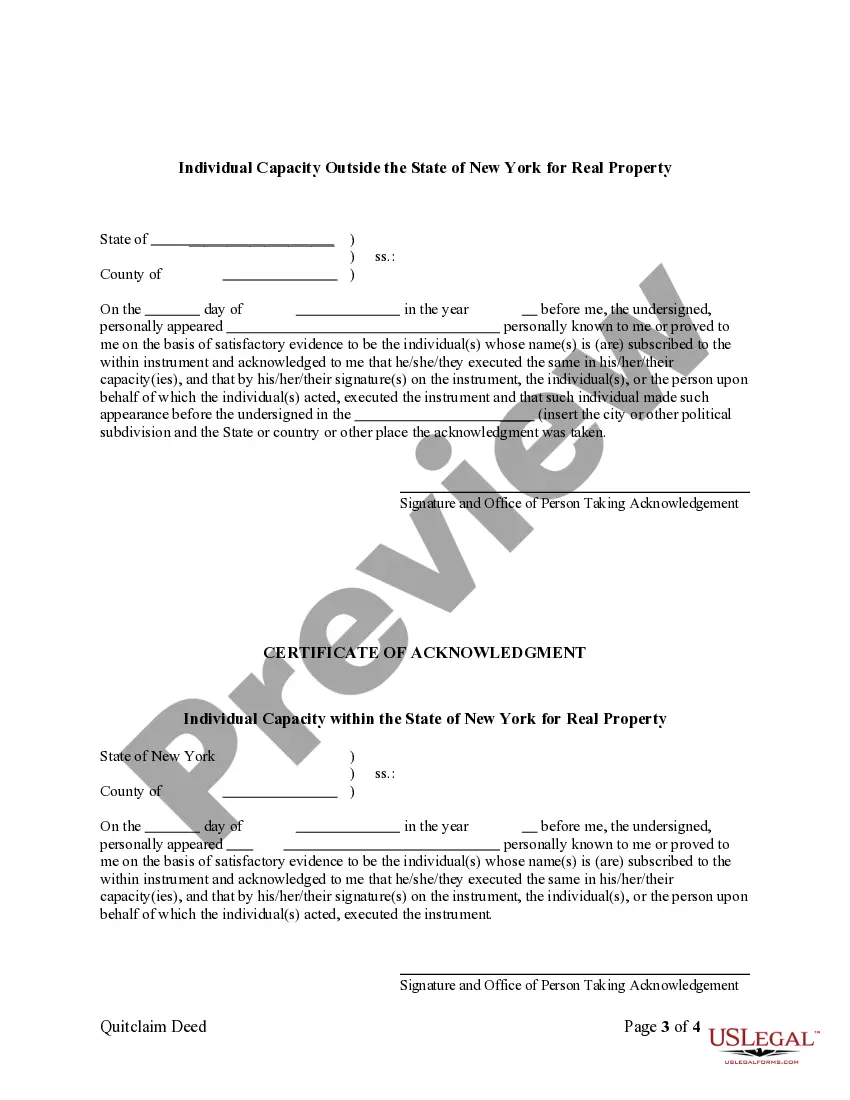

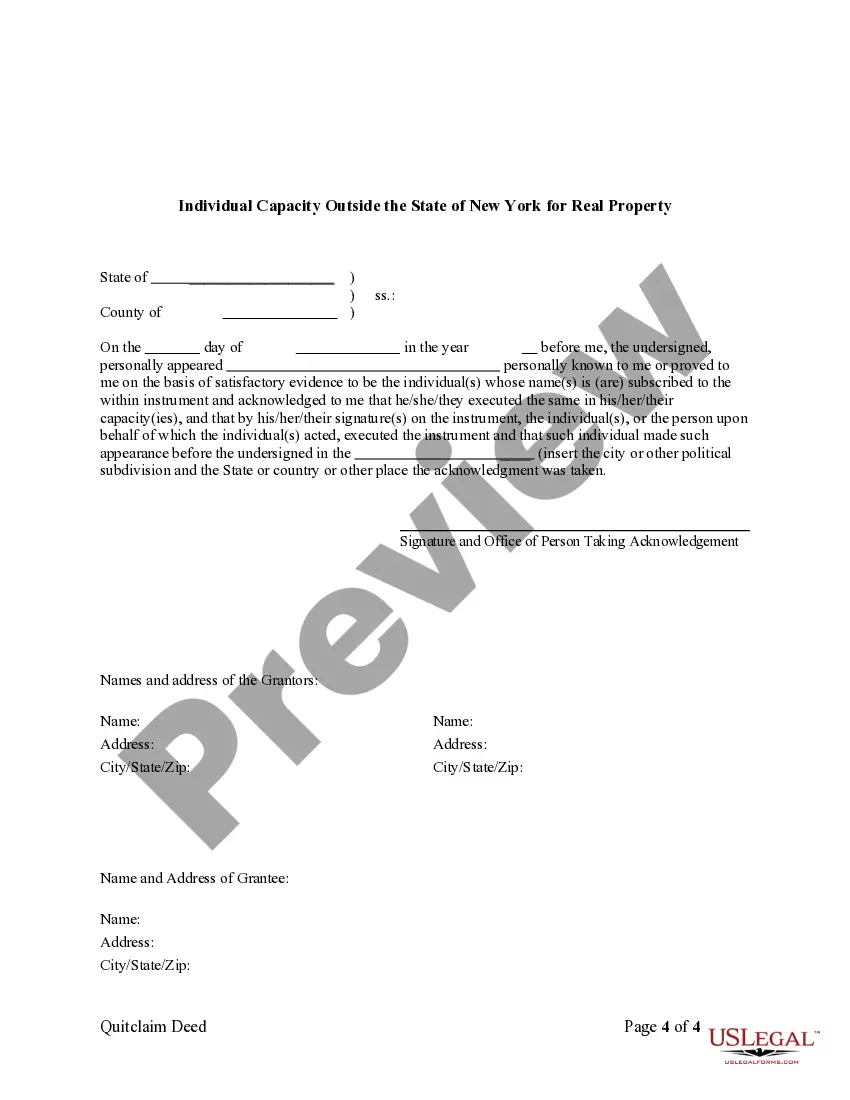

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

Free preview Ny Limited Liability Company