Warning Letter To Tenant For Noise

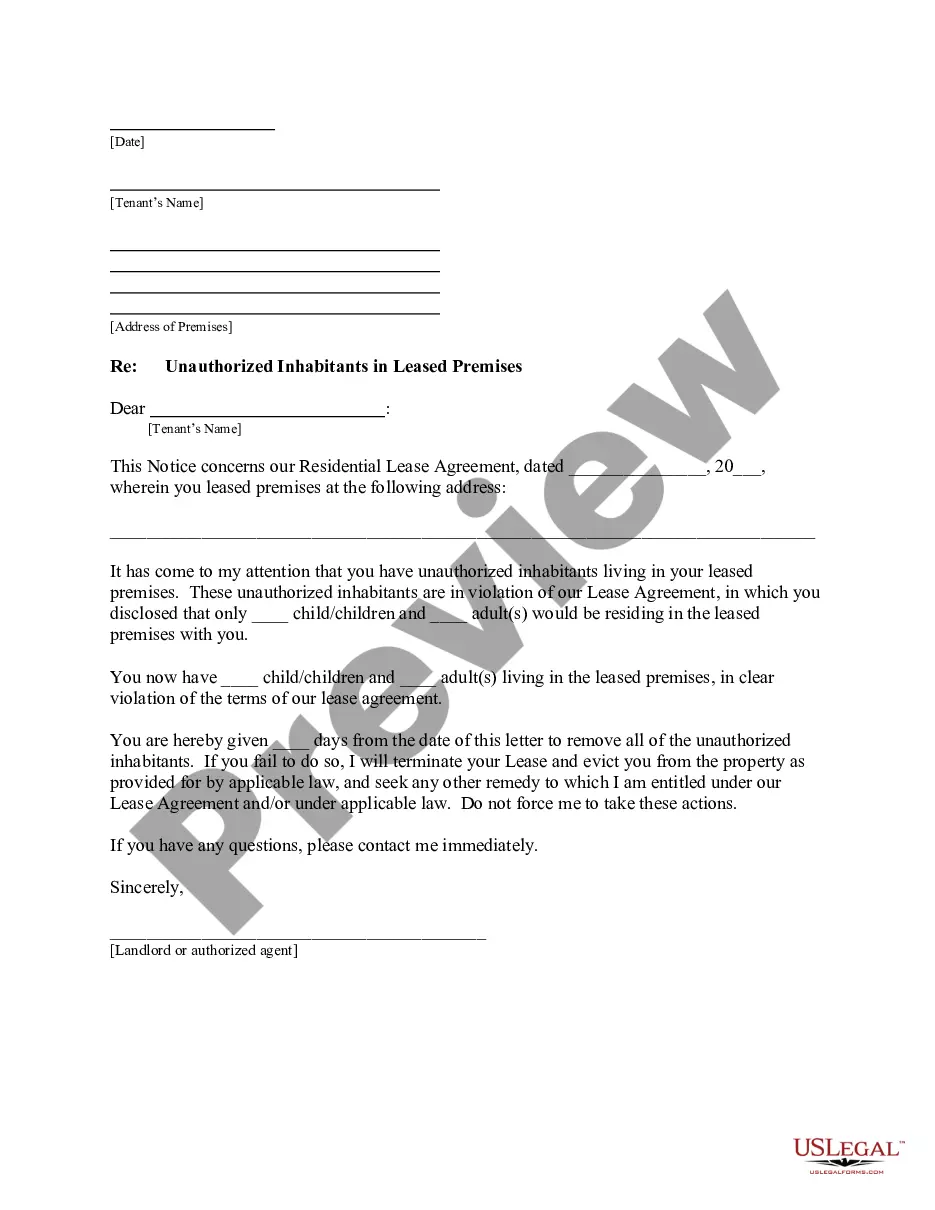

Description noise complaint letter to tenant

How to fill out Warning Letter To Tenant For Noise?

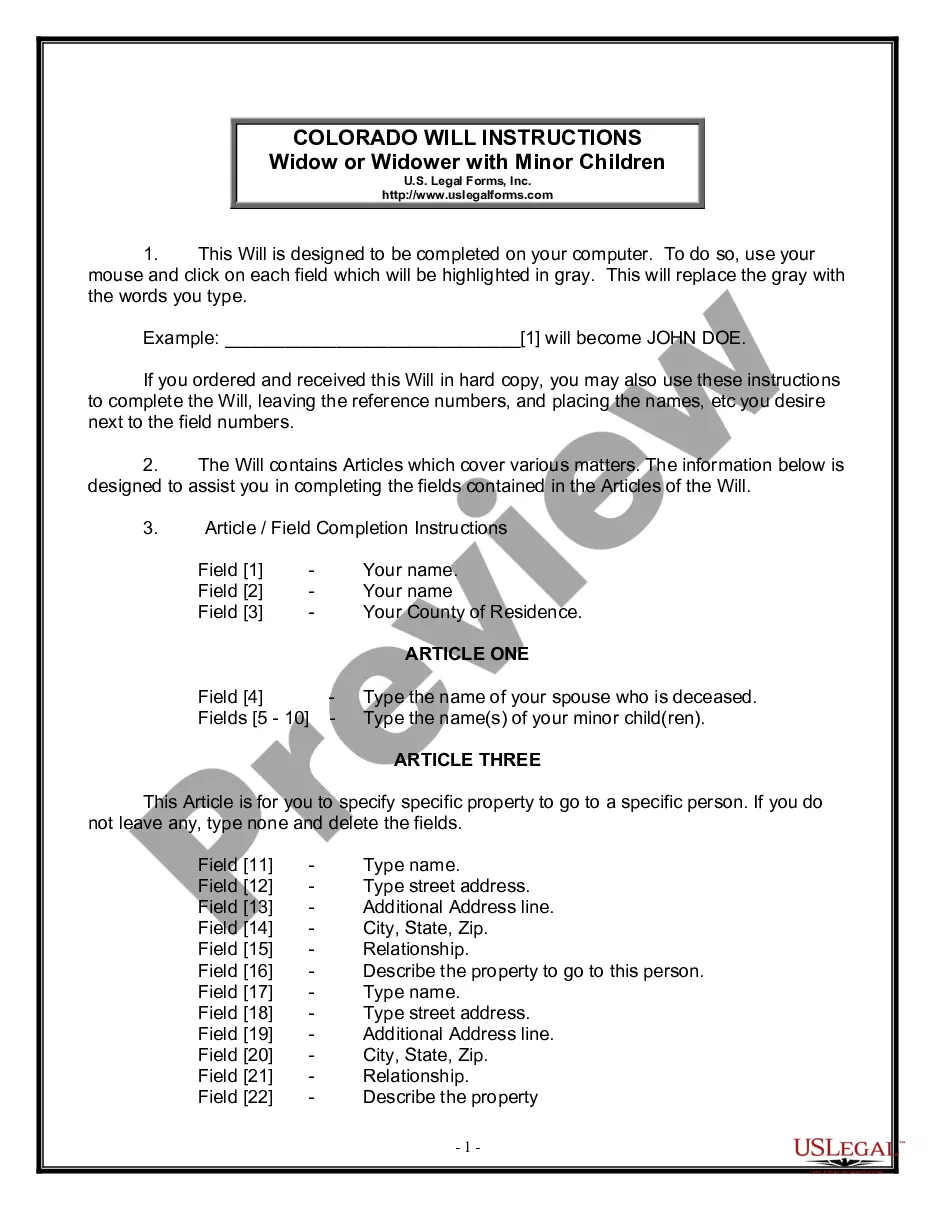

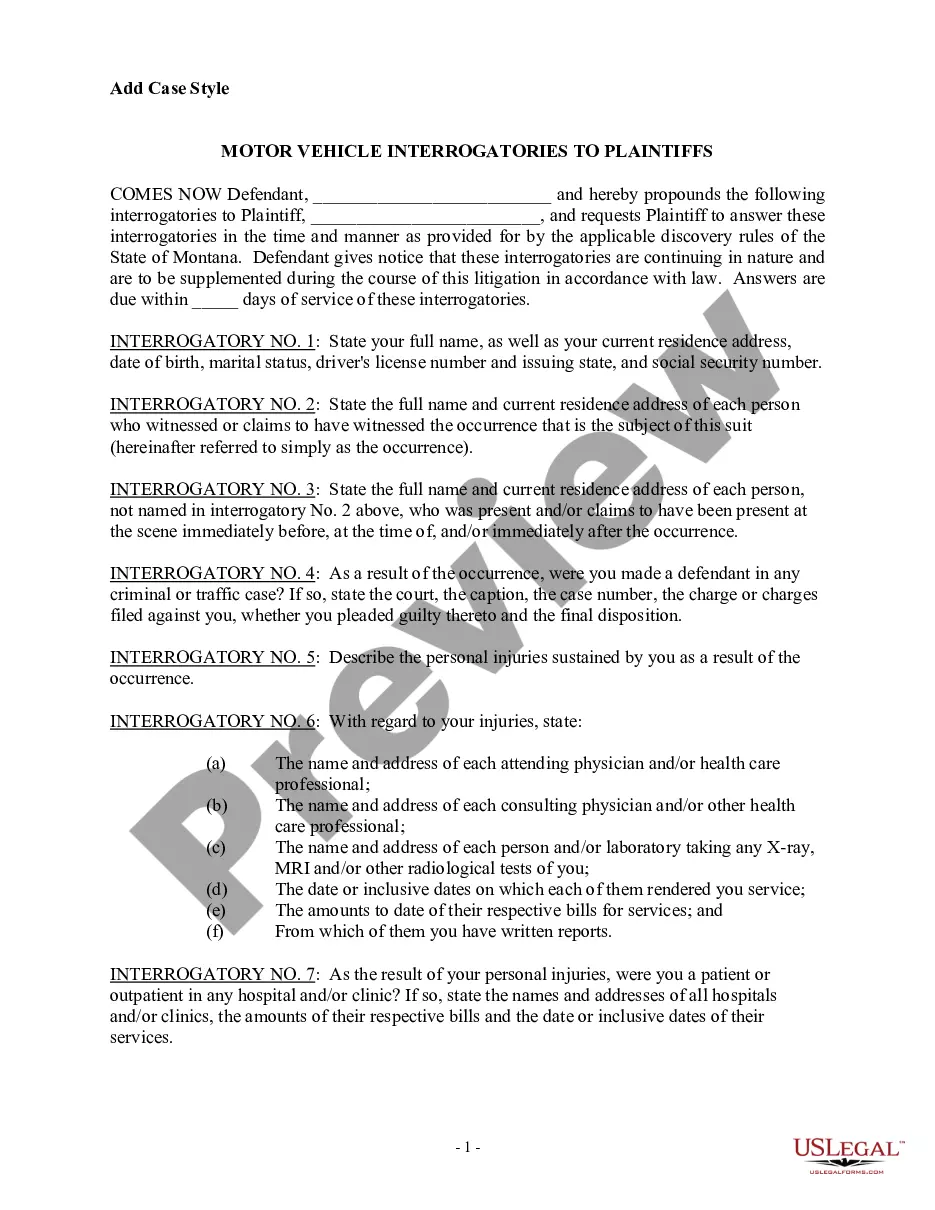

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Completing legal papers needs careful attention, starting with selecting the correct form template. For instance, when you choose a wrong version of a Warning Letter To Tenant For Noise, it will be turned down once you send it. It is therefore essential to have a dependable source of legal files like US Legal Forms.

If you have to get a Warning Letter To Tenant For Noise template, stick to these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to make sure it suits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the wrong document, get back to the search function to find the Warning Letter To Tenant For Noise sample you need.

- Get the template when it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Warning Letter To Tenant For Noise.

- After it is downloaded, you can fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate template across the web. Use the library’s simple navigation to find the correct template for any situation.

how to write a warning letter to a tenant Form popularity

FAQ

Check it with the state ?Go to the ?Online Services? page at the Oklahoma Tax Commission site and click ?Sales Tax Permit Look-up System.? Enter the requested permit number. You can see where to verify retail certificates from every state here.

A sales tax permit authorizes a business to collect and remit sales tax on taxable sales of products and services, as required by law. A seller's permit isn't the same as a resale certificate. A resale certificate allows a business to make tax-free purchases of taxable goods they plan to resell.

Resale Certificate in OK. Many businesses routinely purchase goods on a wholesale basis, with the intention of later reselling these items at retail. This transaction requires the use of an Oklahoma resale certificate, which is filled out by the buyer and given to the seller.

If You are Presented with an Oklahoma Resale Certificate It must include your buyer's sales tax permit number. Check it with the state ?Go to the ?Online Services? page at the Oklahoma Tax Commission site and click ?Sales Tax Permit Look-up System.? Enter the requested permit number.

Common details listed on the Oklahoma resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Oklahoma sales tax number.

Most businesses operating in or selling in the state of Oklahoma are required to purchase a resale certificate annually. Even online based businesses shipping products to Oklahoma residents must collect sales tax.

How many acres must I farm to be considered eligible for the exemption permit? If the land is being actively farmed, there is no restriction on the number of acres that you are farming.