- US Legal Forms

- Assigments

-

New York Assignment of Mortgage by Individual Mortgage Holder

Assignment Of Mortgage New York Form

Description Assignment Mortgage New York

Assignment Mortgage Form New York Related forms

View Client and business contract with ancient city

View Client and business contract with modals

View Client and business contract with small

View Client and business contract with ups

View Client and business contract without

How to fill out Assignment Mortgage Pdf?

Correctly drafted official paperwork is one of the fundamental guarantees for avoiding issues and litigations, but getting it without a lawyer's help may take time. Whether you need to quickly find an up-to-date Assignment Of Mortgage New York Form or any other templates for employment, family, or business occasions, US Legal Forms is always here to help. It's a user-friendly platform comprising over 85k legal documents organized by state and area of use verified by professionals for compliance with regional laws and regulations.

If you want to know how to obtain the Assignment Of Mortgage New York Form within clicks, adhere to the guide below:

- Make sure that the form is suitable for your case and region by checking the description and preview.

- Browse for another sample (if needed) via the Search bar in the page header.

- Click on Buy Now when you find the corresponding template.

- Select the pricing plan, log in to your account or create a new one.

- Pick the payment method you like to buy the subscription plan (via a credit card or PayPal).

- Select PDF or DOCX file format for your Assignment Of Mortgage New York Form.

- Click Download, then print the sample to fill it out or add it to an online editor.

The process is even simpler for existing users of the US Legal Forms library. If you subscription is valid, you only need to log in to your account and click the Download button near the chosen file. In addition, you can access the Assignment Of Mortgage New York Form later at any moment, as all the documentation ever obtained on the platform is available within the My Forms tab of your profile. Save time and money on preparing official paperwork. Try US Legal Forms right now!

Assignment Mortgage Ny Form Rating

New York Mortgage Form Form popularity

Ny Mortgage Form Other Form Names

New York Assignment Mortgage FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

An Assignment is the transfer by the holder of a life insurance plan (the assignor) of the benefits or proceeds of the plan to a lender (the assignee), as a collateral for a Mortgage or loan.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

Assignment Of Mortgage New York Form Related Searches

-

satisfaction of mortgage new york form

-

new york mortgage form

-

satisfaction of mortgage new york pdf

-

new york mortgage template

-

assignment of mortgage document

-

how to challenge an assignment of mortgage

-

invalid mortgage assignment

-

new york mortgage document

-

assignment of mortgage pdf

-

satisfaction of mortgage new york form

Assignment Mortgage Pdf Interesting Questions

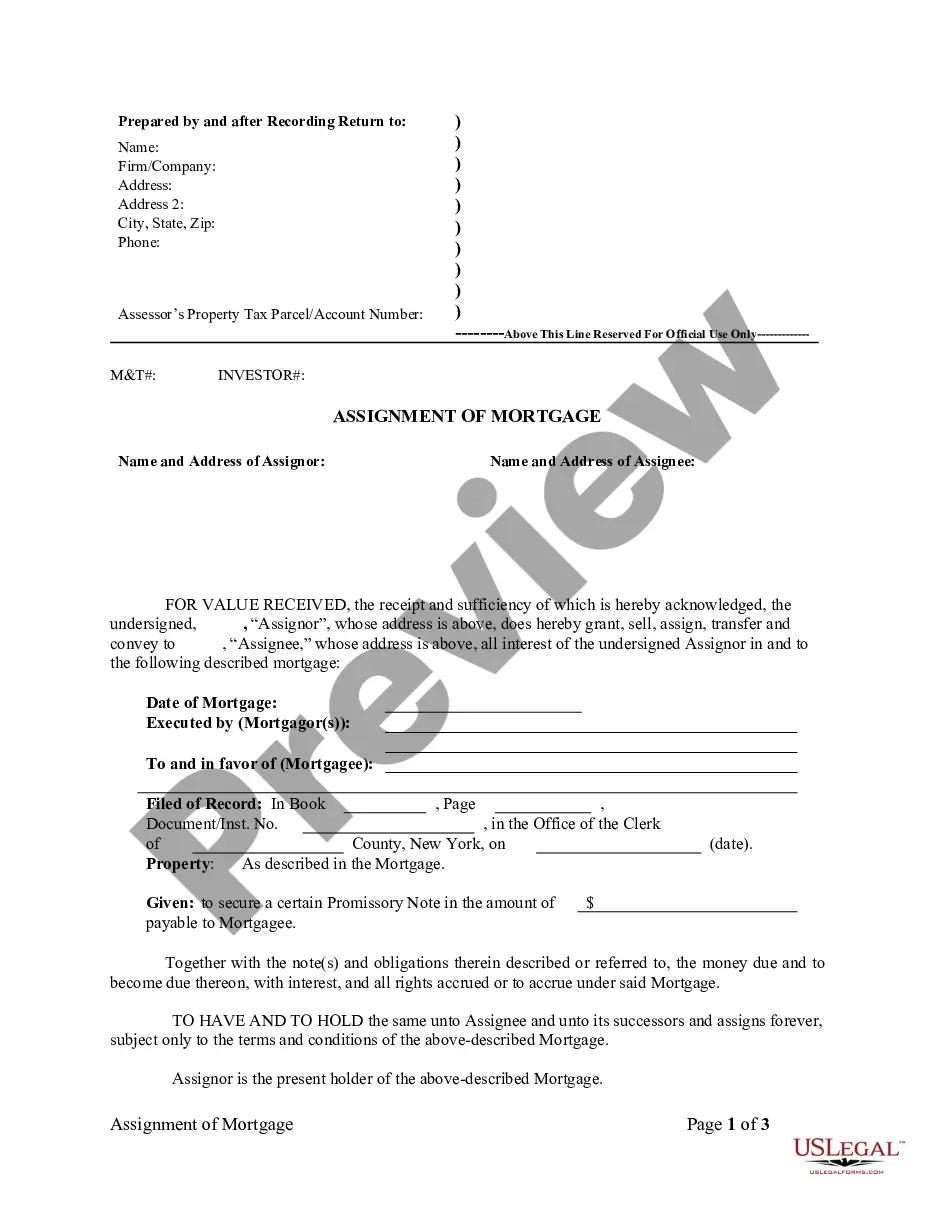

An Assignment of Mortgage form in New York is a legal document that transfers the rights and obligations of a mortgage loan from one party to another.

In New York, the assignment is usually prepared by the lender or the loan servicer who is authorized to transfer the mortgage. It is important to consult with a legal professional to ensure accuracy and compliance with applicable laws.

The Assignment of Mortgage form in New York typically requires information such as the names of the assignor (current mortgage holder) and assignee (new mortgage holder), the property address, the loan details, and the effective date of the assignment.

Yes, an Assignment of Mortgage form is necessary to legally transfer the mortgage rights. It ensures a proper transfer of ownership and allows the new mortgage holder to enforce the terms of the loan.

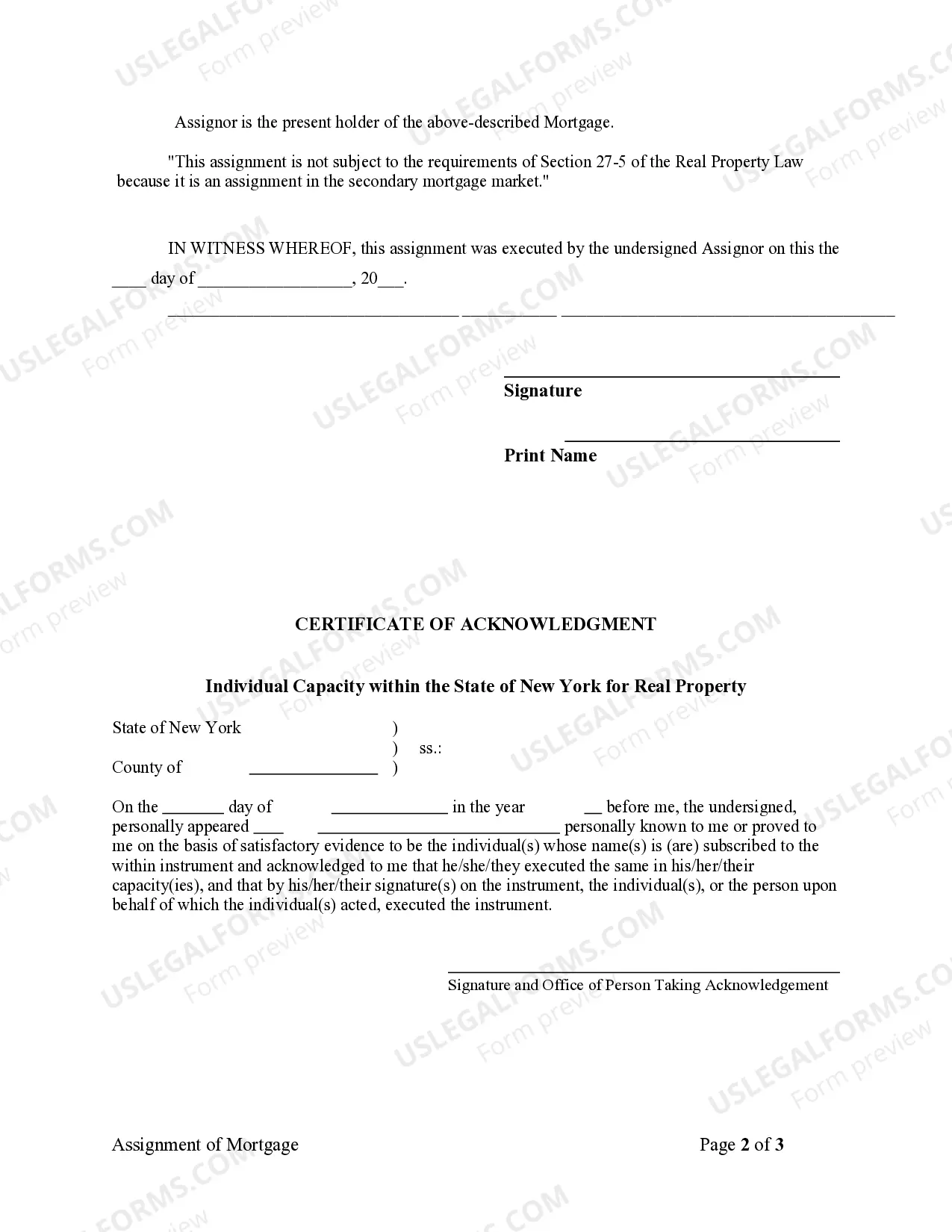

Once the Assignment of Mortgage form in New York is completed, it needs to be recorded in the county clerk's office where the property is located. This ensures its public record and provides notice to interested parties.

Yes, there may be filing fees associated with recording the Assignment of Mortgage form in New York. These fees vary by county, so it's advisable to check with the specific county clerk's office for the applicable fees.

Generally, the terms of an Assignment of Mortgage form in New York cannot be modified. It is crucial to ensure accuracy and compliance with existing agreements. Any alterations may require legal advice or the preparation of a new document.

While it is not required by law to have an attorney review the Assignment of Mortgage form in New York, it is highly recommended. Attorneys can provide legal guidance, ensuring the document is error-free, compliant, and protects the rights and interests of all parties involved.

If an Assignment of Mortgage form in New York is not properly executed, it may be deemed invalid or unenforceable. This can lead to complications in asserting ownership rights or enforcing the terms of the mortgage.

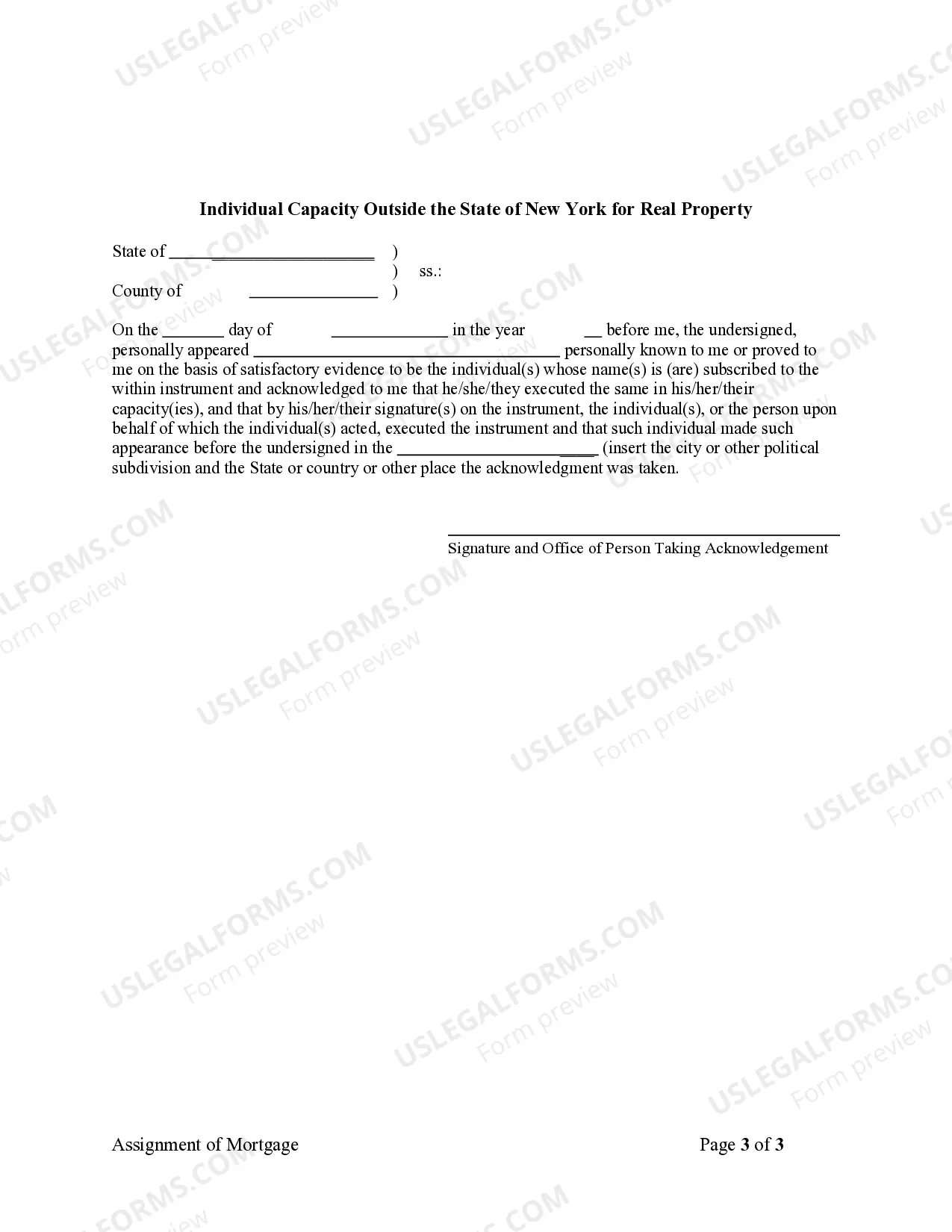

It is generally advisable to use a state-specific Assignment of Mortgage form for New York to ensure compliance with the state's laws and regulations. Generic forms may not include all the necessary provisions or account for specific state requirements.

More info

Assignment Mortgage Fill Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

New York

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

New York Law

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

Not required.

Recording Satisfaction:

After full payoff, mortgagee, unless otherwise requested in writing by mortgagor, must execute and acknowledge before a proper officer a satisfaction of mortgage, and thereupon within forty-five days arrange to have the satisfaction of mortgage either presented for recording to the recording officer of the county where the mortgage is recorded, or, if so requested, to the mortgagor.

Marginal Satisfaction:

Not allowed. A mortgage must be satisfied by recording a separate instrument of release.

Penalty:

The Court shall award costs and reasonable attorney's fees to the debtor, in the absence of the showing of a valid reason for the failure or refusal by the mortgagee to execute the satisfaction of mortgage and deliver the same.

Acknowledgment:

An assignment or satisfaction must contain a proper New York acknowledgment, or other acknowledgment approved by Statute.

New York Statutes

Sec. 275. Certificate of discharge of mortgage required. [But see also, sec. 1921, below.]

1. Whenever a mortgage upon real property is due and payable,

and the full amount of principal and

interest due on the mortgage is paid, a certificate

of discharge of mortgage shall be given to the mortgagor or person

designated by him, signed by the person or persons specified in section

three hundred twenty-one of this chapter. The person signing

the certificate shall, within thirty days

thereafter, arrange to have the certificate presented for recording to

the recording officer of the county where the mortgage is recorded.

The provisions of this section shall not apply to any mortgage

granted to or made by the state

of New York, or any agency or instrumentality

thereof or any political subdivision of the state or any agency

or instrumentality thereof.

2. For purposes of this section,

the full amount of principal and interest due on a mortgage

shall not be considered to be paid whenever such mortgage continues

to secure a bona fide debt and an enforceable lien

continues to exist, such as may occur in the following situations:

(a) the commercial practice of lenders

trading or selling mortgages on the secondary market;

(b) the replacement of a construction loan with permanent

financing;

(c) the refinancing of an existing loan with a new

lender, such as where the original lender assigns a note and the mortgage

securing its payment to another lender in

return for consideration and such mortgage

is consolidated with another mortgage which secures any funds advanced

by the new lender to the mortgagor;

(d) the modification of the terms of a loan by a mortgagor

and mortgagee in order to avoid foreclosure; and

(e) a refinancing that occurs in conjunction

with the sale of property such that the seller conveys property to the

purchaser subject to the lien of the mortgage and

the original lender assigns its note and mortgage on the property to the

purchaser's lender.

§ 1921 Real Prop. Acts. Discharge of mortgage.

1. After payment of authorized principal, interest and

any other amounts due thereunder or otherwise owed by law has actually

been made, and in the case of a credit line mortgage as defined in

section two hundred eighty-one of the real property law on written request,

a mortgagee of real property situated in this state, unless otherwise requested

in writing by the mortgagor or the assignee of such mortgage, must execute

and acknowledge before a proper officer, in like manner as to entitle a

conveyance to be recorded, a satisfaction of mortgage, and thereupon within

forty-five days arrange to have the satisfaction of mortgage: (a) presented

for recording to the recording officer of the county where the mortgage

is recorded, or (b) if so requested by the mortgagor or the mortgagor's

designee, to the mortgagor or the mortgagor's designee. The mortgagee

shall within forty-five days deliver the note and the mortgage and where

a title is registered under article twelve of the real property law, the

registration copy of the mortgage and any registration certificates in

the mortgagee's possession to the mortgagor or the mortgagor's designee

making such payment and request if required as aforesaid. Delivery of

a satisfaction of mortgage in accordance with the terms of section two

hundred seventy-five of the real property law shall be deemed to satisfy

the requirements of this section regarding the satisfaction of mortgage.

2. Upon the failure or refusal of any such mortgagee to comply

with the foregoing provisions of this section any person having an interest

in the mortgage or the debt or obligation secured thereby or in the mortgaged

premises may apply to the supreme court or a justice thereof, or to the

county court or a judge thereof, in or of any county in which the mortgaged

premises or any part thereof are situated in whole or in part, upon a petition,

for an order to show cause why an order should not be made by such court

canceling and discharging the mortgage of record, and directing the register

or clerk of any county in whose office the same may have been recorded

to mark the same upon his records as canceled and discharged, and further

ordering and directing that the debt or other obligation secured by the

mortgage be canceled, upon condition that in the event such mortgage is

not paid, the sums tendered pursuant to the foregoing provisions of this

section be paid to the officer specified by law to hold court funds and

moneys deposited in court in the county wherein the mortgaged premises

are situated in whole or in part. Said petition must be verified in like

manner as a verified pleading in an action in the supreme court and it

must set forth the grounds of the application.

3. In any case where an actual tender, as provided in subdivision

one of this section, cannot with due diligence be made within this state,

any person having an interest in the mortgage or the debt or obligation

secured thereby, or in the mortgaged premises, may apply to the supreme

court or a justice thereof, or to the county court or a judge thereof,

in or of any county in which the mortgaged premises, or any part thereof

are situated in whole or in part, upon petition setting forth the grounds

of the application and verified as aforesaid, for an order to show cause

why an order should not be made by said court canceling and discharging

the mortgage of record, and directing the register or clerk of any county

in whose office the same may have been recorded to mark the same upon his

records as canceled and discharged and further ordering and directing that

the debt or other obligation secured by the mortgage be canceled, upon

condition that the principal sum of the mortgage or any unpaid balance

thereof, with interest up to the date when said order shall be entered

and the aforesaid fees allowed by law, be paid to the officer specified

by law to hold court funds and moneys deposited in court in the county

wherein the mortgaged premises are situated in whole or in part.

4. In the case of a mortgage secured by property improved

by a one-to-six family, owner occupied, residential structure or residential

condominium unit, if the mortgagee fails within ninety days to deliver

the satisfaction of mortgage and/or fails within ninety days to deliver

the note and the mortgage and any other documents as required by subdivision

one of this section and if the mortgage is not otherwise satisfied the

mortgagee shall be liable to such person in the amount of five hundred

dollars or the economic loss to such person, whichever is greater. If the

mortgagee has delivered such satisfaction of mortgage in a timely manner

and has certified that the note and/or mortgage are not in its possession

as of such date, the mortgagee shall not be liable under this section if

the mortgagee agrees to defend and hold harmless the mortgagor by reason

of the inability or failure of the mortgagee to furnish the note or mortgage

within the time period prescribed in this subdivision; provided that in

connection with mortgage loans purchased prior to July twenty-seven, nineteen

hundred ninety-one by the state of New York mortgage agency pursuant to

section two thousand four hundred five or two thousand four hundred five-b

of the public authorities law, the state of New York mortgage agency, its

successors or assigns shall not be liable under this section if it does

not defend and hold harmless the mortgagor by reason of the inability or

failure of the state of New York mortgage agency, its successors or assigns

to furnish the note or mortgage within the time period prescribed in this

subdivision. Damages imposed by this subdivision shall be in addition to

the other costs and fees allowed in this section.

5. (a) In the case of a mortgage secured by property improved

by a one-to-six family, owner occupied, residential structure or residential

condominium unit, if within ninety days of receipt of payment, and request

if required, the mortgagee fails to deliver to the mortgagor or the mortgagor's

designee the satisfaction of mortgage, the note and the mortgage and any

other documents as required by subdivision one of this section, any attorney-at-law

may execute, acknowledge and upon payment of an additional filing fee of

fifty dollars cause to be filed with the recording officer of the county

where the mortgage is recorded, an affidavit which complies with this section.

Unless the mortgagee shall file a verified objection to such affidavit

within thirty-five days of being filed, as of the date thirty-five days

subsequent to its filing, such affidavit shall be recorded and satisfy

the lien of such mortgage on the mortgaged premises.

(b) The affidavit shall state that:

(i) The affiant is an attorney-at-law and that the affidavit

is made on behalf of and at the request of the mortgagor or any person

who has acquired title to the mortgaged premises;

(ii) The mortgagor made a proper request of the mortgagee

for the execution of the satisfaction of mortgage pursuant to subdivision

one of this section;

(iii) The mortgagor has received a payoff statement for

the loan secured by the mortgage, and shall annex as evidence a copy of

the payoff statement;

(iv) The affiant has ascertained that the mortgagee received

payment of the loan in accordance with the payoff statement, and shall

annex as evidence, copies of the check negotiated by the mortgagee or documentary

evidence of such payment;

(v) The affiant, at least thirty days after the mortgagee

received payment, has given the mortgagee written notice together with

a copy of the proposed affidavit, delivered by certified or registered

mail, return receipt requested, to the attention of the person or department

set forth in the payoff statement, of the affiant's intention to execute

and record an affidavit in accordance with this section; and

(vi) The mortgagee has not responded in writing to such

notification or all requests by the mortgagee for payment have been complied

with at least fifteen days prior to the date of the affidavit.

(c) Such affidavit shall identify the mortgagor and the mortgagee,

state the date of the mortgage, the liber and page of the land records

where the mortgage is recorded and give similar information with respect

to any recorded assignment of the mortgage.

(d) The affiant shall attach to the affidavit photostatic

copies of the documentary evidence that payment has been received by the

mortgagee, including mortgagee's endorsement of any check, and a photostatic

copy of the payoff statement and certify each to be a copy of the original

document.

(e) Within five days of the filing of such affidavit the

register or clerk of every county in whose office said mortgage has been

recorded shall give the mortgagee written notice, delivered by certified

or registered mail, return receipt requested, to the attention of the person

or department set forth in the payoff statement, as annexed to the affidavit

filed hereunder, of the filing of such affidavit, which notice shall include

the following notice in capital letters:

"THIS NOTICE IS MADE UNDER SECTION 1921 OF THE REAL PROPERTY ACTIONS AND PROCEEDINGS LAW. FAILURE TO FILE WITH THIS OFFICE WITHIN THIRTY DAYS OF THIS NOTICE A VERIFIED OBJECTION TO THE DISCHARGE OF THE MORTGAGE DESCRIBED IN THIS NOTICE WILL RESULT IN SUCH MORTGAGE BEING CANCELED AND DISCHARGED OF RECORD."

Unless the register or clerk of such county shall receive from the

mortgagee, within thirty-five days of the date of filing of such affidavit,

a verified objection by the mortgagee to the discharge of said mortgage,

the register or clerk shall record the affidavit and supporting documents

and mark the mortgage described in the affidavit canceled and discharged

of record and such recorded affidavit shall have the same force and effect

as a duly executed satisfaction of mortgage recorded in accordance with

section three hundred twenty-one of the real property law. If the register

or clerk of such county shall receive from the mortgagee, within thirty-five

days of the date of filing of such affidavit, a verified objection by the

mortgagee to the discharge of said mortgage, the register or clerk shall

return the original affidavit and the verified objection to the attorney

filing such affidavit without marking the mortgage described in the affidavit

canceled or discharged of record. The clerk or register of such county

shall additionally transmit a copy of the affidavit and the verified objection

to its applicable appellate division of the supreme court, committee on

professional standards, for such further proceedings as determined appropriate

by such committee.

(f) The county clerk or register shall index the affidavit

in the same manner as a satisfaction of mortgage and shall record such

instrument upon payment of the same fees as for a satisfaction of mortgage.

(g) (i) Any attorney who prepares an affidavit and negligently

causes the affidavit to contain false information shall be liable to the

mortgagee for any monetary damages and subject to other applicable sanctions

under law.

(ii) Any person who supplies false information for the affidavit

shall be liable to the mortgagee for any monetary damages and subject to

other applicable sanctions under law.

(h) A banking or other organization having the original or

copies thereof, shall furnish, within sixty days of receiving a written

request, a copy of the front and reverse sides of a check issued to satisfy

the mortgage obligation by such banking or other organization, needed for

completion of an affidavit in accordance with this subdivision.

6. Eight days' notice of the application for either of the

orders provided for in subdivisions two and three of this section shall

be given to the then mortgagee of record and also, if the petition shows

that there is a mortgage not of record, to such mortgagee. Such notice

shall be given in such manner as the court or the judge or justice thereof

to whom the petition is presented may direct, and said court or judge or

justice may require such longer notice to be given as may seem proper.

If sufficient cause be shown the court or judge or justice thereof may

issue such order to show cause returnable in less than eight days.

7. Upon the return day of such order to show cause, the court,

upon proof of due service thereof and on proof of the identity of the mortgagee

and of the person presenting the petition, shall inquire in such manner

as it may deem advisable, into the truth of the facts set forth in the

petition, and in case it shall appear that said principal sum or any unpaid

balance thereof and interest and the said fees allowed by law have been

duly paid or tendered but not accepted and said satisfaction of mortgage

has been duly presented for execution, or that such tender and presentation

could not have been made within this state with due diligence, then, in

the event such mortgage is not paid, the court shall make an order directing

the sums so tendered, or in a case where such tender could not have been

made as aforesaid, directing the principal sum or any unpaid balance thereof,

with interest thereon to the date of entry of said order together with

all other amounts due thereunder pursuant to subdivision three of this

section and the aforesaid fees allowed by law, to be paid to the officer

specified by law to hold court funds and moneys deposited in court in the

county wherein the application herein is made, and directing and ordering

that upon such payment the debt or other obligation secured by the mortgage

be canceled and further directing the register or clerk of any and every

county in whose office said mortgage shall have been recorded to mark said

mortgage canceled and discharged of record upon the production and delivery

to such register or clerk of a certified copy of the order and the receipt

of such officer, showing that the amount required by said order has been

deposited with him, which certified copy of said order and which receipt

shall be recorded, filed and indexed by any such register or clerk in the

same manner as a certificate of discharge of a mortgage. Said receipt need

not be acknowledged to entitle it to be recorded. The court in its discretion,

when granting any such order after application therefor pursuant to subdivision

two of this section, may award costs and reasonable attorney's fees

to the person making the application, in the absence of the showing of

a valid reason for the failure or refusal to execute the satisfaction of

mortgage and deliver the same, the note and mortgage and any other

documents required under subdivision one of this section. The money deposited

shall be payable to the mortgagee, his personal representative or assigns,

upon an order of the supreme court or county court, directing the payment

thereof to him upon such evidence as to his right to receive the same as

shall be satisfactory to the court.

8. Wherever any register or clerk shall record any order

and receipt as hereinbefore specified, he shall mark the record of said

mortgage as follows:

"Canceled and discharged by order of the .......................... Court, County of ...................... , dated .................. and filed ...................... ," and thereupon the lien of such mortgage shall be deemed to be discharged and the debt secured thereby shall be deemed to be canceled. Said register or clerk shall be permitted to charge for recording and filing said order and receipt, the same fees to which he is now entitled for recording and filing a certificate of satisfaction of a mortgage.

9. When used in this section:

(a) "Mortgagee" means (i) the current holder of the mortgage

of record or the current holder of the mortgage, or (ii) any person to

whom payments are required to be made or (iii) their personal representatives,

agents, successors, or assigns.

(b) "Attorney-at-law" means any person admitted to practice

law in this state and in good standing.

(c) "Payoff statement" means a statement setting forth the

unpaid balance of the mortgage, including principal, interest and other

charges pursuant to the loan documents, together with a per diem rate for

interest accruing after the date to which the unpaid balance has been calculated.

The payoff statement furnished by a banking organization or corporate mortgagee

shall include a name of an individual employed by such banking organization

or corporate mortgagee or department of such banking organization or corporate

mortgagee to whom inquiry concerning the payoff statements are to be addressed

in addition to the address of the banking organization or corporation for

use in connection with the affidavit under subdivision five of this section.

(d) "Banking organization" shall have the same meaning as

provided in subdivision eleven of section two of the banking law and shall

include any institution chartered or licensed by the United States or any

state.

(e) "Note" shall include any written evidence of indebtedness.

§ 321 Real Prop. Recording discharge of mortgage.

1. The recording officer shall mark on the record of a mortgage

the word "discharged" when there is presented to him a certificate or certificates

signed as hereinafter provided, and acknowledged or proved and certified

in like manner as to entitle a conveyance to be recorded, specifying that

the mortgage has been paid or otherwise satisfied and discharged.

(a) When it does not appear from the record that any interest

in the mortgage has been assigned, the discharge shall be signed by the

mortgagee or by his personal representative.

(b) When it appears from the record that the mortgage has

been assigned, whether or not the assignment was made as collateral security,

the discharge shall be signed by the person who appears from the record

to be the last assignee thereof or by his personal representative.

(c) When the mortgage or an assignment thereof names two

or more persons as mortgagees or assignees, the discharge shall be signed

by the person or persons designated by the mortgage or assignment to receive

payment of the mortgage debt or to give full acquittance and discharge

therefor. When no such person or persons are designated by the mortgage

or assignment, the certificate of discharge shall be signed by all of the

persons named, in the mortgage or assignment, as mortgagees or assignees,

as the case may be, or by their personal representatives, if the mortgage

or assignment (i) specifies their respective interest in terms of a sum

of money, or in terms of a fraction or percentage, or (ii) states that

such persons shall share equally in, or shall have equal shares in the

mortgage, or (iii) describes such persons as tenants in common of the mortgage.

When it appears from the record that the mortgage is held by trustees,

the certificate of discharge shall be signed by a majority of such trustees

or of the survivors of them or by the survivors or survivor of them, unless

the instrument creating the trust provides otherwise. Except as required

above, the discharge may be signed by any one of the persons named in the

mortgage or assignment, as mortgagees or assignees, as the case may be,

or by the personal representative of the last survivor of them. If the

mortgage or assignment states that the persons named therein as mortgagees

or assignees shall hold the mortgage jointly, or describes such persons

as joint tenants or tenants by the entirety of the mortgage, or expressly

creates a right of survivorship among them, the discharge may be signed

by any one of such persons or by the personal representative of the last

survivor of them notwithstanding that the mortgage or assignment specifies

their respective interests in the mortgage or states that they shall share

equally or have equal shares therein.

(d) When the mortgage has been partially assigned, the certificate

of discharge shall be signed by all of the persons, or their personal representatives,

who in the aggregate are the holders of all portions of the mortgage, including

each partial assignee, and the assignor in case any portion of the mortgage

has not been assigned; provided, however, that if any partial assignment

names two or more persons as assignees, the person or persons who may sign

the certificate discharging such partial interest shall be determined in

accordance with the provisions of paragraph (c) of this subdivision.

(e) Whenever two or more persons are required to execute

a certificate of discharge as provided in this subdivision, there may be

presented in lieu of such certificate, separately executed certificates

of discharge as to the respective interests of each in the mortgage so

that together the several certificates purport to discharge the entire

mortgage.

(f) In place of any of the persons specified in paragraphs

(a), (b), (c) or (d) of this subdivision, a certificate of discharge of

the mortgage or of any interest therein may be signed (i) by an agent who

has been authorized by any such person to demand or receive payment or

to give a certificate of discharge of the mortgage by a power of attorney,

provided such power of attorney is of record in the office where the mortgage

is recorded, and no instrument of revocation has been recorded; or (ii)

by any person in whom title to such mortgage or to such interest, or authority

to act on behalf of or in exercise of the right or power of the holder

of such mortgage or of such interest is vested, in a fiduciary capacity,

by virtue of an order or decree of a court having jurisdiction thereof,

including, but not limited to, the guardian of a minor, the committee of

an incompetent person, or the conservator of a conservatee, whether domestic

or foreign, and a receiver in bankruptcy or trustee in bankruptcy. A certificate

executed by any person specified in clause (ii) of this paragraph shall

recite the name of the court and the venue of the proceedings in which

his appointment was made, or the order or decree vesting him with such

title or authority was entered.

(g) If the mortgage is stated in the certificate of discharge

to have been taken by the alien property custodian under and pursuant to

the trading with the enemy act adopted by the United States congress, and

approved October sixth, nineteen hundred sixteen, or any act amendatory

thereof, or supplemental thereto, such certificate may be executed by such

alien property custodian or such person as the president may appoint to

give full acquittance and discharge for money or property belonging to

an enemy or ally of an enemy which may be conveyed, assigned, delivered

or transferred to said alien property custodian, with like effect as if

the same had been executed by the mortgagee, his personal representative

or assignee. Such certificate may be recorded, and such certificate, the

record thereof and a certified copy of such record may be introduced in

evidence in all courts of this state.

2. (a) The recording officer shall record and file such certificate

or certificates together with the certificates of acknowledgment or proof,

and shall note on the record of the mortgage the book and page containing

such record of such certificate or certificates or the serial number of

such record in the minute of the discharge of such mortgage, made by the

officer upon the record thereof. The provisions of this paragraph shall

not apply to the county of Suffolk, if the block method of index is in

use, or a separate index of satisfactions recorded is maintained.

(b) The recording officer shall also record every other instrument

relating to a mortgage which is presented to him, acknowledged or proved

in like manner as to entitle a conveyance to be recorded, including certificates

purporting to discharge a mortgage or an interest therein which are signed

by persons other than those specified in the first subdivision of this

section, and also including, but not limited to, assignments, releases,

partial discharges, reductions, estoppel certificates, extensions, discharges

of partial interest and partial discharges of partial interest, regardless

by whom any such instrument has been executed. When any such instrument

has been recorded, the recording officer, except in counties where the

block method of indexing is in use, or in Suffolk county, if a separate

index of said instruments is maintained, shall enter a minute upon the

record of the mortgage to which such instrument relates, indicating the

nature of such instrument and the book and page where it has been recorded

or the serial number of such record.

3. Every certificate presented to the recording officer shall

be executed and acknowledged or proved in like manner as to entitle a conveyance

to be recorded. If the mortgage has been assigned, in whole or in part,

the certificate shall set forth the date of each assignment in the chain

of title of the person or persons signing the certificate, the names of

the assignor and assignee, the interest assigned, and, if the assignment

has been recorded, the book and page where it has been recorded or the

serial number of such record; or if the assignment is being recorded simultaneously

with the certificate of discharge, the certificate of discharge shall so

state. If the mortgage has not been assigned of record, the certificate

shall so state.

No certificate presented to the recording officer shall purport

to discharge more than one mortgage, except that one certificate may purport

to discharge two or more mortgages where the certificate states that one

of such mortgages corrects, perfects or modifies the other mortgage or

mortgages, or spreads the lien of the other mortgage or mortgages over

the property subject to the lien of such mortgage, or consolidates the

lien of the other mortgage or mortgages with the lien of such mortgage

to constitute a single lien, or where the certificate states that the liens

of the mortgages which the certificate purports to discharge have been

so spread or so consolidated by a separate instrument and such instrument

has been recorded; provided that in such case the certificate of discharge

shall identify and describe each mortgage which it purports to discharge,

in a separate paragraph, in the same manner and with the same particularity,

and setting forth the same information with respect to assignments thereof,

as would be required for a separate certificate discharging that mortgage,

and shall also state, in a separate paragraph for each instrument, the

date of any such separate instrument by which the liens of the mortgages

have been spread or consolidated, the names of the parties thereto, and

the book and page where it has been recorded or the serial number of such

record. In any such case, except where otherwise expressly provided by

law, the fee or fees which the recording officer is entitled to receive

for filing and entering a certificate of discharge of a mortgage and examining

assignments of such mortgage shall be payable with respect to each mortgage

which the certificate purports to discharge, to the same extent as if a

separate certificate of discharge had been filed for such mortgage.

4. After the record of the mortgage has been marked with

the word "discharged," the recording officer shall make and deliver to

any person tendering the lawful fees therefor, his certificate setting

forth the names of the mortgagor and the mortgagee, the book and page at

which, the date when such mortgage was recorded, and the date on which

the record of such mortgage was so marked, except in a county where recording

is done by microphotography or photostating in the manner permitted by

law, in which case, after microphotography or photostating, such certificate

of discharge and the certificates of its acknowledgment or proof shall,

in lieu of filing as provided in paragraph (a) of subdivision two of this

section, be returned to the party leaving same for record.

5. The term "personal representative" as used in this section

shall include the following:

(a) An executor, administrator or voluntary administrator

or one of two or more executors, administrators or voluntary administrators,

whether domestic or foreign, including the public administrator, and an

ancillary administrator appointed in this state. A certificate executed

by any such personal representative shall recite the name of the court

and the venue of the proceedings in which his letters testamentary or of

administration were issued.

(b) All of the distributees of a person dying intestate for

whom no administrator shall have been appointed, provided that two years

shall have elapsed since the date of death of such intestate. A certificate

executed by such distributees shall recite the date of death of the intestate,

his place of residence at the time of death, the fact that he died intestate,

that no administrator has been appointed and that they constitute all the

distributees of the intestate.

6. The provisions of this section authorizing the recording

officer to mark on the record of a mortgage the word "discharged" shall

not be deemed to enlarge, diminish or alter the legal effect which a certificate

executed by any person or persons, or any payment made by the mortgagor

or other transaction with respect to the mortgage or the mortgage debt,

would otherwise have upon the rights of the mortgagor or of any person

claiming a right or interest in the mortgage, the mortgage debt or the

property subject to the mortgage.

7. In a county in which recording is accomplished by microfilm

process and in which a block index of mortgages is also maintained it will

not be necessary to mark the record of the mortgage "discharged", but it

will be deemed sufficient compliance with this section if there is entered

upon the block index of such mortgage the date of filing and the serial

number of the certificate effecting the discharge.

7-a. If in any county, recording is accomplished by microfilm

process and a separate index for satisfactions recorded is maintained or

in which a block index of mortgages is also maintained it will not be necessary

to mark the record of the mortgage "discharged", but it will be deemed

sufficient compliance with this section if there is entered upon the index

of such mortgage the date of filing and the serial number of the certificate

effecting the discharge.

8. Certificates of discharge of mortgage and certificates

of their acknowledgment or proof heretofore or hereafter recorded and filed,

may be returned personally or by mail to the party leaving same for record

or destroyed after microfilming or photostating where proper indices are

maintained.

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rule is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

New York Law

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

Not required.

Recording Satisfaction:

After full payoff, mortgagee, unless otherwise requested in writing by mortgagor, must execute and acknowledge before a proper officer a satisfaction of mortgage, and thereupon within forty-five days arrange to have the satisfaction of mortgage either presented for recording to the recording officer of the county where the mortgage is recorded, or, if so requested, to the mortgagor.

Marginal Satisfaction:

Not allowed. A mortgage must be satisfied by recording a separate instrument of release.

Penalty:

The Court shall award costs and reasonable attorney's fees to the debtor, in the absence of the showing of a valid reason for the failure or refusal by the mortgagee to execute the satisfaction of mortgage and deliver the same.

Acknowledgment:

An assignment or satisfaction must contain a proper New York acknowledgment, or other acknowledgment approved by Statute.

New York Statutes

Sec. 275. Certificate of discharge of mortgage required. [But see also, sec. 1921, below.]

1. Whenever a mortgage upon real property is due and payable,

and the full amount of principal and

interest due on the mortgage is paid, a certificate

of discharge of mortgage shall be given to the mortgagor or person

designated by him, signed by the person or persons specified in section

three hundred twenty-one of this chapter. The person signing

the certificate shall, within thirty days

thereafter, arrange to have the certificate presented for recording to

the recording officer of the county where the mortgage is recorded.

The provisions of this section shall not apply to any mortgage

granted to or made by the state

of New York, or any agency or instrumentality

thereof or any political subdivision of the state or any agency

or instrumentality thereof.

2. For purposes of this section,

the full amount of principal and interest due on a mortgage

shall not be considered to be paid whenever such mortgage continues

to secure a bona fide debt and an enforceable lien

continues to exist, such as may occur in the following situations:

(a) the commercial practice of lenders

trading or selling mortgages on the secondary market;

(b) the replacement of a construction loan with permanent

financing;

(c) the refinancing of an existing loan with a new

lender, such as where the original lender assigns a note and the mortgage

securing its payment to another lender in

return for consideration and such mortgage

is consolidated with another mortgage which secures any funds advanced

by the new lender to the mortgagor;

(d) the modification of the terms of a loan by a mortgagor

and mortgagee in order to avoid foreclosure; and

(e) a refinancing that occurs in conjunction

with the sale of property such that the seller conveys property to the

purchaser subject to the lien of the mortgage and

the original lender assigns its note and mortgage on the property to the

purchaser's lender.

§ 1921 Real Prop. Acts. Discharge of mortgage.

1. After payment of authorized principal, interest and

any other amounts due thereunder or otherwise owed by law has actually

been made, and in the case of a credit line mortgage as defined in

section two hundred eighty-one of the real property law on written request,

a mortgagee of real property situated in this state, unless otherwise requested

in writing by the mortgagor or the assignee of such mortgage, must execute

and acknowledge before a proper officer, in like manner as to entitle a

conveyance to be recorded, a satisfaction of mortgage, and thereupon within

forty-five days arrange to have the satisfaction of mortgage: (a) presented

for recording to the recording officer of the county where the mortgage

is recorded, or (b) if so requested by the mortgagor or the mortgagor's

designee, to the mortgagor or the mortgagor's designee. The mortgagee

shall within forty-five days deliver the note and the mortgage and where

a title is registered under article twelve of the real property law, the

registration copy of the mortgage and any registration certificates in

the mortgagee's possession to the mortgagor or the mortgagor's designee

making such payment and request if required as aforesaid. Delivery of

a satisfaction of mortgage in accordance with the terms of section two

hundred seventy-five of the real property law shall be deemed to satisfy

the requirements of this section regarding the satisfaction of mortgage.

2. Upon the failure or refusal of any such mortgagee to comply

with the foregoing provisions of this section any person having an interest

in the mortgage or the debt or obligation secured thereby or in the mortgaged

premises may apply to the supreme court or a justice thereof, or to the

county court or a judge thereof, in or of any county in which the mortgaged

premises or any part thereof are situated in whole or in part, upon a petition,

for an order to show cause why an order should not be made by such court

canceling and discharging the mortgage of record, and directing the register

or clerk of any county in whose office the same may have been recorded

to mark the same upon his records as canceled and discharged, and further

ordering and directing that the debt or other obligation secured by the

mortgage be canceled, upon condition that in the event such mortgage is

not paid, the sums tendered pursuant to the foregoing provisions of this

section be paid to the officer specified by law to hold court funds and

moneys deposited in court in the county wherein the mortgaged premises

are situated in whole or in part. Said petition must be verified in like

manner as a verified pleading in an action in the supreme court and it

must set forth the grounds of the application.

3. In any case where an actual tender, as provided in subdivision

one of this section, cannot with due diligence be made within this state,

any person having an interest in the mortgage or the debt or obligation

secured thereby, or in the mortgaged premises, may apply to the supreme

court or a justice thereof, or to the county court or a judge thereof,

in or of any county in which the mortgaged premises, or any part thereof

are situated in whole or in part, upon petition setting forth the grounds

of the application and verified as aforesaid, for an order to show cause

why an order should not be made by said court canceling and discharging

the mortgage of record, and directing the register or clerk of any county

in whose office the same may have been recorded to mark the same upon his

records as canceled and discharged and further ordering and directing that

the debt or other obligation secured by the mortgage be canceled, upon

condition that the principal sum of the mortgage or any unpaid balance

thereof, with interest up to the date when said order shall be entered

and the aforesaid fees allowed by law, be paid to the officer specified

by law to hold court funds and moneys deposited in court in the county

wherein the mortgaged premises are situated in whole or in part.

4. In the case of a mortgage secured by property improved

by a one-to-six family, owner occupied, residential structure or residential

condominium unit, if the mortgagee fails within ninety days to deliver

the satisfaction of mortgage and/or fails within ninety days to deliver

the note and the mortgage and any other documents as required by subdivision

one of this section and if the mortgage is not otherwise satisfied the

mortgagee shall be liable to such person in the amount of five hundred

dollars or the economic loss to such person, whichever is greater. If the

mortgagee has delivered such satisfaction of mortgage in a timely manner

and has certified that the note and/or mortgage are not in its possession

as of such date, the mortgagee shall not be liable under this section if

the mortgagee agrees to defend and hold harmless the mortgagor by reason

of the inability or failure of the mortgagee to furnish the note or mortgage

within the time period prescribed in this subdivision; provided that in

connection with mortgage loans purchased prior to July twenty-seven, nineteen

hundred ninety-one by the state of New York mortgage agency pursuant to

section two thousand four hundred five or two thousand four hundred five-b

of the public authorities law, the state of New York mortgage agency, its

successors or assigns shall not be liable under this section if it does

not defend and hold harmless the mortgagor by reason of the inability or

failure of the state of New York mortgage agency, its successors or assigns

to furnish the note or mortgage within the time period prescribed in this

subdivision. Damages imposed by this subdivision shall be in addition to

the other costs and fees allowed in this section.

5. (a) In the case of a mortgage secured by property improved

by a one-to-six family, owner occupied, residential structure or residential

condominium unit, if within ninety days of receipt of payment, and request

if required, the mortgagee fails to deliver to the mortgagor or the mortgagor's

designee the satisfaction of mortgage, the note and the mortgage and any

other documents as required by subdivision one of this section, any attorney-at-law

may execute, acknowledge and upon payment of an additional filing fee of

fifty dollars cause to be filed with the recording officer of the county

where the mortgage is recorded, an affidavit which complies with this section.

Unless the mortgagee shall file a verified objection to such affidavit

within thirty-five days of being filed, as of the date thirty-five days

subsequent to its filing, such affidavit shall be recorded and satisfy

the lien of such mortgage on the mortgaged premises.

(b) The affidavit shall state that:

(i) The affiant is an attorney-at-law and that the affidavit

is made on behalf of and at the request of the mortgagor or any person

who has acquired title to the mortgaged premises;

(ii) The mortgagor made a proper request of the mortgagee

for the execution of the satisfaction of mortgage pursuant to subdivision

one of this section;

(iii) The mortgagor has received a payoff statement for

the loan secured by the mortgage, and shall annex as evidence a copy of

the payoff statement;

(iv) The affiant has ascertained that the mortgagee received

payment of the loan in accordance with the payoff statement, and shall

annex as evidence, copies of the check negotiated by the mortgagee or documentary

evidence of such payment;

(v) The affiant, at least thirty days after the mortgagee

received payment, has given the mortgagee written notice together with

a copy of the proposed affidavit, delivered by certified or registered

mail, return receipt requested, to the attention of the person or department

set forth in the payoff statement, of the affiant's intention to execute

and record an affidavit in accordance with this section; and

(vi) The mortgagee has not responded in writing to such

notification or all requests by the mortgagee for payment have been complied

with at least fifteen days prior to the date of the affidavit.

(c) Such affidavit shall identify the mortgagor and the mortgagee,

state the date of the mortgage, the liber and page of the land records

where the mortgage is recorded and give similar information with respect

to any recorded assignment of the mortgage.

(d) The affiant shall attach to the affidavit photostatic

copies of the documentary evidence that payment has been received by the

mortgagee, including mortgagee's endorsement of any check, and a photostatic

copy of the payoff statement and certify each to be a copy of the original

document.

(e) Within five days of the filing of such affidavit the

register or clerk of every county in whose office said mortgage has been

recorded shall give the mortgagee written notice, delivered by certified

or registered mail, return receipt requested, to the attention of the person

or department set forth in the payoff statement, as annexed to the affidavit

filed hereunder, of the filing of such affidavit, which notice shall include

the following notice in capital letters:

"THIS NOTICE IS MADE UNDER SECTION 1921 OF THE REAL PROPERTY ACTIONS AND PROCEEDINGS LAW. FAILURE TO FILE WITH THIS OFFICE WITHIN THIRTY DAYS OF THIS NOTICE A VERIFIED OBJECTION TO THE DISCHARGE OF THE MORTGAGE DESCRIBED IN THIS NOTICE WILL RESULT IN SUCH MORTGAGE BEING CANCELED AND DISCHARGED OF RECORD."

Unless the register or clerk of such county shall receive from the

mortgagee, within thirty-five days of the date of filing of such affidavit,

a verified objection by the mortgagee to the discharge of said mortgage,

the register or clerk shall record the affidavit and supporting documents

and mark the mortgage described in the affidavit canceled and discharged

of record and such recorded affidavit shall have the same force and effect

as a duly executed satisfaction of mortgage recorded in accordance with

section three hundred twenty-one of the real property law. If the register

or clerk of such county shall receive from the mortgagee, within thirty-five

days of the date of filing of such affidavit, a verified objection by the

mortgagee to the discharge of said mortgage, the register or clerk shall

return the original affidavit and the verified objection to the attorney

filing such affidavit without marking the mortgage described in the affidavit

canceled or discharged of record. The clerk or register of such county

shall additionally transmit a copy of the affidavit and the verified objection

to its applicable appellate division of the supreme court, committee on

professional standards, for such further proceedings as determined appropriate

by such committee.

(f) The county clerk or register shall index the affidavit

in the same manner as a satisfaction of mortgage and shall record such

instrument upon payment of the same fees as for a satisfaction of mortgage.

(g) (i) Any attorney who prepares an affidavit and negligently

causes the affidavit to contain false information shall be liable to the

mortgagee for any monetary damages and subject to other applicable sanctions

under law.

(ii) Any person who supplies false information for the affidavit

shall be liable to the mortgagee for any monetary damages and subject to

other applicable sanctions under law.

(h) A banking or other organization having the original or

copies thereof, shall furnish, within sixty days of receiving a written

request, a copy of the front and reverse sides of a check issued to satisfy

the mortgage obligation by such banking or other organization, needed for

completion of an affidavit in accordance with this subdivision.

6. Eight days' notice of the application for either of the

orders provided for in subdivisions two and three of this section shall

be given to the then mortgagee of record and also, if the petition shows

that there is a mortgage not of record, to such mortgagee. Such notice

shall be given in such manner as the court or the judge or justice thereof

to whom the petition is presented may direct, and said court or judge or

justice may require such longer notice to be given as may seem proper.

If sufficient cause be shown the court or judge or justice thereof may

issue such order to show cause returnable in less than eight days.

7. Upon the return day of such order to show cause, the court,

upon proof of due service thereof and on proof of the identity of the mortgagee

and of the person presenting the petition, shall inquire in such manner

as it may deem advisable, into the truth of the facts set forth in the

petition, and in case it shall appear that said principal sum or any unpaid

balance thereof and interest and the said fees allowed by law have been

duly paid or tendered but not accepted and said satisfaction of mortgage

has been duly presented for execution, or that such tender and presentation

could not have been made within this state with due diligence, then, in

the event such mortgage is not paid, the court shall make an order directing

the sums so tendered, or in a case where such tender could not have been

made as aforesaid, directing the principal sum or any unpaid balance thereof,

with interest thereon to the date of entry of said order together with

all other amounts due thereunder pursuant to subdivision three of this

section and the aforesaid fees allowed by law, to be paid to the officer

specified by law to hold court funds and moneys deposited in court in the

county wherein the application herein is made, and directing and ordering

that upon such payment the debt or other obligation secured by the mortgage

be canceled and further directing the register or clerk of any and every

county in whose office said mortgage shall have been recorded to mark said

mortgage canceled and discharged of record upon the production and delivery

to such register or clerk of a certified copy of the order and the receipt

of such officer, showing that the amount required by said order has been

deposited with him, which certified copy of said order and which receipt

shall be recorded, filed and indexed by any such register or clerk in the

same manner as a certificate of discharge of a mortgage. Said receipt need

not be acknowledged to entitle it to be recorded. The court in its discretion,

when granting any such order after application therefor pursuant to subdivision

two of this section, may award costs and reasonable attorney's fees

to the person making the application, in the absence of the showing of

a valid reason for the failure or refusal to execute the satisfaction of

mortgage and deliver the same, the note and mortgage and any other

documents required under subdivision one of this section. The money deposited

shall be payable to the mortgagee, his personal representative or assigns,

upon an order of the supreme court or county court, directing the payment

thereof to him upon such evidence as to his right to receive the same as

shall be satisfactory to the court.

8. Wherever any register or clerk shall record any order

and receipt as hereinbefore specified, he shall mark the record of said

mortgage as follows:

"Canceled and discharged by order of the .......................... Court, County of ...................... , dated .................. and filed ...................... ," and thereupon the lien of such mortgage shall be deemed to be discharged and the debt secured thereby shall be deemed to be canceled. Said register or clerk shall be permitted to charge for recording and filing said order and receipt, the same fees to which he is now entitled for recording and filing a certificate of satisfaction of a mortgage.

9. When used in this section:

(a) "Mortgagee" means (i) the current holder of the mortgage

of record or the current holder of the mortgage, or (ii) any person to

whom payments are required to be made or (iii) their personal representatives,

agents, successors, or assigns.

(b) "Attorney-at-law" means any person admitted to practice

law in this state and in good standing.

(c) "Payoff statement" means a statement setting forth the

unpaid balance of the mortgage, including principal, interest and other

charges pursuant to the loan documents, together with a per diem rate for

interest accruing after the date to which the unpaid balance has been calculated.

The payoff statement furnished by a banking organization or corporate mortgagee

shall include a name of an individual employed by such banking organization

or corporate mortgagee or department of such banking organization or corporate

mortgagee to whom inquiry concerning the payoff statements are to be addressed

in addition to the address of the banking organization or corporation for

use in connection with the affidavit under subdivision five of this section.

(d) "Banking organization" shall have the same meaning as

provided in subdivision eleven of section two of the banking law and shall

include any institution chartered or licensed by the United States or any

state.

(e) "Note" shall include any written evidence of indebtedness.

§ 321 Real Prop. Recording discharge of mortgage.

1. The recording officer shall mark on the record of a mortgage

the word "discharged" when there is presented to him a certificate or certificates

signed as hereinafter provided, and acknowledged or proved and certified

in like manner as to entitle a conveyance to be recorded, specifying that

the mortgage has been paid or otherwise satisfied and discharged.

(a) When it does not appear from the record that any interest

in the mortgage has been assigned, the discharge shall be signed by the

mortgagee or by his personal representative.

(b) When it appears from the record that the mortgage has

been assigned, whether or not the assignment was made as collateral security,

the discharge shall be signed by the person who appears from the record

to be the last assignee thereof or by his personal representative.

(c) When the mortgage or an assignment thereof names two

or more persons as mortgagees or assignees, the discharge shall be signed

by the person or persons designated by the mortgage or assignment to receive

payment of the mortgage debt or to give full acquittance and discharge

therefor. When no such person or persons are designated by the mortgage

or assignment, the certificate of discharge shall be signed by all of the

persons named, in the mortgage or assignment, as mortgagees or assignees,

as the case may be, or by their personal representatives, if the mortgage

or assignment (i) specifies their respective interest in terms of a sum

of money, or in terms of a fraction or percentage, or (ii) states that

such persons shall share equally in, or shall have equal shares in the

mortgage, or (iii) describes such persons as tenants in common of the mortgage.

When it appears from the record that the mortgage is held by trustees,

the certificate of discharge shall be signed by a majority of such trustees

or of the survivors of them or by the survivors or survivor of them, unless

the instrument creating the trust provides otherwise. Except as required

above, the discharge may be signed by any one of the persons named in the

mortgage or assignment, as mortgagees or assignees, as the case may be,

or by the personal representative of the last survivor of them. If the

mortgage or assignment states that the persons named therein as mortgagees

or assignees shall hold the mortgage jointly, or describes such persons

as joint tenants or tenants by the entirety of the mortgage, or expressly

creates a right of survivorship among them, the discharge may be signed

by any one of such persons or by the personal representative of the last

survivor of them notwithstanding that the mortgage or assignment specifies

their respective interests in the mortgage or states that they shall share

equally or have equal shares therein.

(d) When the mortgage has been partially assigned, the certificate

of discharge shall be signed by all of the persons, or their personal representatives,

who in the aggregate are the holders of all portions of the mortgage, including

each partial assignee, and the assignor in case any portion of the mortgage

has not been assigned; provided, however, that if any partial assignment

names two or more persons as assignees, the person or persons who may sign

the certificate discharging such partial interest shall be determined in

accordance with the provisions of paragraph (c) of this subdivision.

(e) Whenever two or more persons are required to execute

a certificate of discharge as provided in this subdivision, there may be

presented in lieu of such certificate, separately executed certificates

of discharge as to the respective interests of each in the mortgage so

that together the several certificates purport to discharge the entire

mortgage.

(f) In place of any of the persons specified in paragraphs

(a), (b), (c) or (d) of this subdivision, a certificate of discharge of

the mortgage or of any interest therein may be signed (i) by an agent who

has been authorized by any such person to demand or receive payment or

to give a certificate of discharge of the mortgage by a power of attorney,

provided such power of attorney is of record in the office where the mortgage

is recorded, and no instrument of revocation has been recorded; or (ii)

by any person in whom title to such mortgage or to such interest, or authority

to act on behalf of or in exercise of the right or power of the holder

of such mortgage or of such interest is vested, in a fiduciary capacity,

by virtue of an order or decree of a court having jurisdiction thereof,

including, but not limited to, the guardian of a minor, the committee of

an incompetent person, or the conservator of a conservatee, whether domestic

or foreign, and a receiver in bankruptcy or trustee in bankruptcy. A certificate

executed by any person specified in clause (ii) of this paragraph shall

recite the name of the court and the venue of the proceedings in which

his appointment was made, or the order or decree vesting him with such

title or authority was entered.

(g) If the mortgage is stated in the certificate of discharge

to have been taken by the alien property custodian under and pursuant to

the trading with the enemy act adopted by the United States congress, and

approved October sixth, nineteen hundred sixteen, or any act amendatory

thereof, or supplemental thereto, such certificate may be executed by such

alien property custodian or such person as the president may appoint to

give full acquittance and discharge for money or property belonging to

an enemy or ally of an enemy which may be conveyed, assigned, delivered

or transferred to said alien property custodian, with like effect as if

the same had been executed by the mortgagee, his personal representative

or assignee. Such certificate may be recorded, and such certificate, the

record thereof and a certified copy of such record may be introduced in

evidence in all courts of this state.

2. (a) The recording officer shall record and file such certificate

or certificates together with the certificates of acknowledgment or proof,

and shall note on the record of the mortgage the book and page containing

such record of such certificate or certificates or the serial number of

such record in the minute of the discharge of such mortgage, made by the

officer upon the record thereof. The provisions of this paragraph shall

not apply to the county of Suffolk, if the block method of index is in

use, or a separate index of satisfactions recorded is maintained.

(b) The recording officer shall also record every other instrument

relating to a mortgage which is presented to him, acknowledged or proved

in like manner as to entitle a conveyance to be recorded, including certificates

purporting to discharge a mortgage or an interest therein which are signed

by persons other than those specified in the first subdivision of this

section, and also including, but not limited to, assignments, releases,

partial discharges, reductions, estoppel certificates, extensions, discharges

of partial interest and partial discharges of partial interest, regardless

by whom any such instrument has been executed. When any such instrument

has been recorded, the recording officer, except in counties where the

block method of indexing is in use, or in Suffolk county, if a separate

index of said instruments is maintained, shall enter a minute upon the

record of the mortgage to which such instrument relates, indicating the

nature of such instrument and the book and page where it has been recorded

or the serial number of such record.

3. Every certificate presented to the recording officer shall

be executed and acknowledged or proved in like manner as to entitle a conveyance

to be recorded. If the mortgage has been assigned, in whole or in part,

the certificate shall set forth the date of each assignment in the chain

of title of the person or persons signing the certificate, the names of

the assignor and assignee, the interest assigned, and, if the assignment

has been recorded, the book and page where it has been recorded or the

serial number of such record; or if the assignment is being recorded simultaneously

with the certificate of discharge, the certificate of discharge shall so

state. If the mortgage has not been assigned of record, the certificate

shall so state.

No certificate presented to the recording officer shall purport

to discharge more than one mortgage, except that one certificate may purport

to discharge two or more mortgages where the certificate states that one

of such mortgages corrects, perfects or modifies the other mortgage or

mortgages, or spreads the lien of the other mortgage or mortgages over

the property subject to the lien of such mortgage, or consolidates the

lien of the other mortgage or mortgages with the lien of such mortgage

to constitute a single lien, or where the certificate states that the liens

of the mortgages which the certificate purports to discharge have been

so spread or so consolidated by a separate instrument and such instrument

has been recorded; provided that in such case the certificate of discharge

shall identify and describe each mortgage which it purports to discharge,

in a separate paragraph, in the same manner and with the same particularity,

and setting forth the same information with respect to assignments thereof,

as would be required for a separate certificate discharging that mortgage,

and shall also state, in a separate paragraph for each instrument, the

date of any such separate instrument by which the liens of the mortgages

have been spread or consolidated, the names of the parties thereto, and

the book and page where it has been recorded or the serial number of such

record. In any such case, except where otherwise expressly provided by

law, the fee or fees which the recording officer is entitled to receive

for filing and entering a certificate of discharge of a mortgage and examining