Notice Payment Pay For Furloughed Employees

State:

New York

Control #:

NY-1301LT

Format:

Word;

Rich Text

Instant download

Description

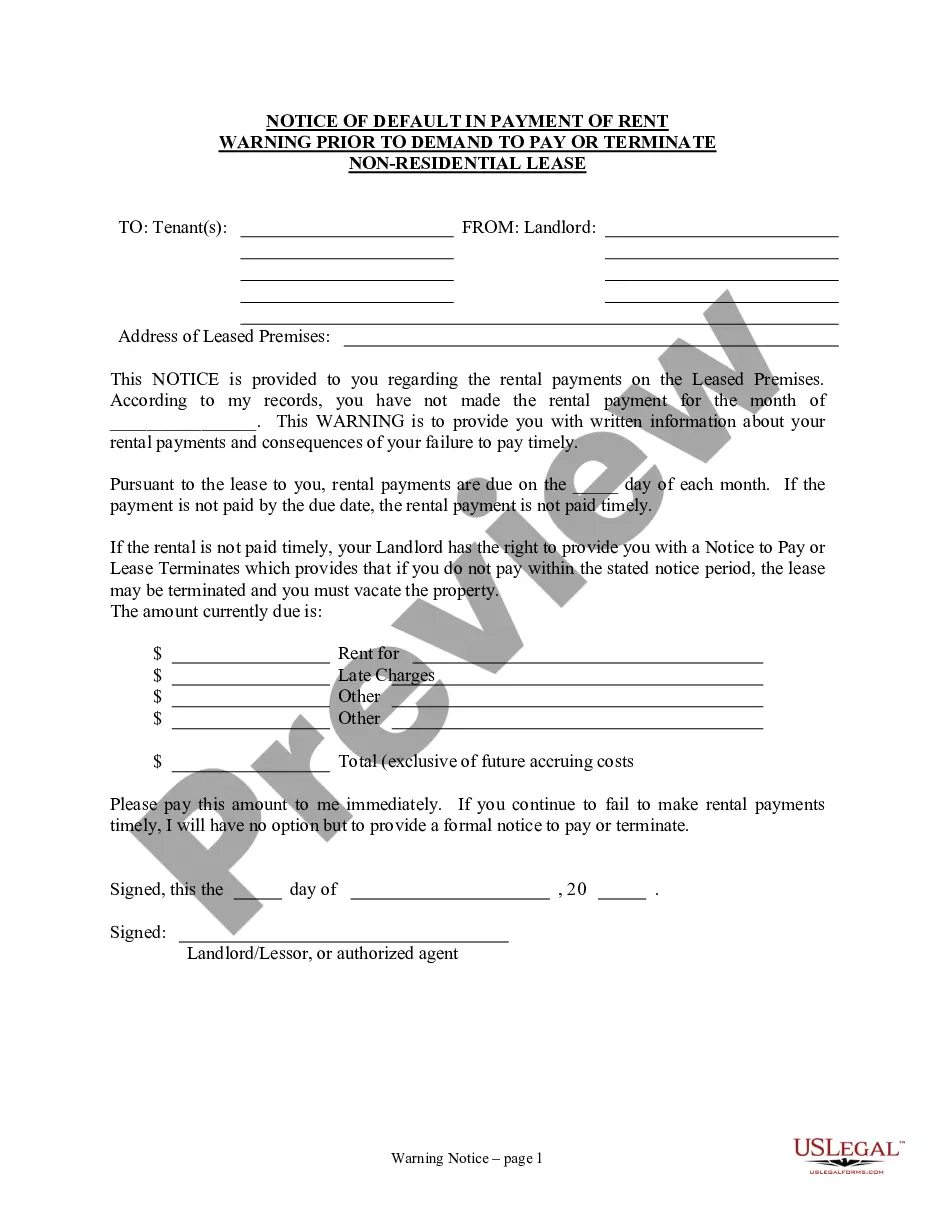

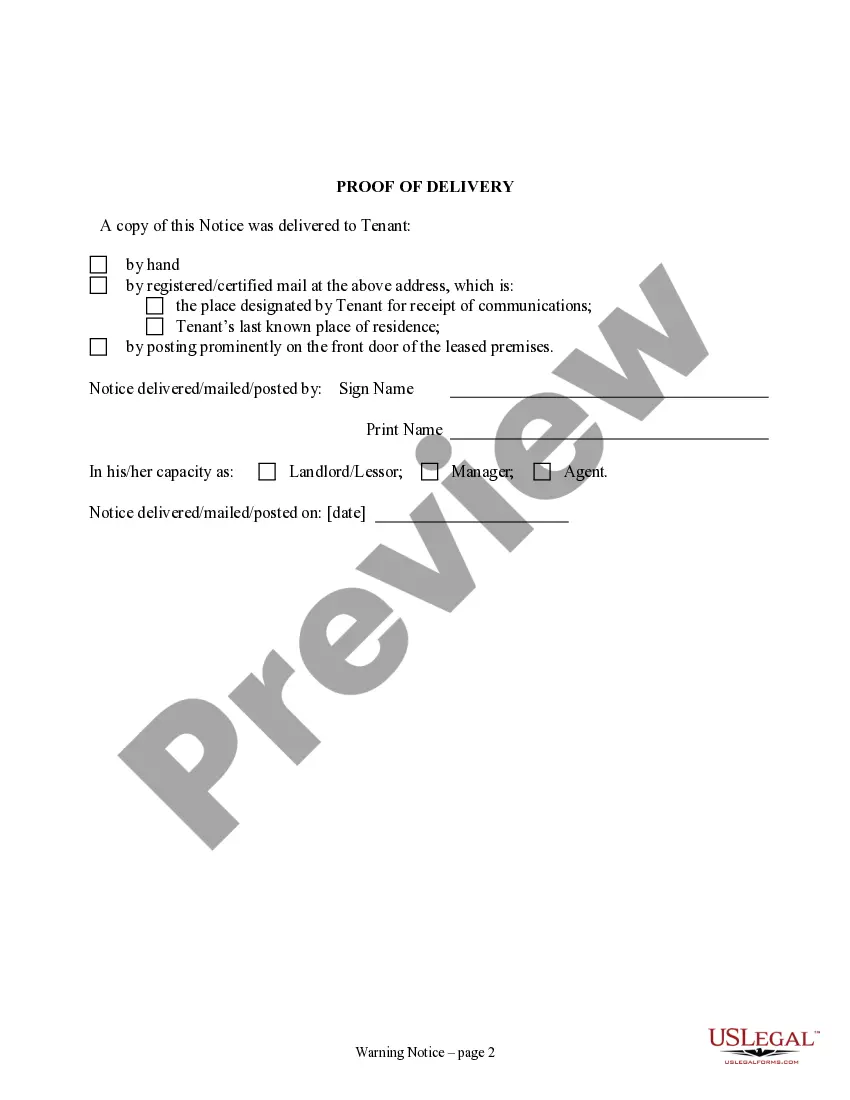

This Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Non-Residential or Commercial Property form is for use by a Landlord to inform Tenant of Tenant's default in the payment of rent as a warning prior to a pay or terminate notice. The form advises the Tenant of the due date of rent and the consequences of late payment. This form may be used where you desire to remind the Tenant of payment terms, the default, demand payment and inform the Tenant that under the laws of this state or lease, the Landlord may terminate if rent is not paid timely.

Free preview