Notice Commercial Property With Rental Income

State:

New York

Control #:

NY-1305LT

Format:

Word;

Rich Text

Instant download

Description Not Renew End Landlord

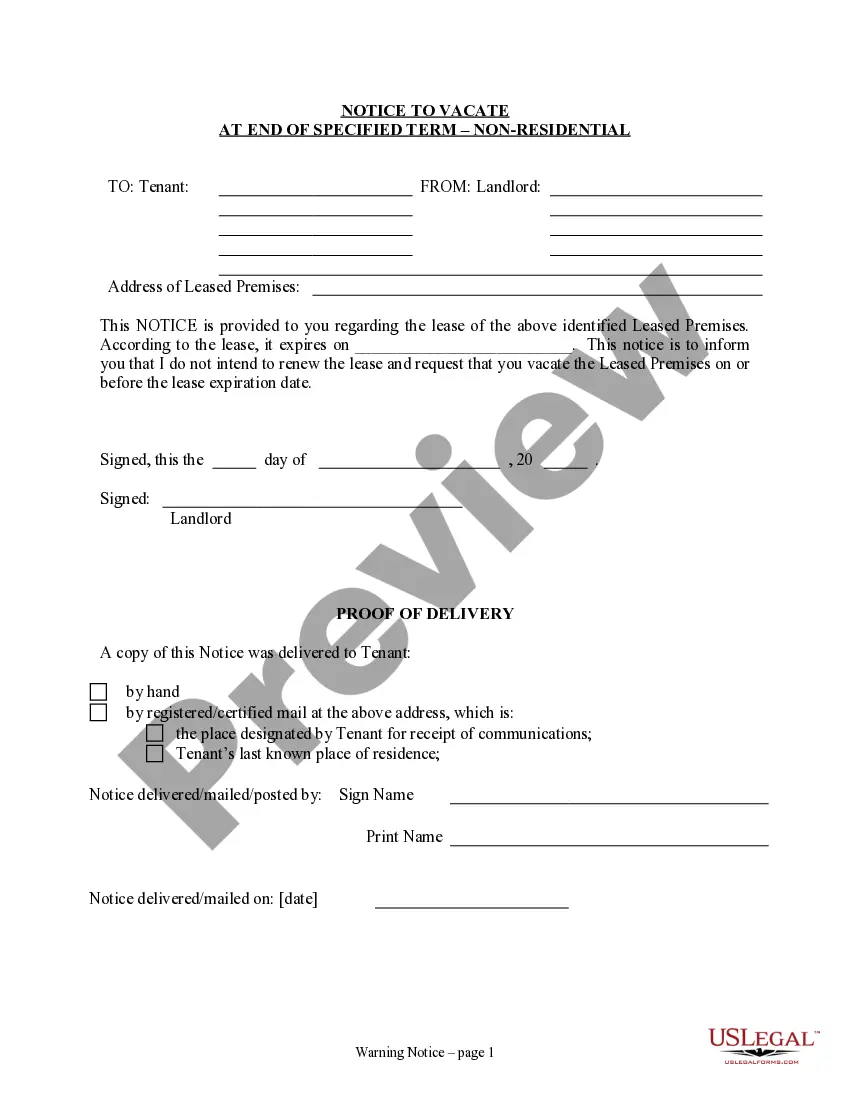

This Notice of Intent Not to Renew at End of Specified Term from Landlord to Tenant for Non-Residential or Commercial Property means that no notice is required to terminate a lease which ends at a specific date. Example: "This lease begins on January 1, 2005 and ends on January 1, 2006". However, Landlords and Tenants routinely renew such leases. This form is for use by a Landlord to inform the Tenant that the lease will not be renewed at the end of the specific term and to be prepared to vacate at the end of the lease term.