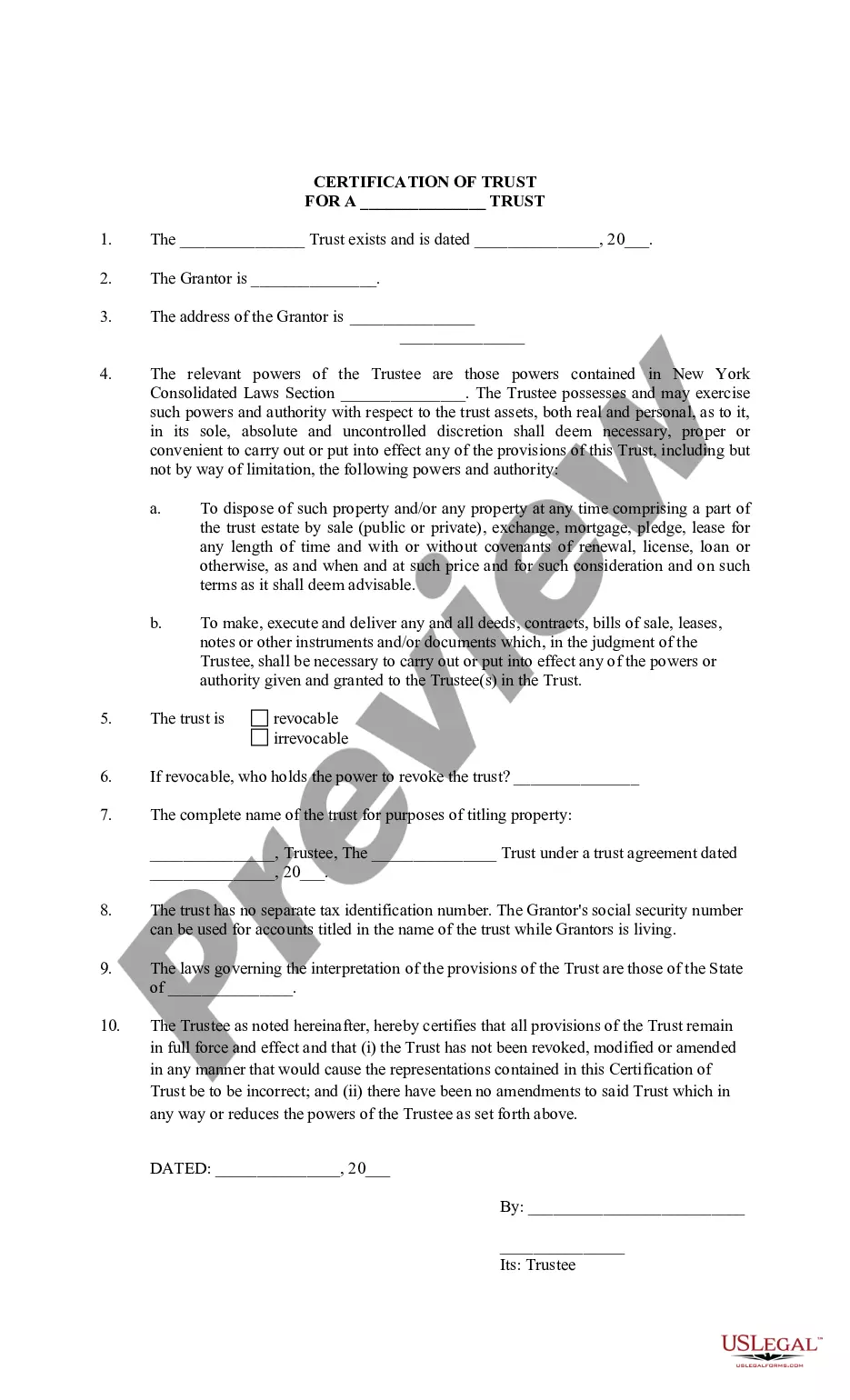

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Certification of Trust in Florida — Explained in Detail Certification of Trust is a legal document used in Florida to verify the existence and terms of a trust, while also protecting the privacy of the beneficiaries. It is commonly used when a trust is involved in a transaction, such as purchasing or refinancing real estate, to avoid the need for disclosing the entire trust agreement. In Florida, there are two main types of Certification of Trust: 1. Short Form Certification of Trust: The Short Form Certification of Trust is a condensed version that provides key information about the trust's existence and authority conferred upon the trustee(s). It is primarily used to confirm essential details without disclosing sensitive information such as the trust's assets or specific provisions. This type of certification includes the following details: — Name and datthrustersus— - Full name of the trustee(s) — Powers granted to the trustee(s) by the trust — Legal documentation, including the trust's tax identification number 2. Long Form Certification of Trust: The Long Form Certification of Trust is a more comprehensive document that gives a complete overview of the trust's terms and conditions. Unlike the Short Form, it also includes detailed information about the trust's assets, beneficiaries, and any specific provisions outlined in the trust agreement. This type of certification is typically used in situations where more in-depth knowledge of the trust is required, such as during estate administration or litigation. Importance of Certification of Trust in Florida: Certification of Trust is essential in Florida for various reasons: 1. Privacy Protection: Certification of Trust ensures privacy by allowing the trustee to provide only necessary trust details required for a transaction, rather than disclosing the entire trust agreement. This helps keep the beneficiaries' personal information confidential, preventing unnecessary public scrutiny. 2. Easy Verification of Trust Existence: Having a Certification of Trust readily available simplifies the verification process for third parties, such as title companies, banks, and other financial institutions. It serves as proof of trust existence, allowing transactions involving trust assets to proceed smoothly. 3. Simplified Transactions: By providing key information about the trust, the parties involved in a transaction can promptly verify the trustee's authority and proceed accordingly. This eliminates the need to involve all trust beneficiaries or produce the entire trust agreement, which can be time-consuming and cumbersome. In summary, Certification of Trust in Florida plays a crucial role in confirming the existence and terms of a trust while preserving privacy. Whether opting for the Short Form or Long Form Certification, it enables smooth and efficient transactions involving trust assets.