New York Certificate Name Withdrawal Foreign Llc

Description

How to fill out New York Certificate Name Withdrawal Foreign Llc?

Individuals frequently link legal documentation with something intricate that solely a specialist can manage.

In a certain respect, it's accurate, as formulating New York Certificate Name Withdrawal Foreign LLC requires significant expertise in subject-related criteria, including state and municipality regulations.

Nonetheless, with the US Legal Forms, everything has turned more straightforward: pre-prepared legal documents for any life and business circumstance tailored to state laws are assembled in a single online directory and are now accessible to all.

Select a subscription plan that suits your needs and financial constraints. Set up an account or Log In/">Log In to move to the payment page. Complete your payment through PayPal or with your credit card. Choose the format for your file and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once purchased, they remain saved in your profile. You can access them anytime needed via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe promptly!

- US Legal Forms provides over 85,000 current forms categorized by state and area of application, so searching for New York Certificate Name Withdrawal Foreign LLC or any other specific template only takes a few minutes.

- Users who have previously registered with a valid subscription must Log In/">Log In to their account and click Download to acquire the form.

- New users to the platform will initially need to create an account and subscribe before they can store any documents.

- Here is a step-by-step instruction on how to obtain the New York Certificate Name Withdrawal Foreign LLC.

- Examine the page content meticulously to ensure it meets your requirements.

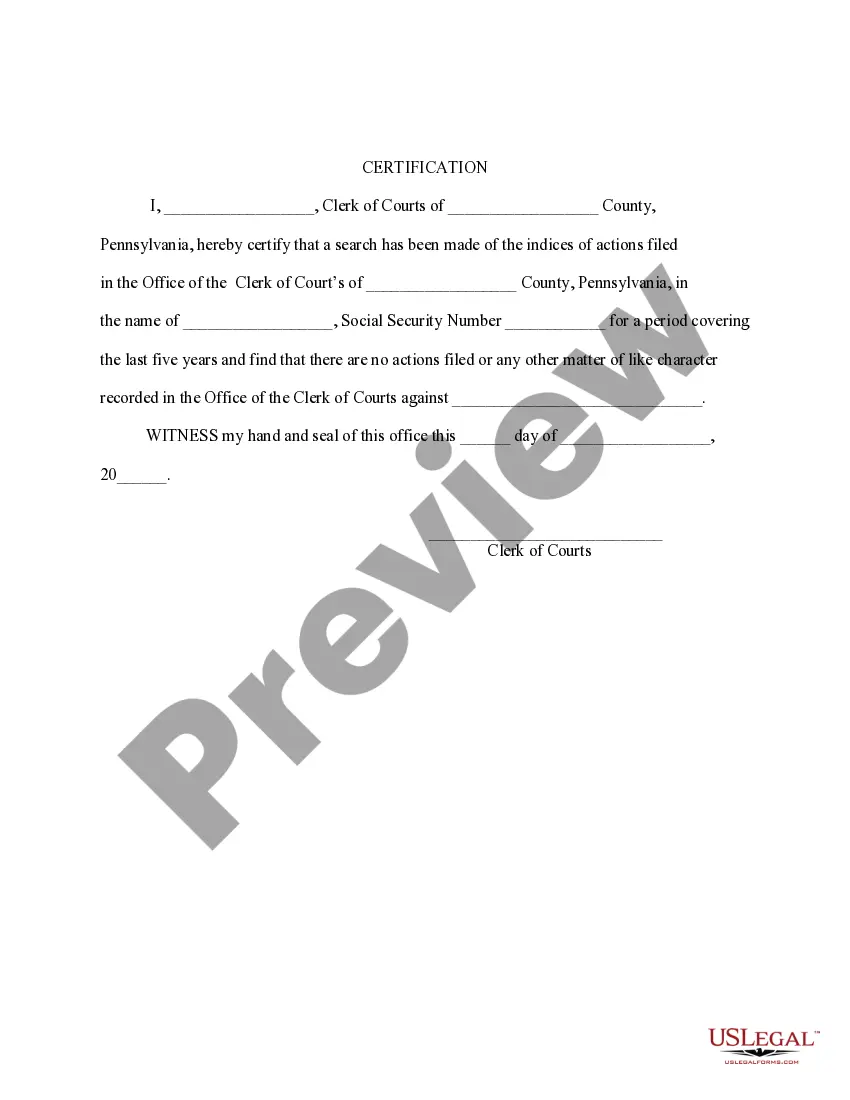

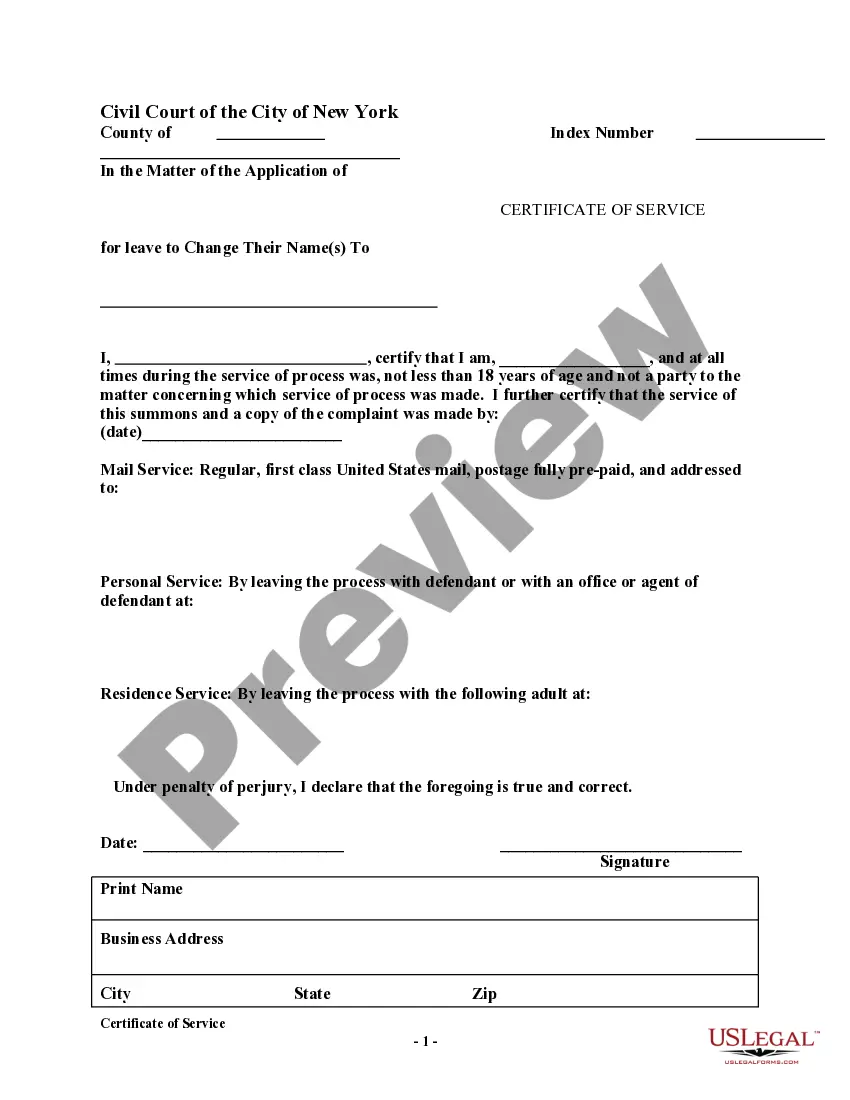

- Review the form description or confirm it through the Preview feature.

- Find another template via the Search bar above if the previous one doesn’t suit you.

- Click Buy Now once you discover the appropriate New York Certificate Name Withdrawal Foreign LLC.

Form popularity

FAQ

Certificate of surrender means a certificate in a form approved by the supreme court that is completed by a surety insurance company or its bail agent, or a person who has posted a property bond or cash deposit, and provided to the sheriff of the county where the action is pending for signature.

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

If your foreign LLC is currently in good standing and will remain in existence in its home state, you provide the completed Certificate of Surrender of Authority form to the New York Department of State by mail, fax or in person, along with the filing fee.

A foreign business corporation that is no longer going to conduct business in New York State may surrender its authority to do so....File the following with the Department of State:Tax Department consent.Certificate of Surrender of Authority.$60 filing fee, payable to New York Department of State.

Expedited processing requires that you pay an additional fee. Foreign LLCs are required to register with New York if they conduct business in the state.