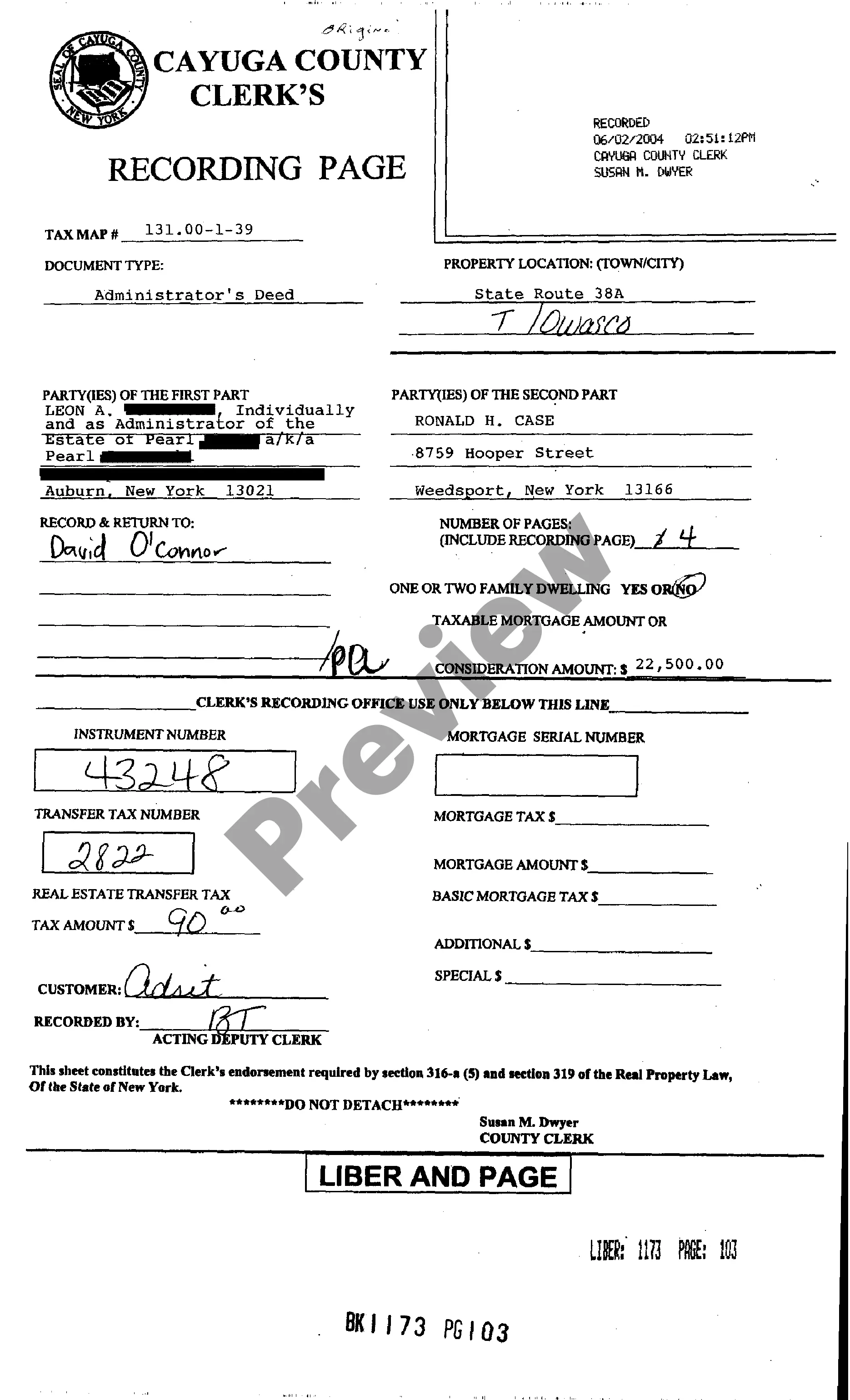

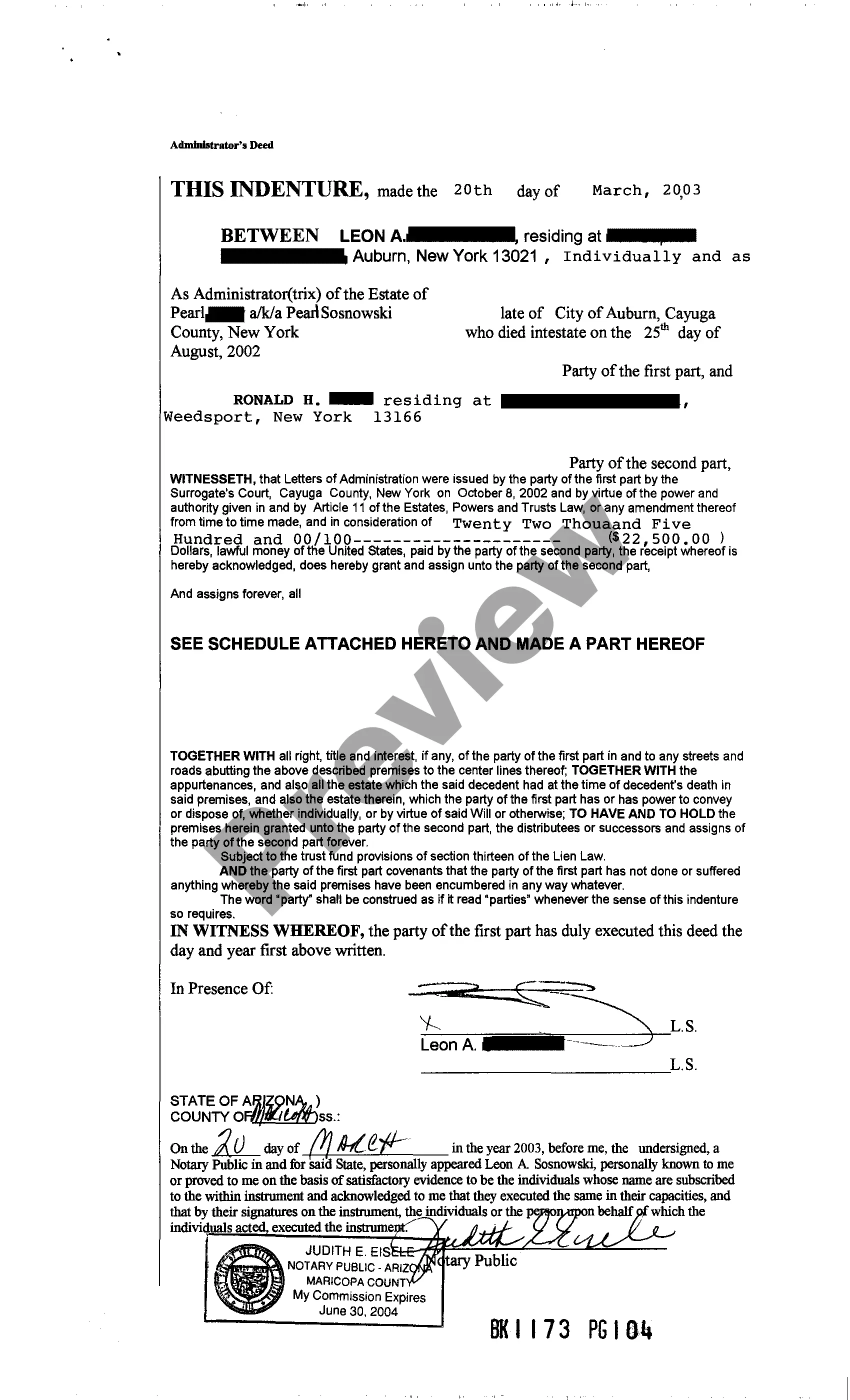

Administrator's Deed New York Form Ct-3 Instructions

Description

How to fill out Administrator's Deed New York Form Ct-3 Instructions?

When you need to present the Administrator's Deed New York Form Ct-3 Directions following your local state's laws, there can be numerous selections to choose from.

There's no requirement to review every document to confirm it fulfills all legal standards if you are a US Legal Forms member.

It is a reliable source that can assist you in acquiring a reusable and current template on any topic.

Acquiring appropriately composed legal documents becomes simple with US Legal Forms. Furthermore, Premium members can also utilize the robust integrated tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online database containing over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading the Administrator's Deed New York Form Ct-3 Directions from our platform, you can be assured that you possess a legitimate and up-to-date document.

- Obtaining the essential template from our platform is exceptionally straightforward.

- If you already possess an account, just Log In to the system, confirm your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile to retrieve the Administrator's Deed New York Form Ct-3 Directions at any time.

- If this is your first experience with our library, please adhere to the instructions below.

- Browse through the suggested page and verify it for alignment with your needs.

Form popularity

FAQ

Generally, any corporation doing business in New York, or earning income from New York sources, must file a corporate tax return. This requirement applies to both C corporations and S corporations. It's essential to refer to the Administrator's deed new york form ct-3 instructions for details on specific exemptions or obligations, ensuring you meet all necessary compliance standards.

You can file your CT-3-S, the New York S Corporation Franchise Tax Return, with the New York State Department of Taxation and Finance. Typically, filing can be done electronically through their online portal or by submitting a paper form. If you're unsure about the requirements, consulting the Administrator's deed new york form ct-3 instructions can provide clarity on filing specifics and deadlines.

Form NYC 3L is a document required for New York City corporate businesses to report their income, deductions, and tax credits. This form helps ensure compliance with city tax regulations. If you're filing the New York corporate tax return, you might also need the Administrator's deed new york form ct-3 instructions. Understanding how these forms work together can simplify your filing process.

To file form CT 3 in New York State, send it to the address specified in the tax return instructions provided by the New York State Department of Taxation and Finance. You can choose to file electronically for a quicker process. Proper filing is important for maintaining good standing with state authorities. Should you need assistance with the Administrator's deed New York form CT-3 instructions, look into the helpful tools available on USLegalForms.

You file CT 3, the corporation franchise tax return, with the New York State Department of Taxation and Finance. The filing can be completed online or by mail, depending on your preference. It is essential to file this form promptly to avoid penalties. If you have questions about related documents like the Administrator's deed New York form CT-3 instructions, USLegalForms can provide you clarity and help streamline your process.

New York form CT 3M is specifically designed for organizations that elect to be treated as a tax-exempt corporation. This form reports the income and expenses incurred by such organizations. It plays a crucial role in ensuring compliance with New York tax laws. For detailed guidance on completing forms, including the Administrator's deed New York form CT-3 instructions, you can refer to expert resources available through USLegalForms.

You can file a UCC 3 form in New York at the Department of State or through the local county clerk's office. This form is used to amend or terminate a UCC filing. It is important to file in the correct location to ensure that your records are accurate. If you need assistance with related forms, including the Administrator's deed New York form CT-3 instructions, consider resources available on the USLegalForms platform.

The mailing address for New York State corporation tax can be found on the NYS corporation tax form instructions. This address often varies based on whether you are expecting a refund or filing payment. Always verify the correct address to avoid delays in processing your return. Use the Administrator's deed New York form CT-3 instructions for the latest mailing information.

The NYS CT 3 form should be mailed to the address specified in the form's instructions, tailored to your specific filing situation. This address is essential for the proper processing of your tax return. For the most accurate information and potential updates, refer to the Administrator's deed New York form CT-3 instructions.

To mail your New York CT-3 form, use the designated address listed in the form's instructions. This address may vary depending on your filing status. A correct mailing address ensures that your form arrives promptly and is processed efficiently. Don't forget to check the Administrator's deed New York form CT-3 instructions for up-to-date mailing details.