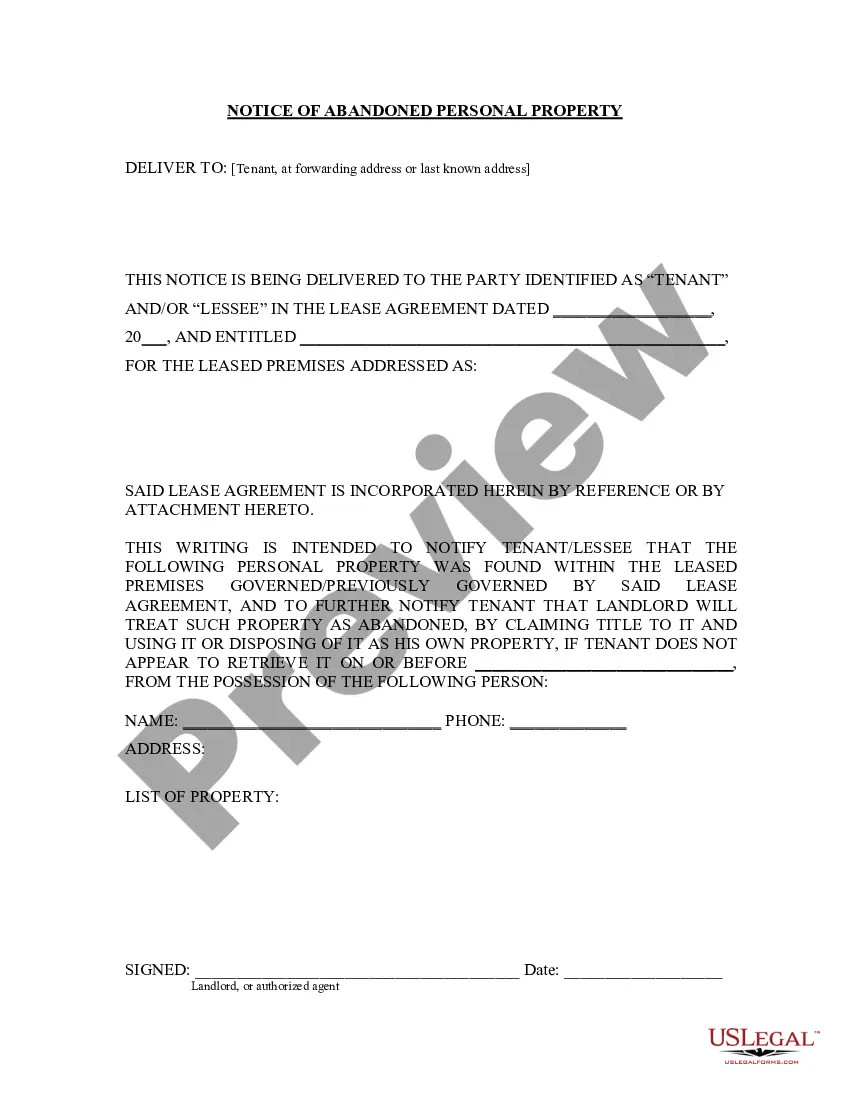

This is an official notice from the Landlord to the Tenant. This Notice to Tenant sets out specific directions to either retrieve items of personal property left behind by tenant, or have items be confiscated by landlord. This form conforms to applicable state statutory law.

Abandoned property is property left behind intentionally and permanently, often by a tenant, when it appears that the former owner or tenant has no intent to reclaim or use it. Examples may include possessions left in a house after the tenant has moved out or autos left beside a road for a long period of time.

Abandoned personal property is that to which the owner has voluntarily relinquished all right, title, claim and possession, with the intention of terminating his ownership, but without vesting ownership in any other person, and without the intention of reclaiming any future rights therein, such as reclaiming future possession or resuming ownership, possession, or enjoyment of the property.

Unclaimed property letter from Discover: An unclaimed property letter from Discover is a communication sent out by Discover Financial Services to its customers regarding unclaimed funds or assets that have been left untouched for a certain period of time. Discover is a major credit card issuer and financial services company, and its unclaimed property letters serve as an attempt to reunite customers with their dormant or forgotten assets. The primary purpose of the unclaimed property letter is to inform Discover customers that they have unclaimed funds or property with the company. The letter typically provides specific details about the amount, type, and nature of the unclaimed property. It may also mention the exact time limits and instructions for the customer to take action in order to claim their assets. Keywords: unclaimed property letter, Discover, Discover Financial Services, unclaimed funds, unclaimed assets, dormant assets, forgotten assets, unclaimed property notification, customer communication. Different types of Unclaimed Property Letters from Discover: 1. Unclaimed Cash or Checking Accounts: Discover may send out a specific unclaimed property letter to customers who have unclaimed cash balances or checking account funds that have not been accessed or utilized for an extended period. 2. Unclaimed Credit Card Rewards: Discover credit card holders may receive an unclaimed property letter if they have accumulated unclaimed rewards that have not been redeemed or utilized within a certain timeframe. 3. Unclaimed CD (Certificate of Deposit) Balances: In cases where customers have unused or forgotten CD balances with Discover, the company may send out a separate unclaimed property letter to inform them about the unclaimed funds and how to claim them. 4. Unclaimed Gift Cards or Store Credit: If customers have purchased gift cards or received store credit and have not utilized the full amount within a specified timeframe, Discover may issue an unclaimed property letter to remind them of their unclaimed balance. 5. Unclaimed Dividends or Stock Holdings: Discover may also send unclaimed property letters to customers who have unclaimed dividends or unclaimed stock holdings with the company that they have not accessed or requested. Each type of unclaimed property letter from Discover aims to notify customers about their unclaimed assets or funds and provide instructions on how to reclaim them. To prevent loss of funds or assets, it is essential for customers to carefully read and respond to these letters within the instructed time limits.