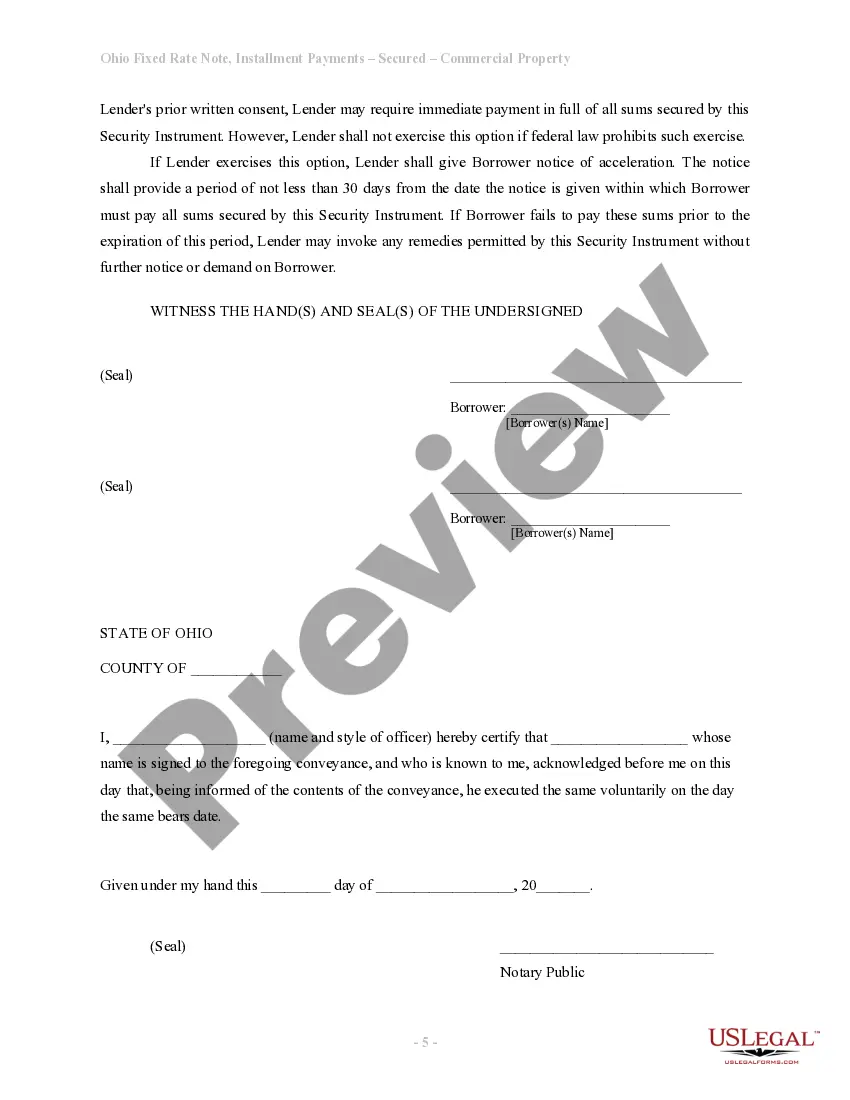

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Ohio Promissory Note For Loan

Description how to write a promise to pay letter

How to fill out Ohio Promissory Note For Loan?

There’s no longer any justification to squander hours searching for legal documents to adhere to your local state regulations.

US Legal Forms has compiled all of them in one location and made their access easy.

Our platform offers over 85k templates for any business and individual legal needs organized by state and area of use.

Utilize the Search bar above to look for another sample if the previous one didn’t suit you.

- All documents are expertly drafted and verified for correctness, ensuring you receive an updated Ohio Promissory Note For Loan.

- If you are acquainted with our service and already possess an account, make sure that your subscription is active before retrieving any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all acquired documents whenever necessary by navigating to the My documents tab in your profile.

- If you are new to our service, the process will involve a few additional steps to finish.

- Here’s how new users can access the Ohio Promissory Note For Loan from our library.

- Examine the page content closely to confirm it includes the template you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

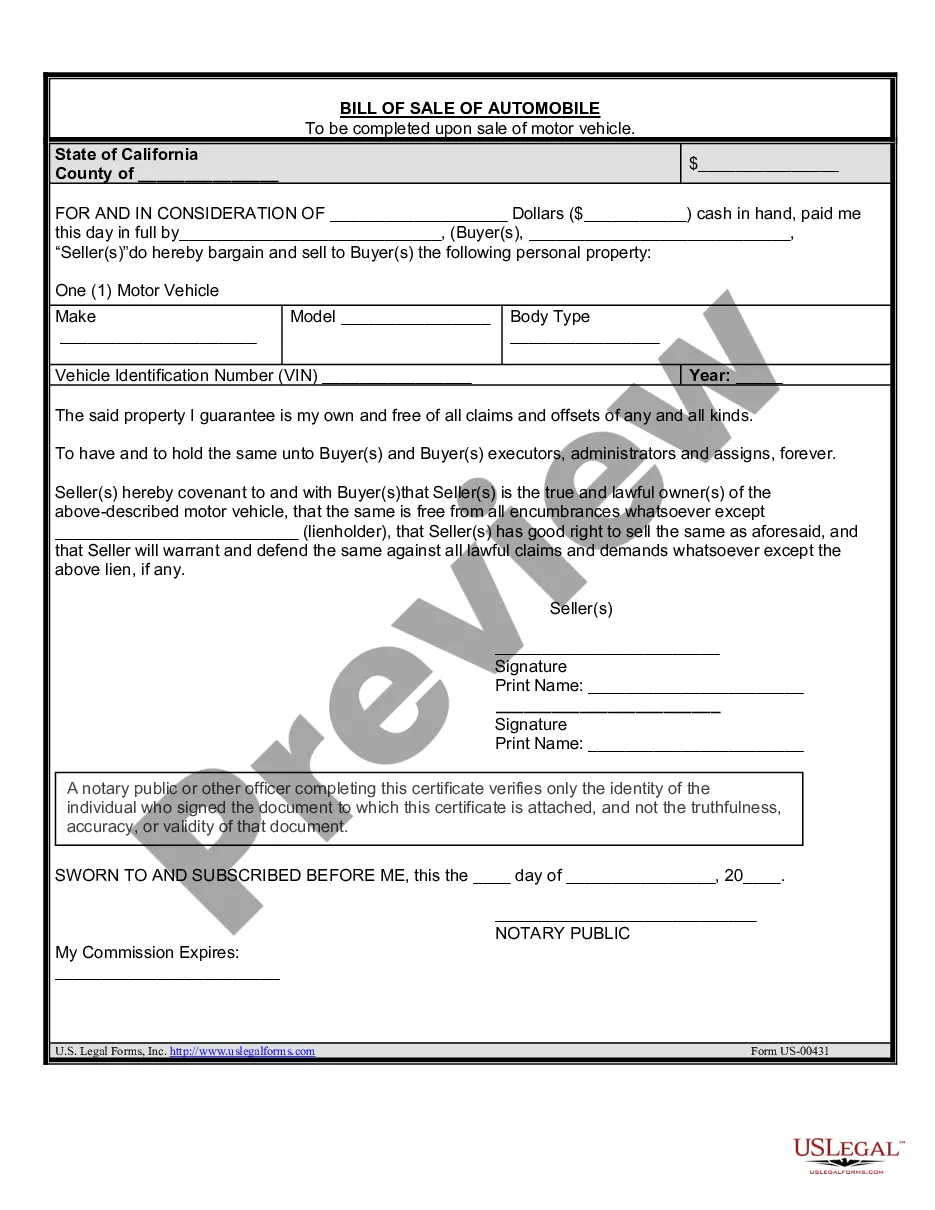

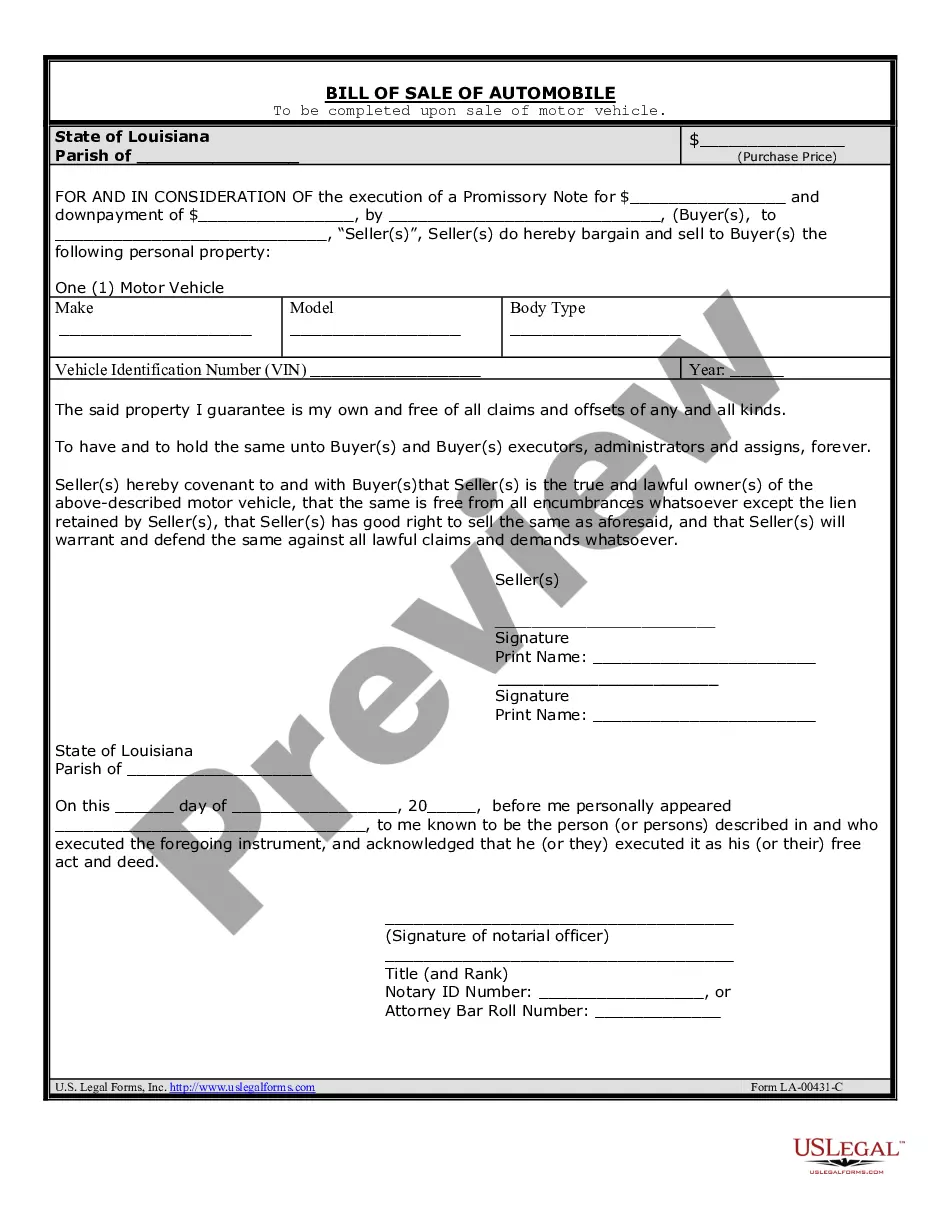

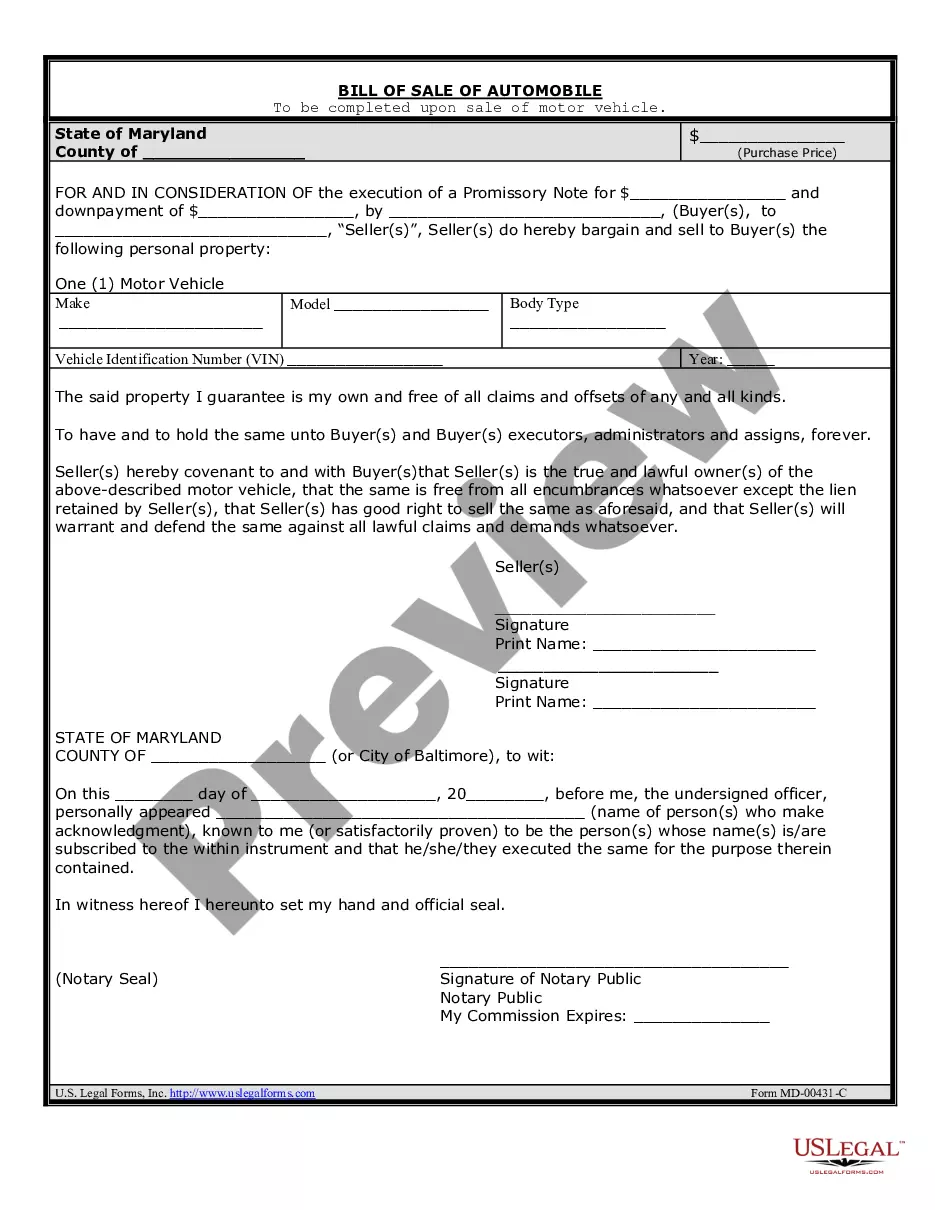

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.